The third quarter of 2025 was crucial for the crypto market, serving as a bridge between the past and the future: it built upon the rebound in risk assets that began in July and further confirmed the macroeconomic turning point after the September interest rate cut. However, entering the fourth quarter, the market was simultaneously impacted by macroeconomic uncertainties and the outbreak of structural risks within the crypto market itself, leading to a sharp reversal in market dynamics and shattering previous optimistic expectations.

As the pace of inflation decline slowed, coupled with the longest-ever US federal government shutdown in October and escalating fiscal disputes, the latest FOMC meeting minutes explicitly signaled caution against premature rate cuts, causing significant fluctuations in market sentiment regarding the policy path. The previously clear narrative that a rate-cutting cycle had begun was quickly weakened, and investors began repricing potential risks such as "higher interest rates being more persistent" and "soaring fiscal uncertainty." Repeated speculation about rate cuts significantly increased volatility in risk assets. Against this backdrop, the Federal Reserve deliberately suppressed excessive market expectations to avoid premature easing of financial conditions.

Amid rising policy uncertainty, the prolonged government shutdown has further exacerbated macroeconomic pressures, creating a double squeeze on both economic activity and financial liquidity.

• GDP growth will be significantly dragged down: The Congressional Budget Office estimates that the government shutdown will reduce the annualized growth rate of real GDP in Q4 2025 by 1.0% to 2.0%, equivalent to billions of dollars in economic losses.

• Key data gaps and liquidity contraction: The shutdown prevented the timely release of key data such as non-farm payrolls, CPI, and PPI, leaving the market in a "data blind spot" and increasing the difficulty of policy and economic judgments; at the same time, the interruption of federal spending led to a passive tightening of short-term liquidity, putting pressure on risk assets across the board.

Entering November, discussions within the US stock market regarding whether the AI sector was experiencing a temporary overvaluation intensified . Volatility in highly valued tech stocks increased, impacting overall risk appetite and making it difficult for crypto assets to receive spillover support from the US stock market's beta. Although the pre-emptive pricing of interest rate cuts in the third quarter significantly boosted risk appetite, this "liquidity optimism" weakened considerably in the fourth quarter due to repeated government shutdowns and policy uncertainties, leading to a new round of repricing for risk assets.

Amid rising macroeconomic uncertainty, the crypto market is also facing its own structural shocks. Between July and August, Bitcoin and Ethereum broke through their all-time highs (Bitcoin reached over $120,000; Ethereum touched around $4,956 at the end of August), and market sentiment became more positive in stages.

However, the massive liquidation of Binance on October 11th became the most severe systemic shock to the crypto industry:

• As of November 20, both Bitcoin and Ethereum have experienced significant pullbacks from their highs, weakening market depth and widening the divergence between bulls and bears.

• Liquidity gaps caused by liquidation weakened overall market confidence, market depth declined significantly in early Q4, and the spillover effect of liquidation exacerbated price volatility and increased counterparty risk.

Meanwhile, the inflow of funds into spot ETFs and crypto-stock DAT slowed significantly in the fourth quarter. Institutional buying was insufficient to offset the selling pressure from liquidations, causing the crypto market to gradually enter a high-level turnover and fluctuation phase from late August, which eventually evolved into a more obvious correction.

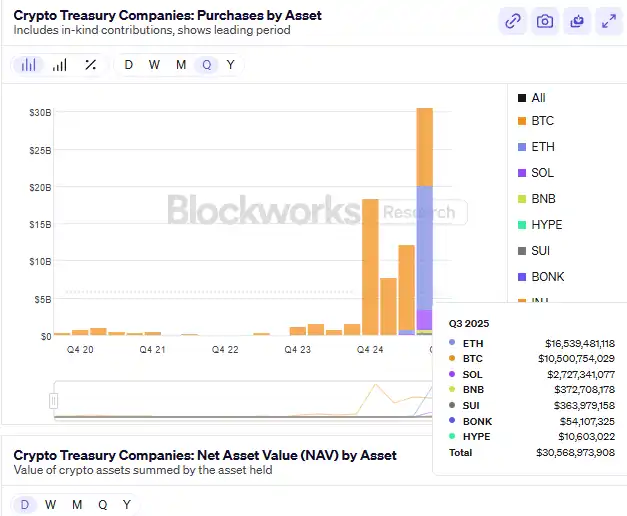

Looking back at the third quarter, the crypto market's rise stemmed from two main factors: a general recovery in risk appetite and the positive impact of listed companies promoting DAT (Digital Asset Treasury) strategies. These strategies increased institutional acceptance of crypto asset allocation and improved the liquidity structure of some assets, becoming one of the core narratives of the quarter. However, as liquidity tightened and price corrections intensified in the fourth quarter, the sustainability of DAT-related buying began to weaken.

