The new week began with a familiar "Monday red" (referring to a bad Monday).

On the morning of November 17th, Beijing time, Bitcoin (BTC) unexpectedly fell below $94,000, briefly dipping to $93,005. Ethereum (ETH) even broke through the $3,000 mark, hitting a low of $3,004.

This is by no means a healthy technical correction.

Panic is palpable in the Altcoin market. GIGGLE fell 9.59% in the last 24 hours, ICP fell 8.3%, and PHA fell 8.5%. This seems more like a panic-driven, preemptive risk aversion.

The market has become extremely jittery. After the rapid plunge on October 11 and the subsequent blows of the US government shutdown in November, traders were already deeply divided on the future outlook—Galaxy Digital had just cut its year-end target to $120,000, while JPMorgan Chase was still sticking with $170,000.

In the past 72 hours, two of the three pillars upon which the market depends for survival—fiscal stimulus, monetary easing, and the AI bubble—have collapsed , and the third will face its final judgment in 48 hours.

Monday's plunge was not a "wait" for judgment, but a "race to escape" from a confirmed crisis.

Pillar One: The "Friday Sniper" of Currency Fantasy

Over the past few weeks, one of the core bullish arguments of bulls (such as Raoul Pal) has been betting on an "insurance rate cut" by the Federal Reserve on December 10. A month ago (October 16), the market was convinced of this, with the CME FedWatch tool showing a probability of 88.2% for a rate cut.

However, on Friday, November 14, the hawkish bigwigs within the Federal Reserve launched a full-scale attack on this "consensus" .

The two hawkish voting leaders—Dallas Fed President Lorie Logan and Kansas City Fed President Jeff Schmid —delivered coordinated and extremely hawkish speeches that directly thwarted market hopes for interest rate cuts.

Logan's statement was straightforward: " It's difficult to support a December rate cut ." She explicitly stated, " I don't think the U.S. job market needs further insurance rate cuts ."

Schmid completely overturned the table, shattering the dovish argument that "inflation comes solely from tariffs": " My concerns about inflation go far beyond tariffs ," he said, worrying that " further interest rate cuts... could have a lasting impact on inflation ."

The market was immediately crushed by this hawkish duo.

This wasn't just a "verbal" collapse. Coinglass's data starkly reveals that in the 24 hours between November 14th and 15th (following the hawkish remarks), the total market liquidation reached a staggering $1.7 billion , with 95% ($1.62 billion) of that being long positions, resulting in the liquidation of over 404,000 traders .

This $1.7 billion liquidation has shifted market expectations for interest rate cuts from "complacent" to "extremely divided."

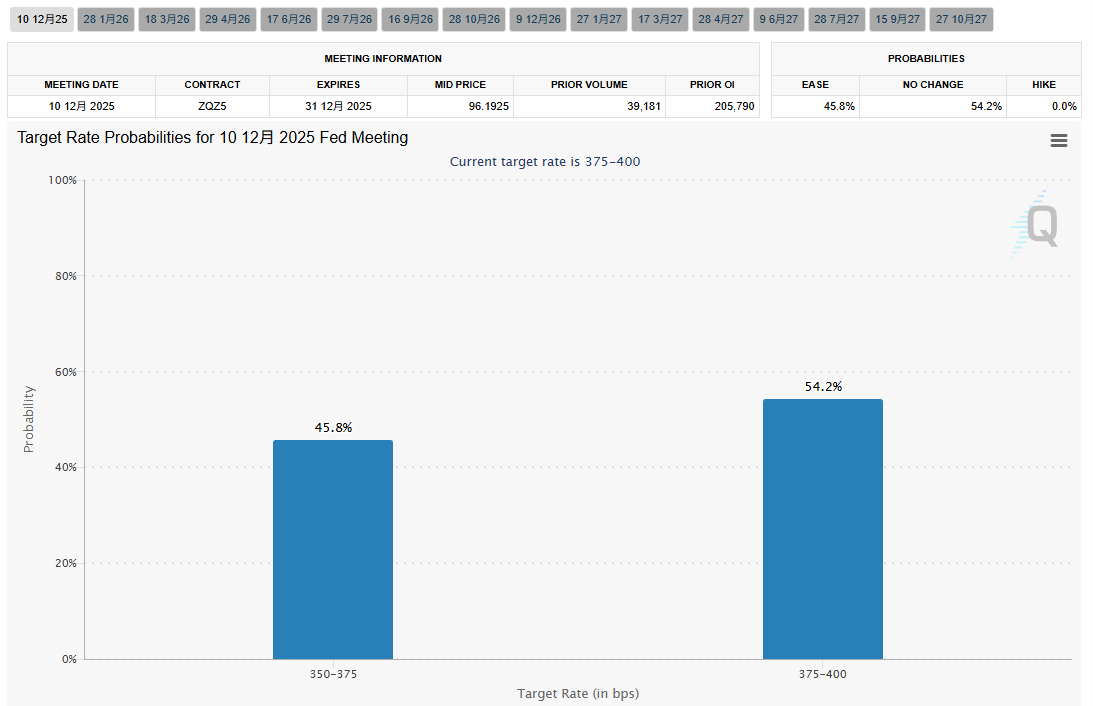

According to the latest CME FedWatch data (as of November 16), market expectations for the December 10 meeting are completely divided :

- There is a 45.8% probability of betting on an interest rate cut.

- There is a 54.2% probability that the interest rate will remain unchanged.

While the bullish case for monetary easing hasn't been completely eradicated, it has been downgraded from a "certain positive factor" to a " 50/50 coin toss ." This first severely damaged market confidence on Friday (14th).

