This report, authored by Tiger Research, analyzes the current state of public launchpads, a new form of platform emerging after the ICO boom of 2017. It examines the differentiation strategies of four major platforms—Legion, Biddlepad, Sonar, and Kaito—and forecasts the sustainability and future direction of public launchpads.

TL;DR

Following the ICO boom of 2017, public sales are resurfacing in a new form, with various launchpads such as Legion, Biddlepad, Sonar, and Kaito leading the market trend.

These platforms, most of which presuppose KYC and regulatory compliance, attempt to differentiate themselves by developing unique strategies through their own participant selection criteria and token allocation methods.

While the short-term overheating of public launchpads may ease, as a means of securing early adopters and liquidity for projects, public launchpads are expected to remain a model driven by structural demand.

1. Transition from private sale to public sale

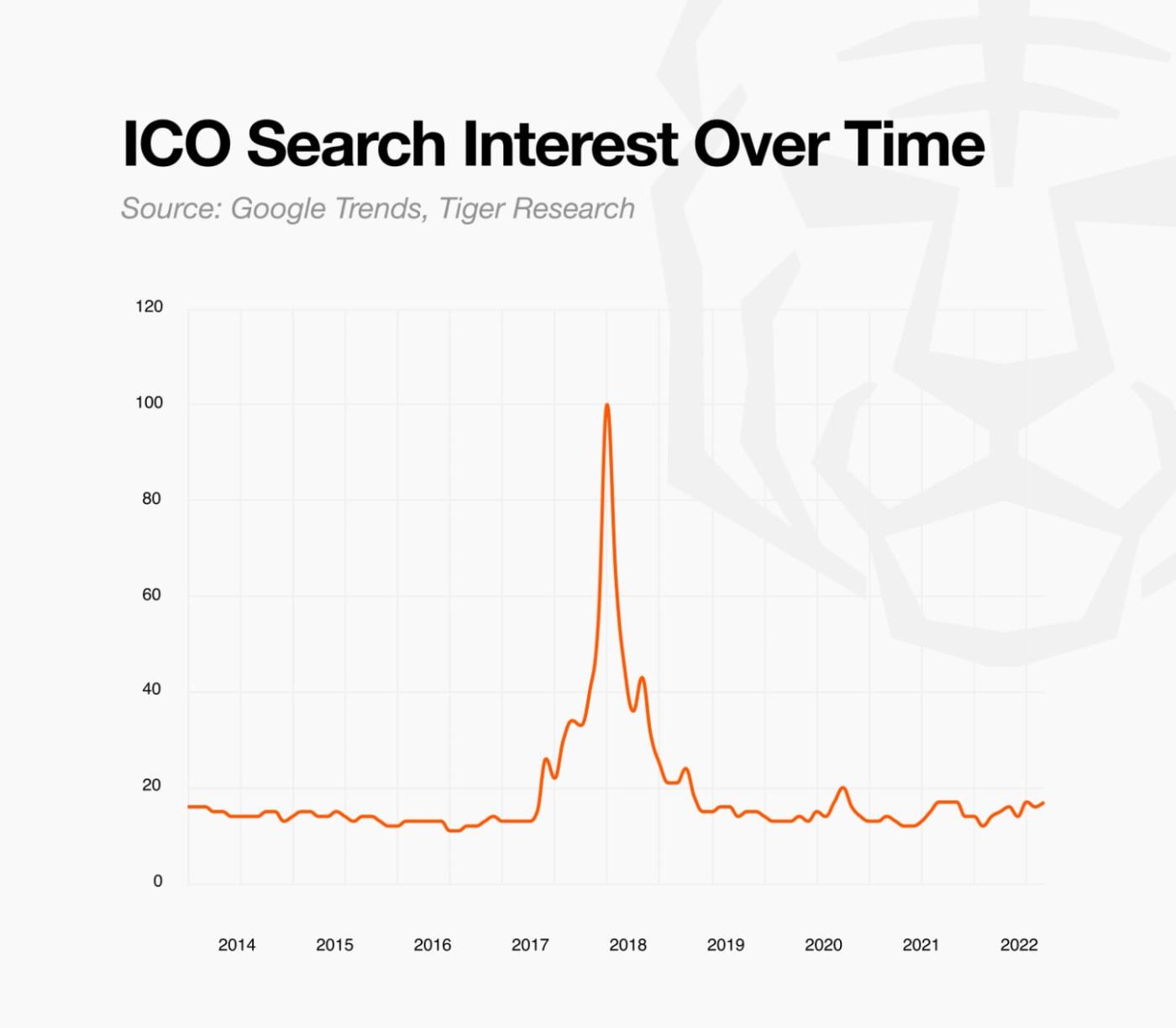

The initial coin offering (ICO) boom, which peaked in 2017, quickly declined due to a loss of trust stemming from various scams and opaque information. Since then, the market has reorganized around private sales, significantly reducing opportunities for early participation for general investors. However, public sales have recently been making a comeback in a new form. This is driven by the emergence of various launchpad platforms that address the shortcomings of past ICOs.