The essence of the DAT strategy lies in enterprises incorporating a portion of their tokenized assets into their balance sheets, thereby improving capital efficiency through on-chain liquidity, yield aggregation, and staking tools. As more listed companies and funds explore partnerships with stablecoin issuers, liquidity protocols, or tokenization platforms, this model is gradually moving from the conceptual exploration stage to the practical implementation stage. In this process, assets such as ETH, SOL, BNB, ENA, and HYPE are demonstrating a trend of convergence between "tokens, equity, and assets" in different dimensions, reflecting the bridging role of digital asset treasuries in the macro liquidity cycle.

However, in the current market environment, valuation frameworks for innovative assets related to DAT (such as mNAV) have generally fallen below 1 , indicating a discount in the market's assessment of the net asset value on the chain. This phenomenon reflects investors' concerns about the liquidity, return stability, and valuation sustainability of related assets, and also implies that the asset tokenization process faces certain adjustment pressures in the short term.

At the sector level, multiple segments are demonstrating sustained growth momentum:

• The market capitalization of stablecoins continues to expand, exceeding $297 billion, further strengthening their role as a financial anchor in an environment of macroeconomic uncertainty.

• The Perp sector, represented by HYPE and ASTER, has achieved a significant increase in activity by leveraging innovative transaction structures (such as on-chain matching, optimized funding rates, and tiered liquidity mechanisms), becoming the main beneficiary of quarterly fund rotation.

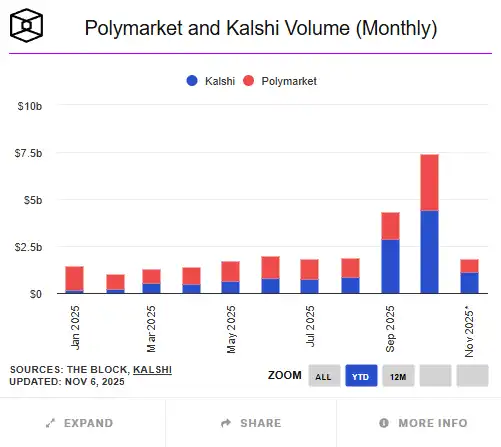

• Market sectors are expected to become active again amid macroeconomic volatility, with Polymarket and Kalshi experiencing record trading volumes, serving as immediate indicators of market sentiment and risk appetite.

The rise of these sectors indicates that funds are shifting from a single price game to a structured allocation based on three core logics: "liquidity efficiency, yield generation, and information pricing."

Overall, the divergence between the crypto and US stock markets in the third quarter of 2025 translated into a concentrated exposure of structural risks and a comprehensive increase in liquidity pressure in the fourth quarter. The government shutdown delayed the release of key macroeconomic data and exacerbated fiscal uncertainty, weakening overall market confidence. The debate surrounding AI valuations in the US stock market fueled volatility, while the crypto market faced a more direct liquidity and depth shock following the Binance liquidation. Meanwhile, the slowdown in DAT strategy inflows and the widespread drop in mNAV below 1 indicate that the market remains highly sensitive to the liquidity environment and exhibits significant vulnerability during its institutionalization process. Whether the market can stabilize subsequently will largely depend on the speed at which the impact of the liquidation is digested and whether the market can gradually restore liquidity and sentiment stability amidst increasing divergence between bulls and bears.

With interest rate cut expectations realized, the market enters a repricing phase.

In the third quarter of 2025, the key variable in the global macroeconomic environment will not be the event of "interest rate cuts" themselves, but rather the generation, trading, and consumption of interest rate cut expectations. The market's pricing in of a liquidity inflection point began in July, and actual policy actions will become the point of verification of existing consensus.

After two quarters of back-and-forth, the Federal Reserve lowered the target range for the federal funds rate by 25 basis points to 4.00%–4.25% at its September FOMC meeting, followed by a slight rate cut in October. However, because the market had largely priced in the rate cuts, the policy action itself had limited marginal impact on risk assets; the signaling effect of the rate cuts had already been largely priced in. Meanwhile, with inflation slowing and the economy showing greater resilience than expected, the Fed began to explicitly express its concern about the market pricing in consecutive rate cuts next year, leading to a significant decrease in the probability of a further rate cut in December after October. This communication stance became a new variable dragging down market risk appetite.

Macroeconomic data showed a "mild cooling" trend in the third quarter:

• The core CPI annual rate fell from 3.3% in May to 2.8% in August, confirming the downward trend in inflation;

• Non-farm payrolls have increased by less than 200,000 for three consecutive months;

• The job vacancy rate fell to 4.5%, the lowest level since 2021.

This data indicates that the US economy has not fallen into recession, but rather entered a period of moderate slowdown, providing the Federal Reserve with policy space for "controlled interest rate cuts." As a result, the market had already reached a consensus on "certain interest rate cuts" by early July.

According to the CME FedWatch tool, investors had already priced in a 25 basis point rate cut in September with a probability exceeding 95% by the end of August, meaning the market had almost fully priced in this expectation. The bond market also reflected this signal:

• The yield on the 10-year U.S. Treasury note fell from 4.4% at the beginning of the quarter to 4.1% at the end of the quarter;

• The 2-year yield fell more sharply, by about 50 basis points, indicating that market bets on a policy shift were more concentrated.

