A series of stablecoins fell into crisis after the incident of Stream Finance and Balancer when USDX of Stable Labs lost peg and Elixir announced the "death" of deUSD.

Stablecoins in Crisis After Stream Finance and Balancer Crashes

Stablecoins in Crisis After Stream Finance and Balancer Crashes

USDX loses peg below $0.45, suspected to be related to the $70 million Balancer hack

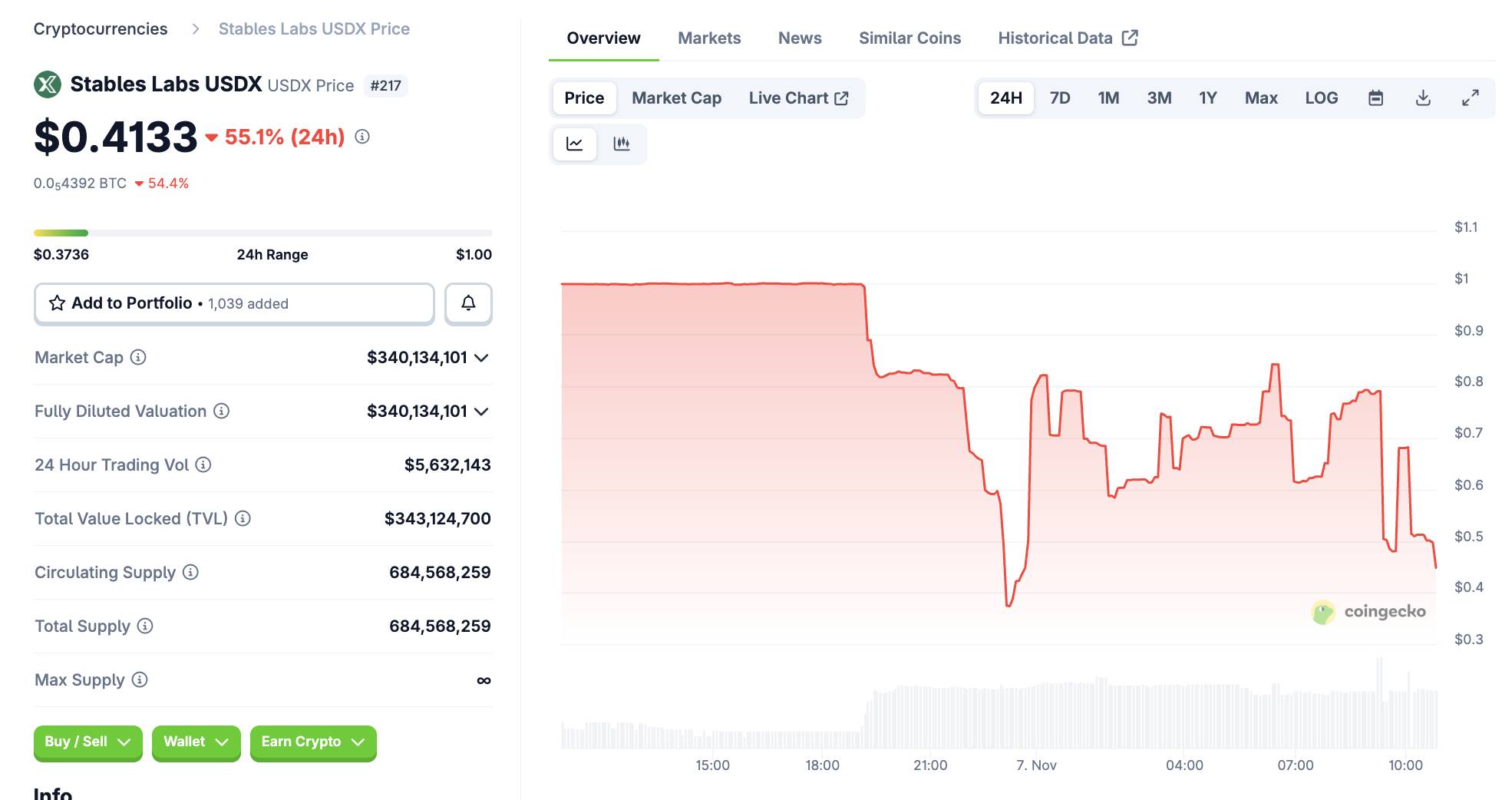

- On November 7, Stables Labs' stablecoin USDX lost serious peg, falling below $0.45, down more than 55% in the past 24 hours.

