This report, written by Tiger Research, analyzes Everclear's clearing infrastructure, which transforms multichain fragmentation into opportunity.

TL;DR

The infrastructure war continues. The blockchain ecosystem faces liquidity fragmentation and high fees. Chain abstraction solutions have emerged, but they fail to address inefficiencies. They simply shift the cost burden from bridges to solvers , and then to exchanges .

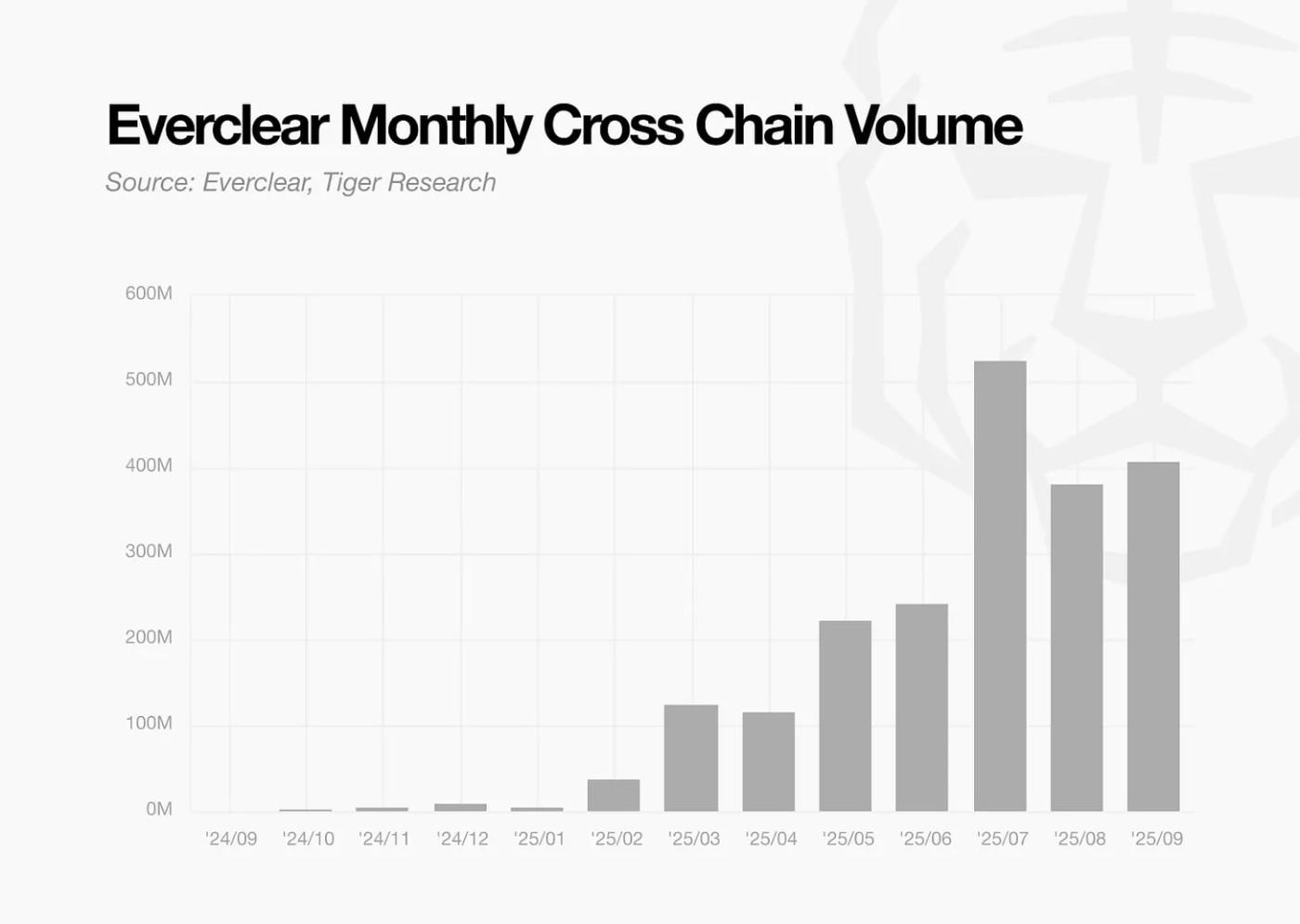

Everclear applies traditional financial clearing methods to net transactions and eliminate unnecessary asset movements. Rhino.fi's liquidity solution has reduced rebalancing fees by 97% and reduced settlement times from days to just 30 minutes. Thanks to its proven efficiency, Everclear's volume has grown 100x since the beginning of this year and has surpassed $2 billion cumulatively.