A key driver of these changes is the resolution of regulatory uncertainty. Europe's Markets in Virtual Assets Regulation (MiCA) established a clear licensing framework for issuers and fundraising platforms, providing a legal basis for token sales to qualified participants. Furthermore, several hubs in parts of Asia and the Middle East have also begun allowing KYC-based token sales under local licensing regimes, creating an environment where public sales can be legally conducted within a regulatory framework.

This report analyzes the characteristics and differentiation strategies of new launchpad platforms emerging amidst these changing environments and forecasts the future direction of the public launchpad market.

As new launchpad platforms emerge, public sale methods are diversifying. While they all rely on regulatory compliance (KYC, etc.), each platform's approach to selecting participants and distributing tokens differs significantly. This report examines four representative launchpads in detail.

Legion is a public sale platform that identifies investors who can make a substantial contribution to project development and provides them with fair investment opportunities. Rather than simply seeking investors for funding purposes, Legion aims to maximize long-term value by connecting participants who can add tangible value to the project.

To achieve this, Legion operates a proprietary merit-based system called the "Legion Score." This score is quantitatively calculated by synthesizing various on- and off-chain data, including on-chain activity history, social media influence, and GitHub activity scores. Furthermore, when participating in an investment round, investors are required to write a cover letter explaining how they can contribute to the project. Furthermore, subjective factors that are difficult to quantify are qualitatively evaluated (primarily based on the LLM). This allows for a comprehensive assessment of an investor's ecosystem contribution capacity, rather than their financial strength.

The recent Yield Basis sale demonstrates this approach in action. With over 67,000 applicants, Legion prioritized Legion Score, but adopted a relative rather than absolute evaluation. The final selection process involved comprehensive consideration of factors such as tweets about Yield Basis, on-chain activity in related protocols, and, for developers, GitHub contributions. These factors were combined with a manual review process.

