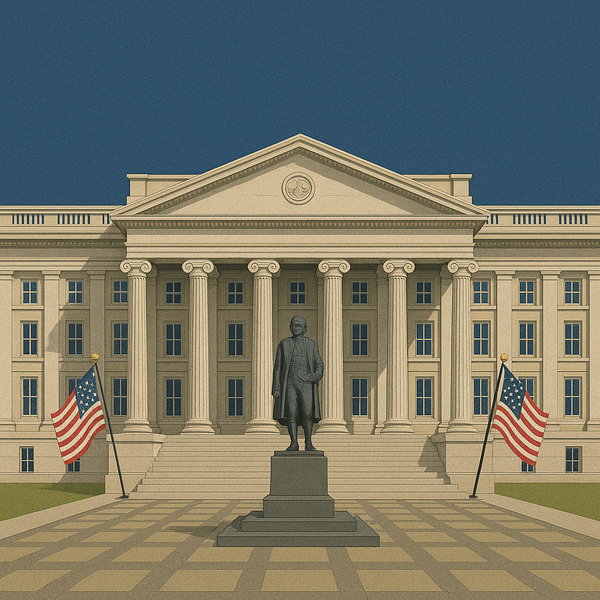

On the 11th (local time), the U.S. Treasury Department and the Internal Revenue Service (IRS) officially approved staking returns for cryptocurrency exchange-traded funds (ETFs) traded on Wall Street. This marks the beginning of a major institutional adoption of Proof-of-Stake (PoS) blockchains like Ethereum and Solana.

These guidelines grant investment trusts "safe harbor" status, exempting them from tax and regulatory risks when staking digital assets, provided they meet certain conditions. They only need to hold a single digital asset and rely on an independent third-party vendor for custody and staking.

The legal status of staking rewards has been unclear in the United States. During the Biden administration, the SEC hinted at the possibility of classifying staking rewards as unregistered securities, and even the spot Ethereum ETFs approved last year failed to offer staking functionality. Even though Grayscale launched the first ETH staking ETF last month, regulatory uncertainty persists.

PoS networks reward users for staking tokens in exchange for maintaining network security. Depending on the network, annual returns can range from 1.8% to as much as 7%. Now, even ordinary investors can access these returns through ETFs.

Treasury Secretary Scott Bessent stated, "This action will enhance investor interest and maintain the United States as a global leader in digital assets." Bill Hughes, Global Head of Regulatory Affairs at Ethereum software company ConsenSys, said, "A key legal barrier to integrating staking yields into regulated products has been removed. The impact on staking adoption will be significant."

The industry anticipates a surge in staking services from conservative, traditional financial institutions as clear regulatory standards are established.