Author: 1912212.eth, Foresight News

Original title: US government ends shutdown and provides cash handouts; crypto market returns to bull market trajectory?

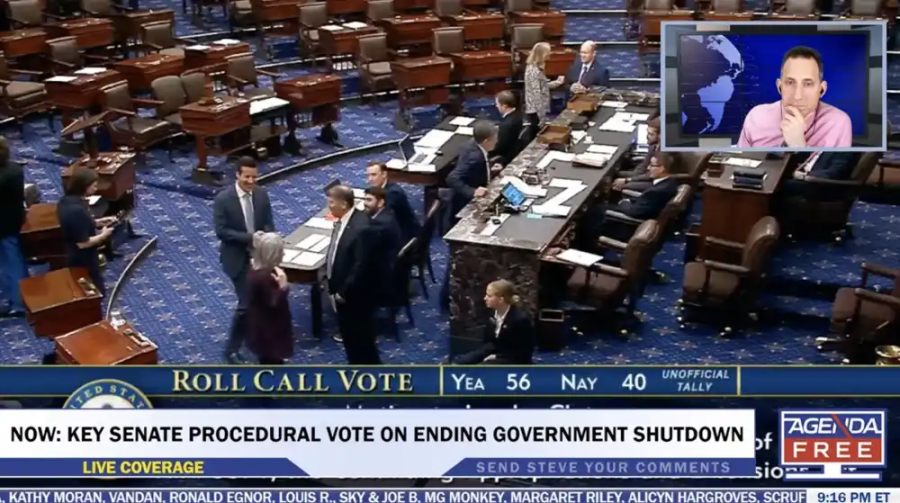

The cryptocurrency market recently received two major boosts: on November 9th, Trump announced a bonus of at least $2,000 for everyone. The following day, Trump told the media that the shutdown looked like it was nearing its end. Currently, the US Senate is holding a test vote on a plan to end the government shutdown, which requires 60 votes to pass. Latest data shows that it is only one vote short of passing.

Fueled by positive news, the cryptocurrency market reacted accordingly. On the evening of November 9th, BTC rose steadily from $102,000 to around $106,600, a recent high, while ETH climbed from around $3,400 to around $3,600, a 24-hour increase of over 7%. Altcoin also saw a slight, general rise.

The longest government shutdown in US history is about to end.

The potential end of the US government shutdown is the biggest recent macroeconomic boon for the crypto market. The shutdown, which began in October due to congressional budget disagreements, froze federal funds, impacting multiple areas from Social Security payments to defense spending. According to the Congressional Budget Office, the shutdown has caused approximately $1 billion in economic losses daily, totaling tens of billions of dollars. This has directly damaged investor confidence, exacerbated uncertainty, and led institutional funds to shift towards safe-haven assets such as Treasury bonds, resulting in a liquidity crunch in the crypto market.

White House National Economic Council Director Hassett: If the US government shutdown continues, fourth-quarter GDP could be negative. US Treasury Secretary Bessett also stated that the economic impact of the government shutdown is worsening.

At approximately 9:00 AM on November 10th, 40 days after the US federal government shutdown, President Trump told the media: "It looks like we're getting closer and closer to ending the shutdown." That evening, the US Senate was expected to vote on a bill already passed by the House of Representatives, but the bill would be amended to bundle short-term funding measures (which would provide funding for the federal government until January 2026) with three annual funding bills.

Fox News reporters say the U.S. Senate is holding a test vote on a plan to end the government shutdown, which requires 60 votes to pass.

The Senate is currently holding a procedural vote on a plan to end the government shutdown, and it is just one vote away from passing. According to reports, after the procedural vote passes, the Senate must amend three appropriations bills (legislation, military construction, and agriculture, including the SNAP program) and then send them back to the House of Representatives. Each amendment triggers a 30-hour debate period, which could delay the process. If Democrats choose to extend these debates, the government may not be able to reopen until Wednesday or Thursday, but if they forgo the time, the process to end the shutdown could be completed tonight, and the US government could reopen tomorrow night. Current obstructionist rules of procedure could significantly impact the timeline.