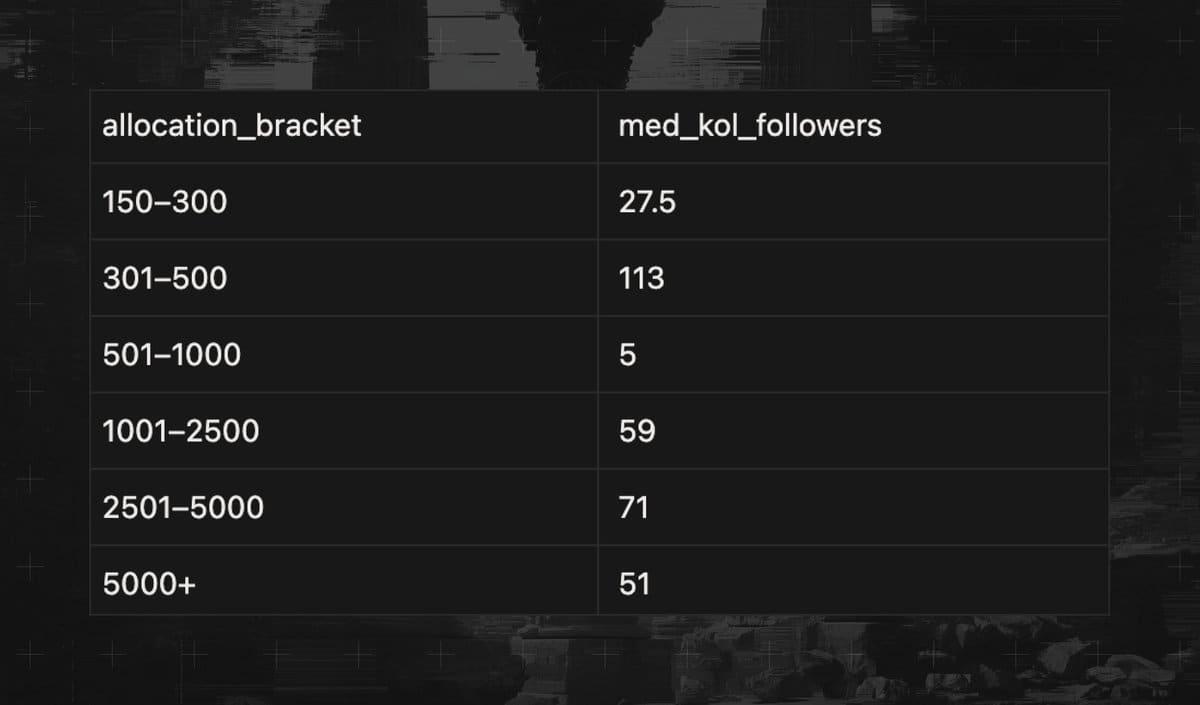

However, this process also generated some controversy. Some participants questioned whether the allocation was excessively concentrated in the hands of a small number of influencers. Legion responded by publishing a transparency report , disclosing the allocation criteria and actual distribution. However, this reveals a fundamental dilemma inherent in reputation-based models. The selection process inevitably involves qualitative judgment, and the criteria for evaluating certain contributions cannot be transparently disclosed. Disclosing detailed evaluation criteria could lead to abuse, making a certain level of opacity unavoidable. Ultimately, Legion faces a structural limitation: it must find a balance between complete objectivity and transparency.

Nevertheless, Legion's attempt is meaningful. It proposes a funding structure centered on contribution capacity, rather than mere capital or first-come, first-served competition, and connects the project with suitable investors. This is an attempt to transform public sales from mere speculation into long-term community engagement, and it represents an experiment in reimagining the openness and accessibility previously pursued by ICOs.

