XRP has struggled to regain bullish momentum after several failed recovery attempts over the past few weeks.

Market conditions have been keeping the altcoin weak, but recent consolidation may be setting the stage for a bounce. Current indicators show early signs of stability, hinting at renewed upside potential.

What do the indicators say about XRP?

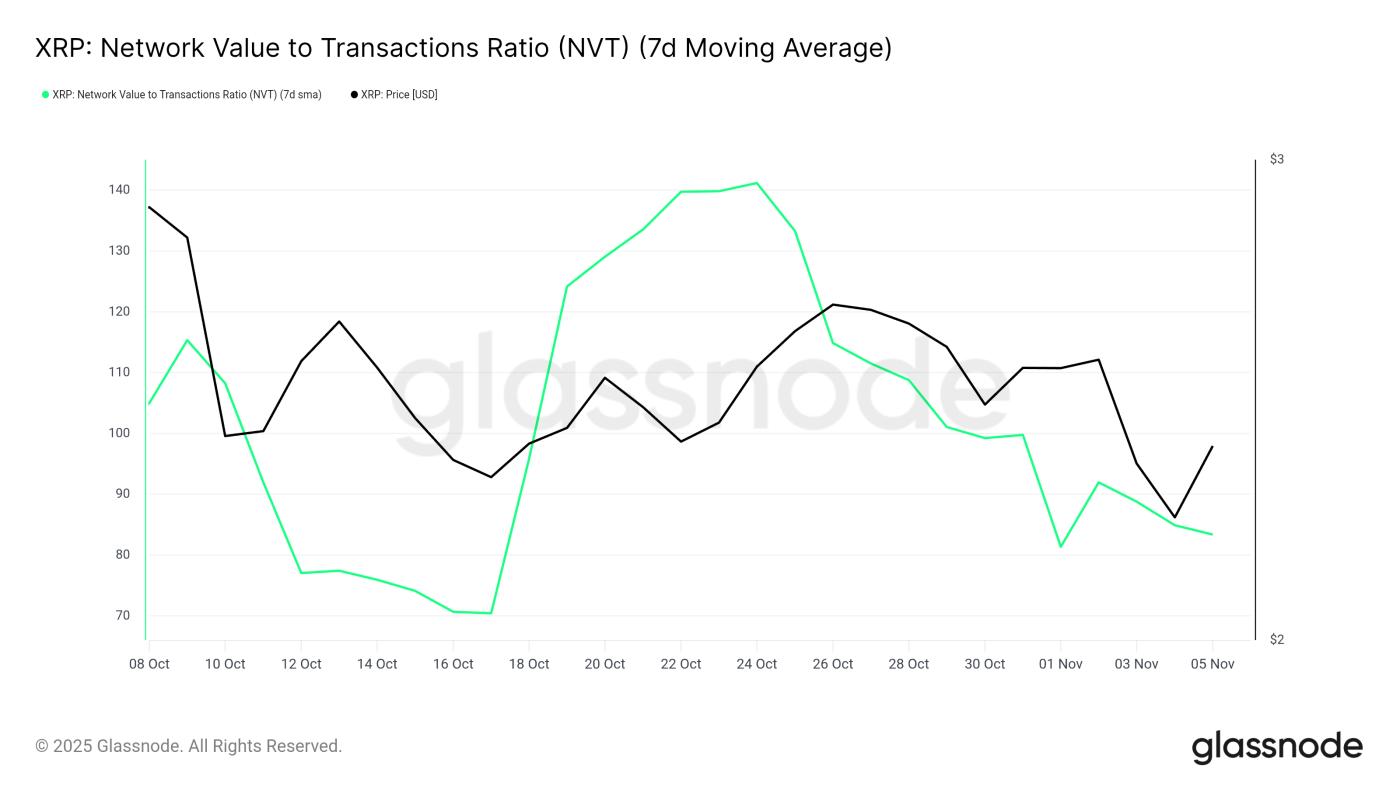

The Network Value to Transactions (NVT) ratio is indicating improving conditions for XRP. The metric has been steadily decreasing in recent days, suggesting that the asset is not at risk of being overbought. A lower NVT indicates healthy network activity relative to valuation, creating the foundation for a sustained price increase.

This lack of excessive volatility is beneficial for XRP's next move . This indicates a balanced market environment where price fluctuations are driven by natural demand rather than speculation. This stability is important to build a solid foundation for a potential breakout in the short term.