The greater the fragmentation, the greater the value of Everclear. More chains mean more netting opportunities. The fragmentation of stablecoins across multiple chains further reinforces this need.

1. Too Many Chains, Too Little Efficiency

Competition for blockchain infrastructure remains intense in 2025. New entrants like Stripe's Tempo and Circle's Arc are joining the fray. Major crypto exchanges like Upbit and Robinhood are also building their own infrastructure. This intensifying competition is accompanied by increasing structural inefficiencies across the ecosystem.

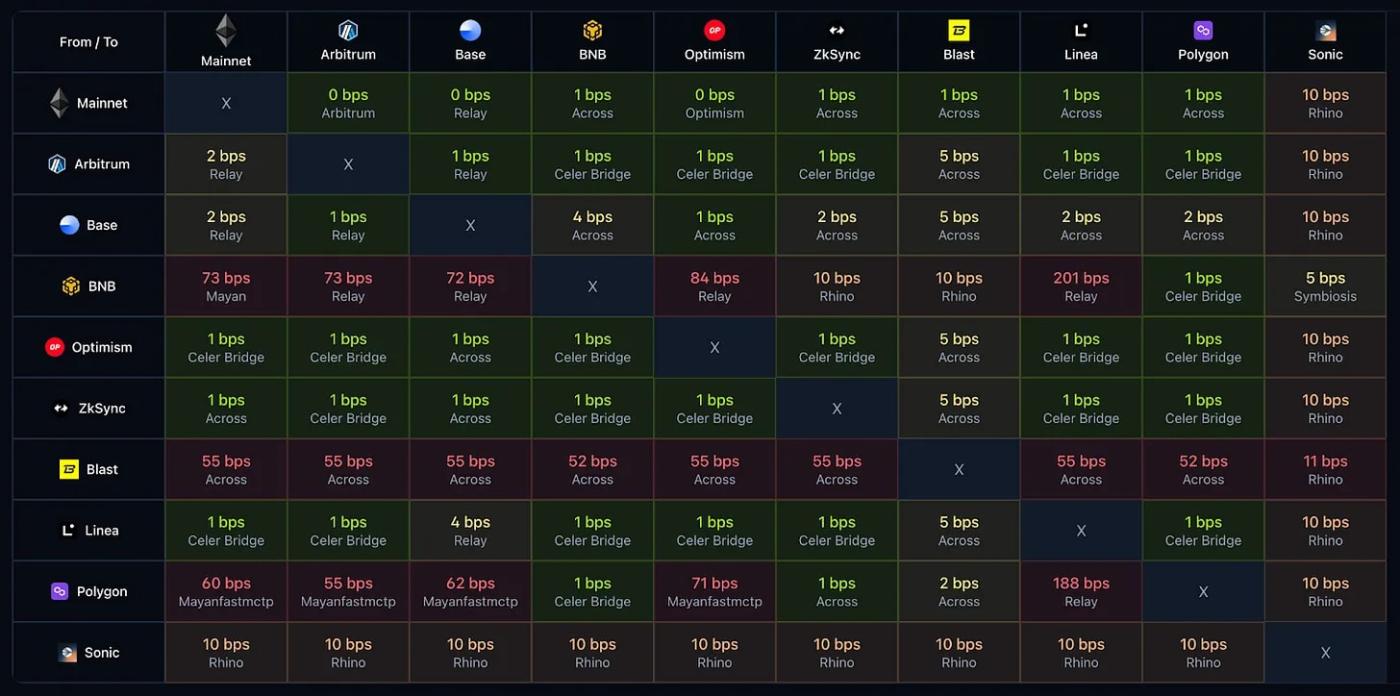

Fragmentation is the biggest problem. Each player builds a different chain . Currently, the blockchain industry has over 400 chains in operation. This fragmented environment creates three problems simultaneously. First, liquidity is spread across multiple individual chains , reducing capital efficiency. Second, operational complexity increases exponentially. Third, cross -chain asset transfers require bridges , which impose high fees. According to the Everclear team's rebalancing dashboard , fees for certain cross -chain transfers reach over 300 bps.