Pillar Two: The "Monday Shattering" of Fiscal Illusions

If Friday's $1.7 billion margin call was just the "first shoe," then today (Monday, November 17) , the market opened with the "second shoe"—the shattering of hopes for fiscal stimulus .

The bulls' (such as Arthur Hayes) "second hope" is based on "liquidity." They believe that once the "government opens up," the "trillion-dollar black hole" in the TGA (Treasury account) will "flood out," and coupled with Trump's promised "$2,000 dividend," the market will "head to Valhalla."

However, just today, Treasury Secretary Scott Bessent personally burst the second bubble.

At the routine press conference on November 17, Bessant publicly "clarified" for the first time the true nature of this $2,000 "dividend":

This is not "direct liquidity injection".

It is a “tariff dividend .” It can take many forms , such as “ simply a tax reduction ” or a “tax refund” for specific groups (such as “households with incomes below $100,000 USD”), and may even include measures like “no tax on tips.”

Even more critical is the timing . Bessant made it clear that the plan not only requires congressional approval but will not be released before Christmas , with a target date of 2026 .

The market's anticipated "2020 COVID-19 model" (Treasury handing out money + Federal Reserve expanding its balance sheet = M2 surge) has been replaced by Bessant's "Made in America" and "populist tax cuts" "2025 model".

If Friday's $1.7 billion liquidation was the market's immediate reaction to the "collapse of the monetary pillar," then today's (Monday) drop in BTC below 94k is a "second confirmation" and a "desperate sell-off" of the "collapse of the fiscal pillar."

Pillar Three: The Zero-Sum AI Game of "Terror Wednesday"

After the two major macroeconomic pillars of "fiscal" and "monetary" collapsed on Friday (14th) and Monday (17th) respectively, the market is left with only the last and most vulnerable narrative pillar: AI .

The "final judgment day" for this pillar is scheduled for after the market closes this Wednesday (November 20) .

NVIDIA will release its Q3 FY2025 financial report at that time.

For the crypto market, Nvidia's earnings report represents a zero-sum game . Three common scenario predictions perfectly illustrate why the crypto market is a "lose-lose" situation:

Scenario 1: The Frenzy Continues (NVIDIA Strongly Exceeds Expectations)

- Performance: Revenue and guidance far exceeded Wall Street expectations (consensus expectation for data center revenue of $48.94 billion), and Jensen Huang signaled that "orders are booked until the year after next."

- Impact on the crypto market: Short-term negative. This will prove that the AI narrative is "secure," and the world's most greedy funds will continue to flood into the AI sector, causing a severe " draining effect " on the crypto market (especially Altcoin).

- (Institutional corroboration): Alex Thorn, head of research at Galaxy Digital, had already pointed out this trend: one reason for Bitcoin's poor performance is that " capital has rotated to other major investment narratives, particularly artificial intelligence and gold ." NVIDIA's "strongly better-than-expected" performance will intensify this "draining" of capital.

Scenario 2: The bubble has peaked (NVIDIA's performance may meet or fall short of expectations)

- Performance: Results met expectations, but guidance was "just in line with expectations" or "slightly weak".

- Impact on the crypto market: Short-term positive. This will be the first time the AI narrative has truly been shaken. Massive amounts of capital will begin to spill over from the AI sector, seeking the "next high-growth narrative." The crypto market (especially AI-related sectors such as $ICP, $PHA) is expected to absorb this "fleeing" capital.

Scenario 3: Total Collapse (NVIDIA Serious Miss)

- Performance: Both earnings and guidance failed, proving that short-term investments in AI have far exceeded actual output.

- Impact on the Crypto Market: A significant short-term negative. As a major constituent of the Nasdaq 100 index, NVIDIA's collapse will trigger a "double whammy" for the entire tech sector. Cryptocurrencies, as high-beta "shadows" of tech stocks, will inevitably be sold off along with the US stock market.

Conclusion: Macroeconomic stress testing has begun.

Now, looking back at today's (Monday, November 17th) market, everything becomes clear.

Today's "Monday Red" – BTC falling below 94k and ETH falling below 3k – is not a simple "technical correction".

This was a panic-driven front-running.

The market lost its "rate cut fantasy" on Friday (Logan/Schmid killed the December rate cut) and lost its "fiscal fantasy" again today (Monday) (Bessenter clarified a 200 billion dividend).

With the collapse of the two major macroeconomic pillars, the market was forced to place all its last hopes on the "AI narrative".

However, traders have realized that NVIDIA's earnings report on Wednesday is likely to be a "zero-sum game" (Scenario 1) or even a "lose-lose" situation (Scenario 3).

The fact that AI-related tokens such as $ICP$ (down 37.2% in 7 days) and $PHA$ (down 9.6% in 24 hours) led the decline today is the most direct evidence that the market is "rushing" to prepare for this "NVIDIA Judgment Day" .

This confirms the concerns of on-chain analyst Willy Woo : the bull market driven by the dual cycles of "halving" and "M2 liquidity" has ended, and Bitcoin "has never experienced a real economic recession" or "business cycle downturn".

The "collapse of the three pillars" from November 14 to 17 was the first practical exercise of the "macro stress test" predicted by Willy Woo.

The "downturn in the business cycle" in 2025 will manifest in the following ways : fiscal stimulus will shift from "helicopter money" to "tax-free tips," monetary policy will change from "50bp rate cuts" to a "12-month pause," and capital will flee from the "speculative narrative" (crypto) to the "productive narrative" (AI). This is an extremely painful but inevitable reassessment of the market, a shift from "liquidity illusion" to "macroeconomic reality." Please fasten your seatbelts.