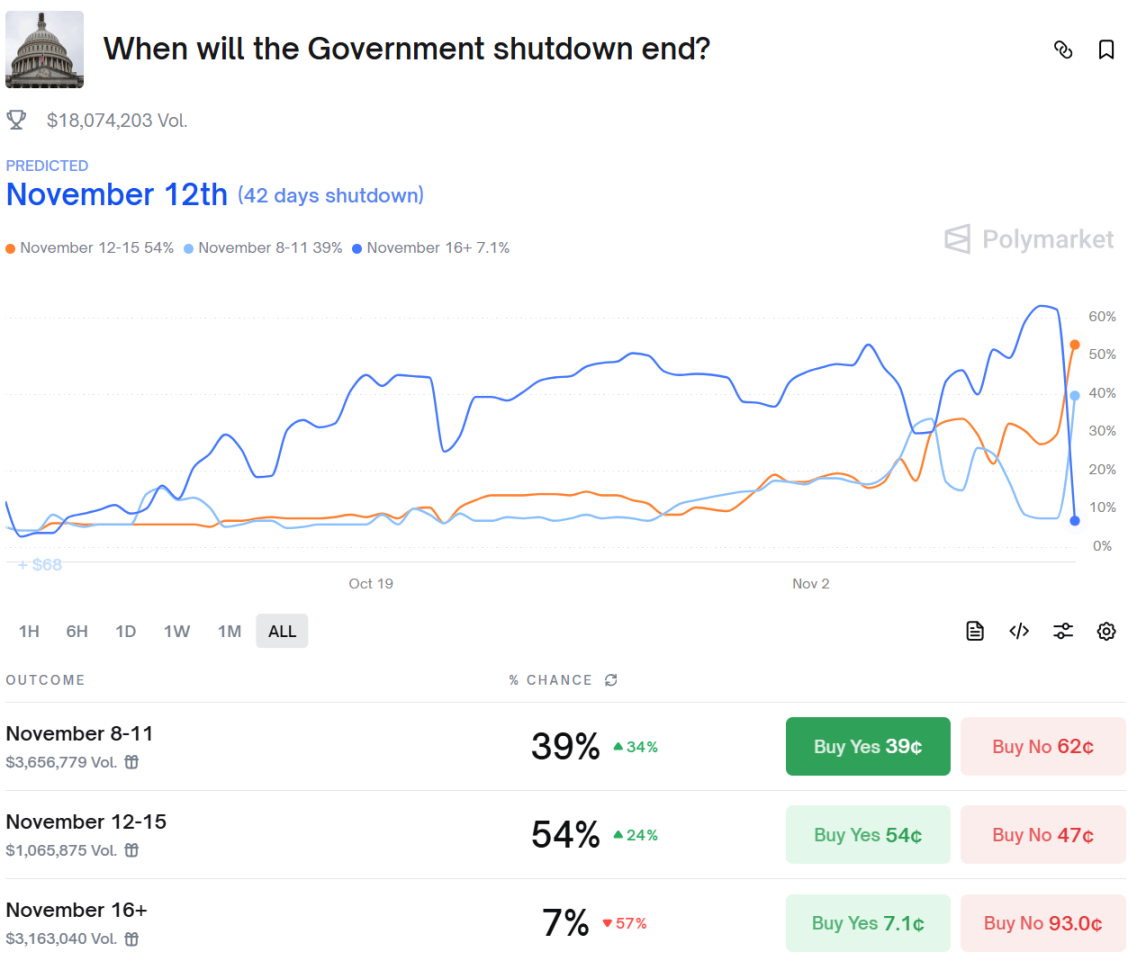

Data from Polymarket shows that the probability of the US government shutdown ending before November 11 has risen to 39%, while the probability of it ending between November 12 and 15 is 55%. The total trading volume in this prediction market currently exceeds $18.1 million.

BitMEX co-founder Arthur Hayes wrote that the US government is back to what it does best – printing money and distributing welfare. He predicted that BTC and ZEC are about to take off. Previously, Hayes analyzed that BTC had fallen 5% since the US debt ceiling increase in July, and dollar liquidity had fallen 8%. The US Treasury Account (TGA) had taken away liquid dollars from the market. When the US government shutdown ends, the TGA will decrease, which will benefit dollar liquidity, and BTC will rise.

Historical data shows that after a shutdown similar to that of 2019, the crypto market rebounded by 10%-15% within two weeks. If history repeats itself this time, the shutdown may once again drive market prices to continue to rebound.

The US government will pay a $2,000 bonus to each person.

Trump's tariff war once put global investors on edge. The tariff war even became the trigger for the "10.11 crash" in the cryptocurrency market.

