Authors: Gia Li, Mia | Editor: Munchee

1. Bitcoin Market

Bitcoin price movement (November 1, 2025 – November 7, 2025)

Over the past four days (November 1 to November 7, 2025), Bitcoin's overall trading pattern can be described as "sideways consolidation → rapid downward fluctuations → low-level rebound and recovery".

The price mainly traded between $111,000 and $101,000, with significant drops during this period. On November 5th, during the crash, it broke through the low point formed by the "10.11" spike, causing Bitcoin to fall below the $100,000 mark and hit a new low since June, indicating a significant decline in market risk appetite.

Sideways consolidation phase (November 1st to November 2nd)

From November 1st to 3rd, Bitcoin traded sideways within the $108,656–$111,133 range with low trading volume, reflecting a strong wait-and-see attitude in the market. Following the Federal Reserve's interest rate cut the previous week, short-term buying interest gradually waned, and major funds began cautiously reducing their positions.

Causes of the trend:

Market expectations for macroeconomic policies (such as US interest rate cuts and interest rate path) have become more cautious, and no new strong catalysts have emerged.

Prices are in a high range, short-term buying is weak, and while institutional funds have not left the market quickly, their entry is also slow.

Technical analysis shows that the price is approaching the previous high, with buying and selling forces locked in a stalemate, resulting in a sideways consolidation.

Rapid downward trend during the period of volatility (November 3 to November 5)

On November 3, the cryptocurrency market experienced a flash crash, with prices breaking downwards and declining from the support level of approximately $108,000. More than $1.2 billion in positions were liquidated within 24 hours.

On November 4th, the price experienced a brief period of fluctuation and pullback, rising to $108,000 multiple times before repeatedly dipping to $105,000, with the trading range gradually widening.

On November 5th, Bitcoin further declined during trading, breaking below the psychological barrier of $100,000 and accelerating its downward trend. It fell as low as $99,000, hitting a new low since June, triggering market concerns. The 24-hour drop reached 7.34%. In the past 24 hours, a total of $2.028 billion in positions were liquidated across the network, with $614 million of that in BTC. Market panic intensified, and short sellers dominated short-term price movements.

Causes of the trend:

After the support level was broken, stop-loss orders and leveraged funds were forcibly liquidated, pushing the price down rapidly.

The macroeconomic environment is deteriorating: the US dollar index is strengthening, US Treasury yields are rising, risk appetite is declining, and funds are flowing out of risky assets, including crypto.

Technical indicators have weakened: the price has broken through multiple key support levels and moving averages, forming a downward channel.

Long positions and leveraged liquidations have intensified. Reports indicate that this round of declines has triggered large-scale liquidations, tightening liquidity in risky assets.

Low-level rebound and recovery phase (November 6th to November 7th)

On November 6th, Bitcoin rebounded from a low of approximately $99,000, trading in the $100,832–$103,000 range, reaching a high of $104,526.

However, it remains in a weak and volatile state, with no signs of reversal yet. As of press time, the price was $101,141.

Causes of the trend:

After bottoming out, some buying entered the market, forming a rebound, but the momentum was insufficient.

Market funds remain cautious, and institutions have not yet made large-scale contrarian investments.

Technical and financial factors remain bearish, making it difficult for the rebound to break through the high-level resistance.

2. Market Dynamics and Macroeconomic Background: Capital Flows

1. ETF Fund Dynamics

Bitcoin ETF fund flows this week:

November 3: -$186.5 million

November 4th: -$566.4 million

November 5th: -$137 million

November 6: +127.5 million USD

ETF inflow/outflow data image

ETF funds saw significant outflows this week, particularly on the 4th and 5th, reflecting institutional withdrawal or a wait-and-see approach as market uncertainty intensified. While there was a small inflow on November 6th, the magnitude was far lower than the outflows of the previous two days, indicating an overall continued outflow trend.

2. Net outflows from exchanges widen during the global accumulation phase.

As of early November, data from multiple exchanges showed that net outflows of Bitcoin continued to widen. Analysts point out that while some funds continue to move to cold wallets, the outflows are accompanied by signs of weak demand, potentially interrupting the accumulation phase. According to a Citibank report, the slowdown in inflows into spot ETFs has become a key risk factor for Bitcoin bulls.

Bloomberg ETF analyst Eric Balchunas wrote that the growth of Bitcoin ETFs follows a pattern of two steps forward, one step back, and is currently in the step-back phase. This pattern can be seen in IBIT's fund flows. In my opinion, this is part of the development process. Only children expect prices to rise every day.

3. Long-term holder dynamics

Midweek, market reports indicated that Bitcoin's price fell below the $100,000 mark, leading to increased pressure from high-leverage liquidations. While specific open interest (OI) and funding rates were not available, the combination of ETF outflows and price pullbacks suggests that short-term leverage risks are becoming increasingly apparent, and liquidity is tightening.

