Original title: "How did Binance CEO CZ, who fled Shanghai, get pardoned by Trump? — A veteran in the crypto shares his ten-year memories and the industry's mysteries"

Original author: JayZhou, 3D Blockchain

From his humble beginnings in Beijing's Xi'erqi district in 2014 to Trump's pardon in 2025, CZ's decade-long trajectory serves as a mirror, reflecting the wild growth of the crypto, regulatory storms, and power struggles. Those details, scattered throughout time, have become the key to unlocking the "pardon puzzle."

First encounter: Xi'erqi's fireworks and the "grassroots era"of the crypto

1 The "Trio" in the Beijing Yiquanhui Office

In 2010, I was working as a senior product operator for Shanda Online, the open platform of Chen Tianqiao's company. At the time, Shanda Group had invested in hundreds of companies, including Moji Weather, co-founded by Zhao Dong, and Docin, where Star Xu served as CTO. My job was to integrate all Shanda-backed products into our open platform. It was around that time, before I knew anything about Bitcoin, that I met Star Xu and was responsible for facilitating Docin's integration with the Shanda open platform. On November 22, 2013, I bought my first Bitcoin and posted it on WeChat Moments, earning hundreds of likes and comments.

In 2013, CZ met a venture capitalist through Texas Hold'em, which opened his eyes to the world of cryptocurrency. As a relatively early believer in cryptocurrencies, his keen eye for the future seemed to glimpse the potential of virtual currencies to rapidly move money. He then joined the digital wallet provider blockchain.info, embarking on a journey into the world of cryptocurrency.

In Beijing in 2014, blockchain was still a term that required half an hour to explain. The doorplate of the Yiquanhui office building in Xi'erqi, Beijing, read "OKCoin", which was a product of Beijing Lekuda Network Technology Co., Ltd. at the time. It then evolved into OKEX after 1994 in 2017 and now OKX.

That day, Star Xu hosted a dinner, claiming it was a "welcome party for the technical team." Pushing open the glass door, he revealed a 20-square-meter office packed with more than a dozen workstations, the clatter of keyboards echoing incessantly. Star Xu, wearing a plaid shirt, approached and pointed to a man in a corner wearing black-framed glasses and a windbreaker. "This is CZ, our new technical director. He's from Canada and knows blockchain," he said, pointing to a woman in a red dress nearby. "He Yi, in charge of marketing, formerly a host on Travel Channel." CZ, a quiet man clutching a thermos, suddenly burst into conversation while discussing the matching logic of the Bitcoin trading system.

CZ had just resigned from Blockchain.info, giving up his high salary in Silicon Valley to come to Beijing for a monthly salary of tens of thousands of yuan; He Yi had He Yi resigned from CCTV, giving up his stable position and diving into the "virtual currency" field that no one was optimistic about; Star Xu even bet his entire fortune on Bitcoin trading, and his quilt was still piled on the cot in the office.

He said OKCoin's system throughput was insufficient at the time, and they were working on optimizing the code. "Once we get this right, our user base could triple."He Yi, meanwhile, joked about turning "What is Bitcoin" into a short educational video, "so even grandpa and grandma can understand it." Lunch that day was donkey meat hot pot downstairs. Star Xu rushed to pay, saying, "The company has just turned a profit, so we have to be frugal." I later learned that the crypto in 2014 was just that—"rough and pure." Everyone gathered simply because they "believed this thing had a future."

2 The "Establishment of Jianghu" in a Small Salon

From 2013 to 2016, most crypto events were small salons with around ten people, held either in incubators' free conference rooms or in the corners of Garage Coffee. I went there a few times with Star Xu, and almost always I saw CZ, He Yi, Li Lin, Du Jun, Bao Erye, and other future "bigwigs."

The most memorable event was a salon in the winter of 2014, held on Zhongguancun's Startup Street. The theme was "Bitcoin's Development Trends." Li Lin brought along some key technical staff from Huobi, clutching a sample mining chip and carrying a backpack handing out business cards. He Yi was the most active, jokingly saying, "Although there aren't many people here now, when the crypto becomes popular, we'll hold a 10,000-person conference." Back then, CZ hadn't yet acquired the aura of a powerful figure; he looked more like an engineer obsessed with technology.