The macroeconomic shift in the third quarter was more a reflection of "the digestion of expectations" than "policy changes." The pricing of liquidity recovery was largely completed between July and August, and the actual rate cut in September was merely a formal confirmation of the existing consensus. For risk assets, the new marginal variable has shifted from "whether to cut rates" to "the pace and sustainability of rate cuts."

However, when the interest rate cut was actually implemented, the expected marginal effect had been completely consumed, and the market quickly entered a vacuum phase with "no new catalysts".

Since mid-September, changes in macroeconomic indicators and asset prices have shown a clear stagnation:

• The US Treasury yield curve is flattening: As of the end of September, the spread between 10-year and 3-month Treasury yields was only about 14 basis points, indicating that although the term premium still exists, the risk of inversion has been eliminated.

• The US dollar index fell back to the 98–99 range, significantly weaker than the high at the beginning of the year (107), but dollar funding costs remained tight at the end of the quarter.

• US stock market liquidity is tightening: The Nasdaq index continues to rise, but ETF inflows are slowing and trading volume growth is weak, indicating that institutions have begun to adjust their risk exposure at high levels.

This "vacuum period after expectations are realized" has become the most representative macroeconomic phenomenon of the quarter. The market trades on the "certainty of interest rate cuts" in the first half, and begins to price in the "reality of slowing growth" in the second half.

The Federal Reserve's September dot plot (SEP) revealed a clear division within the policymaking body regarding the future path of interest rates:

• The median expected policy interest rate by the end of 2025 has been lowered to 3.9%;

• The committee members' forecast ranged from 3.4% to 4.4%, reflecting the divergence of opinions among policymakers regarding inflation stickiness, economic resilience, and policy space.

Following the September rate cut and another small rate cut in October, the Federal Reserve's communication has gradually shifted to a more cautious tone to avoid premature easing of financial conditions. As a result, the probability of another rate cut in December, which was previously highly anticipated, has now significantly decreased, and the policy path has returned to a framework of "data dependence" rather than "pre-set pace".

Unlike previous rounds of "crisis-driven easing," this round of interest rate cuts represents a controlled policy adjustment. While cutting rates, the Federal Reserve continues to reduce its balance sheet, signaling a commitment to "stabilizing capital costs and curbing inflation expectations," emphasizing a balance between growth and prices rather than actively expanding liquidity. In other words, the interest rate inflection point has been established, but the liquidity inflection point has not yet arrived.

Against this backdrop, the market exhibited a clear divergence. Lower financing costs provided valuation support for some high-quality assets, but broad liquidity did not expand significantly, and capital allocation became more cautious.

• Sectors with robust cash flow and earnings support (AI, technology blue chips, and some DAT-related US stocks) continued their valuation recovery trend;

• Assets with high leverage, high valuations, or lack of cash flow support (including some growth stocks and non-mainstream crypto tokens) have seen their momentum weaken after expectations are realized, resulting in a significant decrease in trading activity.

Overall, the third quarter of 2025 is a period of "expectation realization" rather than a period of "liquidity release." The market priced in the certainty of interest rate cuts in the first half, and shifted to a reassessment of the slowdown in growth in the second half. The premature consumption of expectations meant that while risk assets remained high, they lacked sustained upward momentum. This macroeconomic landscape laid the foundation for subsequent structural divergence and explained the "breakout-pullback-high-level consolidation" pattern in the crypto market in Q3: funds flowed to relatively stable assets with verifiable cash flows, rather than systemically risky assets.

The DAT Explosion and Structural Turning Point in Non-Bitcoin Assets

In the third quarter of 2025, the Digital Asset Treasury (DAT) leaped from a fringe concept in the crypto industry to the fastest-spreading new theme in global capital markets. For the first time, public market funds simultaneously entered the crypto asset market in terms of both scale and mechanism: billions of dollars of fiat currency liquidity flowed directly into the crypto market through traditional financing tools such as PIPE, ATMs, and convertible bonds, forming a structured trend of "crypto-equity linkage".

The origins of the DAT model can be traced back to MicroStrategy (NASDAQ: MSTR), a pioneer in the traditional market. Since 2020, the company has been the first to include Bitcoin on its balance sheet, and between 2020 and 2025, it has purchased approximately 640,000 Bitcoins through multiple rounds of convertible bonds and ATM issuances, with a total investment exceeding $47 billion . This strategic move not only reshaped the company's asset structure but also created a paradigm where traditional stocks become a "secondary carrier" of crypto assets.

Due to the systemic differences in valuation logic between the equity market and on-chain assets, MicroStrategy's stock price has consistently exceeded its Bitcoin net asset value, with mNAV (market capitalization/on-chain net asset value) remaining in the 1.2–1.4x range for many years. This "structural premium" reveals the core mechanism of DAT:

Companies raise funds in the public market to hold crypto assets, enabling two-way communication and valuation feedback between fiat capital and crypto assets at the company level.