Related images

A CryptoQuant report indicates that loss-making sell-offs by short-term holders are exacerbating downward pressure on the market. Today alone, approximately 30,300 bitcoins were transferred to exchanges at a loss, demonstrating a significant increase in "capitulationist" selling pressure from buyers recently.

Citigroup analysts also noted that the number of large Bitcoin holders continues to decline, while the number of small retail wallets is increasing, indicating that some long-term investors are gradually reducing their holdings. ETF fund flows remain a key indicator of shifts in market sentiment. Meanwhile, declining financing rates reflect weakening market leverage demand and a more conservative investor sentiment.

On-chain data shows that long-term holders sold approximately 400,000 Bitcoins (worth about $45 billion) in the past month, becoming a major driver of the recent price drop. Analysts believe that the continued selling pressure in the spot market has temporarily disrupted the market structure, especially as long-term holders cashed out at high levels, further exacerbating short-term supply and demand imbalances and price volatility.

Technical indicator analysis

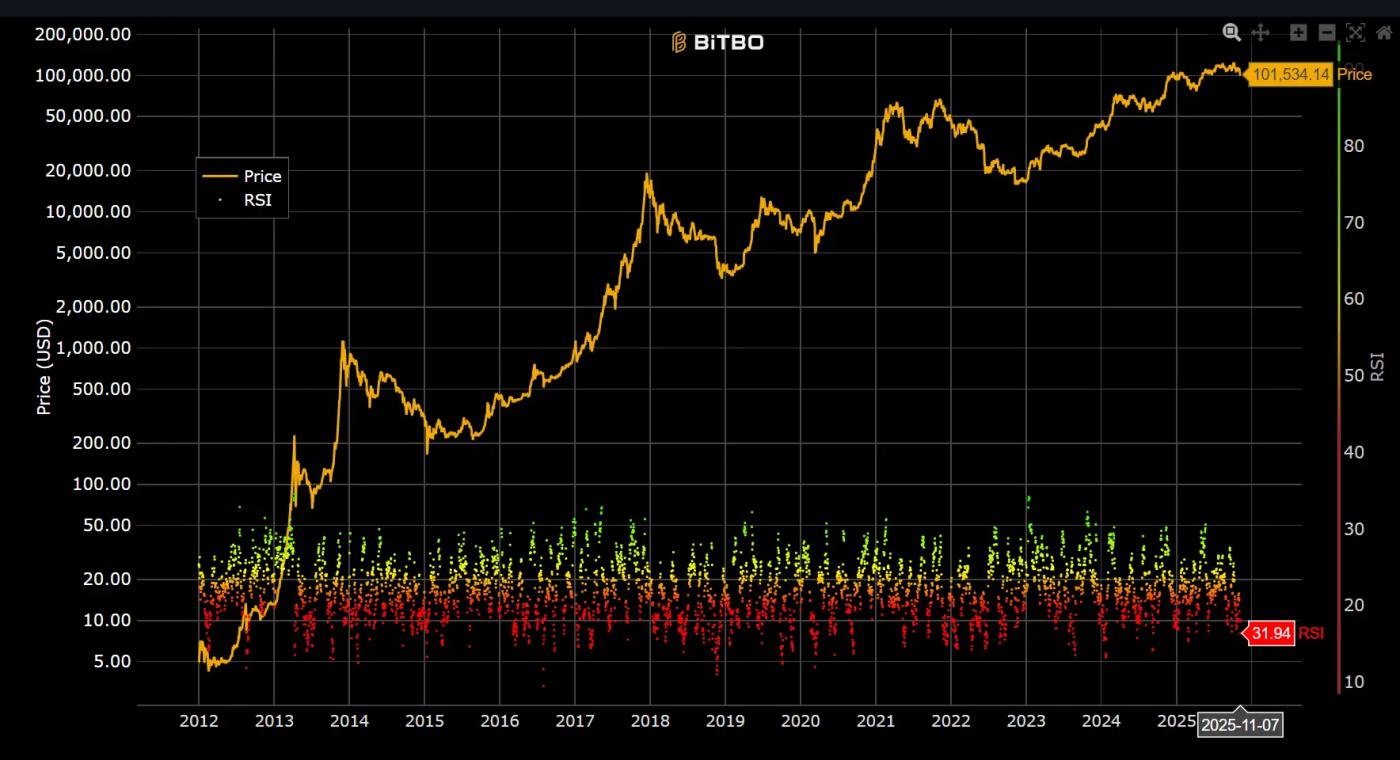

1. Relative Strength Index (RSI 14)

Bitcoin 14-day RSI data image

According to the latest data, as of November 7, the RSI was approximately 31.94, falling to a relatively weak level.