XRP NVT Ratio . Source: Glassnode

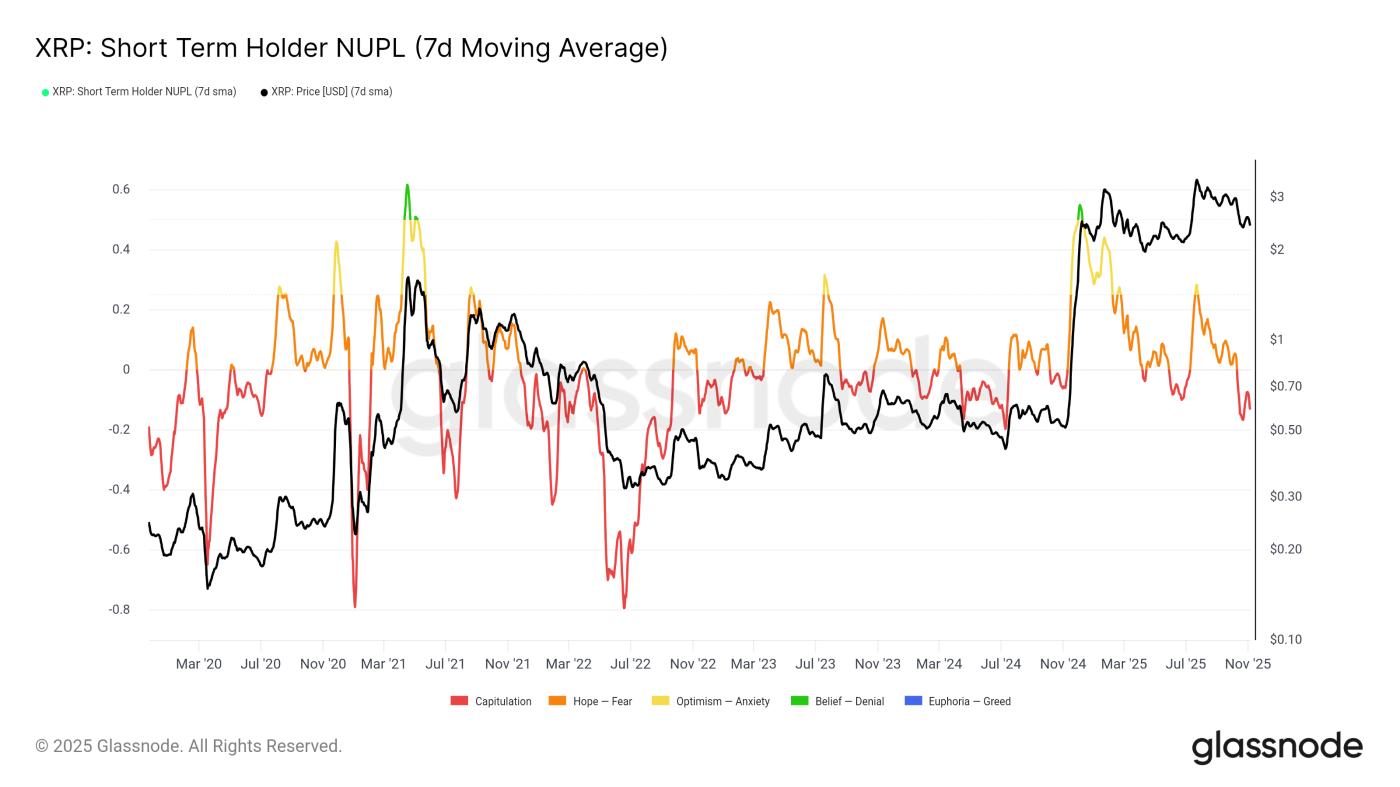

XRP NVT Ratio . Source: GlassnodeThe Short-Term Holder Net Unrealized Profit/Loss (STH-NUPL) ratio is currently in the Capital zone. Normally, this would be a cause for concern in a prolonged bear market, but historical data shows the opposite for XRP. Each drop into this zone in previous cycles has resulted in a significant rally in the following weeks.

As long as STH-NUPL remains above the -0.2 threshold, the outlook remains positive. This position suggests that investor losses have not reached extreme levels, leaving room for recovery.

XRP STH NUPL Ratio. Source: Glassnode

XRP STH NUPL Ratio. Source: GlassnodeXRP price may recover

XRP price is currently trading at $2.33, just below the $2.35 resistance zone. A break above this important level is needed to confirm a short-term recovery. This could also re-establish bullish sentiment among traders.

If XRP can break above $2.35, it could rise to $2.54 and possibly $2.80, reversing recent declines. Such a move would boost market confidence and attract stronger Capital from investors waiting in the wings.

XRP Price Analysis. Source: TradingView

XRP Price Analysis. Source: TradingViewHowever, if the bullish conditions fail to materialize, XRP could slip below the $2.27 support level it has held for weeks. A drop below this level could drag the price down to $2.13, invalidating the bullish thesis and extending the correction.