From a mechanistic perspective, MicroStrategy's experiments laid the foundation for the three pillars of the DAT model:

• Financing channels: Introduce fiat currency liquidity through PIPE, ATMs, or convertible bonds to provide enterprises with on-chain asset allocation funds;

• Asset reserve logic: Incorporate crypto assets into the financial reporting system to form an enterprise-level "on-chain treasury";

• Investor access: Allows traditional capital market investors to gain indirect exposure to crypto assets through stocks, reducing compliance and custody barriers.

These three elements together constitute DAT's "structural cycle": financing—holding—valuation feedback. Companies use traditional financial instruments to absorb liquidity, forming a reserve of crypto assets, and then use the premium in the equity market to increase capital, achieving a dynamic rebalancing between capital and tokens.

The significance of this structure lies in the fact that it enables digital assets to enter the balance sheets of the traditional financial system in a compliant manner for the first time , and gives the capital market a completely new asset form— "tradable on-chain asset mapping." In other words, enterprises are no longer just on-chain participants, but become structural intermediaries between fiat capital and crypto assets.

As this model was validated and rapidly replicated by the market, the third quarter of 2025 marked the second phase of the DAT concept's diffusion: extending from a "store of value" centered on Bitcoin to productive assets (PoS yields or DeFi yields) such as Ethereum (ETH) and Solana (SOL) . This new generation of DAT models, based on the mNAV (market capitalization/on-chain net asset value) pricing system, incorporates yield-generating assets into corporate cash flow and valuation logic, forming a "yield-driven treasury cycle." Unlike early Bitcoin treasuries, ETH, SOL, and others possess sustainable staking yields and on-chain economic activity, giving their treasury assets not only store of value attributes but also cash flow characteristics. This shift signifies that DAT is moving from simple asset holding to a stage of capital structure innovation centered on productive returns, becoming a key bridge connecting the value of productive crypto assets with the valuation system of traditional capital markets.

Note: Entering November 2025, a new round of decline in the crypto market triggered the most systematic valuation repricing in the DAT sector since its inception. With core assets such as ETH, SOL, and BTC experiencing rapid pullbacks of 25-35% in October and November, and the short-term dilution effect brought about by some DAT companies accelerating balance sheet expansion through ATMs, the mNAV of mainstream DAT companies generally fell below 1. BMNR, SBET, and FORD all experienced varying degrees of "discounted trading" (mNAV≈0.82-0.98), and even MicroStrategy (MSTR), which had long maintained a structural premium, saw its mNAV briefly fall below 1 in November, the first time since the launch of the Bitcoin Treasury strategy in 2020. This phenomenon signifies that the market has transitioned from a period of structural premium to a defensive phase of "asset-driven, valuation-discounted" valuations. Institutional investors generally view this as the first comprehensive "stress test" for the DAT industry, reflecting that the capital market is reassessing the sustainability of on-chain asset returns, the rationality of the pace of treasury expansion, and the long-term impact of financing structure on equity value.

SBET and BMNR lead the Ethereum treasury revolution

In the third quarter of 2025, the market landscape for Ethereum Treasury (ETH DAT) was initially established. SharpLink Gaming (NASDAQ: SBET) and BitMine Immersion Technologies (NASDAQ: BMNR) emerged as two leading companies defining industry paradigms. They not only replicated MicroStrategy's balance sheet strategy but also achieved a leap "from concept to system" in terms of financing structure, institutional participation, and information disclosure standards, thus constructing the dual pillars of the ETH treasury cycle.

BMNR: Capital Engineering for Ethereum Treasuryization

As of the end of September 2025, BitMine Immersion Technologies (BMNR) had established itself as the world's largest Ethereum Treasury. According to the company's latest disclosure, it held approximately 3,030,000 ETH, which, based on the closing price of $4,150/ETH on October 1st, corresponded to approximately $12.58 billion (approximately US$12.58 billion) in on-chain net assets. Including the company's cash and other liquid assets, BMNR's total crypto and cash holdings were approximately $12.9 billion (approximately US$12.9 billion).

Based on this estimate, BMNR holds approximately 2.4–2.6% of the circulating supply of Ethereum, making it the first listed institution in the market to hold over 3 million ETH. This corresponds to a market capitalization of approximately $11.2–11.8 billion (approximately US$11.2–11.8 billion) , and an estimated mNAV of ≈ 1.27, making it the highest-valued publicly traded digital asset treasury (DAT) company currently.

BMNR's strategic leap is closely related to its organizational restructuring. After Chairman Tom Lee (former co-founder of Fundstrat) took full control of capital operations in mid-2025, he put forward the core proposition: "ETH is the institutional sovereign asset of the future." Under his leadership, the company completed its structural transformation from a traditional mining company to one that "uses ETH as its sole reserve asset and PoS returns as its core cash flow," becoming the first US-listed company to use Ethereum staking returns as its main operating cash flow.