The RSI is on the verge of oversold territory (30 is usually considered oversold), indicating significant downward pressure in the short term and an overly pessimistic market. However, from a cyclical perspective, conditions for a rebound are accumulating.

Based on historical backtesting and trading volume characteristics, if the RSI can steadily rise above 40 and ETF fund flows turn positive, it will likely confirm a short-term bottom.

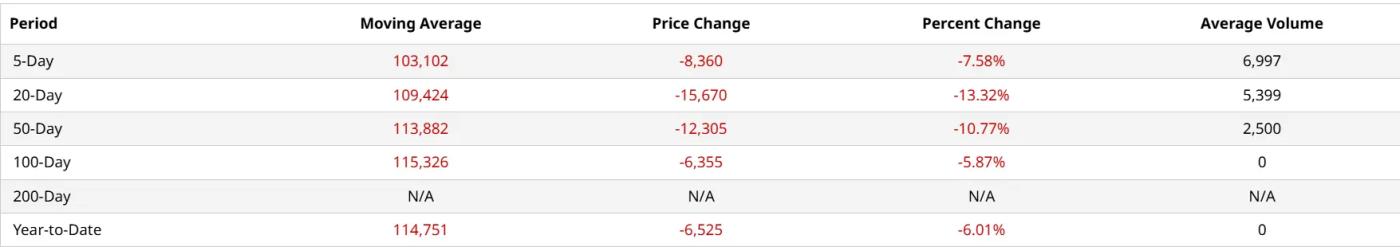

2. Moving Average (MA) Analysis

The latest moving average data shows:

MA5 (5-day moving average): $103, $102

20-day moving average (MA20): $109,424

MA50 (50-day moving average): $113,882

MA100 (100-day moving average): $115,326

Current price: Approximately $101,555

MA5, MA20, MA50, MA100, M200 data images

Bitcoin has broken below its 200-day moving average (SMA). It lost key support at $109,000 and is currently hovering around $103,500. The next key level is at $99,000, a level that has historically provided support during pullbacks. A rise above the MA20 ($109,424) would be a reversal signal; a sustained move lower could lead to a test of even lower support levels.

3. Key support and resistance levels

Support level: around $99,000 (a new area of concern after the recent break below this level).

Resistance level: Approximately $105,000 area

The current price is above the support level, and after several unsuccessful attempts to break through the resistance level, it has fallen back, and the market may fall into a range-bound oscillation in the short term.