Recently, Trump defended his tariff war, saying: "Those who oppose tariffs are fools! We are now the richest and most respected country in the world, with near-zero inflation and a record high stock market. 401k retirement account balances are also at an all-time high. We earn trillions of dollars annually and will soon be able to begin paying off our massive $37 trillion debt. Investment in the United States is at an all-time high, with factories and businesses springing up like mushrooms. We will pay at least $2,000 in dividends to everyone (excluding high-income earners!)."

Trump's tariff bonus plan injects potential funds into the consumer market, amplifying its leverage effect. This is based on his trade policy: imposing tariffs of 10%-60% on imported goods, expected to generate $1 trillion in revenue by 2026. The Treasury Department's initial estimate is that this will cover hundreds of millions of people, with total expenditures exceeding $6 trillion, partly through direct transfers.

The positive impact of this plan on crypto liquidity lies in its spillover effect. US consumer spending accounts for 70% of GDP, and the dividend will stimulate retail and investment. According to Federal Reserve data, following similar pandemic stimulus checks in 2021, retail funds flowed into crypto by 15%, pushing Bitcoin from $40,000 to $60,000. This dividend is even larger, with an estimated 10%-20% (approximately $600-1.2 trillion) flowing into high-risk assets.

Two major events combined to significantly boost short-term sentiment in the crypto market. The resolution of the shutdown released frozen institutional funds, while the bonus program injected fresh capital from the retail side.

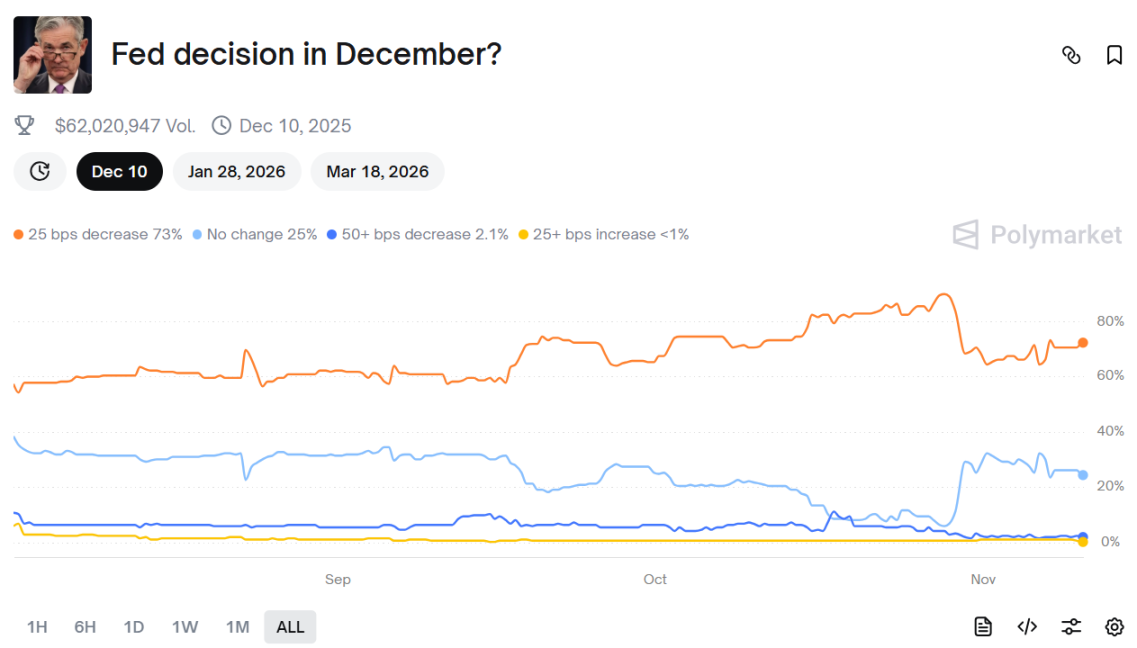

In addition, the probability of the Federal Reserve cutting interest rates by 25 basis points in December has risen to 73% on Polymarket, which will continue to inject liquidity into risk assets.

The crypto market has been gripped by extreme panic since early November, with the fear index currently at 29. Market sentiment may improve significantly once liquidity returns.

Twitter: https://twitter.com/BitpushNewsCN

BitPush Telegram Community Group: https://t.me/BitPushCommunity

Subscribe to Bitpush Telegram: https://t.me/bitpush