In terms of financing, BMNR demonstrated exceptional fundraising strength and execution efficiency. The company simultaneously expanded its funding sources through public markets and private channels, providing long-term ammunition for its Ethereum treasury strategy. This quarter, BMNR not only refreshed the fundraising pace of traditional capital markets but also laid the foundation for the institutionalization of "on-chain asset securitization."

On July 9, BMNR, through a Form S-3 registration statement, signed an "At-the-Market (ATM)" issuance agreement with Cantor Fitzgerald and ThinkEquity, with an initial authorized limit of $2 billion. Just two weeks later, on July 24, the company disclosed in its SEC 8-K filing that it had increased this limit to $4.5 billion in response to the positive market response to its ETH treasury model. On August 12, the company submitted further supplementary information to the SEC, increasing the total ATM limit to $24.5 billion (an additional $20 billion), and specifying that the funds would be used to purchase ETH and expand its PoS staking portfolio.

These limits represent the maximum number of shares that BMNR can obtain through a sustainable market-based offering approved by the SEC, and are not equivalent to actual cash raised.

Regarding the funding aspect, the company has completed several concrete transactions:

• In early July 2025, a $250 million PIPE private placement was completed to fund the initial ETH position building;

• ARK Invest (Cathie Wood) disclosed on July 22 that it had purchased approximately $182 million worth of BMNR common stock, of which $177 million of net proceeds were used directly by the company to increase its holdings of ETH;

• Founders Fund (Peter Thiel) filed a 9.1% stake with the SEC on July 16. Although it was not new financing, it strengthened institutional consensus in the market.

Furthermore, BMNR has sold approximately $4.5 billion worth of stock under its early ATM licenses, significantly exceeding the initial PIPE amount. As of September 2025, the company has utilized billions of dollars through multiple channels including PIPE and ATMs, and continues to advance its long-term expansion plans within the framework of a total license of $24.5 billion.

BMNR's financing system presents a clear three-tiered structure:

• Secured funding tier – Completed PIPE and institutional private placements, totaling approximately $450-500 million;

• Market-based expansion layer – Through the ATM mechanism, shares are sold in stages, and the actual funds raised have reached the level of billions of US dollars;

• Potential ammunition layer – The $24.5 billion ATM quota already approved by the SEC provides ceiling flexibility for subsequent ETH treasury expansion.

With this tiered capital structure, BMNR quickly built up reserves of approximately 3.03 million ETH (worth approximately $12.58 billion), transforming its treasury strategy from a "single holding experiment" to an "institutionalized asset allocation."

BMNR's valuation premium mainly stems from two factors:

• Asset-level premium: PoS collateralized yields remain at 3.4–3.8% annualized, forming a stable cash flow anchor;

• Capital premium: As a "compliant ETH leverage channel", its stock price usually leads the ETH spot price by 3-5 trading days, becoming a leading indicator for institutions to track the ETH market.

In terms of market behavior, BMNR's stock price reached a new all-time high in the third quarter, in sync with ETH, and repeatedly drove sector rotation. Its high turnover rate and the speed of circulating share circulation indicate that the DAT model is gradually evolving into an "on-chain asset mapping mechanism" that can be traded in the capital market.

SBET: A Case Study of Transparency in Institutionalized Treasury Systems

Compared to BitMine Immersion Technologies' (BMNR) aggressive balance sheet expansion strategy, SharpLink Gaming (NASDAQ: SBET) opted for a more robust and institutionalized financial treasury path in the third quarter of 2025. Its core competitiveness lies not in the size of its funds, but in the transparency of its governance structure, disclosure standards, and audit system, establishing a replicable "institutional-level template" for the DAT industry.

As of September 2025, SBET held approximately 840,000 ETH, with on-chain assets estimated at approximately $3.27 billion based on the quarterly average price, corresponding to a stock market capitalization of approximately $2.8 billion, and mNAV ≈ 0.95×. Although the valuation is slightly lower than net assets, the company's quarterly EPS growth reached 98%, demonstrating its strong operating leverage and execution efficiency in ETH monetization and cost control.

SBET's core value lies not in aggressive position expansion, but in establishing the first compliant and auditable governance framework in the DAT industry:

• Strategic advisor Joseph Lubin (Ethereum co-founder and ConsenSys founder) joined the company's strategy committee in Q2 to push for the integration of staking rewards, DeFi derivatives, and liquidity mining strategies into the corporate portfolio;

• Pantera Capital and Galaxy Digital participated in PIPE financing and secondary market shareholding, respectively, providing the company with institutional liquidity and on-chain asset allocation advisory services;

• Ledger Prime provides on-chain risk hedging and volatility management models;

• Grant Thornton, as an independent auditing firm, is responsible for verifying the authenticity of on-chain assets, yields, and staking accounts.

This governance system constitutes the first disclosure mechanism in the DAT industry that combines "on-chain verifiable information with traditional auditing".