2.2. Buidlpad: A Participatory Cryptocurrency Launchpad Platform

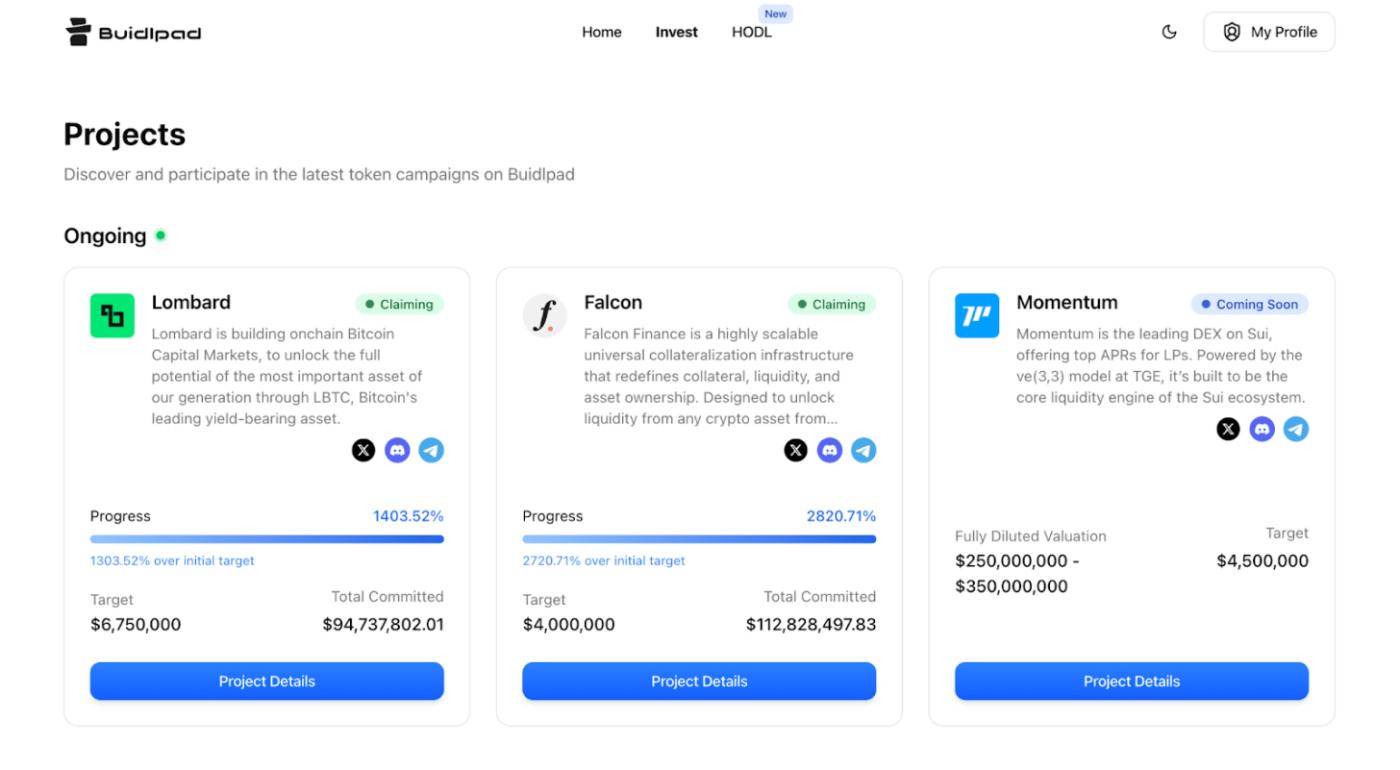

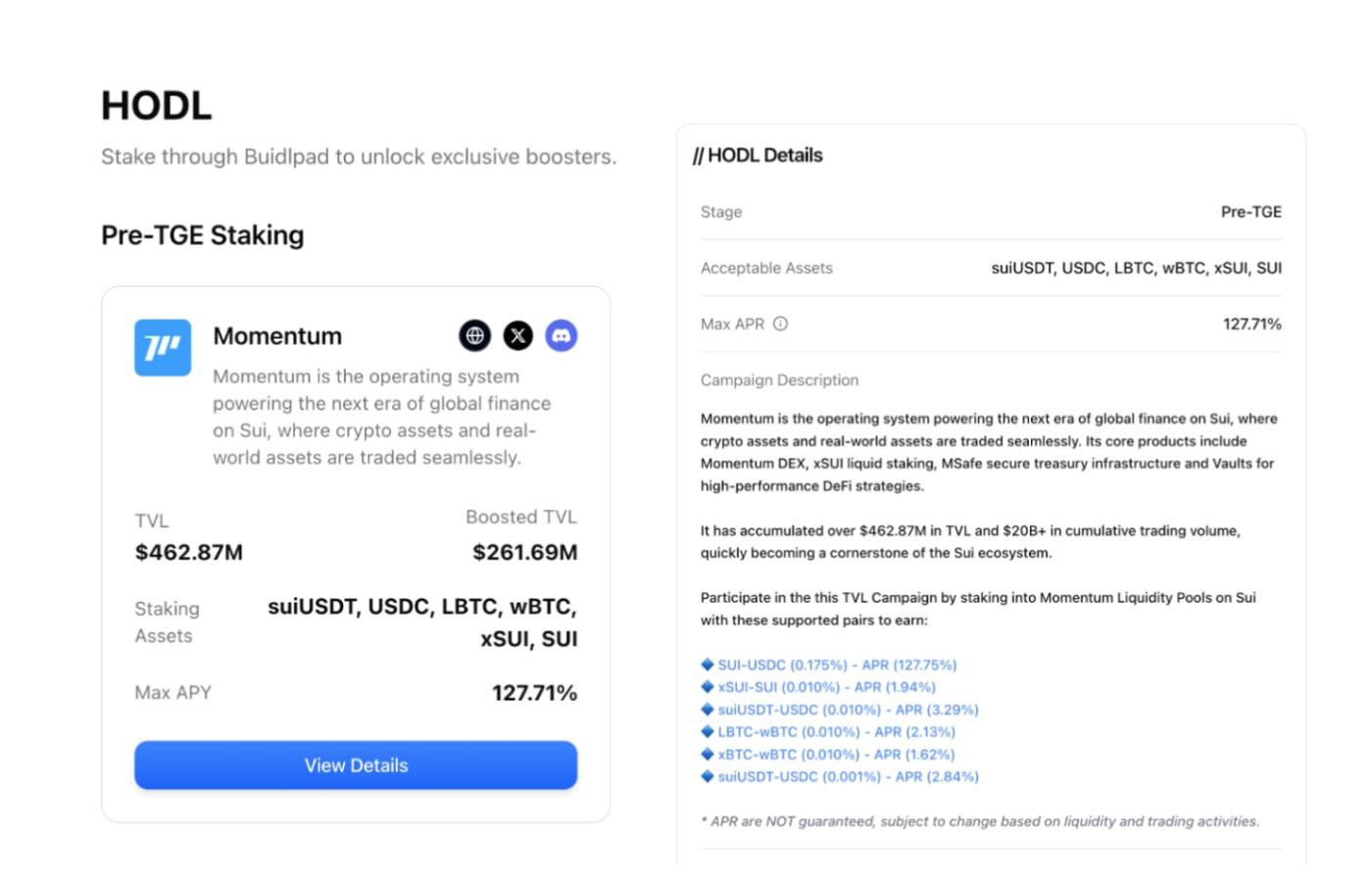

Buidlpad, a launchpad centered around the Sui ecosystem, takes a different approach from Legion. While anyone can participate after completing KYC verification, the criteria for selecting participants differ. While Legion utilizes reputation scores, Buidlpad relies on liquidity provision to projects. Participants stake directly in the pool of their choice in the Hodl section, and their tier is determined based on the size of their stake. Higher tiers offer better token purchase prices.