Chain abstraction technology appears to solve this problem. The user experience improves, but the inefficiencies don't disappear. The problem simply shifts like a "hot potato": bridges shift the burden to solvers , who then shift it to exchanges or market makers . Ultimately, all these costs trickle back to end users in the form of fees or slippage .

While infrastructure competition has spurred short-term innovation, excessive fragmentation is now a barrier to sustainable industrial growth.

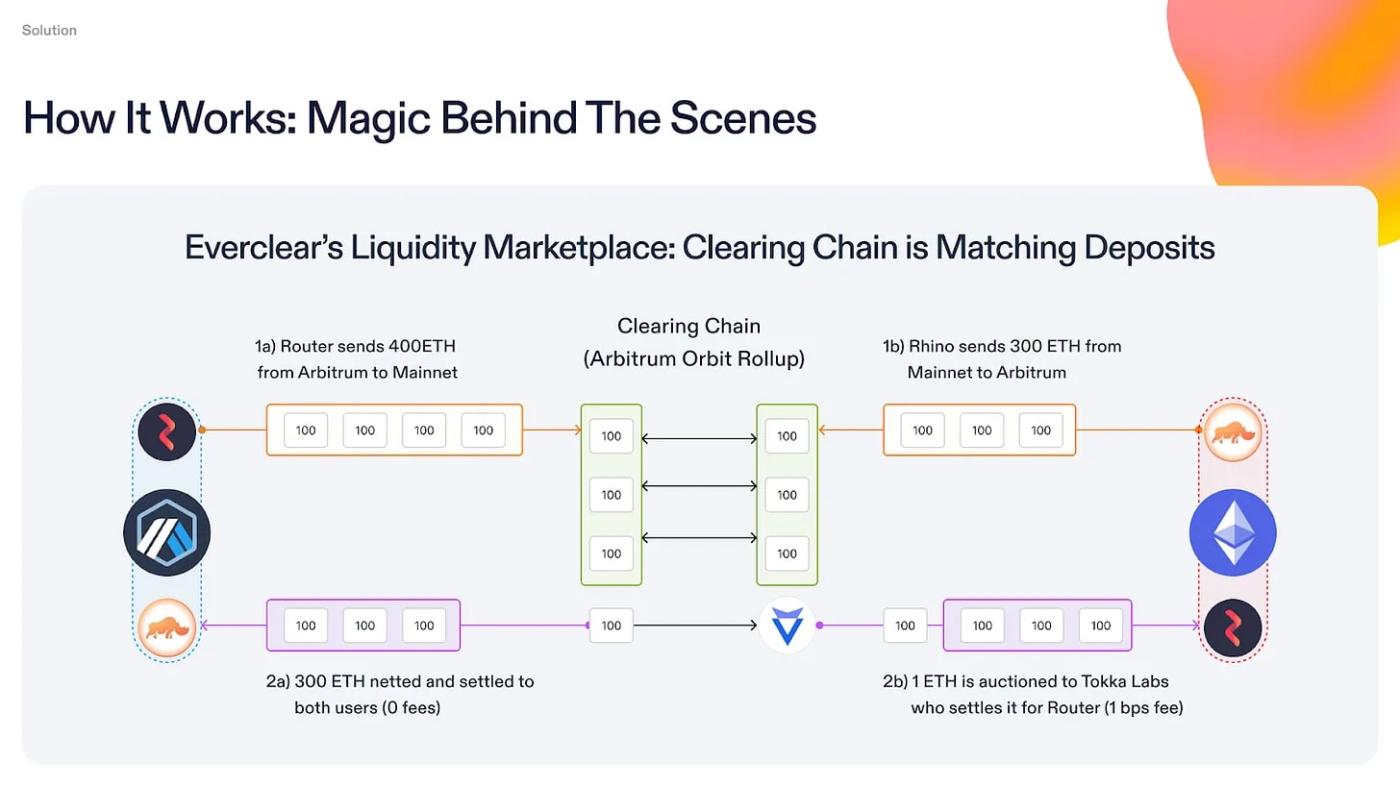

Everclear provides the most direct and effective solution to the structural inefficiencies that arise in today's multi-chain environment. As explained in a previous report , Everclear's core concept is to bring the clearing mechanism from traditional finance to the blockchain. Clearing minimizes the actual movement of assets by netting multiple transactions, thereby reducing costs and increasing operational efficiency. Simply put, this mechanism "eliminates" multiple fund movements by balancing them against each other, rather than processing each transaction individually.