After a salon, he shared his thoughts on the industry, saying, "The biggest issues right now are compliance and technology. Only when these two are resolved can blockchain truly take off." No one could have imagined that ten years later, it would be the very word "compliance" that would lead him to prison, only to be freed through a political maneuver. My WeChat chats from those years still contain his occasional sharing: the "Chinese version of the Ethereum whitepaper" forwarded in 2015, a reminder in 2016 to "be aware of security vulnerabilities in exchanges," and in early 2017, his promise to "start something on my own, and we'll talk in Shanghai when we have the chance." Looking back now, I realize the seeds of fate were already planted.

Rise: Binance Speed in Shanghai SOHO and the Eve of Its Global Expansion

1 I recommend a candidate to Binance CZ, a startup in SOHO Fuxing Plaza

2017 was a breakout year for the crypto and a turning point in CZ's life. That year, he resigned from OKCoin to found Binance, building his initial team in Shanghai's SOHO Fuxing Plaza and then, after the turmoil of the 1994 protests, hastily leading the team overseas. I was fortunate to witness this "lightning rise and migration" story. The details of those offices hold the key to Binance's subsequent destiny.

On August 2nd, the price of BNB was 0.8 yuan per coin. I arranged to meet CZ for the first time at noon. I wanted to visit the then-newly established Binance office, located in Fuxing Plaza, SOHO, Shanghai, just above Xiaohongshu. The office was small, with dozens of people crammed into workstations. CZ's desk was in the corner, next to several cases of mineral water. He Yi hadn't joined Binance yet. He told me, "I've been busy with Binance's globalization efforts lately, and a lot of people have approached me through events to collaborate." At that time, Binance had just launched, and offline events had become their primary way to quickly connect with resources. He also asked if I was interested in joining Binance. As a coin enthusiast who had been in the industry for four years since 2013, I was definitely interested. However, our P2P platform was in the midst of its three-year anniversary promotion. I told Changpeng that I'd help him out after I was done with my work, but in the meantime, if you had any questions, I'd be happy to help.