This approach has clear advantages and disadvantages. Anyone with capital can participate, lowering the barrier to entry. It also provides projects with the liquidity they need in their early stages. Indeed, projects like Momentum, currently being sold on Biddlepad, have been confirmed to have secured significant TVL (Total Value Locked). However, because capital is a prerequisite for participation, opportunities are limited for participants like Legion who can contribute through influence or technological prowess.

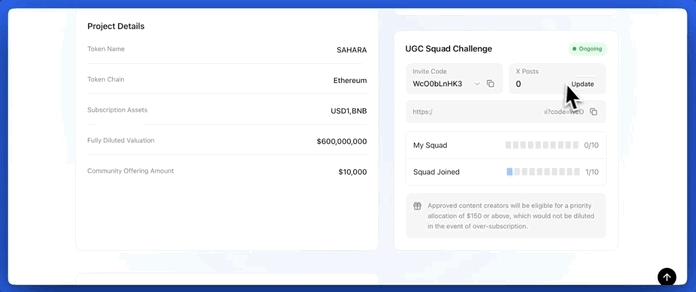

To address the limitations of this capital-centric structure, Biddlepad recently introduced the "Squad" system. Squad adds gamification to the existing staking system, extending beyond simple capital provision. Participants can upload project-related content through social media creation, community activities, and other means, and receive additional rewards based on quality.

This structure fosters an active community from the launchpad stage, encouraging participation and contribution, as well as capital. From the project's perspective, this allows them to simultaneously secure the liquidity and promotional impact necessary for initial bootstrapping. Biddlepad's efforts demonstrate that launchpads can evolve beyond mere funding channels into ecosystem bootstrapping tools.