In its 10-Q report for the third quarter of 2025, SBET will disclose in full for the first time:

• The company's main wallet addresses and on-chain asset structure;

• Pledge yield curve and node distribution;

• Risk limits for mortgage and restaking positions.

This report makes SBET the first publicly traded company to simultaneously disclose on-chain data in its SEC filings , significantly enhancing institutional investor confidence and financial comparability. SBET is widely regarded as a "compliant ETH index constituent": its mNAV is close to 1×, its price maintains a high correlation with the ETH market, yet it exhibits relatively low volatility due to its information transparency and robust risk structure.

ETH's dual-track approach to treasury management: asset-driven and governance-driven.

The divergence between BMNR and SBET constitutes the two core pillars of ETH DAT ecosystem development in the third quarter of 2025:

• BMNR: Asset-driven – with financing and balance sheet expansion, institutional shareholding, and capital premium as its core logic. BMNR rapidly accumulates ETH positions using PIPE and ATM financing tools, and forms a market-based leverage channel through mNAV pricing, promoting the direct coupling of fiat capital and on-chain assets.

• SBET: Governance-Driven – Focusing on transparency and compliance, structured treasury revenue, and risk control. SBET incorporates on-chain assets into its audit and information disclosure system, establishing the institutional boundaries of DAT through a governance architecture that combines on-chain verification with traditional accounting.

These two represent the two extremes of ETH's treasury transformation from a "reserve logic" to an "institutionalized asset form": the former expands capital scale and market depth, while the latter lays the foundation for governance trust and institutional compliance. In this process, the functional attributes of ETH DAT have transcended that of an "on-chain reserve asset," evolving into a composite structure that combines cash flow generation, liquidity pricing, and balance sheet management.

The institutional logic of PoS revenue, governance rights, and valuation premium

The core competitiveness of PoS crypto assets such as ETH comes from the triple combination of interest-bearing asset structure, network layer discourse power, and market valuation mechanism.

High collateralized yield: Establishing a cash flow anchor

Unlike Bitcoin's "non-productive holdings," ETH, as a PoS network asset, can generate an annualized yield of 3-4% through staking, forming a compound yield structure (Staking + LST + Restaking) in the DeFi market. This allows DAT companies to capture real on-chain cash flow in a corporate form, transforming digital assets from "static reserves" into "yield assets" with stable endogenous cash flow characteristics.

The power of discourse and scarcity of resources under the PoS mechanism

As the ETH treasury's staking volume increases, it gains governance and ranking power at the network level. BMNR and SBET currently control approximately 3.5-4% of the total ETH staking volume, placing them within the marginal influence range of protocol governance. This type of control carries a premium logic similar to "systemic status," and the market is willing to assign it a valuation multiplier higher than its net asset value.

The formation mechanism of mNAV premium

The valuation of DAT company not only reflects the net asset value (NAV) of its on-chain assets, but also incorporates two types of expectations:

• Cash flow premium: Expected distributable profits from staking returns and on-chain strategies;

• Structural premium: Corporate equity provides traditional institutions with a compliant channel for ETH exposure, thereby creating institutional scarcity.

At the market peak in July and August, the average mNAV of ETH DAT remained in the range of 1.2-1.3 times, with some individual companies (BMNR) even reaching 1.5 times. This valuation logic is similar to the premium or discount structure of gold ETFs or closed-end funds' NAV, serving as an important "pricing intermediary" for institutional funds entering on-chain assets.

In other words, the premium of DAT is not driven by sentiment, but rather by a complex structure based on real yield, network power, and capital channels. This also explains why the ETH Treasury achieved higher capital density and trading activity than the Bitcoin Treasury (MSTR model) in just one quarter.

The structural evolution from ETH to a multi-altcoin asset treasury

Entering August and September, the expansion of non-Ethereum-based DATs accelerated significantly. A new wave of institutional allocation, exemplified by Solana's treasury-based model, signifies a shift in market focus from "single-asset reserves" to "multi-chain asset stratification." This trend indicates that the DAT model is being replicated from the Ethereum core to multiple ecosystems, forming a more systematic cross-chain capital structure.

FORD: An Institutionalized Example of the Solana Treasury

Forward Industries (NASDAQ: FORD) stands out as the most representative case in this phase. The company completed a $1.65 billion PIPE funding round in the third quarter, with all funds used for Solana spot trading and ecosystem collaboration investments. As of September 2025, FORD held approximately 6.82 million SOL tokens. Based on an average quarterly price of $248–$252, its on-chain treasury net value was approximately $1.69 billion, corresponding to a stock market capitalization of approximately $2.09 billion, with a mNAV ≈ 1.24×, ranking first among non-ETH treasury companies.