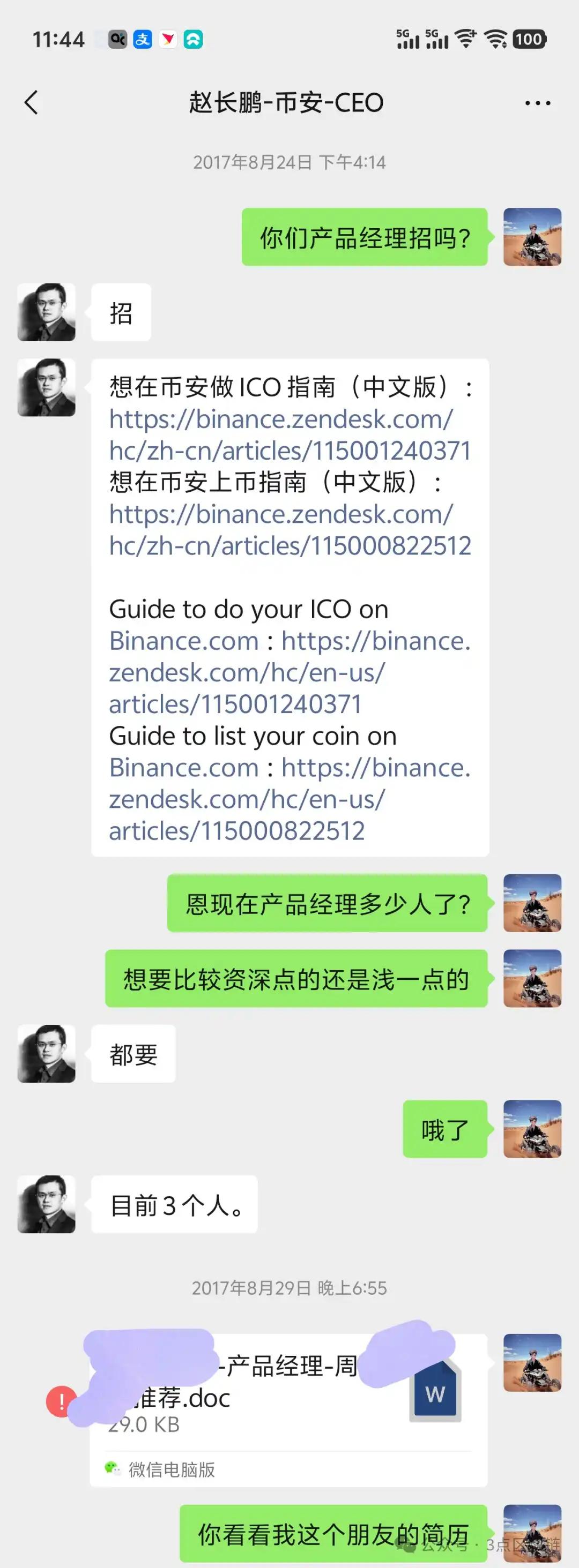

Because I started blogging in college, I met many internet executives, and many people also wanted to find jobs at internet companies through me. I joined Alibaba Group right after graduating from college and recommended over 100 people internally. I also helped recommend many people to many of the earliest companies in the crypto. As a result, my resume database, which I built up, reached around a million people. I later worked as an assistant to the CEO at Kanzhun.com and BOSS Zhipin, overseeing product operations, marketing, strategy, and other aspects of the company. I also continued to deepen my expertise in internet human resources recruitment. On August 24, 2017, I recommended the first of my friend's resumes to CZ. At the time, Binance only had three product managers.

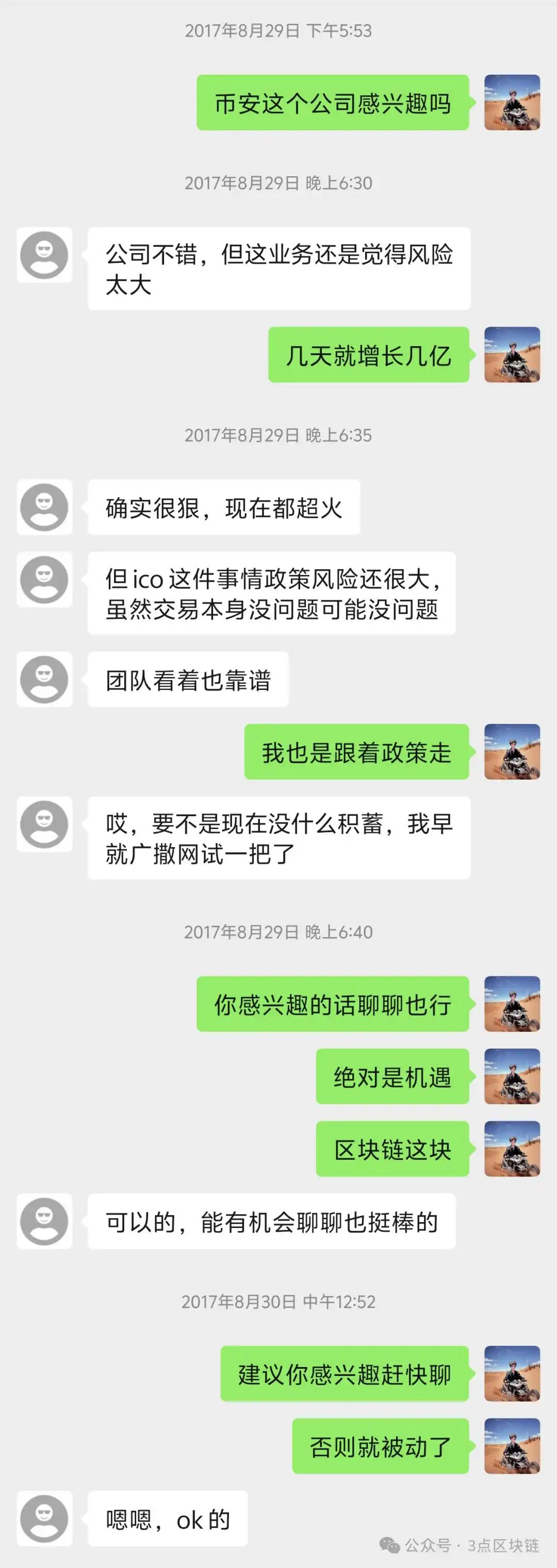

I recommended Binance to a friend. He thought the company had good business, but the risks were high. I also encouraged the candidate to be more proactive because such reliable startups are rare. CZ had first invited me over for dinner, but I was currently very busy with company work and agreed to go after I was done. So I recommended other friends to help out first.

