This report analyzes the resurgence of public token sales and takes a closer look at the operational strategies of four major launchpad platforms: Legion, BuildPad, Sonar, and Kaito.

Summary of key points

Since the ICO boom of 2017, public sales are making a comeback in new forms. Launchpads as diverse as Legion, Buildpad, Sonar, and Kaito are leading the market.

Most platforms require KYC (identity verification) and comply with relevant regulations. Each platform differentiates itself through unique participant screening criteria and token distribution mechanisms.

The short-term hype surrounding public launch platforms may gradually cool. However, due to structural demand, public launch platforms are expected to persist for a long time. They serve as a valuable tool for projects to acquire early users and liquidity.

1. Returning from private sales to public sales

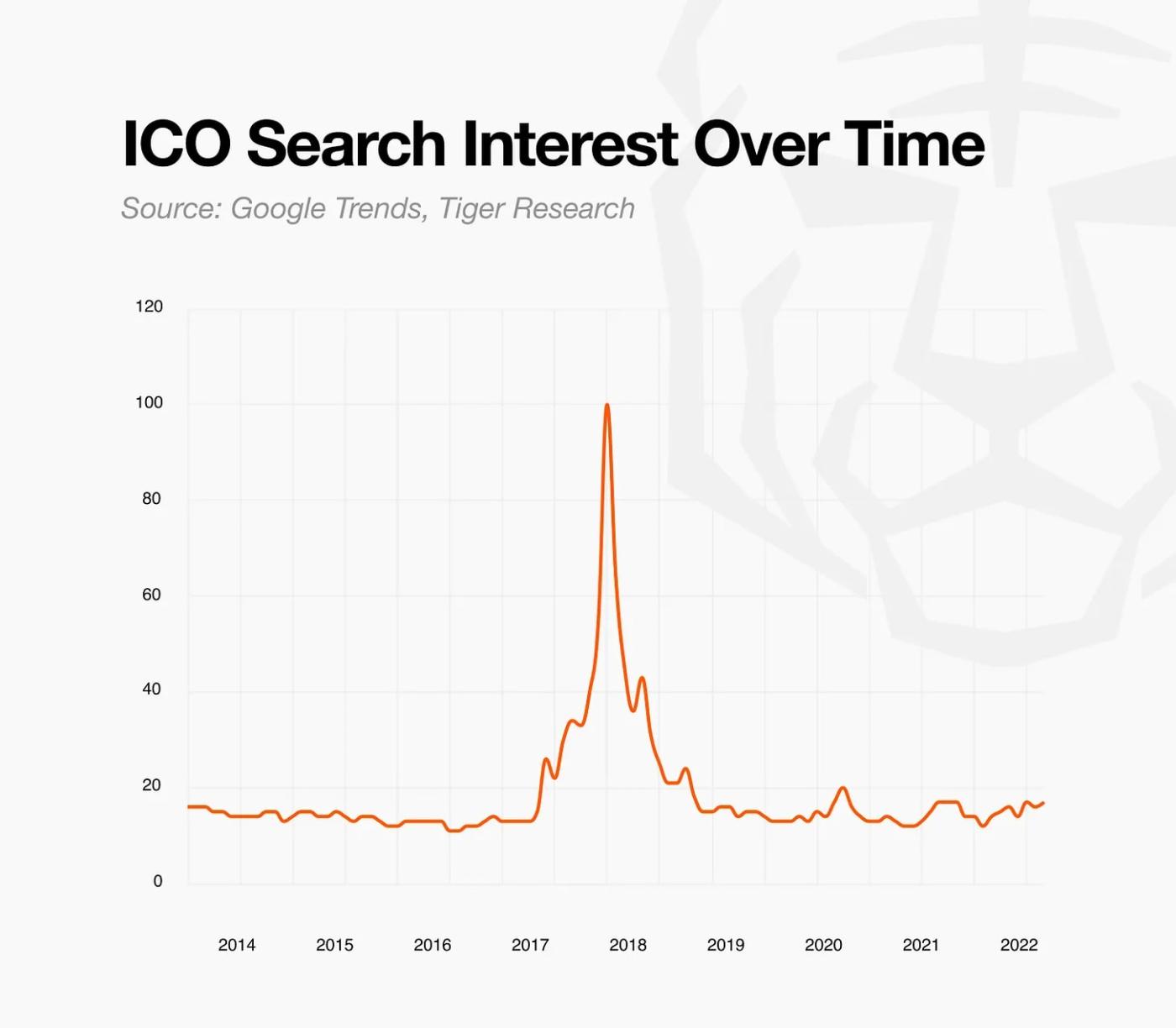

The ICO (Initial Coin Offering) craze peaked in 2017, but quickly lost credibility due to issues like fraud and a lack of transparency, leading to a sharp decline in the market. This shifted to private sales, significantly reducing the opportunities for retail investors to participate early. However, public sales have recently seen a resurgence in new forms. This resurgence is driven by the emergence of various launch platforms that address the challenges of past ICOs.

