Author: Jasper De Maere, Source: Wintermute, Translated by: Shaw Jinse Finance

Key points at a glance

Liquidity drives the cryptocurrency cycle , while inflows into stablecoins, ETFs, and DAT have slowed.

Global liquidity remains strong , but high overnight secured funding rates (SOFR) are driving funds more into U.S. Treasuries and away from the cryptocurrency market.

Cryptocurrencies are currently in a self-funding phase , with funds circulating internally until a strong return of capital inflows.

Liquidity dictates every cycle of cryptocurrency . Adoption may drive long-term growth, but the flow of funds determines price fluctuations. Over the past few months, the momentum of fund inflows has slowed. Whether through stablecoins, exchange-traded funds (ETFs), or digital asset treasuries (DAT) , the inflow of funds into the cryptocurrency ecosystem has weakened, placing cryptocurrencies in a self-funding phase rather than an expansion phase.

While technological adoption is important, liquidity is the key driver that truly defines each cryptocurrency cycle. This is not only about market depth but also about the availability of funds themselves . When the global money supply expands or real interest rates fall, excess liquidity inevitably seeks venture capital, and cryptocurrencies have historically been among the biggest beneficiaries, especially during the 2021 cycle.

In previous cycles, liquidity entered digital assets primarily through the issuance of stablecoins , which were the core channel for fiat currency inflows into digital assets. As the cryptocurrency sector matures, three major liquidity channels have gradually become the dominant drivers of new capital inflows into the cryptocurrency market:

Digital Asset Treasury (DAT) is a tokenized fund and yield structure that connects traditional assets with on-chain liquidity.

Stablecoins , as on-chain representations of fiat currency liquidity, serve as underlying collateral for leverage and trading activities.

Exchange-traded funds (ETFs) are a traditional financial gateway for passive and institutional funds seeking investment exposure in Bitcoin and Ethereum.

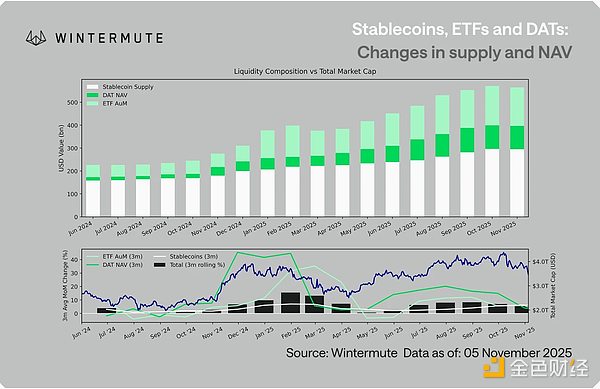

Combining ETF assets under management (AUM), net asset value (NAV) of digital assets (DAT), and stablecoin issuance provides a reasonable representation of the total inflow of funds into digital assets. The chart below shows the evolution of these components over the past 18 months. The bottom chart highlights the strong correlation between changes in these metrics and the total market capitalization of digital assets, indicating that prices tend to rise as inflows accelerate.

A key observation is that the inflow momentum of funds into DAT and ETFs has slowed significantly . Both performed strongly in Q4 2024 and Q1 2025, with a brief rebound in early summer, but this momentum has since gradually subsided. Liquidity (M2 money supply) is no longer flowing into the ecosystem as naturally as it did at the beginning of the year . Since the beginning of 2024, the total size of DAT and ETFs has grown from approximately $40 billion to $270 billion , while the size of stablecoins has more than doubled from approximately $140 billion to approximately $290 billion , demonstrating strong structural growth, but also a noticeable slowdown.

This slowdown is significant because each liquidity channel reflects a different source of liquidity. Stablecoins reflect the inherent risk appetite of crypto, DAT captures institutional yield needs, and ETFs reflect broader traditional financial asset allocation trends. The leveling off of growth across these three channels indicates a general slowdown in new capital inflows, rather than just a rotation of funds between different products. Liquidity hasn't disappeared; it's simply circulating within the system, rather than expanding .

Looking beyond cryptocurrencies to the broader economic landscape, liquidity (M2 money supply) is not stagnant . While high SOFR rates have imposed some constraints in the short term by keeping cash yields attractive and locking liquidity into short-term Treasury bonds, we are still in a global easing cycle, and the US quantitative tightening policy has officially ended. The structural backdrop remains favorable; it's just that liquidity is currently inclined to seek other risk manifestations, such as the stock market .

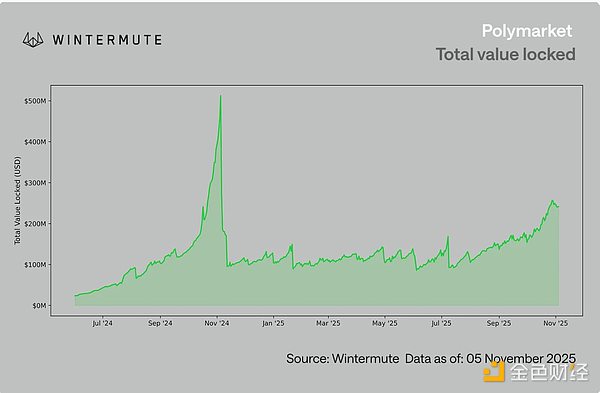

With reduced external capital inflows, market dynamics are becoming increasingly closed. Funds are rotating more between mainstream and alternative sectors rather than entering new areas, creating a competitive landscape within these sectors. This explains why rallies are short-lived and why market breadth is narrowing , even as total assets under management remain stable. Currently, the surge in volatility is primarily driven by a chain reaction of liquidations rather than the formation of a sustained trend .

Looking ahead, a significant recovery in any of these liquidity channels—such as a renewed increase in stablecoin issuance, the launch of new ETFs, or a rebound in DAT issuance —would indicate that macro liquidity is flowing back into the digital asset sector. Until then, cryptocurrencies are still in a self-financing phase; capital is merely circulating but not yet achieving compound growth.