USDX price movement in the last 24 hours, screenshot on CoinGecko at 11:50 AM on 07/11/2025

USDX price movement in the last 24 hours, screenshot on CoinGecko at 11:50 AM on 07/11/2025

- This is the deepest depeg since USDX launched, causing concern for a series of DeFi protocols and investors. Before losing the peg, USDX had a total supply of more than 683 million USD, widely traded on Uniswap, PancakeSwap and lending platforms such as Lista DAO.

- Immediately after the USDX incident, both Lista DAO and PancakeSwap issued announcements stating that they were closely monitoring the situation and taking risk mitigation measures.

- According to on-chain experts, the cause may stem from the Balancer hack that cost more than $100 million a few days ago.

- Stable Labs' USDX stablecoin operates on a delta-neutral hedging mechanism, meaning the value of the stablecoin is maintained by balanced positions between collateral assets (such as ETH, BTC ) and Derivative Short orders on the exchange.

- However, in early November, this mechanism was broken after a $128 million Balancer hack. The incident caused a series of liquidations of Stable Labs' hedge positions, causing Capital pressure and forcing users to massively exchange USDX for other stablecoins, causing the USDX exchange rate to collapse.

- Researcher Min from Hyperithm Fund pointed out that USDX's investment portfolio has not changed in more than two months, indicating that the team has little to no active risk management. He also emphasized that at one point, Stable Labs even held exotic altcoins like BANANA31 in its portfolio, raising questions about its investment capacity and risk management.

USDX claims to generate yield through delta-neutral and US Treasury strategies, but as far as I can tell, their portfolio hasn't changed in over two months.

— Min l Hyperithm (@ingerxyz) November 6, 2025

Are they actually doing any active management?

At one point, they even had weird alts like BANANA31 in the portfolio. pic.twitter.com/KDqSqZF5yD

- The situation became more complicated when a wallet believed to be linked to Flex Yang, founder of Stable Labs and Babel Finance, was found to have used USDX as collateral to borrow additional stablecoins such as USDC, USDT , and USD1 on the Euler, Lista, and Silo protocols at interest rates of up to 100% with no signs of repayment.

- @arabebluechip account said: “All USDC, USD1 and USDT liquidation has been drained by USDX collateral loans, it is absurd to accept 100% interest payment with no intention of repayment.”

Perhaps @StablesLabs can clarify why founder Flex Yang's wallet is linked to these addresses

— Arabe ₿luechip (@arabebluechip) November 5, 2025

It appears that all USDC / USD1 / USDT liquidity was drained by sUSDX / USDX as collateral in Euler / Lista / Silo, paying 100% borrow interest with seemingly no intent to repay.…

- In this situation, Lista DAO was forced to trigger an emergency liquidation of USDX/USD1 pairs. The protocol used a flash loan to liquidate more than 3.5 million USDX and recover 2.9 million USD1 to stabilize liquidation.

📢 LIP 022 - Emergency Vote: Enabling Forced Liquidation for USDX Market (re7 vault)

— Lista DAO (@lista_dao) November 6, 2025

This proposal is being put forward as an emergency one-hour vote, following a request from the vault curator, to enable forced liquidation mechanisms for the USDX/USD1 market.

🔹The @Re7Labs … pic.twitter.com/cs9ynd3XOH

- However, just days later, the unit that set up the vault for Lista DAO, Re7 Labs, revealed that some of their vaults were related to Stream Finance's stablecoin xUSD, which had just lost serious peg after a $93 million loss , further escalating the severity.

Elixir forced to "kill" stablecoin deUSD

- The domino effect from Stream Finance continues to spread to Elixir when this project announced to stop operating stablecoin deUSD, a product similar to USDe from Ethena Labs .

Elixir has worked tirelessly over the previous 48 hours and has successfully processed redemptions of 80% of all deUSD holders thus far (not including Stream).

— Elixir (@elixir) November 6, 2025

As it stands now, Stream holds roughly 90% of the deUSD supply (~$75m), while Elixir holds a similar proportion of its…

- According to the announcement on X on November 7, Elixir said it had completed refunding about 80% of deUSD holders, and taken a Snapshot of the remaining balance to prepare to open a 1:1 conversion portal to USDC in the near future.

- The project said the current portal lock is to prevent Stream from dumping deUSD before repaying the loan, and to build a new system to handle outstanding conversion orders.

- Elixir said the current portal lock is to “prevent Stream from dumping deUSD before repaying the debt”, and is building a new request portal to handle the remaining exchanges.