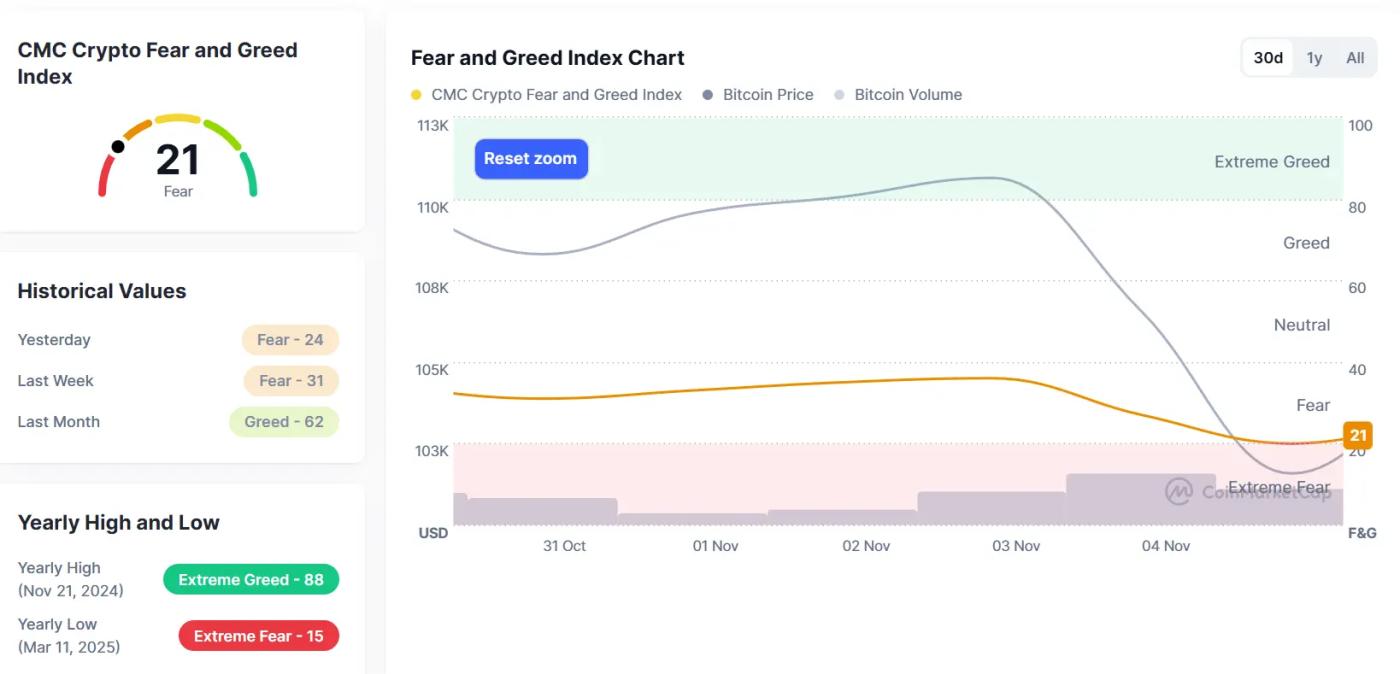

Market sentiment analysis

Fear and Greed Index Data Image

As of November 7, the Fear & Greed Index stood at 21 points at the end of this period, placing it in the "extreme fear" zone. The chart data shows the index continues to decline.

Looking back at this week (November 1st to November 7th), the Fear & Greed Index were 33 (Fear), 35 (Fear), 36 (Fear), 27 (Fear), 20 (Fear), and 21 (Fear), respectively. The overall range was between 36 and 20 points, consistently remaining in the "Fear" zone. This low sentiment reflects investors' general risk aversion and reduced exposure. If the index rebounds to 30-40 points, it could be seen as the starting point for a recovery in confidence.

Overall, Bitcoin market sentiment showed a rapid decline this week. Although fear dominated, market sentiment slightly improved from 33 points between November 1st and November 3rd. After the market crash, sentiment plummeted, falling into the extreme fear zone around 20 points. Sentiment was near its bottom but rebounded slightly to 21 points on November 6th, but there are no signs of a bottom yet.

Macroeconomic Background

1. The easing of tensions between China and the United States has entered the implementation phase.

On November 1, the White House released a "Fact Sheet on US-China Trade Relations," confirming that the two sides had reached a phase-one trade agreement. China will suspend some tariff and non-tariff measures imposed on the US since March 2025. On November 5, Reuters reported that China would lift or suspend export controls on some US high-tech and energy companies starting November 10, marking the implementation phase of the trade easing. Furthermore, the Associated Press reported that the two sides agreed to establish a military communication and crisis hotline mechanism, the first reopening of military communication channels since 2022, seen as a signal of reduced geopolitical risk. The easing of geopolitical risk has effectively compressed global risk premiums, providing medium- to long-term support for risk assets, including Bitcoin.

Related images

2. US stock market correction and decline in risk appetite

The US stock market continued its high volatility, and retail investor sentiment cooled significantly.

According to a Goldman Sachs report cited by Jinshi Data, the Retail Favorites Index fell 3.6% on November 5th, marking its largest single-day drop since April 10, 2025, roughly three times the decline of the S&P 500. The index comprises growth stocks with high retail investor holdings, such as Palantir, Tesla, and Nvidia.

Bitcoin saw a similar pullback this week, briefly falling below the $100,000 mark. Given the high correlation between US stocks and crypto assets, retail investor withdrawals and reduced leverage exacerbated risk aversion in the market, putting short-term downward pressure on Bitcoin prices.

3. US employment data shows signs of economic slowdown.

1. ADP Nonfarm Employment Change

Released on November 5th, the actual number of new jobs added was +42,000, higher than the market expectation of +32,000, but significantly lower than the previous figure. The data shows that the US labor market continues to grow, but the growth rate has slowed significantly, indicating that companies are becoming more cautious in their hiring activities. This result, to some extent, reinforces the market's assessment of a slowdown in economic momentum.

2. Initial Jobless Claims

Released on November 7 (for the week ending November 1), the report showed that initial jobless claims rose to 229,000, up from 219,000 the previous week. The modest increase in unemployment claims suggests marginal weakness in the labor market, potentially providing a basis for a shift in monetary policy in the coming months.

4. The US government shutdown sets a new record for the longest in history.

Related images

As of November 6th, Eastern Time, the US federal government shutdown had lasted 37 days, breaking the previous record of 35 days from the end of 2018 to the beginning of 2019. This shutdown reflects the long-standing deadlock between the two parties in Congress over budget appropriations. It may force the "Crypto Market Structures Act" to be delayed until 2026. The continued shutdown not only affects government employee salaries but also puts negative pressure on economic confidence and financial markets. White House digital asset advisor Patrick Witt stated that the shutdown of relevant departments has severely impacted the drafting of the bill; Blockchain Association CEO Summer Mersinger also pointed out that legislative delays are almost a foregone conclusion.