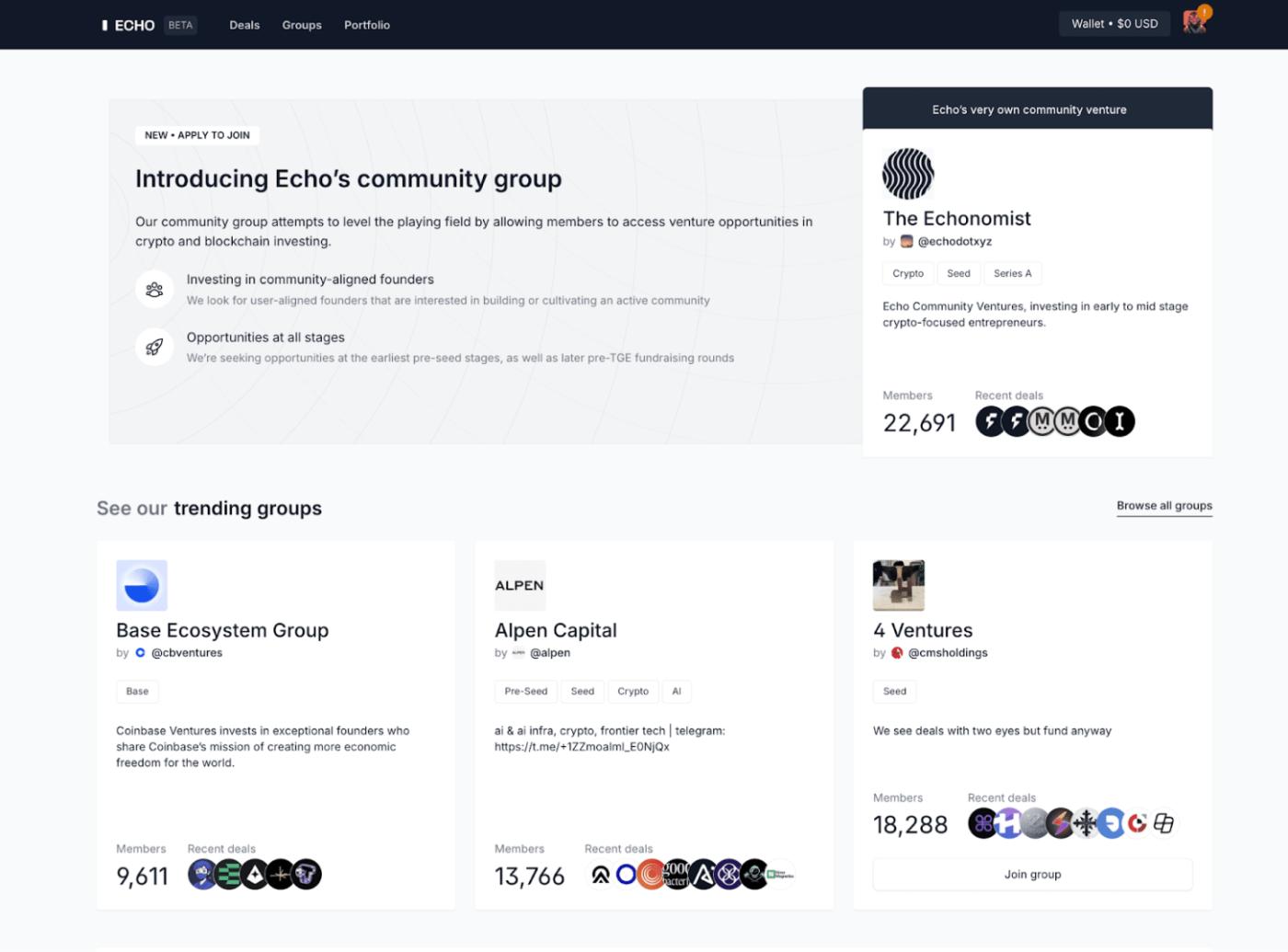

Sonar is a public launchpad developed by the syndicate investment platform Echo . Echo operates on an invitation-only basis and is exclusively for professional investors, strictly screening participants based on investment experience and capabilities, in addition to KYC. This closed structure poses a high barrier to entry for general investors. Sonar was created to address this, pursuing a more open token sale model.