Driving this change is a clearer regulatory framework. Europe's Markets in Crypto-Assets Act (MiCA) establishes a clear licensing system for token issuers and fundraising platforms. This provides a solid legal basis for selling tokens to qualified participants. Some Asian regions and several Middle Eastern financial centers now allow token sales with KYC checks under local licensing frameworks. These developments have collectively created a market environment where public sales can operate legally within regulatory frameworks.

This report will examine the characteristics and operating strategies of emerging launch platforms in this transformative environment. It will also explore the future development direction of the public launch platform market.

New launch platforms continue to emerge, driving a diversification in public sale methods. All platforms require compliance measures such as Know Your Customer (KYC). However, there are significant differences in participant screening mechanisms and token distribution methods. This report examines four representative launch platforms to explore these differences in detail.

Legion is a public sale platform whose core philosophy is to identify investors who can truly contribute to project development and provide them with fair investment opportunities. The platform's goal isn't simply to find investors for fundraising purposes. Legion is committed to connecting participants who can create real value for projects, thereby maximizing long-term value.

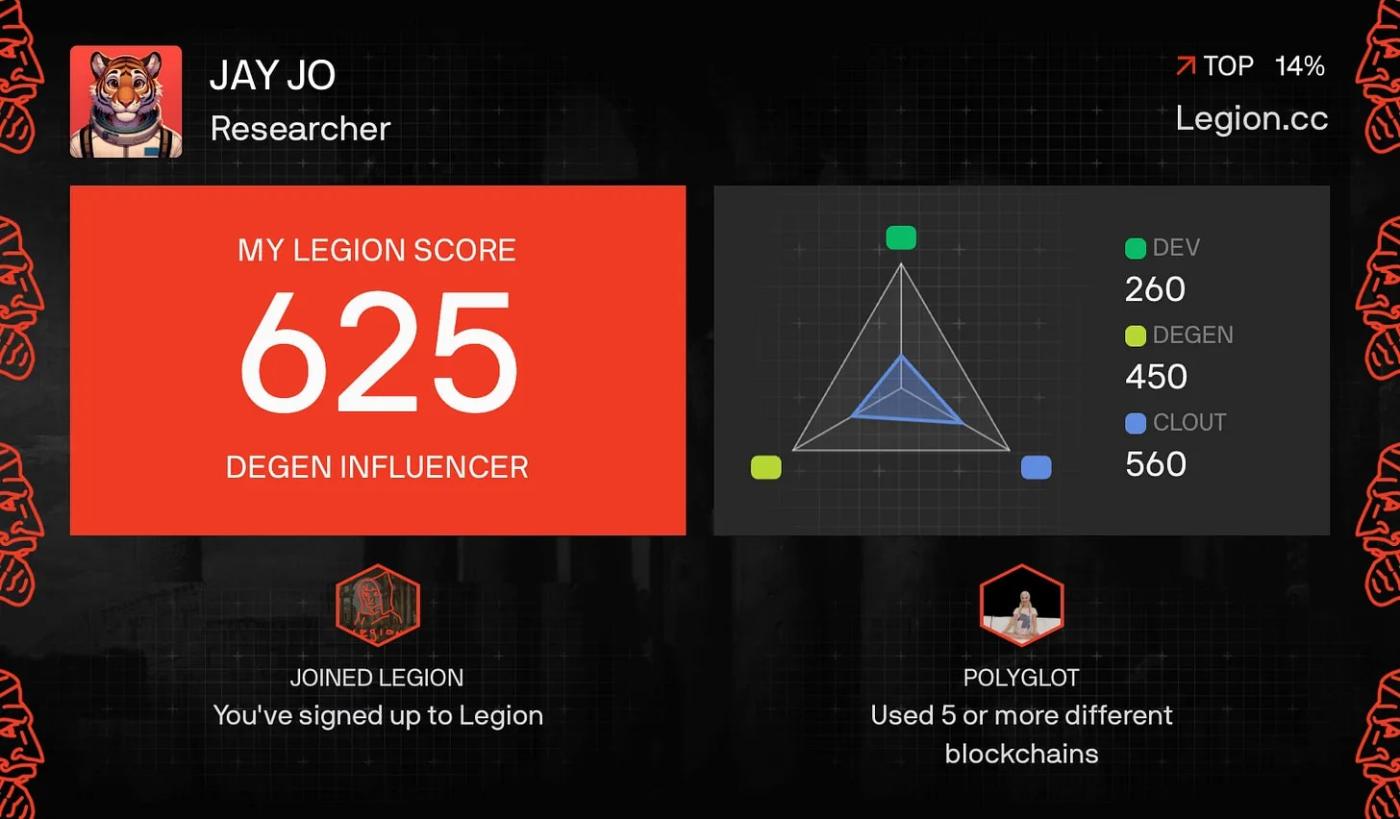

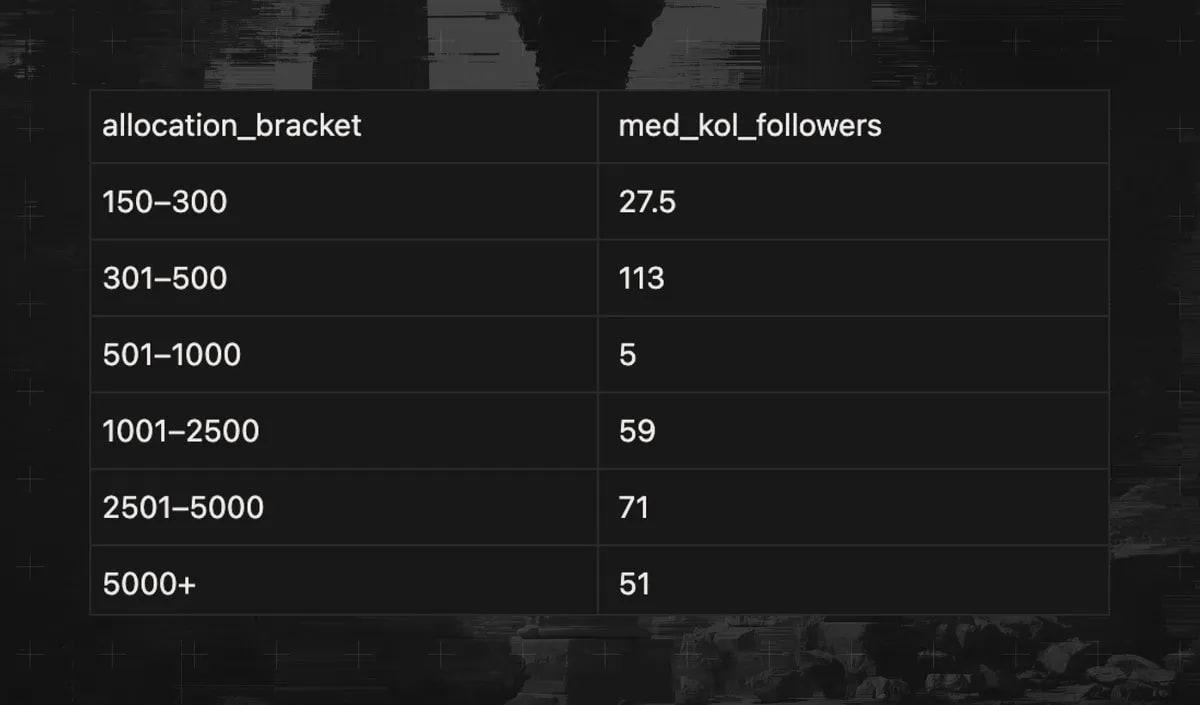

To achieve this goal, Legion has developed and operates a proprietary valuation system called the Legion Score. This score is quantitatively calculated by integrating multiple dimensions of on-chain and off-chain data, including on-chain activity history, social media influence metrics, and GitHub development activity scores. Investors are also required to submit a letter detailing how they can contribute to the project when participating in an investment round. This mechanism allows the platform to qualitatively assess difficult-to-quantify subjective factors (primarily through Large Language Model (LLM) analysis). This approach comprehensively assesses an investor's ability to contribute to the ecosystem, rather than simply considering their financial strength.