In 2017, I was generally perceived as a reliable "part-time headhunter," after all, providing a wealth of talent to major internet companies. That day, Changpeng and I chatted for two hours, his eyes gleaming with excitement. He explained that Binance was aiming to be the "world's fastest exchange," already supporting over ten cryptocurrencies, and that its transaction fees after launch would be half that of Huobi and OKEx. "Now people are calling in every day to discuss partnerships, and people are sleeping on the sofa in the office all the time," he said, gesturing to a pile of sleeping bags in the corner. I noticed a notebook on his desk, densely packed with compliance questions: "How do we deal with regulations in different countries?" "How do we build an anti-money laundering system?" Looking back, these issues, seemingly masked by the rapid expansion, became hidden dangers later. As he was leaving, he said, "Shanghai is a great place with a wealth of talent, especially people like you. I welcome your recommendations to Binance, and I welcome you to join us as soon as possible. We're desperate for operational talent like you!" We were just wrapping up our P2P company's 3rd anniversary celebration, when "94" unexpectedly showed up!

2. Wanxiang Conference and the Decision to Expand Overseas in the Storm of "94"

On September 4, 2017, the People's Bank of China and seven other ministries and commissions issued the "Announcement on Preventing Risks in Token Issuance and Financing," completely halting ICOs and virtual currency trading. The crypto instantly fell into panic. My WeChat Moments were filled with news about "exchanges closing" and "cryptocurrency prices collapsing." I quickly sent a WeChat message to CZ, who replied, "Don't panic. Wait for my news. See you at the Wanxiang Conference in October." Since 1994, the 2017 Shanghai Wanxiang Blockchain Conference has become a haven for the industry. I entered the venue with my media ticket and ran into CZ and He Yi at the entrance. He was wearing a black jacket and looked much more serious than usual. He said, "We're looking for an overseas office; Japan has more friendly policies." At the conference that day, Ethereum founder Vitalik Buterin was in attendance and spoke about the importance of compliance in the development of blockchain technology. I asked some exchange founders about their plans to "defund domestic users and expand overseas." CZ revealed, "The Binance team will be flying to Japan next week and renting an office in Tokyo for the time being."He Yi added, "A few people are left in the Shanghai office to finish up the work, so some of the equipment can only be sold at a low price, which is a pity."

In October, CZ, He Yi, and their team rushed to Tokyo, Japan. Standing in front of their new office window, they captioned, "Starting over again." Looking at that photo, I remembered the folding bed in SOHO Fuxing Plaza, and suddenly had a premonition: This team, having left Shanghai, will shake up the global crypto market in the future, but they may also face even greater challenges.

No one could have predicted that this "going global" move was just the beginning of CZ's global migration. From Japan to Malta to Dubai, Binance's headquarters shifted from one location to another, yet it was never able to completely resolve the ever-present challenge of regulatory compliance.

Fall: $4.3 billion in fines and four months in jail

1 Regulatory Storm: 18 Months from Prosecution to Guilty Plea

CZ's legal woes began in March 2023, when the U.S. Commodity Futures Trading Commission (CFTC) sued Binance and CZ, accusing them of operating an unregistered exchange and violating trading rules. The following June, the U.S. Securities and Exchange Commission (SEC) filed 13 charges, including providing false trading supervisory statements and selling securities without registration.

When the news broke, I was attending an event in Hong Kong, where everyone in the crypto was discussing whether Binance would collapse. A lawyer friend familiar with US regulation told me, "This time, they're serious. The US Department of Justice has long been targeting Binance for anti-money laundering issues." Sure enough, in November 2023, CZ pleaded guilty in a Seattle court to "failure to maintain an effective anti-money laundering program" and resigned as CEO of Binance. Binance, in turn, admitted to "engaging in money laundering, unlicensed money transmission, and sanctions violations" and agreed to pay a massive $4.32 billion fine—$2.51 billion in forfeiture and $1.81 billion in criminal penalties.

The $4.3 billion fine set a record for the crypto industry. I recall Star Xu's words in the Xi'erqi office in 2014: "Spend sparingly." Looking back at the fine today, I can't help but reflect on how the industry has changed. An old OG commented in a WeChat group, "Back then, Binance relied on low fees to capture market share, but its anti-money laundering systems couldn't keep up. Now they're paying the price for their rapid expansion." After pleading guilty, CZ wrote an apology, saying, "I should have focused on compliance issues from the beginning and accepted full responsibility." But it was too late to regret. On April 30, 2024, the Seattle Federal Court sentenced him to four months in prison. While far less than the three years requested by prosecutors, he still became "the only crypto founder in U.S. history to be imprisoned solely for Bank Secrecy Act charges."