Everclear Clearing addresses liquidity challenges across the crypto ecosystem. Solvers , bridges , and market makers rebalance funds through Everclear. In current cross- chain transactions, intent bridges receive user intents , and solvers then fulfill them.

Solvers manage assets across multiple chains and must continually rebalance to reflect changes in demand. For example, when demand for USDC swaps from Ethereum to Solana increases, the USDC supply on Solana decreases. Solvers must then move assets to Solana. Everclear assists with this rebalancing process by netting to eliminate unnecessary asset movements.

Centralized exchanges (CEXs) and market makers face the same problem. CEXs must support deposits and withdrawals across multiple chains . Binance alone supports over 17 chains for USDT withdrawals alone. When one chain runs low on assets, the exchange must draw supply from other chains . Market makers also constantly rebalance to maintain their positions in a multi-chain environment.

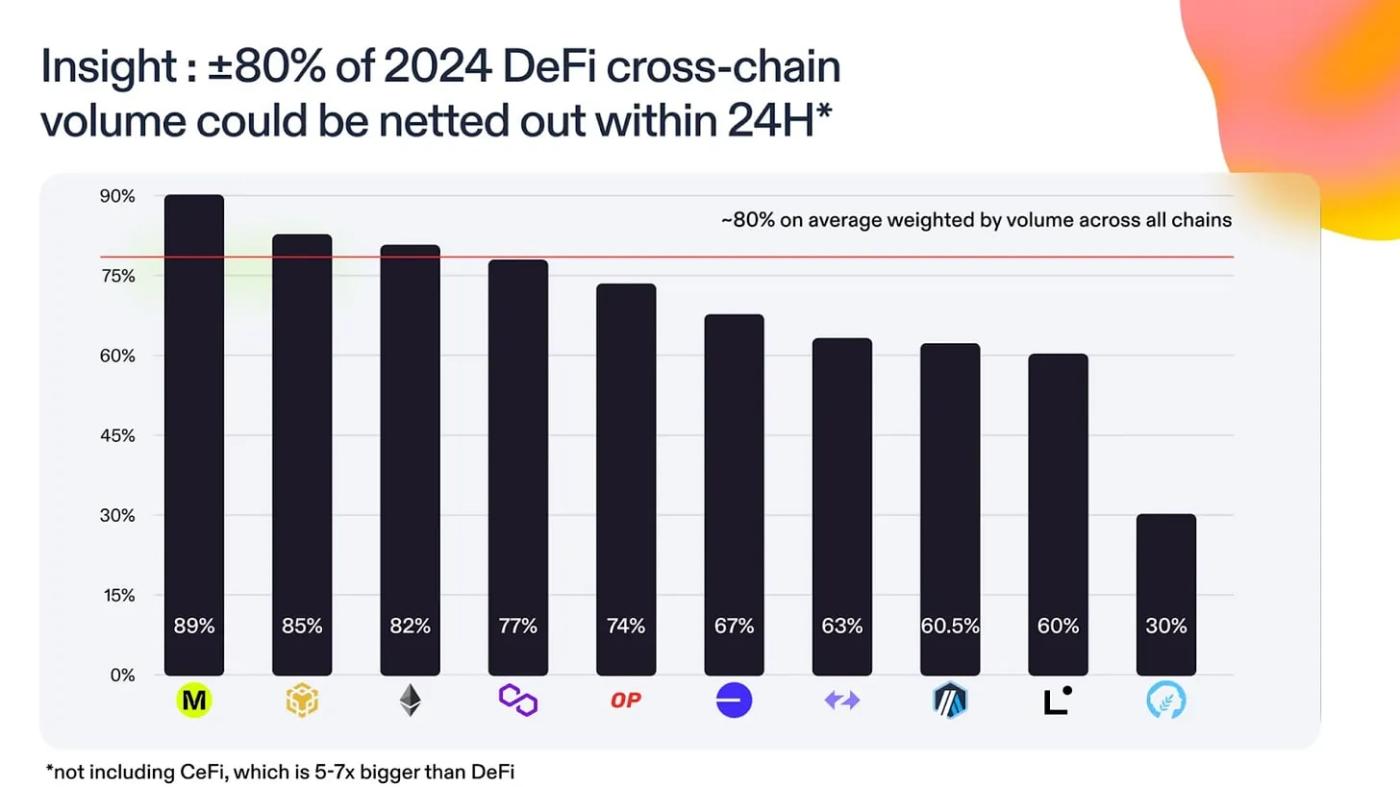

Data proves its potential. According to Everclear, over 80% of DeFi cross -chain transaction volume by 2024 could be netted . This means clearing mechanisms could replace a significant portion of current asset transfers. Netting also reduces the frequency and scale of rebalancing , as well as the need for excess capital placement across multiple chains .

