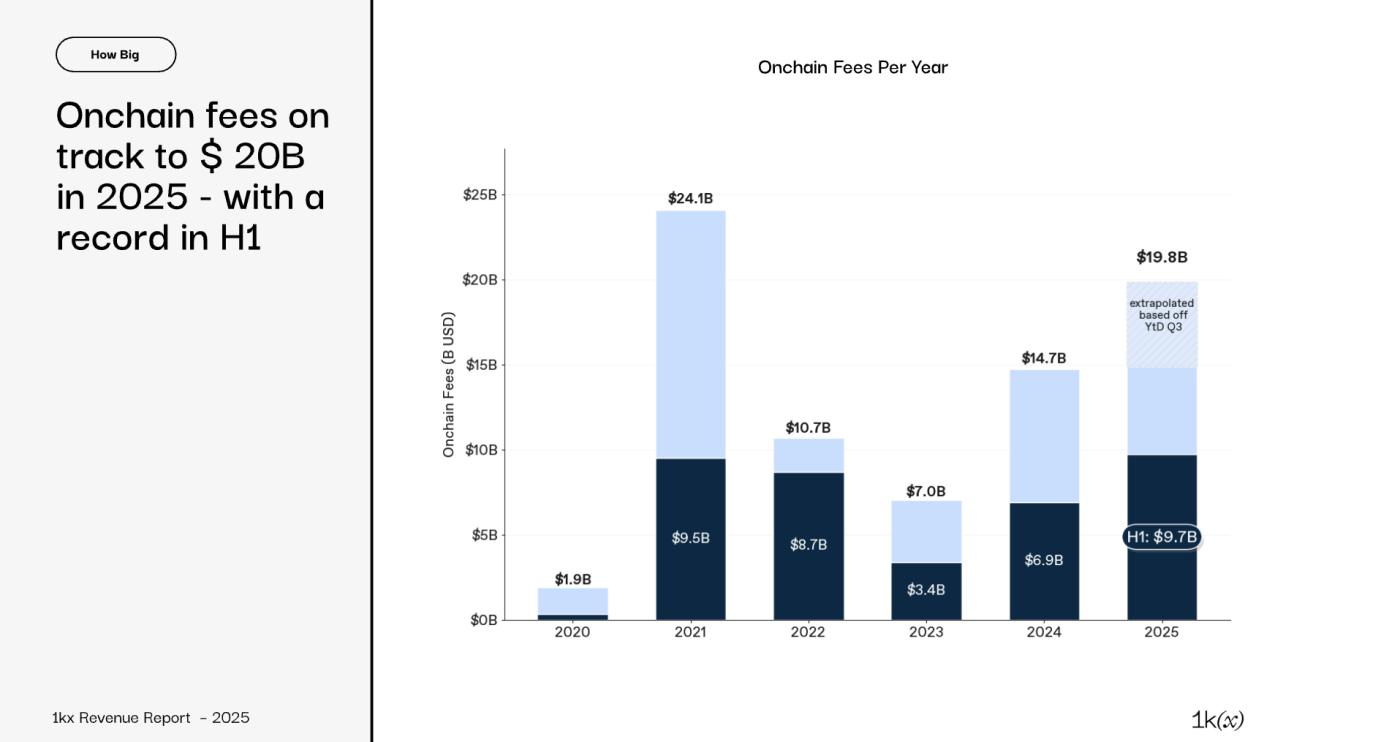

As the blockchain industry moves from speculative booms to sustained growth, on-chain fees have emerged as an important measure of economic maturity. According to a recent report, the on-chain economy is on track to generate $19.8 billion in fees by 2025.

This shows a shift towards a sustainable economic model based on usage in decentralized finance (DeFi) and Web3 ecosystems.

The State of the On-Chain Economy in 2025

In a new report, 1kx.capital said on-chain fees in 2025 will be more than 10 times higher than in 2020, representing a compound annual growth rate (CAGR) of around 60%.

Users spent $9.7 billion in the first half of 2025 , the highest first-half figure on record, up 41% from the previous year. That figure even surpassed 2021, when fees hit $9.5 billion in the same period.

“Back then, fees were primarily generated by billions of dollars in user incentives, related speculation, and a few high-cost PoW blockchains. Today, fees are primarily generated by applications, driven by financial problems but rapidly expanding to DePINs, Wallets, and consumer applications (each growing >200% year-over-year),” the report states.

on-chain fee growth in 2025. Source: 1kx.capital

on-chain fee growth in 2025. Source: 1kx.capital1kx.capital added that Medium transaction fees have dropped by 86%, mainly due to Ethereum (ETH). The network contributed more than 90% of the decrease . As transaction costs go down, participation in the ecosystem accelerates.

The Medium number of daily transactions increased by 2.7 times compared to the second half of 2021. The number of wallets with monthly transactions also skyrocketed to 273 million in the first half of 2025, a 5.3-fold increase. In parallel, the number of fee-generating protocols expanded, from just 125 in 2021 to 969 in H1 2025.

“Based on end-Q3 data, 2025 fees are forecast to reach $19.8 billion – up 35% YoY but still 18% lower than 2021 levels. The base case forecasts on-chain fees in 2026 to reach over $32 billion, up 63% YoY, continuing the application-led growth trajectory,” 1kx.capital forecasts.

DeFi and finance drive on-chain activity

DeFi and financial applications in general continue to dominate on-chain, contributing 63% of total fees in H1 2025, or about $6.1 billion. This is a 113% increase year-on-year.

Of this, about $4.4 billion came from core groups including decentralized exchanges (DEXs), perpetual and Derivative platforms, and lending protocols.

“As total onchain fees recover in 2024, Blockchains have lost their lead to DeFi/Finance Applications, which are on track to reach $13.1 billion / 66% of the total in 2025,” 1kx.capital said.

On Solana, protocols like Raydium and Meteora led the growth, pulling Uniswap 's market share from 44% to 16%. Jupiter emerged as a major player in the perpetual and Derivative space, increasing its share of industry fees from 5% to 45%. In addition, newcomer Hyperliquid contributed 35% of the total fees in this group.

In the lending space, AAVE remains the dominant protocol. However, Morpho has rapidly expanded its presence, capturing 10% of the fee market share.

Outside of DeFi, blockchains themselves account for 22% of total fees, mainly from Layer 1 transaction costs and MEV collection. Meanwhile, fees from Layer 2 and Layer 3 remain quite modest.

Wallets account for 8%. Leading this trend is Phantom, which generates about 30% of all wallet-related fees. Consumer apps contribute 6% of total fees, with launchpads accounting for over 80% of this segment (largely thanks to Pump.fun ).

Other contributors include casinos (8%) and the creator/social economy (4%). Finally, DePINs (decentralized physical infrastructure network) and middleware each account for 1% of total fees.

Beyond on-chain fees: expanding digital asset revenue streams

The report emphasizes that blockchain-related revenue is not limited to on-chain fees alone. A significant portion also comes from off-chain and network-level sources, which together form a broader picture of the digital asset economy.

Off-chain fees totaled $23.5 billion, with centralized exchanges (CEXs) accounting for the majority of the total, around $19 billion. 1kx.capital also recorded around $23.1 billion in additional revenue, mainly from block rewards received by Miners and Staking , and stablecoin yields.