The recent Yield Basis token sale showcased this approach in action. Over 67,000 applications were received for the sale. Legion utilizes the Legion Score as its foundation, but uses a relative rather than absolute evaluation approach. The platform considers multiple factors, including applicants' history of tweeting about Yield Basis, on-chain activity in related protocols, and a GitHub contribution history focused on the developer community. Manual review is performed throughout the process to finalize the selection process.

However, this process has also sparked controversy. Some participants have questioned whether token distribution is overly concentrated in the hands of a few influential individuals. In response, Legion released a transparency report detailing the distribution criteria and actual distribution. However, this report reveals a fundamental dilemma inherent in the value-contribution model. Qualitative judgments inevitably enter the selection process. The platform cannot fully disclose the detailed criteria for evaluating the value of different types of contributions. Disclosing overly detailed evaluation criteria could lead participants to manipulate the system through fraudulent participation. A certain degree of opacity remains unavoidable. This model faces a structural constraint between the pursuit of complete objectivity and the maintenance of transparency.

Despite this, Legion's approach remains of significant practical significance. It presents a fundraising structure centered on contribution, rather than simply relying on capital strength or a first-come, first-served competitive system. This approach connects projects with truly suitable investors. It seeks to transform public sales from pure speculation into long-term community engagement and development. It also represents an experimental attempt to achieve the ideals of openness and universal participation pursued by previous ICOs through innovative methods.