2 Years in prison and Dubai's timely assistance

From April to September 2024, CZ served his sentence in Lompoc State Prison in California. During that time, the discussion in the crypto shifted from "Will he receive a heavy sentence?" to "Can Binance survive?" Just when everyone thought Binance was doomed, in March 2025, news shocked the industry: MGX, a UAE-based artificial intelligence investment company, invested $2 billion in Binance. This was not only Binance's first institutional investment, but also the largest single investment in the history of the crypto industry.

MGX is no ordinary investment institution. Backed by the Abu Dhabi sovereign wealth fund, it serves as the UAE's core platform for AI and blockchain development. The investment, paid in stablecoins, grants MGX a minority stake in Binance. Market speculation suggests Binance's valuation is between $20 billion and $40 billion—though significantly lower than the $200 billion rumored in 2021, it's more than enough to tide Binance over during its current crisis. A source close to Binance revealed that CZ personally negotiated the investment after his release from prison. On September 27, 2024, CZ was released early due to a weekend. His first stop after his release was Dubai, where he met with the head of MGX. Dubai's willingness to provide timely assistance stems from its recognition of the blockchain's potential and its desire to establish itself as a "global crypto hub." Furthermore, Binance's user base and technical capabilities remain, and a $2 billion investment will help Dubai quickly seize market leadership.

After CZ was released from prison, everyone knew that as long as his criminal record remained in the US, he would not be able to truly return, and Binance would have difficulty returning to the US market. At this time, another key figure—Trump—came into the attention of the crypto.

Reversal: Trump's pardon and the interests behind it

1 Behind the Pardon: Trump’s “Crypto Card”

On October 23, 2025, I was at the main forum of the Shanghai Wanxiang Blockchain Conference when Trump announced his pardon to the media. The veterans around me were instantly in an uproar. Some pulled out their phones to check the news, while others exclaimed, "This plot is more exciting than a movie." The seemingly sudden pardon was actually a complex game of political calculations, commercial interests, and industry competition.

Trump's pardon of CZ is primarily intended to solidify his image as a "crypto-friendly" person. Since taking office, he has been undoing the Biden administration's enforcement actions against the crypto industry, pardoning Silk Road founder Ulbricht and several BitMEX founders. With CZ, he's simply continuing his policy path.

In response, White House spokesperson Levitt bluntly stated that CZ was a victim of the Biden administration's "war on cryptocurrency," and that Trump's pardon was an "exercise of constitutional authority." These remarks, clearly reflecting a bipartisan policy game regarding the crypto industry, are a testament to Trump's desire to garner support from young voters and tech investors by supporting the industry. Pardoning an "industry icon" like CZ is undoubtedly the most direct expression of this stance. However, the underlying conflict of interest lies at stake. According to the Wall Street Journal, Binance began reaching out to Trump's allies around the time of the 2024 US election, establishing a dedicated working group to explore the possibility of returning to the US market and seeking a pardon for CZ.

The breakthrough came from World Liberty Financial (WLFI), a cryptocurrency company owned by the Trump family. Binance not only assisted WLFI in launching a stablecoin, which generates tens of millions of dollars in annual revenue for the Trump family, but also discussed injecting capital into WLFI in exchange for a pardon for CZ. This move is not unprecedented: after Tron founder Justin Sun invested $30 million in WLFI, the SEC suspended its fraud lawsuit against him.

While CZ denied "trading" the pardon, the market generally believes the logic of "commercial cooperation in exchange for political endorsement" has long been established. Trump himself admitted that the pardon was "requested by numerous influential people," but emphasized that he "never met CZ." This rhetoric is more like political rhetoric, distancing himself from direct involvement while simultaneously wooing the crypto industry.

2 Barron takes over Binance US?

After the pardon announcement, another even more explosive rumor began to swirl: Trump's youngest son, Barron Trump, might acquire Binance US. While neither Binance nor the Trump family responded directly, the rumor is not unfounded.