Real-world results are also evident. Rhino.fi's cross -chain liquidity solution adopted Everclear and processed $12.9 million worth of transactions in just five weeks. Rebalancing fees were reduced by 97%. Settlement times were reduced from 8 hours to 7 days to just 30 minutes. The extremely low clearing fee of 0.2 basis points enabled this significant efficiency increase.

Market adoption is growing rapidly. Many services have integrated Everclear as their clearing layer. In addition to Rhino.fi, several major protocols have also switched to Everclear-based systems. The industry estimates the potential for operational cost savings of up to 10x. Everclear is positioning itself as a core infrastructure capable of simultaneously addressing capital efficiency and operational stability in the multi-chain era.

Everclear's potential extends beyond its current use case. The stablecoin era is creating new opportunities as its growth accelerates. The institutional foundation for stablecoins is beginning to form a framework that expands their use beyond mere intermediaries into real-world payment methods. The frequency and volume of stablecoin transactions are expected to increase rapidly.

However, the fragmentation problem is intensifying with the increasing adoption of stablecoins . For dollar-based stablecoins alone, there are various types, such as USDT, USDC, USAT, PYUSD, and MUSDC, issued by various institutions. Each circulates on a different blockchain. The existence of local stablecoins denominated in euros, yen, and won further complicates this situation.

