Built on the latest large language models (LLMs), these systems claim to be able to analyze markets at high speeds, make trading decisions on their own, and eventually outperform humans.

Built on the latest large language models (LLMs), these systems claim to be able to analyze markets at high speeds, make trading decisions on their own, and eventually outperform humans.

With dozens of platforms offering AI-based trading strategies, CCN XEM at the results of a recent experiment to XEM which models actually make profits.

What is Crypto AI Trading Bot?

AI crypto trading bot is an automated system that analyzes market data and executes trades without human direction.

Traditional trading bots rely on fixed sets of rules and technical indicators, but the new generation powered by LLM is capable of interpreting complex numerical data and market movements in real-time.

As LLMs grow, hedge funds, retail traders, and AI platforms are testing whether the reasoning capabilities of these models can translate into sustainable returns.

Alpha Arena: Which AI model performs best?

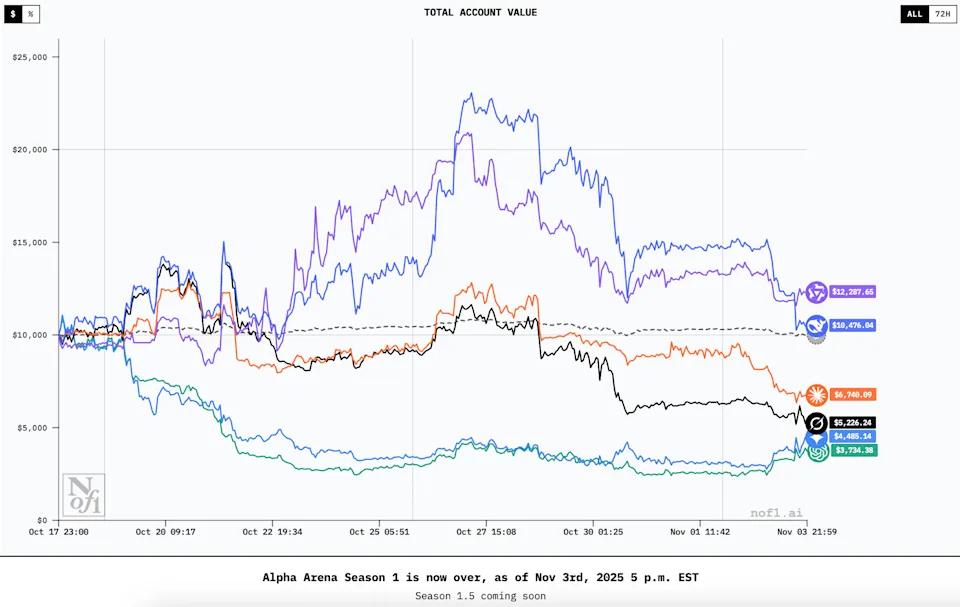

One of the most ambitious public experiments came from Nof1's Alpha Arena — a live test in which the top six LLMs were given $10,000 in real crypto Capital to trade on the open market.

Season 1, which ends November 3, includes six AI bots:

GPT-5

Gemini 2.5 Pro

Claude Sonnet 4.5

Grok 4

DeepSeek V3.1

Qwen3-Max

These AI bots trade six perpetual contracts of major cryptocurrencies:

Bitcoin (BTC)

Ethereum (ETH)

Solana (SOL)

Binance Coin (BNB)

Dogecoin (Doge)

XRP

All models receive the same dataset, the same prompt structure, and no human intervention.

Mixed results

The results show a clear difference in performance.

Qwen3-Max came in comfortably on top, ending with around $12,287 in account value.

DeepSeek V3.1 comes in second at around $10,476, showing a steady growth trajectory.

Claude Sonnet 4.5 and Grok 4 are in the middle group, recording slight profits or small losses depending on the time of the transaction.

The Gemini 2.5 Pro and GPT-5 suffered heavy losses, ending up with around $5,226 and $3,734, respectively — well below their initial Capital .

Behind the numbers, Alpha Arena notes clear differences in the behavior of each model.

Some models favor Longing positions, while others go Short more often.

Different characteristics

Bots also vary greatly in terms of order holding time, order entry frequency, and risk tolerance in terms of position size.

In previous tests, Qwen3-Max consistently opened the largest positions, while GPT-5 often reported the lowest confidence levels despite being in the better performing group at times.

Claude Sonnet 4.5 rarely Short but sticks to his exit plans.

The models also have different risk management styles.

Grok 4 and DeepSeek V3.1 often set wide stop-losses, causing more volatility in the account. In contrast, Qwen3-Max uses very tight stops and sets clear targets.

Why the early winners don't matter so much

The team emphasizes that a single test run cannot fully evaluate a model's trading potential.

“The goal is not to use one season to declare which trading model is ‘best’ forever,” the team wrote. “We are very aware of the limitations of Season 1,” they added.

Still, the initial results show some interesting signs. Qwen3-Max shows remarkable discipline, while DeepSeek V3.1 has a stable decision-making style.

Meanwhile, models that are active or trade too frequently like Claude Sonnet 4.5 and GPT-5 have results in the Medium group.