Sources familiar with the matter revealed that Binance has long sought to re-enter the US market, but its 2023 plea agreement has left it in disrepute in the US, making it difficult to find partners. Partnering with the Trump family is undoubtedly the best stepping stone. If Barron were to join Binance US, he could leverage the Trump family's influence to improve Binance's public image while also taking advantage of the Trump administration's favorable policies to quickly obtain regulatory licenses.

For the Trump family, this is also a lucrative deal. With the global rise of the crypto industry, investing in a leading platform like Binance US allows them to directly participate in the market's dividends. Some analysts suggest that if Binance US is relaunched, its valuation could reach billions of dollars, allowing the Trump family to reap substantial returns even with a minority stake.

More notably, Barron Trump himself has a keen interest in technology and cryptocurrency, having publicly expressed his optimism about blockchain technology on numerous occasions in recent years. If he were to acquire Binance US, it would not only provide him with business experience but also add a crucial piece to the Trump family's political and business empire. While the rumors remain unconfirmed, industry logic suggests the possibility of such a powerful alliance is highly plausible.

3 Industry shock: chain reaction after the pardon

News of CZ's pardon instantly triggered a chain reaction in the crypto market. BNB prices skyrocketed that day, reaching a record high, and Binance's trading volume surged by 30%. More importantly, this could allow Binance to prematurely end its three-year external monitoring program—a requirement mandated by the 2023 plea agreement. A pardon could potentially waive this requirement.

For the global crypto industry, this pardon sends a clear signal: US regulation of the crypto industry is easing. A friend at a compliance agency told me, "There will undoubtedly be more crypto companies applying to enter the US market. The Trump administration wants to make the US the 'capital of cryptocurrency,' which is good for the industry, but it may also bring new risks."

Yet, skepticism persists. Democrats have demanded that the Trump administration detail its interactions with Binance, arguing that this "intertwined business relationship and political pardon" raises serious ethical concerns. Some even bluntly call it a "blatant exchange of power for money" that undermines judicial justice in the United States. At a dinner gathering of veteran crypto, the views were more rational. Some said, "The pardon resolves CZ's personal issues, but Binance still has a long way to go to achieve compliance." Others lamented, "Binance, having left Shanghai, now relies on American political forces to turn things around. How unpredictable things are."

Echo: The legend of Shanghai and the future of the industry

1 Shanghai: The "Original Place" of Blockchain

On October 23, 2025, the Shanghai Wanxiang Blockchain Conference was bustling with activity. Dr. Xiao Feng delivered a passionate speech on the main stage. Young entrepreneurs shared case studies of "AI + Blockchain." In the booths, newly established projects were busy handing out flyers. During a coffee break, I ran into some young industry insiders who, seeing me wearing a BINANCE shirt at the conference, asked if I worked for Binance. I said no, but I had a close relationship with them. They heard I knew CZ and surrounded me, asking, "Was his Shanghai office really that shabby back then?"

Looking at these new faces, I suddenly realized: the crypto is no longer the small, "salon-like" world of the dozen or so people it once was. But those old stories and places still linger, especially from July to October 2017 at Shanghai SOHO Fuxing Plaza, where the Binance dream began. Today, Shanghai has become the most open city in mainland China regarding blockchain policies. The Science and Technology Industrial Park has introduced a series of policies, including "enterprise subsidies" and "talent settlement." By 2024, Shanghai's blockchain-related industries will flourish. The annual Wanxiang Blockchain Conference has become a bellwether for the mainland blockchain industry.

But veterans know that what's most precious are those "historical traces." The OKCoin office in Beijing's Xi'erqi district has long since moved, but the security guard at the Yiquanhui office building still recalls "a bespectacled Canadian technician who worked overtime every day." Binance's old office in Shanghai's SOHO Fuxing Plaza is now rented to an internet company, but the owner of the coffee shop downstairs still remembers "a group of young people rushing in with their laptops to order takeout." At the Wanxiang Blockchain Conference, a photo exhibition featuring Vitalik Buterin's 2017 speech can still be found.

During the conference, I made a special trip to SOHO Fuxing Plaza. Standing at the elevator entrance on the 15th floor, I could still hear He Yi yelling, "Keep working hard!" and saw CZ resting on a folding bed. The security guard nearby, upon hearing I was looking for "the old Binance office," said with a smile, "People often ask. I heard that company is now very big overseas." I nodded, but I felt mixed emotions.