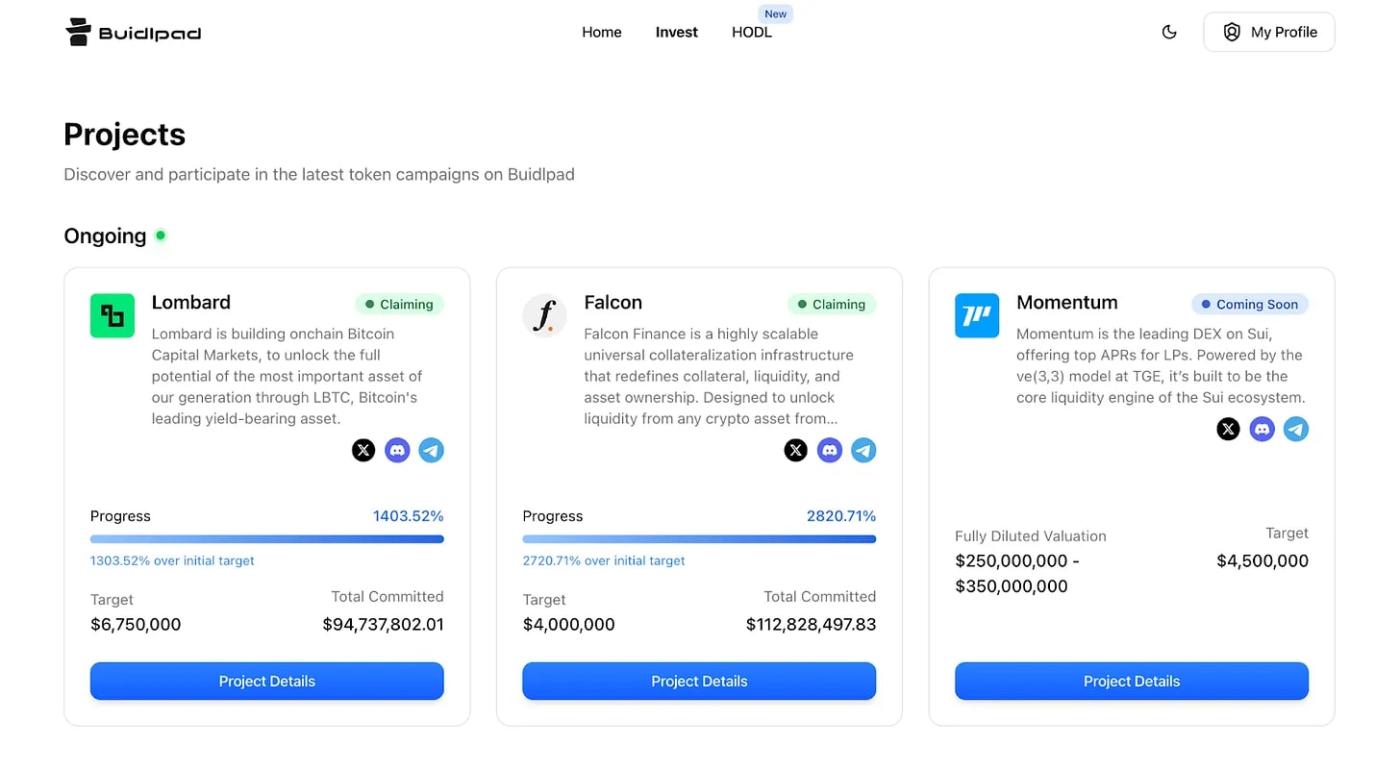

2.2. Buildpad: A crypto-launching platform based on participation mechanism

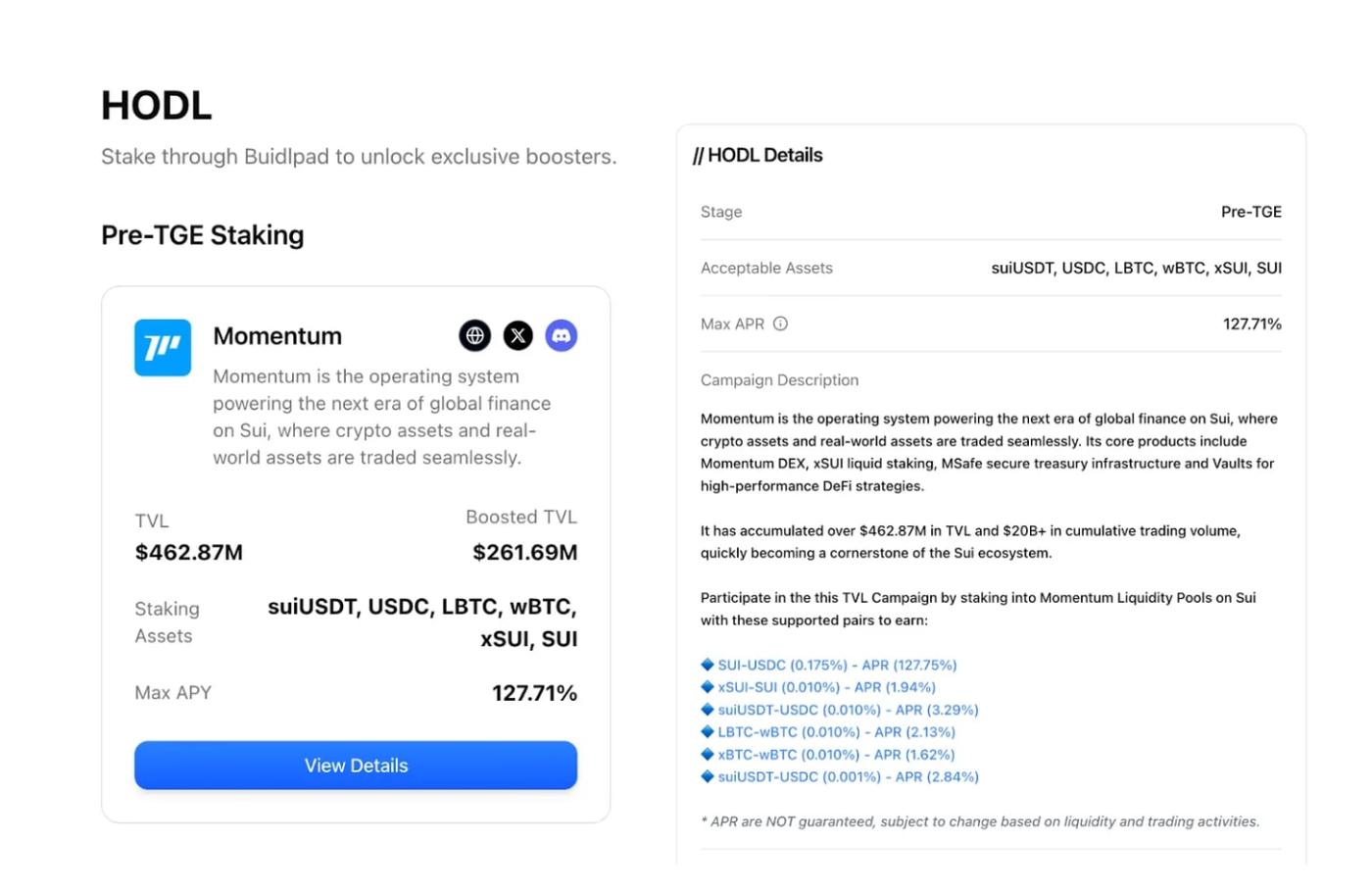

Buidlpad , a startup platform focused on the Sui ecosystem, adopts a distinct operational strategy from Legion. While both platforms allow anyone who completes KYC verification to participate, there are fundamental differences in participant screening criteria. Legion utilizes a value scoring system, while Buidlpad's screening is based on the liquidity contribution provided by participants to the project. Participants are required to stake funds directly in the Hodl section of their preferred project pool. Tiers are determined by the amount staked. Higher tiers offer more favorable token purchase prices.

This approach has distinct advantages and disadvantages. Anyone with capital can participate, creating a low barrier to entry. Projects can obtain necessary liquidity support at an early stage. Projects like Momentum, currently selling on Buildpad, have successfully achieved significant TVL (total value locked). However, capital size becomes a prerequisite for participation. This limits opportunities for participants who can contribute through influence or technical expertise (as on the Legion platform).

Buildingpad recently launched the "Squad" system to address the limitations of this capital-centric structure. Squad adds a gamification element to the existing staking model. This initiative aims to move beyond the simple capital provision model. Participants can upload project-related content through social media creation and community activities. They will receive additional incentives based on the quality of their content.

This architecture fosters an active community from the very beginning, encouraging participants to invest and contribute beyond their initial capital. Projects can simultaneously secure the liquidity and promotional benefits they need during the early stages of development. Building a platform's exploration demonstrates how a launchpad can evolve from a simple fundraising channel to a comprehensive tool for guiding and nurturing an ecosystem.

