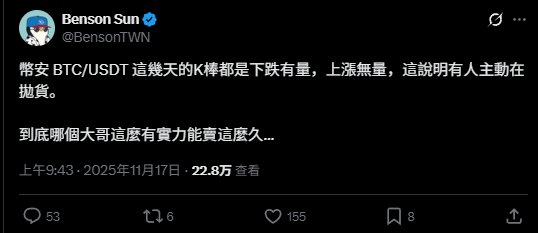

"The K-line chart for the past few days shows that there is volume on the decline and no volume on the rise, which indicates that someone is actively selling off their shares."

On November 18th, this comment circulating on the X platform accurately captured the shared feeling of all traders recently. The market has fallen into a strange "suppressive" state, with each rebound appearing "weak and powerless," as if an invisible hand is continuously and mechanically selling off.

The market is panicking over the specter of Mt. Gox, but they may have mistaken the real "market manipulator."

A new in-depth report based on November court documents has revealed a more structural source of selling pressure that has been overlooked by the market: the UK government .

In the case of "Crypto Queen" Qian Zhimin, British authorities have successfully seized and controlled over 61,000 bitcoins . Now, all evidence suggests that the British government is actively preparing to "liquidate" this asset , not for "value investment," but to fill its multi-billion pound "fiscal gap."

Unlike the "HODLers" creditors at Mt. Gox, a rational, profit-driven "national whale" holding 61,000 BTC is about to become a long-term market "pressure level".

Intent confirmed: The UK is using a "tender" system to monetize its assets.

The market once had "romantic" fantasies about the fate of these 61,000 BTC.

Industry groups and commentators have publicly called on the British government to follow El Salvador's example and include this "digital gold" in its "national strategic reserve."

However, the UK Treasury has explicitly rejected the proposal, citing " concerns about volatility ."

The British government's intention is very clear: to sell .

They weren't just talking. Reports have revealed that the UK Home Office, through its business services arm BlueLight Commercial, has issued a formal tender worth between £40 million and £60 million.

The purpose of this tender is to seek to establish a " cryptocurrency storage and monetization framework ".

The tender document is straightforward, seeking a "SaaS-based hosting and transaction service" to enable the " realisation " of seized assets.

All speculation can now cease. Liquidation and monetization are the only viable options.

Motivation Analysis: The £5 billion "Fiscal Gap"

Why is the British government in such a hurry to sell?

The answer is simple: they need money .

Analysis indicates that the British government is facing a massive fiscal deficit of £5 billion to £20 billion . Chancellor of the Exchequer Rachel Reeves is " closely monitoring " this windfall.

These 61,000 bitcoins, which were worth only about £300 million when they were seized in 2018, have now skyrocketed to about £5 billion to £5.5 billion .

This windfall became a highly tempting direct source for filling the budget deficit.

Even more "ingenious" is the fact that the British government seems to have found a legal path to "legally embezzle" this huge increase in value. The core point of contention in this case is that the Crown Prosecution Service (DPP) has proposed a " customized compensation scheme " to the High Court.

The plan is highly likely to rule that the 128,000 Chinese victims are only entitled to recover their " original fiat currency losses in 2018 " (approximately £640 million).

This means that the UK Treasury will legally "retain" the "value-added gains" of over £4.5 billion .

With such strong "fiscal incentives," it's a foregone conclusion that the British government will "sell" this batch of Bitcoins at a high price and in an orderly manner.

Key Comparison: Why is it much more terrifying than Mentougou?

The prevailing narrative in the market right now is that "the selling pressure on Mt. Gox has been absorbed." However, market analysts warn that it is completely wrong to compare the UK government's (UKGov) sell-off with that of Mt. Gox.

The market dynamics of the two are quite different:

1. Mt. Gox (Mentougou):

- Assets: Approximately 142,000 Bitcoins.

- Recipient: Long-term creditor .

- Motivation: These creditors are "believers" who have fought a decade-long legal battle. They ultimately chose to receive compensation in Bitcoin (rather than Japanese Yen). They are ideologically aligned " HODLers " (long-term holders).

- Market Impact (Forecast): Low . Analysts generally expect only a “ small fraction ” of creditors to sell immediately. The market will readily absorb this marginal selling pressure.

2. UKGov (Qian Zhimin case):

- Assets: Approximately 61,000 Bitcoins.

- Seller: UK Government (Treasury/Home Office).

- Motivation: Fiscal needs (to fill the budget gap).

- Market impact (forecast): High (persistent) . This constitutes pure, inorganic sell pressure .

Bitcoin held by Mt. Gox was transferred from one "cold wallet" to another group of "cold wallets." In contrast, the UK government's Bitcoin was transferred directly from a "cold wallet" to an "exchange hot wallet," with the sole purpose of "converting it into fiat currency."

A German precedent: a "stress test" with 50,000 BTC.

How will the British government sell it? They won't "foolishly" replicate the inefficient "public auction" model used by the US Marshals Service (USMS) in 2014-2015.

A report points to a more recent and likely template: the German government selling 50,000 bitcoins in 2024 .

The German government at the time adopted a more modern approach, selling the huge sum of money in batches through mainstream exchanges such as Kraken and Coinbase , as well as over-the-counter (OTC) market makers.

Its market impact was immediate . The report stated that the move created " tremendous " and " violent " selling pressure in the short term, severely shaking the market.

But in the end, the market successfully absorbed this supply.

The German precedent proves two things:

- The market has the capacity to absorb a supply of 50,000 to 60,000 Bitcoins.

- The digestive process will be extremely painful and accompanied by violent fluctuations.

Conclusion: It wasn't a "flash crash," but rather a "pressure cap."

Now we can answer the question circulating on the X platform: "Which big shot is so powerful that they can sell for so long?"

The answer is: the UK Treasury .

For the market, the most crucial question—"Will there be a market crash?"—has already been answered clearly:

It won't be a devastating "flash crash." The UK government's tender for a "monetization framework" has already hinted at a professional, long-term (potentially 3-4 years) controlled liquidation aimed at "maximizing fiat currency returns."

But it will be a "long-term pressure level" .

The market must digest the fact that a major Western government (the UK) is about to become a rational, profit-driven, large seller with 61,000 Bitcoins.

This "inorganic selling pressure" will act like a "cap," continuously suppressing the market's upside potential for years to come. With each rebound, traders will have to estimate: "How much will the UK government sell today?"—until all 61,000 bitcoins are absorbed by the market.