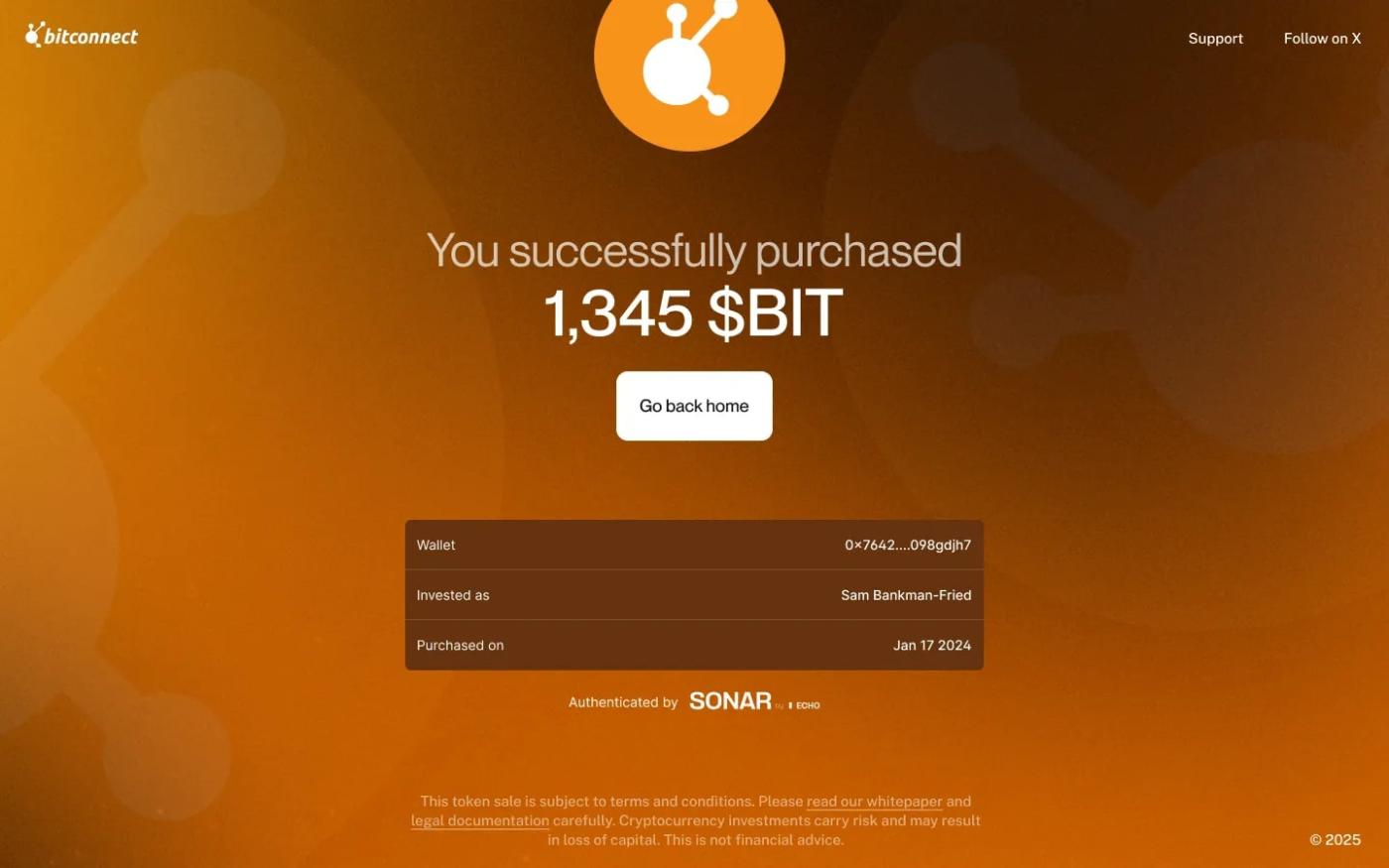

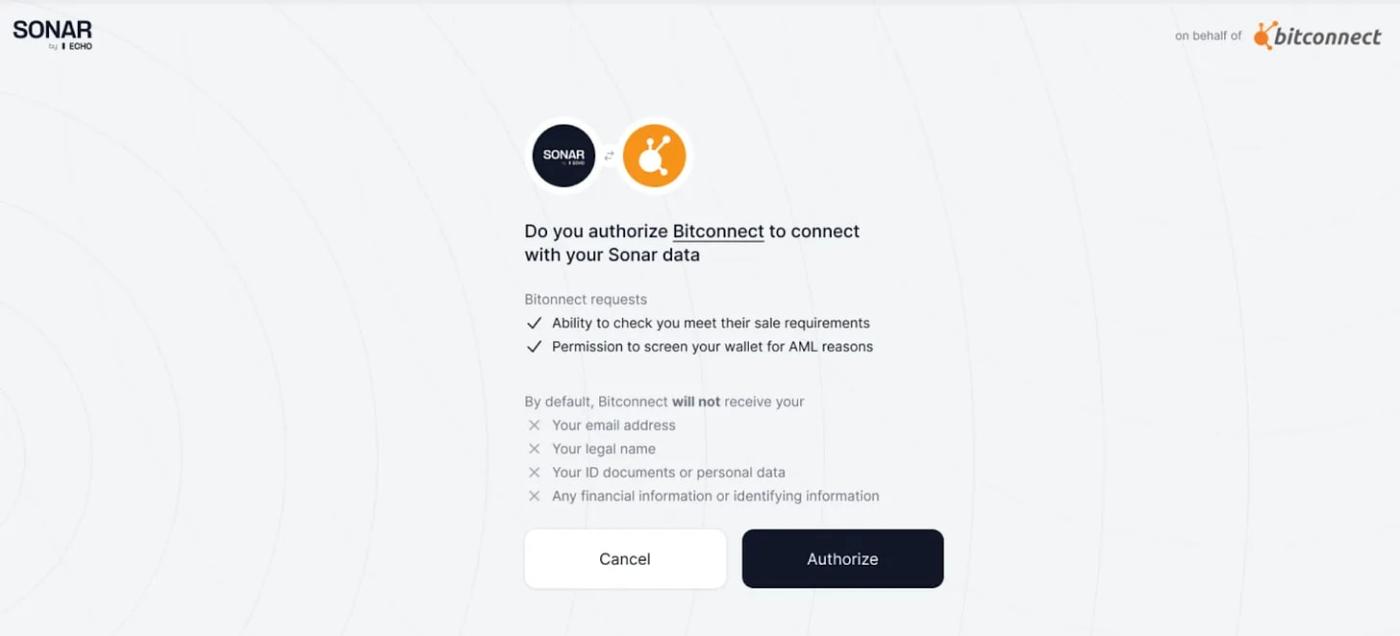

Sonar's defining characteristic is its flexibility. Projects can freely set their own sale schedule, price, and distribution method, while Sonar only provides the software. Throughout this process, Echo's compliance system remains intact. While participants must undergo a qualification review, including KYC, only eligibility attestation is provided to the project, not personal information, ensuring both legal requirements and privacy protection. Plasma and MegaEther have conducted sales through Sonar using this approach.