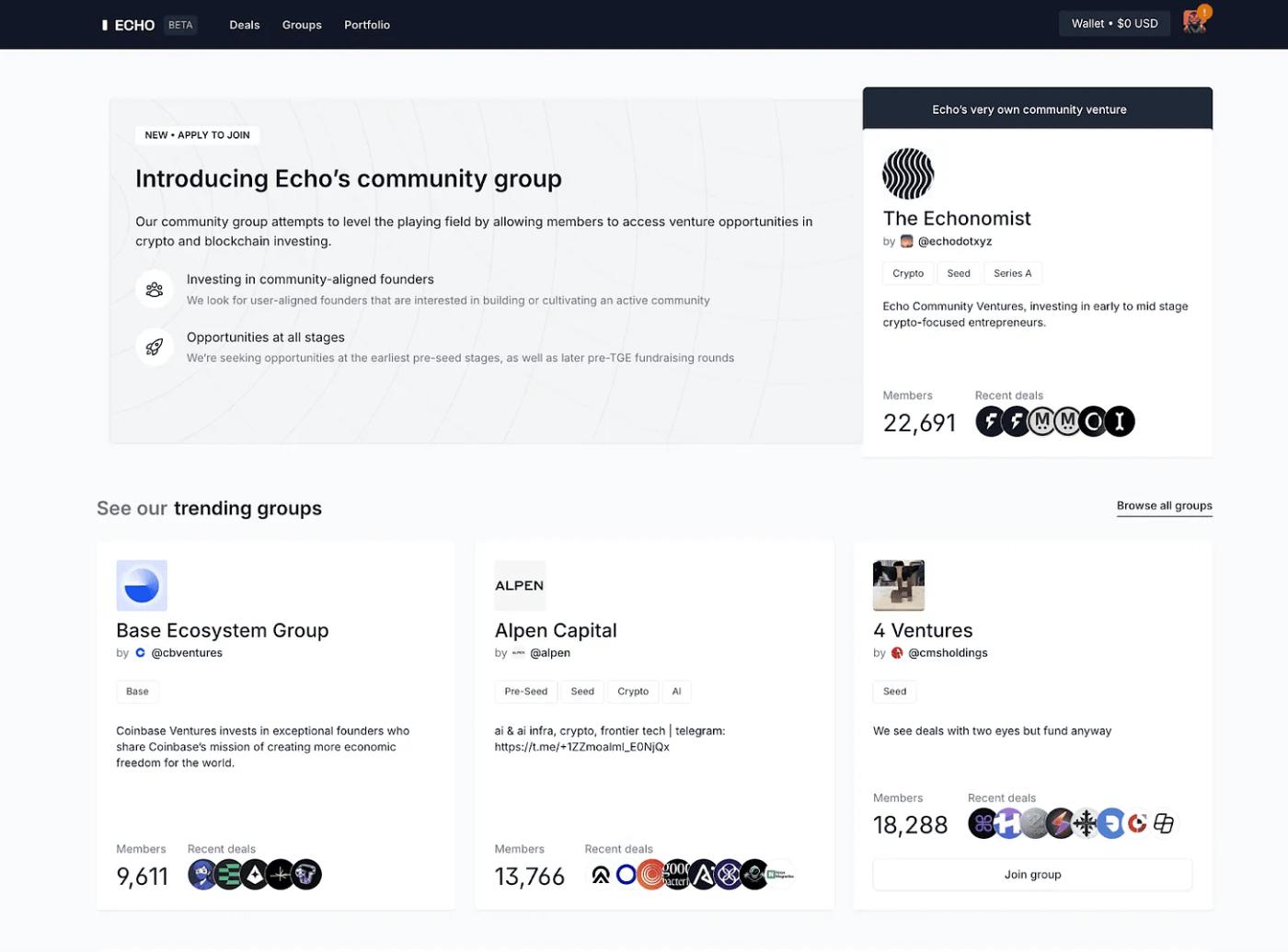

Sonar is a public launch platform developed and launched by Echo, a joint investment platform . Echo itself operates on a closed, invitation-only model. In addition to Know Your Customer (KYC) verification, the platform rigorously screens participants based on their investment experience and capabilities, making it a platform for professional investors only. This closed structure creates a high barrier to entry for retail investors. Sonar was created to fill this gap, pursuing a more open token sale model.