According to data from the decentralized prediction platform Polymarket, the probability that the US government shutdown will end after November 16 has risen to 44%, indicating that the market expects a low probability of resuming work in the short term; the probability of it ending between November 8 and 11 is 22%, and the probability of it ending between November 12 and 15 is 30%. The continued shutdown not only weakens economic confidence but also increases volatility in financial markets, suppressing sentiment towards risk assets.

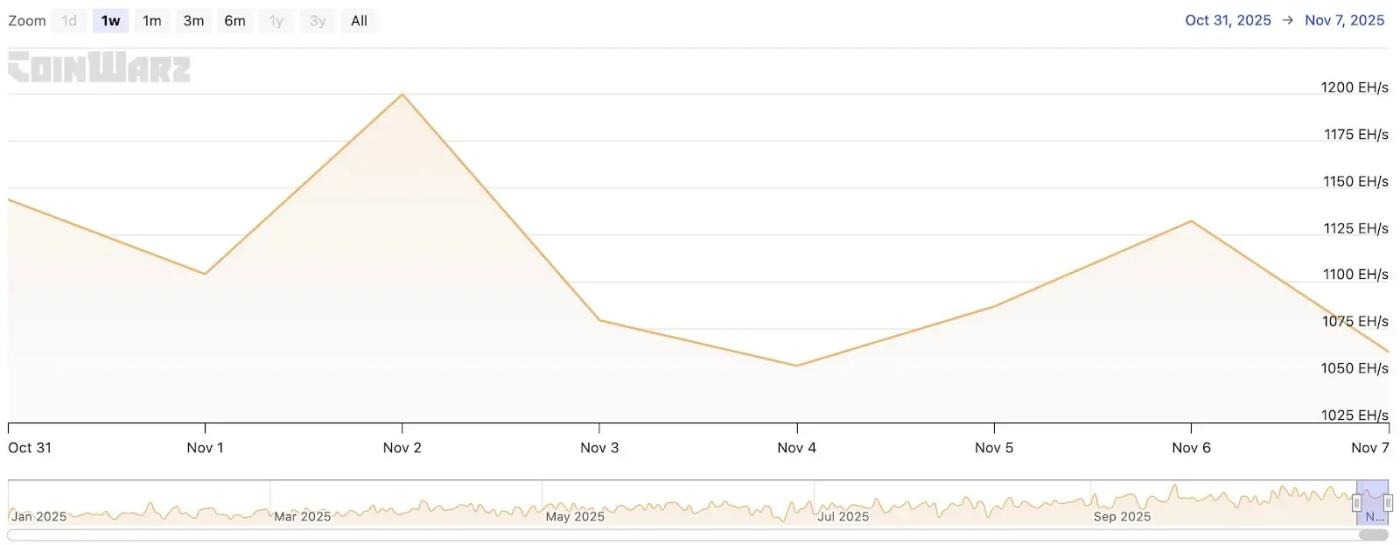

3. Dynamic hash rate changes in the mining industry

Over the past seven days, the Bitcoin network hashrate has remained relatively stable, with the hashrate this week staying between 1055.21 EH/s and 1200.10 EH/s, which is at a relatively high level.

From a trend perspective, the overall network hashrate remains high with relatively small fluctuations. Stable power supply in North American mining areas has allowed some mining companies to resume or increase their hashrate, providing a solid foundation for maintaining a high hashrate level. This week's main fluctuations showed a certain correlation with price movements: as the price of Bitcoin fell on November 3rd, the overall network hashrate also experienced a brief synchronized decline (touching a low of 1055 EH/s); under the pressure of high mining difficulty and energy consumption, miners' profit margins are being squeezed, thus causing short-term fluctuations in the overall hashrate.

Weekly Bitcoin network hashrate data

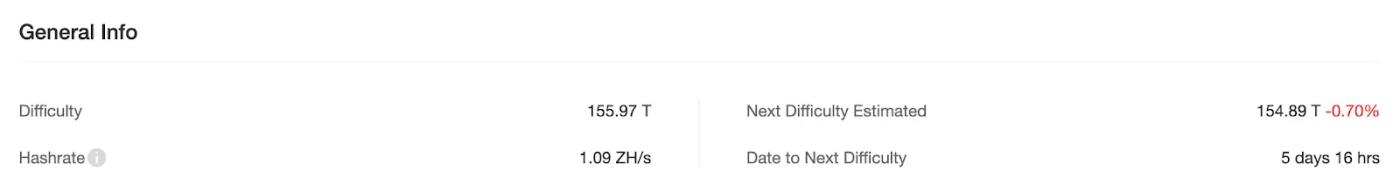

As of November 7th, the total network hashrate reached 1.09 ZH/s, and the mining difficulty was 155.97 T. The next difficulty adjustment is expected to take place on November 12th, with an estimated decrease of 0.70%, bringing the difficulty to approximately 154.89 T.