However, this flexibility brings uncertainty for investors. Sale structures vary from project to project, and sometimes detailed criteria and responsibilities are unclear. In the event of a problem, accountability between the platform and the project can become unclear, posing a structural risk compared to centralized platforms governed by clear rules.

Kaito Capital Launchpad is a public launchpad that selects participants based on reputation. It adopts a similar approach to Legion, but differentiates itself by focusing on social influence. Kaito was originally an AI-powered cryptocurrency information analysis platform, providing market insights based on on-chain data and quantifying social activity through the Yaps system. Kaito Capital Launchpad extends this data infrastructure to a public sale.

Kaito Capital Launchpad scores users' social influence through YAP points. This score is then combined with on-chain participation history, Kaito token holdings and staking, past sale participation, and regional allocation restrictions to determine allocation priorities. While YAP points are not required, higher rankings on the leaderboard increase the likelihood of receiving larger allocations and rewards, and some projects even grant priority to YAP point holders.

This structure offers clear advantages to projects. It allows them to secure influential social media participants as early investors, generating a natural promotional effect. This strategy is particularly effective for projects where early visibility is crucial. However, it also has limitations. Because it's structured around activities within the Kaito ecosystem, it presents a high barrier to entry for external participants. Furthermore, the focus on social influence in the evaluation criteria makes it difficult to fairly evaluate other types of contributors, such as developers.

Interest in public launchpads has surged recently. In particular, projects launched through Biddlepad have been listed on major Korean exchanges like Upbit and Bithumb, resulting in short-term price increases, raising investor expectations. While returns are lower compared to previous IDO cycles (Star Atlas's IDO in 2021 yielded returns of several hundred times), they are still viewed as an attractive opportunity given the market's post-long slump.

However, this enthusiasm is unlikely to last. Repeated high-yield scenarios lead to increasingly unrealistic investor expectations, but not all projects can guarantee the same returns. If results fall short of expectations accumulate, disappointment spreads among participants and is likely to lead to market fatigue. From the project's perspective, overheating is also a burden. A large influx of participants solely focused on short-term gains can degrade the quality of the community, making long-term user conversion and ecosystem maintenance difficult. If this trend continues, participation enthusiasm will naturally subside, and short-term overheating is likely to ease after a certain point.

Nevertheless, public launchpads are likely to remain a model driven by structural demand, not a passing fad. The cryptocurrency market is far more complex than ever before, and will only become more so in the future. In an environment where numerous projects are emerging simultaneously, initial funding is essential for each project to build a community and secure a user base. However, conducting a Token Generation Event (TGE) independently is costly and risky, and in an environment rife with bots and duplicate accounts, even identifying genuine users is challenging. Public launchpads offer a structured solution to these problems. Through a pool of vetted participants, projects can efficiently secure initial liquidity and a community.

From an investor perspective, public launchpads offer renewed access to "early-stage investment opportunities" that had been closed for some time. They offer individual investors, previously excluded from the venture capital-centric market structure, a fairer and more transparent way to participate in early-stage projects. Beyond simply generating profits, they function as a new structure that allows them to directly participate in the very beginning of the token economy.

However, challenges remain. The openness of participation and the efficiency of selection are inherently conflicting. Striking a balance between the ideal of universal participation and the reality of selecting actual users is challenging. Overly transparent criteria can lead to system abuse, while opaque criteria erode trust. Institutional and technological advancements are still necessary.

이번 리서치와 관련된 더 많은 자료를 읽어보세요.

Disclaimer

This report has been prepared based on reliable sources. However, we make no express or implied warranties as to the accuracy, completeness, or suitability of the information. We are not responsible for any losses resulting from the use of this report or its contents. The conclusions, recommendations, projections, estimates, forecasts, objectives, opinions, and views contained in this report are based on information current at the time of preparation and are subject to change without notice. They may also differ from or be inconsistent with the opinions of other individuals or organizations. This report has been prepared for informational purposes only and should not be construed as legal, business, investment, or tax advice. Furthermore, any reference to securities or digital assets is for illustrative purposes only and does not constitute investment advice or an offer to provide investment advisory services. This material is not intended for investors or potential investors.

Tiger Search Report Usage Guide

Tigersearch supports fair use in its reports. This principle allows for the broad use of content for public interest purposes, provided it does not affect commercial value. Under fair use rules, reports may be used without prior permission. However, when citing Tigersearch reports, 1) "Tigersearch" must be clearly cited as the source, and 2) the Tigersearch logo must be included. Reproducing and publishing materials requires separate agreement. Unauthorized use may result in legal action.