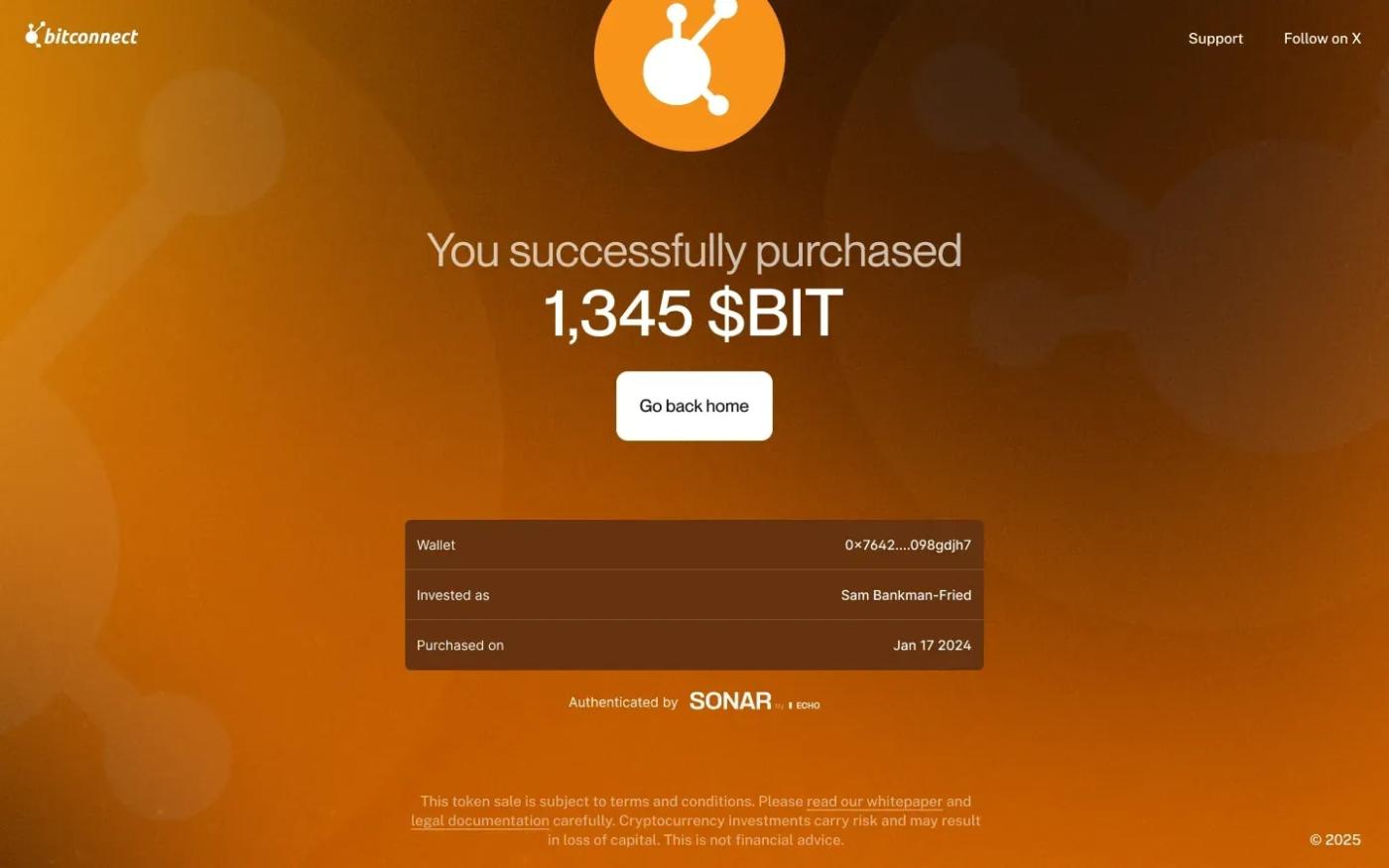

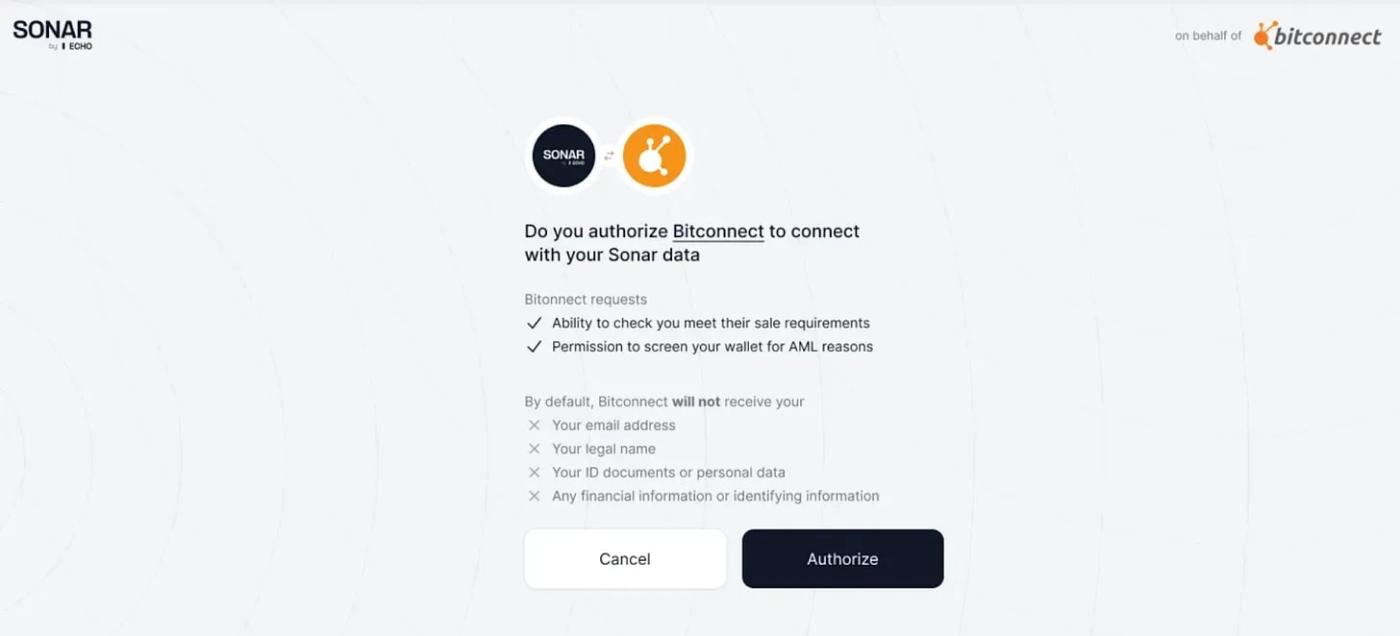

Sonar's most notable feature is its high degree of flexibility. Project owners can freely configure the sale schedule, pricing strategy, and distribution method. Sonar only provides software tool support. Throughout the entire process, Echo's compliance framework remains intact and effective. Participants must undergo a qualification process, including Know Your Customer (KYC). However, only proof of qualification is transmitted to the project owner, not the participant's personal information. This meets both legal compliance requirements and privacy protection needs. Projects such as Plasma and MegaEther have successfully completed token sales using this approach through Sonar.