Unlike the early days of ETH DAT, the rise of FORD was not driven by a single asset, but rather by the resonance of multiple capital sources and the ecosystem:

• Investors include Multicoin Capital, Galaxy Digital, and Jump Crypto, all of which are long-term core investors in the Solana ecosystem;

• The governance structure incorporates members of the Solana Foundation Advisory Board, establishing a strategic framework of "on-chain assets as enterprise production resources";

• The SOL assets held remain fully liquid and have not yet been staked or configured in DeFi, in order to preserve the strategic flexibility for future restaking and linkage with RWA assets.

This "high liquidity + configurable treasury" model makes FORD the capital hub of the Solana ecosystem, and also reflects the market's structural premium expectations for high-performance public chain assets.

Structural changes in the global DAT landscape

As of the end of Q3 2025, the total publicly disclosed global non-Bitcoin DAT treasury exceeded $24 billion, representing a quarter-on-quarter increase of approximately 65%. The structure and distribution are as follows:

• Ethereum (ETH) remains dominant, accounting for approximately 52% of the total market size;

• Solana (SOL) accounts for approximately 25%, making it the second largest allocation direction for institutional funds;

• The remaining funds are mainly distributed in emerging assets such as BNB, SUI, and HYPE, forming the horizontal expansion layer of the DAT model.

The valuation of ETH DAT is anchored by PoS yield and governance value , representing a combination of long-term cash flow and network control. SOL DAT, on the other hand, uses ecosystem growth and staking efficiency as its core premium sources, emphasizing capital efficiency and scalability. BMNR and SBET established the institutional and asset foundations during the ETH phase, while the emergence of FORD has propelled the DAT model into its second phase of multi-chain and ecosystem development.

At the same time, some new entrants have begun to explore the functional extensions of DAT:

• Ethena (ENA) launched the StablecoinX model, which combines government bond yields with on-chain hedging structures to attempt to build a "yield-generating stablecoin treasury" to create stable but cash-flow-generating reserve assets.

• BNB DAT is led by the exchange system and relies on the asset collateral and reserve tokenization of ecosystem enterprises to expand the liquidity pool, forming a "closed treasury system".

A temporary stagnation following overvaluation and risk repricing

After a concentrated upward trend in July and August, the DAT sector entered a rebalancing phase in September following valuation overvaluation . Second-tier financial stocks initially boosted the overall sector premium, with the median mNAV exceeding 1.2x. However, with tightening regulations and slower financing, valuation support quickly declined by the end of the quarter, and the sector's enthusiasm cooled significantly.

Structurally, the DAT industry is transitioning from "asset innovation" to "institutional integration." While ETH and SOL have established a "dual-core valuation system," the liquidity, compliance, and real yield of expansionary assets are still in the verification stage. In other words, market drivers have shifted from "premium expectations" to "yield realization," and the industry has entered a repricing cycle.

Entering September, key indicators weakened in tandem:

• ETH staking yield fell to 3.1% from 3.8% at the beginning of the quarter, while SOL staking yield decreased by more than 25% quarter-over-quarter;

• The mNAV of many second-tier DAT companies has fallen below 1, indicating diminishing marginal returns to capital efficiency;

• PIPE and ATM funding totals declined by approximately 40% month-over-month, with institutions such as ARK, VanEck, and Pantera suspending new DAT allocations;

• At the ETF level, net capital inflows turned negative, and some funds replaced their ETH Treasury holdings with short-duration Treasury bond ETFs to reduce valuation volatility risk.

This pullback exposes a core problem: the capital efficiency of the DAT model has been overdrawn in the short term. The early valuation premium stemmed from structural innovation and institutional scarcity, but as on-chain revenue declined and financing costs rose, companies expanded their balance sheets faster than revenue growth, falling into a "negative dilution cycle"—that is, market capitalization growth depends on financing rather than cash flow.

From a macro perspective, the DAT sector is entering a period of "valuation internalization":

• The core companies (BMNR, SBET, FORD) maintain structural stability through sound financial resources and information transparency;

• Peripheral projects face deleveraging and liquidity contraction due to their simple capital structure and insufficient disclosure;

• In terms of regulation, the SEC requires companies to disclose their main wallet addresses and staking yield disclosure standards, further reducing the space for "high-frequency balance sheet expansion".

The main short-term risk stems from valuation compression caused by liquidity reflexivity. When mNAV continues to decline and PoS yields struggle to cover funding costs, market confidence in the "on-chain reserve + equity pricing" model will be damaged, leading to a systemic valuation correction similar to that following the DeFi summer of 2021. Despite this, the DAT industry has not entered a recession, but rather transitioned from a "balance sheet expansion driven" to a "yield driven" phase. In the coming quarters, ETH and SOL treasuries are expected to maintain their institutional advantages, and their valuations will increasingly rely on:

Efficiency of returns from pledging and re-pledging;

On-chain transparency and compliance disclosure standards.

In other words, the first phase of the DAT boom has ended, and the industry has entered a period of consolidation and validation. The key variables for future valuation correction lie in the stability of PoS yields, the efficiency of re-staking integration, and the clarity of regulatory policies.