Bitcoin mining difficulty data

Bitcoin Hash Price Index

From the perspective of daily revenue per unit of computing power (Hashprice), Hashrate Index data shows that as of November 7, 2025, Hashprice was $41.32/PH/s/day. This week, Hashprice largely mirrored the price movement of Bitcoin, showing a gradual recovery after a high-level pullback.

November 1st: This week's high was $44.79/PH/s/day

November 5th: This week's low was $40.58/PH/s/day

Hashprice's volatility is primarily driven by Bitcoin prices and transaction demand, while the dynamic adjustment of the network's total hashrate is also eroding miners' marginal profits. Overall, although Bitcoin mining revenue saw a significant decline last week due to price and transaction fee fluctuations, it gradually recovered before the weekend, demonstrating some resilience. Looking at Hashprice's trend, miners' profits have experienced some short-term volatility, showing an overall downward trend, and miners' profit margins are being compressed to some extent.

Hashprice data

4. Policy and Regulatory News

Hong Kong plans to relax trading rules and launch a tokenization pilot program, allowing licensed exchanges to share liquidity.

On November 4th, it was reported that Hong Kong regulators and the Securities and Futures Commission (SFC) will relax some trading restrictions, launch an asset tokenization pilot program, and allow licensed local exchanges, with SFC approval, to share order books with overseas platforms to access global liquidity. These measures have been widely reported by major media outlets. Hong Kong is attempting to position itself as a more open digital asset hub—attracting exchanges, market makers, and institutions by easing liquidity access and tokenization support. In the short term, this will benefit local licensed exchanges and boost trading depth, but it will also trigger discussions on compliance and cross-border regulatory coordination.

Related images

A South African court ruled that, under current law, cryptocurrency transfers are temporarily exempt from foreign exchange controls.

On November 5th, a series of judicial opinions from the Pretoria High Court indicated that, under existing foreign exchange control regulations, cryptocurrencies are not defined as "currency" or "capital." Therefore, without legal revisions, it will be difficult to incorporate crypto assets into the existing foreign exchange reporting and control framework. Legal and regulatory commentators pointed out that if regulators want to include crypto assets in foreign exchange controls, they need to amend the legal text or enact specific regulations; otherwise, the regulatory gap will persist. This report emphasizes that this is an important judicial reminder regarding South Africa's regulatory path. In the short term, the degree of restriction on cross-border flows of crypto assets in South Africa remains unchanged; however, for regulators, this ruling increases the urgency to close the loopholes through legislation rather than administrative interpretation.

Canada announces 2025 stablecoin regulatory plan

On November 6, according to Cointelegraph, the Canadian government officially announced its regulatory plan for stablecoins in its 2025 federal budget, following the regulatory direction of the US GENIUS Act.

According to the plan, stablecoin issuers must maintain adequate reserves and establish a sound risk management system.

Related images

5. Bitcoin-related news

Global Corporate and National Bitcoin Holdings (This Week's Statistics)

1. Strategy (formerly MicroStrategy) purchased an additional 397 Bitcoins.

On November 3, it was announced that the company purchased a total of 397 Bitcoins between October 27 and November 3 at an average price of approximately $114,771 per Bitcoin, equivalent to approximately $45.6M, bringing its total holdings to 641,205 Bitcoins. The acquisition was scheduled for November 3, 2025.

2. Hong Kong telecommunications company Moon Inc. increased its holdings by 6.12 bitcoins, at an average purchase price of US$109,800.

On November 3, Hong Kong telecommunications company Moon Inc. announced the acquisition of 6.12 bitcoins at an average price of US$109,800, bringing its bitcoin reserves to 35 bitcoins, with an average cost basis of US$91,394.

3. South Korean listed company Bitplanet increased its holdings by 23 bitcoins, bringing its total holdings to 151.67 bitcoins.

On November 3, according to BitcoinTreasuries.NET, South Korean listed company Bitplanet purchased 23 new Bitcoins, bringing its total Bitcoin holdings to 151.67.

4. Strive plans to issue SATA preferred shares to raise funds to increase its Bitcoin holdings.

On November 4th, according to CoinDesk, Nasdaq-listed asset management company Strive (ASST) announced its plan to issue 1.25 million SATA preferred shares with an initial annualized dividend of 12% and monthly cash dividends. The funds raised will be used to increase Bitcoin holdings, expand operations, and potentially repurchase shares.

5. Steak 'n Shake established the "Strategic Bitcoin Reserve" company to store Bitcoin payment revenue in the company's treasury.

On November 4th, Steak 'n Shake, an American chain restaurant brand, announced the establishment of the Strategic Bitcoin Reserve (SBR): it will directly add Bitcoin payment revenue it receives to the company's Bitcoin vault and encourage customers to pay with BTC through promotions (such as "Bitcoin meals"). The company did not disclose the size of the one-time purchase, which is a strategy of "accumulating Bitcoin with acquiring/operating revenue".