However, this high degree of flexibility also creates uncertainty for investors. Sales structures vary between projects. Detailed evaluation criteria or responsible parties may not be clearly disclosed. When problems occur, the responsibility between the platform and the project may become unclear. This can create structural risks compared to centralized platforms operating under clear rules.

Kaito Capital Launchpad is a value-based public launch platform based on reputational evaluation, screening participants based on their reputation. The platform adopts a similar concept to Legion, but differentiates itself by focusing on social influence. Kaito originally operated as an AI-powered crypto information analysis platform. It provides market insights based on on-chain data and quantifies social activity through the Yaps system. The Kaito Capital Launchpad extends this data infrastructure to the public sale arena.

Kaito Capital's launch platform uses Yap Points to score users' social influence. This score is combined with factors such as on-chain participation history, Kaito Token holdings and stake, past sales participation, and regional allocation limits to determine allocation priority. Yap Points are not mandatory. However, the higher your ranking on the leaderboard, the greater your chances of receiving a larger share of allocations or rewards. Some projects offer priority participation to Yap Points holders.

This structure offers clear advantages to projects. They can enlist influential social media influencers as early investors, generating a natural boost in publicity. This strategy is particularly effective for projects in their early stages, where visibility is crucial. However, this model also has limitations. The structure focuses on activities within the Kaito ecosystem, creating a high barrier to entry for external participants. Evaluation criteria are heavily weighted towards social influence, making it difficult for the platform to fairly assess the value of other contributors, such as developers.

Market interest in public launch platforms has recently increased significantly. Projects launched through Buildlpad have successfully listed on major Korean exchanges such as Upbit and Bithumb, achieving short-term price increases. These success stories have boosted investor expectations. While returns have declined compared to previous Initial Decentralized Exchange Offering (IDO) cycles (Star Atlas' 2021 IDO achieved astonishing returns of hundreds of times), these investment opportunities remain attractive given the market's prolonged downturn.

This surge in enthusiasm is unlikely to last. As high-return stories continue to emerge, investor expectations will rise to unrealistic levels. Not all projects can guarantee the same level of returns. When actual results fall short of expectations, disappointment spreads among participants and is likely to lead to market-wide fatigue. Excessive market overheating can also place a heavy burden on projects. When a large number of participants seeking only short-term profits flood in, the overall quality of the community deteriorates. Long-term user conversion and the continued maintenance of the ecosystem become increasingly difficult. As this pattern repeats itself, enthusiasm will naturally wane. Short-term market overheating is likely to subside after reaching a critical point.

Despite this, public launch platforms are likely to persist as a model driven by structural need rather than a temporary trend. Today's cryptocurrency market is far more complex than in the past, and it will only grow more so. Numerous projects are emerging simultaneously, requiring initial fundraising methods to build communities and secure user bases. However, conducting a TGE (Token Generation Event) independently involves high costs and significant risks. In an environment plagued by bots and duplicate accounts, even identifying genuine users is a daunting challenge. Public launch platforms offer a structured solution to these challenges. Through a pool of screened and vetted participants, projects can efficiently gain initial liquidity and community support.

For investors, public launch platforms offer a way to regain access to early-stage investment opportunities, which have been closed for some time. They provide a path for individual investors, excluded from venture capital-centric market structures, to participate in early-stage projects in a fairer and more transparent manner. This goes beyond simply monetizing profits; they serve as a novel structural mechanism that allows people to directly participate at the starting point of the token economy.

However, challenges remain. There is a fundamental conflict between open participation and efficient screening. Balancing the ideal of "anyone should be able to participate" with the reality of "screening out real, actual users" is an extremely difficult task. Overly transparent standards create the risk of exploitation and manipulation. Opaque standards undermine market trust. At this critical juncture, continued evolution at both the institutional and technological levels remains essential.

This report is based on materials we believe to be reliable. However, we do not guarantee, expressly or impliedly, the accuracy, completeness, or suitability of the information. We assume no liability for any losses arising from the use of this report or its contents. The conclusions and recommendations in this report are based on information available at the time of preparation and are subject to change without notice. All projects, estimates, forecasts, targets, opinions, and views expressed in this report are subject to change without notice and may differ from or be contrary to the opinions of other individuals or organizations.

This document is for informational purposes only and should not be construed as legal, business, investment, or tax advice. Any reference to securities or digital assets is for illustrative purposes only and does not constitute investment advice or an offer to provide investment advisory services. This material is not directed to investors or potential investors.

Tiger Research permits fair use of its reports. The doctrine of "fair use" broadly permits the use of content for public benefit purposes, as long as the material's commercial value is not diminished. If the use qualifies as fair use, these reports may be used without prior permission. However, citations of Tiger Research reports must 1) clearly indicate "Tiger Research" as the source and 2) include the Tiger Research logo ( black / white ). Reprinting and republication of the material requires separate negotiation. Unauthorized use of reports may result in legal action.