- The direct cause comes from the fact that Stream Finance, a major partner of Elixir, reported a loss of 93 million USD and is currently in debt of at least 285 million USD with many DeFi lending protocols, of which Elixir accounts for more than 68 million USD through deUSD loans.

- Stream used deUSD to back the stablecoin xUSD, but after xUSD lost its peg, Stream fell into insolvency, causing deUSD to lose serious liquidation and causing a chain effect to many other projects, including Stable Labs with USDX.

- Elixir claims to be the sole creditor with a full right to repayment at $1/deUSD, but Stream is now said to have refused to repay or close its position. Stream is estimated to hold 90% of the total deUSD supply (~$75 million), while Elixir holds the corresponding collateral in the form of a Morpho loan to Stream.

- Elixir is currently working with Euler, Morpho, Compound protocols and DeFi curators to liquidate Stream positions, recover Capital and redistribute assets to deUSD holders. The project stated:

“We believe that deUSD is still fully backed and will ensure 1:1 redemption. Any affected LPs or lenders will receive the full value of their investment.”

- Launched in mid-2024, deUSD was expected to become a “truly decentralized synthetic dollar” solution, and was even chosen as collateral by Hamilton Lane’s Tokenize fund HLSCOPE. However, the chain collapse from Stream Finance, along with the risks that have not been completely resolved, once again exposed the fragility of the DeFi stablecoin model based on the borrowing mechanism and Derivative guarantees.

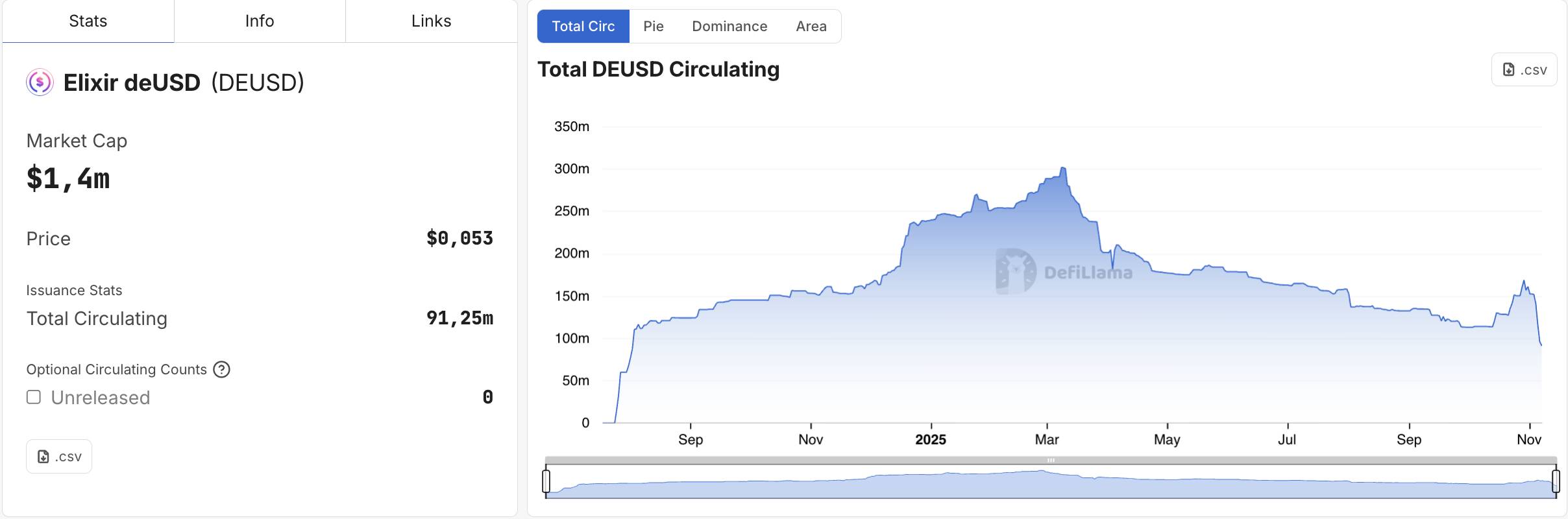

- The decision to "kill deUSD" marks the end of one of the most prominent decentralized synthetic stablecoins in the crypto market, which at one point had a market Capital of more than 300 million USD but is now only worth more than 1.4 million USD.

deUSD Capital Statistics. Source: defillama (November 7, 2025)

deUSD Capital Statistics. Source: defillama (November 7, 2025)

Coin68 synthesis