6. Remixpoint increased its holdings by 29 Bitcoins, bringing its total holdings to 1411 Bitcoins.

On November 4, TreasuryStocks reported that Remixpoint spent $3.4 million to purchase 29 new Bitcoins, bringing its total Bitcoin holdings to 1,411.

7. The Smarter Web Company, a UK-listed company, increased its holdings by 4 bitcoins, bringing its total holdings to 2,664 bitcoins.

On November 4th, according to BitcoinTreasuries.NET, The Smarter Web Company (stock code: $SWC), a UK-listed company, purchased 4 new Bitcoins, bringing its total Bitcoin holdings to 2,664.

8. Canadian publicly traded company Matador Technologies is raising $100 million to purchase Bitcoin.

On November 4, according to market sources, Canadian publicly traded company Matador Technologies (stock code: MATA) is raising $100 million through the issuance of convertible bonds to purchase more Bitcoin.

9. MicroStrategy plans to raise funds through the issuance of euro-denominated perpetual preferred shares (STRE) for future Bitcoin purchases.

On November 4th, digital asset treasury company Strategy announced its initial public offering of 3.5 million euro-denominated perpetual preferred shares to support general corporate operations, including Bitcoin purchases. Additionally, Strategy announced on Monday that it had purchased 397 BTC, bringing its total holdings to 641,205 BTC.

10. Hyperscale Data's Bitcoin treasury has grown to $73.5 million, currently holding 234.72 Bitcoins.

On November 4, PRNewswire reported that Hyperscale Data (NYSE American: GPUS), a US-listed Bitcoin treasury company, announced that its total Bitcoin assets have reached approximately $73.5 million, representing about 61% of the company's market capitalization.

11. Switzerland — FUTURE (Future Holdings AG) completes CHF 28M strategic fundraising to expand its Bitcoin treasury.

On November 5th, Swiss Bitcoin treasury company FUTURE (Future Holdings AG) announced the completion of a strategic financing round of CHF 28,000,000 (approximately US$32 million). The company stated that the funds will be used to expand its BTC inventory, custody, and treasury services.

12. Cango Inc. increased its holdings by 472 bitcoins.

On November 6, Cango Inc., a Chinese auto finance technology service platform listed on the NYSE, announced that it had increased its holdings by 472 bitcoins, bringing its total holdings to 1,944 bitcoins, worth approximately $162 million.

13. Hengyue Holdings increased its holdings by approximately 6.12 Bitcoins.

On November 6, it was reported that Hengyue Holdings Group purchased approximately 6.12 units of Bitcoin on the open market for a total cost of approximately HK$5.242 million, equivalent to approximately US$672,000.

14. James Wynn increased his short Bitcoin position to 8.27 BTC, with a paper profit of $15,000.

On November 6, according to Onchain Lens monitoring, James Wynn further increased his short position in Bitcoin (40x), reaching 8.27 Bitcoins, worth $900,000, with a floating profit of approximately $15,000.

15. Metaplanet raised $100 million by pledging its Bitcoin assets, which will be used to increase its Bitcoin holdings and expand its revenue-generating business.

On November 6, Metaplanet reported that it raised $100 million by pledging its Bitcoin assets. The funds will primarily be used to purchase more Bitcoin, expand its revenue-generating business, and repurchase shares, with some also allocated to revenue-generating activities. The company currently holds 30,823 Bitcoins (approximately $3.517 billion).

The founder of Strategy predicts that Bitcoin will reach $150,000 by the end of the year.

November 3rd news, according to BitcoinNews, Strategy founder Michael Saylor predicts that Bitcoin's price will reach $150,000 by the end of the year, a 36% increase from the current price.

Related images

Analysts: Bitcoin's fundamentals remain strong; a rebound is possible after the October decline.

On November 3, LMAX strategist Joel Kruger stated that Bitcoin fell 4.5% in October, ending a six-year October rally, but this decline may only be temporary rather than a trend reversal.

The fundamentals remain strong, and historically, the fourth quarter is typically Bitcoin's best-performing quarter.

Tom Lee maintains his year-end forecast of Bitcoin at $150,000-$200,000 and Ethereum at $7,000.

On November 3, BitMine Chairman Tom Lee stated in an interview with CNBC that Ethereum's fundamentals are currently performing well, with stablecoin trading volume and application layer revenue both reaching record highs, and a price breakout is expected to follow.

Tom Lee reiterated his previous year-end price forecast, predicting that Bitcoin will reach the $150,000-$200,000 range and Ethereum will target $7,000.

Related images

Analysts: Bitcoin's October pullback may lay the foundation for the next surge, potentially reaching $120,000 to $150,000 by the end of the year.