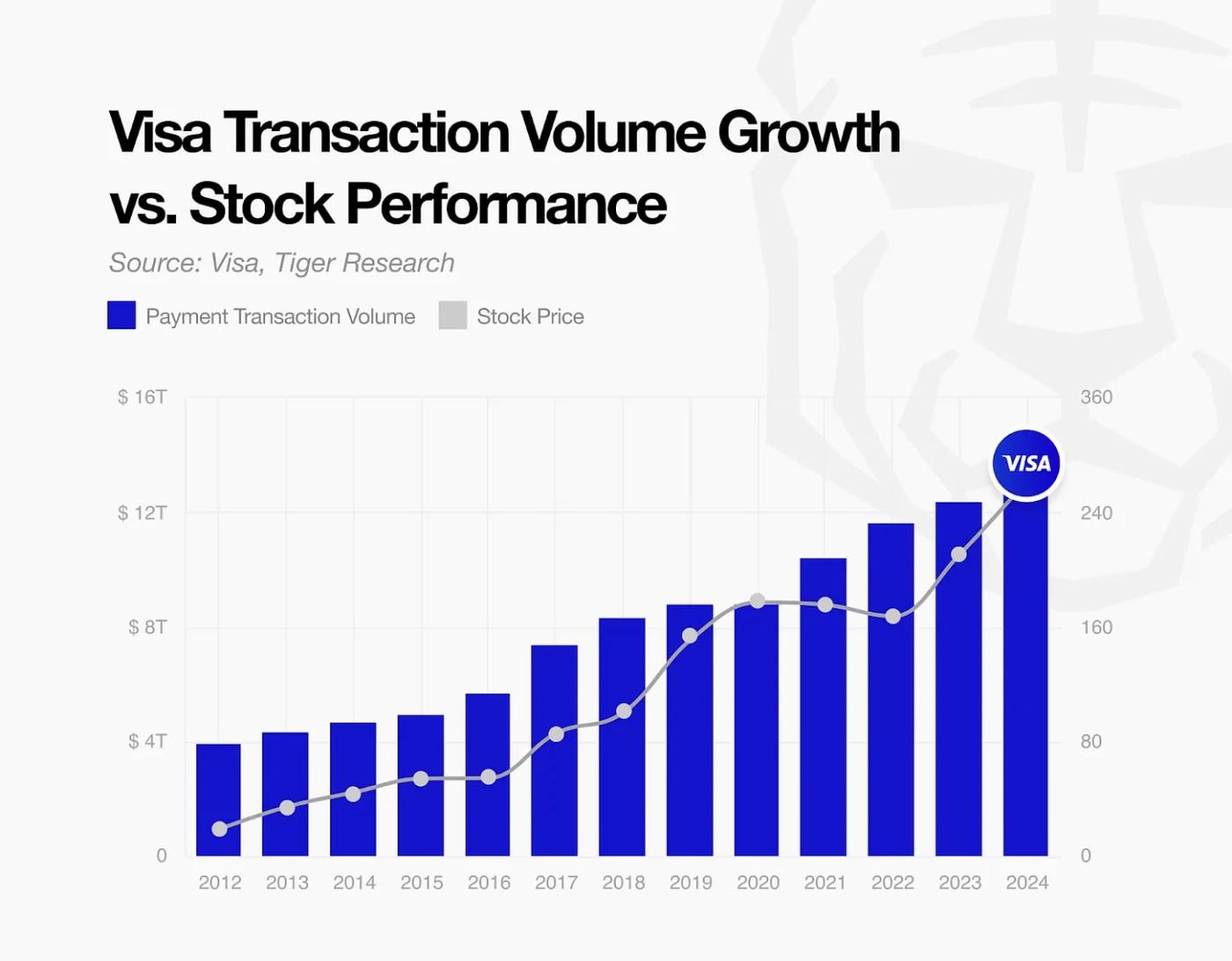

Everclear's strategic value emerges precisely at this point. VISA revolutionized the payments industry by integrating fragmented payment systems through the VisaNet network. Similarly, Everclear can perform netting and clearing within the fragmented stablecoin ecosystem. The platform goes beyond transaction aggregation and netting ; it can also settle transactions using major stablecoins like USDC or USDT, or even issue consortium-based tokens to address these challenges.

Everclear is positioning itself as core infrastructure for the stablecoin- based payments ecosystem. VISA is creating significant value by pioneering global payments innovation. Everclear shows the potential to follow a similar growth trajectory.

Fragmentation in the multi-chain ecosystem actually creates opportunities for Everclear. As the number of chains increases, cross- chain transactions become increasingly complex, and the need for coordination increases significantly. Everclear currently supports 23 chains and plans to expand its support to over 40 chains this year. As fragmentation deepens, Everclear's role in coordinating and completing asset transfers will naturally increase.

Current growth trends reinforce this. Everclear's monthly transaction volume has increased 100-fold compared to early 2025, reaching a total of $2 billion. Currently, Everclear adoption is primarily among bridges and DeFi protocols. Everclear has also partnered with several market makers and begun partnering with CEXs ( centralized exchanges ) to help them rebalance funds across chains .

The market potential is enormous. The estimated annual cross -chain transaction volume currently stands at around $600 billion. Processing even a fraction of that volume could create significant revenue opportunities. Payments using stablecoins are expected to grow rapidly. Furthermore, real -world assets (RWAs) will increasingly migrate on-chain, expanding the market opportunity significantly beyond what it is today.

As the number of chains and assets continues to grow, liquidity becomes increasingly fragmented. However, the need for clearing infrastructure to organize this fragmentation also increases proportionately. This fragmentation itself enhances Everclear's strategic value. This network effect demonstrates Everclear's long-term competitive advantage.

Telusuri lebih lanjut laporan yang relevan dengan topik ini:

Disclaimer

This report was funded in part by Everclear. It was independently produced by our research team using credible sources. The findings, recommendations, and opinions presented are based on information available at the time of publication and are subject to change without notice. We disclaim any liability for any loss arising from the use of this report or its contents, and make no warranty as to its accuracy or completeness. The information presented may differ from the views of others. This report is prepared solely for informational purposes and does not constitute legal, business, investment, or tax advice. References to securities or digital assets are for illustrative purposes only and do not constitute investment advice or an offer. This material is not intended for investors.

Terms of Use

Tiger Research permits fair use of reports it has compiled and published. 'Fair use' is a principle that permits the use of portions of content for the public interest, as long as it does not harm the commercial value of the material. If the use complies with this principle, reports may be used without prior permission. However, when citing Tiger Research reports, you are required to:

Clearly cite 'Tiger Research' as the source.

Includes Tiger Research logo (black/white).

If the material is to be re-compiled and republished, separate approval is required. Unauthorized use of the report may result in legal action.