Shanghai's inclusiveness and openness nurtured the initial form of Binance; the baptism of the "94" incident forced Binance to expand overseas. Today, Shanghai continues to support blockchain development, and Binance has established a firm foothold overseas, but the "Shanghai version of Binance" is forever stuck in the autumn of 2017.

2 The world of the old and the era of the new

At the dinner, after the old OGs finished discussing CZ, the conversation naturally turned to "veterans" like Star Xu, He Yi, Li Lin, Du Jun, and Bao Erye. Some said Star Xu's OKX was now focused on compliance; some said He Yi was a diligent customer service representative; some said Li Lin's Huobi was a consistent leader; and some said Zhao Dong, who once nibbled on donkey meat hot pot in the small salon of Garage Coffee, has now become an industry veteran. Their stories epitomize the past decade of the crypto: from humble beginnings to compliant development, from domestic expansion to global expansion, from technological obsession to commercial maturity.

The young people around me are focused on "MEME," "decentralized DEX," "policy opportunities in the regulatory sandbox," and "RWA." They haven't seen the shabby offices in Xi'erqi, nor experienced the panic of the "94" incident, but they enter the industry with more professional knowledge and clearer plans. For example, at the Shanghai Wanxiang Blockchain Conference, 90% of the attendees were under 30 years old, and the topics they discussed went far beyond the initial discussion of "What is Bitcoin?"

A young man who just joined the industry said to me, "CZ's story is so legendary. When we do projects now, the first thing we consider is compliance. We will not repeat the old path." I was deeply moved when I heard this: the old masters paved the way with their lessons, and the newcomers are moving forward steadily on this road. This may be the inevitable development of the industry.

3 The Future: Balancing Compliance and Innovation

Although CZ’s pardon solved his personal legal problems, it also left the industry with deeper thoughts: How should the development of blockchain balance innovation and compliance?

Binance's experience offers a clear answer: rapid early expansion can indeed capture market share, but ignoring compliance ultimately carries a heavy price. The $4.3 billion fine and four months in prison are lessons that should serve as a warning to all crypto companies. Today, Binance, backed by a $2 billion investment from MGX, is fully committed to compliance and is reportedly licensed in over 10 countries.

Shanghai's development path may offer another example: through clear policy guidance and a robust industrial ecosystem, blockchain technology is being innovated within a compliant framework. From supply chain finance to digital government affairs, from copyright protection to agricultural traceability, Shanghai's blockchain applications have long transcended the realm of "virtual currency" and are now reaching the real economy, including RWA.

On October 24, 2025, CZ posted on the X platform: "Thank you, President Trump. We will help make the United States the 'Crypto Capital.'" Meanwhile, on the final day of the Wanxiang Blockchain Conference in Shanghai, a roundtable discussion on "Compliance and Innovation" was packed. On one hand, the world's largest exchange is undergoing a political reversal, while on the other, mainland China's blockchain industry is steadily moving forward. While these two paths may seem different, they both point in the same direction: only compliant innovation can achieve long-term success.

Conclusion: The Jianghu is not far away, the legend will last forever

Although Binance’s headquarters is not in Shanghai, its ties with the city have never been truly severed.

Looking back over the past decade, from donkey meat hot pot in Beijing's Xi'erqi to pizza and coffee in Shanghai, from folding beds in SOHO Fuxing Plaza to sovereign fund investment in Dubai, from his guilty plea in court to Trump's pardon, CZ's story is like an epic in the crypto. And his contemporaries, those old places that witnessed it all, have become "living fossils" of the industry.

Some say the crypto is forgetful, with new projects and hot topics emerging daily, and old stories quickly forgotten. But I disagree. Like that office in Shanghai's SOHO Fuxing Plaza, like those familiar faces at the Wanxiang Conference, like the dinner with the veterans after CZ's pardon—these details are etched into the very fabric of the industry. There will be more "CZs" and more "Binance stories" in the crypto of the future, but the Binance dream, born in Shanghai that summer of 2017, and the memories of its original aspirations, expansion, setbacks, and rebirth, will never fade. It's not just the starting point of a company, but also the mark of an industry's youth.

The world is not far away, and the legend lives on. If you're new to the #web3 # crypto# blockchain, you must study some of its history. This industry has never been smooth sailing, but as long as you adhere to the bottom line of compliance and maintain your original intention of innovation, you will surely see the light. As CZ said at SOHO Fuxing Plaza: "Shanghai will always be the starting point for Binance."