On November 4th, according to Decrypt, SynFutures CEO Rachel Lin stated, "The October drop could lay the foundation for the next upward move in the Bitcoin bull market; such pullbacks tend to be the midpoint of a larger cycle, not the end." Historical data also supports this optimistic interpretation, with Bitcoin's average return in the third quarter still positive, reaching 6.05%.

It's also worth noting that November has historically been one of Bitcoin's strongest performing months, with an average return of 42% over the past 12 years. Rachel Lin stated, "I expect a period of stability and cautious optimism for November. Bitcoin may trade sideways at the beginning of the month as the market digests the Fed's comments, but a clear shift in policy tone could trigger a rally." She added that if Bitcoin continues to follow its typical post-halving trajectory, "it's still possible for Bitcoin to reach $120,000 to $150,000 by the end of 2025," citing solid fundamental support from ETF inflows to institutional custody solutions.

Arthur Hayes warns: Hidden quantitative easing may be restarted, potentially triggering the next Bitcoin bull market.

On November 4th, BitMEX founder Arthur Hayes published a new lengthy article stating that the actions of the US Treasury and the Federal Reserve are brewing a "stealth QE," which could become a key catalyst for a new round of price increases in Bitcoin and the crypto market. Currently, US government spending continues to expand, and political incentives dictate that they are more inclined to issue bonds than raise taxes.

Hayes advised investors to "preserve capital and wait for the right opportunity," saying the market would see a strong rebound after the "hidden QE begins."

US Senator Lummis: Strategic Bitcoin Reserves are the Only Solution to National Debt

On November 5, U.S. Senator Lummis stated that a strategic Bitcoin reserve is the only solution to our national debt and supported the Trump administration's push for a Strategic Bitcoin Reserve (SBR).

Related images

Multiple institutions believe that Bitcoin is currently undervalued and has medium- to long-term upside potential.

On November 5th, several investment institutions (including JP Morgan and Standard Chartered) stated that Bitcoin is currently "undervalued" compared to gold. JPMorgan's assumed target price is approximately US$165,000; while Standard Chartered noted a potential short-term dip, it believes there is a chance of a medium-term rebound to around US$135,000. These authoritative institutional views support a medium- to long-term upward trend.

Historical data supports a possible Bitcoin rebound in November.

On November 5th, an Indian analyst pointed out that although Bitcoin weakened at the beginning of November, November has historically been a strong month for Bitcoin. The report emphasized that factors such as the end of the US government shutdown, the resumption of fiscal spending, liquidity replenishment, and the recovery of corporate buybacks could provide a catalyst for a "late-half/year-end rebound" for Bitcoin. Seasonal factors and macroeconomic liquidity provide support for Bitcoin.

Bitcoin is experiencing its IPO moment; sideways movement or even a drop could be a "gift."

On November 6th, macro investor Visser believes Bitcoin is undergoing a "silent IPO," transforming from a wild idea into a mainstream success story. He points out that typically, after a stock completes its IPO, it consolidates sideways for 6 to 18 months before initiating an upward trend. Bitcoin's sideways consolidation indicates its IPO moment has arrived—which is why BTC allocation is expected to increase.

Related images

Trump: I hope to make the United States a "Bitcoin superpower"

On November 6, according to CoinDesk, during his speech at the first day of the "American Business Forum" in Miami, Florida (1 p.m. local time on November 5), Trump called for the United States to embrace crypto assets (virtual currencies) and demonstrated his ambition to pursue leadership in this field.

Trump stated, "We are gathered in Miami today to embrace a vital industry. I signed a historic executive order that ended the federal government's war on crypto assets. The crypto industry was once besieged, but that's no longer the case. Because it's a huge industry, a massive industry. I have many talented people and outstanding entrepreneurs around me who are actively involved in the crypto asset space, not only in other businesses."

He further stated, "Crypto assets can greatly alleviate the burden on the US dollar and bring many positive effects, and we are focused on promoting this. We want to make the United States a Bitcoin (BTC) superpower and the global center of crypto assets."

Related images

US Representative Cynthia Lummis calls on community banks to embrace Bitcoin and cryptocurrencies

On November 6, U.S. Senator Cynthia Lummis stated that community banks should actively embrace Bitcoin and cryptocurrencies. She emphasized that 2026 will be a pivotal year for Bitcoin adoption.

Japan becomes the 11th country to use official resources to support Bitcoin mining.

On November 7th, VanEck research data showed that Japan has joined the ranks of countries globally with government-backed cryptocurrency mining, becoming the 11th country (excluding the United States) to officially support Bitcoin mining. This trend has been growing since 2020, with participating countries including Iran, Bhutan, El Salvador, the United Arab Emirates, Oman, Ethiopia, Argentina, Kenya, France, and Russia.

Related images