Prediction Markets: A "Barometer" of Macro Narratives and the Rise of the Attention Economy

In the third quarter of 2025, prediction markets evolved from a "native edge of crypto" to a "new type of market infrastructure where on-chain and compliant finance converge." In an environment of frequent macroeconomic policy changes and dramatic fluctuations in inflation and interest rate expectations, prediction markets have gradually become important venues for capturing market sentiment, hedging policy risks, and discovering narrative prices. The fusion of macroeconomic and on-chain narratives has transformed them from speculative tools into a market layer that combines information aggregation and price signaling functions.

Historically, crypto-native prediction markets have demonstrated significant foresight in numerous macroeconomic and political events. During the 2024 US presidential election, Polymarket's total trading volume exceeded $500 million, with the "Who Will Win the Presidential Election?" contract alone reaching $250 million. The peak daily trading volume surpassed $20 million, setting a record for on-chain prediction markets. In macroeconomic events such as "Will the Federal Reserve cut interest rates in September 2024?", contract price changes significantly outpaced the expected adjustments of CME FedWatch interest rate futures, demonstrating that prediction markets have become leading indicators in certain timeframes.

Nevertheless, the overall size of on-chain prediction markets remains far smaller than that of traditional markets. Since 2025, the global crypto prediction market (represented by Polymarket, Kalshi, etc.) has accumulated a trading volume of approximately $24.1 billion, while traditional compliant platforms such as Betfair and Flutter Entertainment have annual trading volumes in the hundreds of billions of dollars. The on-chain market is less than 5% the size of the traditional market, but it demonstrates higher growth potential than traditional financial products in terms of user growth, topic coverage, and trading activity.

In the third quarter, Polymarket became a phenomenal growth case. Contrary to the mid-year rumors of a $1 billion valuation financing round, the latest news in early October indicated that ICE, the parent company of the NYSE, planned to invest up to $2 billion, acquiring approximately a 20% stake, corresponding to a valuation of approximately $8-9 billion for Polymarket. This signifies that its data and business model have gained recognition from Wall Street. As of the end of October, Polymarket's cumulative annual trading volume was approximately $13.2 billion, with September's trading volume reaching $1.4-1.5 billion, a significant increase from the second quarter, and October's trading volume even setting a new record high of $3 billion. Trading themes focused on macroeconomic and regulatory events such as "whether the Fed will cut interest rates at the September FOMC meeting," "whether the SEC will approve an Ethereum ETF before the end of the year," "the winning probability of key states in the US presidential election," and "Circle (CIR) stock price performance after its listing." Some researchers pointed out that the price fluctuations of these contracts, in most cases, lead the US Treasury yield and the FedWatch probability curve by approximately 12-24 hours, becoming a forward-looking indicator of market sentiment.

Meanwhile, Kalshi achieved an institutional breakthrough in compliance. As a prediction market exchange registered with the U.S. Commodity Futures Trading Commission (CFTC), Kalshi completed a $185 million Series C funding round in June 2025 (led by Paradigm), valuing the company at approximately $2 billion; its latest valuation disclosed in October had risen to $5 billion, with an annualized trading volume growth rate exceeding 200%. In the third quarter, the platform launched contracts related to crypto assets, such as "Will Bitcoin close above $80,000 by the end of this month?" and "Will an Ethereum ETF be approved before the end of the year?", marking the formal entry of traditional institutions into the speculative and hedging market of "crypto narrative events." According to Investopedia, its crypto-related contracts saw a trading volume exceeding $500 million within two months of launch, providing institutional investors with a new channel to express macroeconomic expectations within a compliant framework. Thus, the prediction market has formed a dual-track structure of "on-chain freedom + rigorous compliance."

Unlike earlier prediction platforms that focused on entertainment and political themes, the mainstream market focus in Q3 2025 shifted significantly towards macroeconomic policies, financial regulations, and events linking cryptocurrencies and stocks. Macroeconomic and regulatory contracts on the Polymarket platform saw a cumulative trading volume exceeding $500 million, accounting for over 40% of the quarterly total trading volume. Investors remained highly engaged on topics such as whether an ETH spot ETF would be approved before Q4 and whether Circle's stock price would break through key levels after its listing. The price movements of these contracts even outpaced traditional media sentiment and derivatives market expectations at times, gradually evolving into a "market consensus pricing mechanism."

The core innovation of on-chain prediction markets lies in their use of tokenization to achieve liquidity pricing for events. Each prediction event is priced binary or continuously in the form of tokens (such as YES/NO Token), and liquidity is maintained by automated market makers (AMMs), thus achieving efficient price discovery without the need for matching. Settlement relies on decentralized oracles (such as UMA and Chainlink) for on-chain execution, ensuring transparency and auditability. This structure allows almost all social and financial events—from election results to interest rate decisions—to be quantified and traded as on-chain assets, constituting a new paradigm of "financialization of information."

However, rapid development comes with significant risks. First, oracle risk remains a core technological bottleneck for on-chain prediction markets; any delays or manipulation of external data could trigger disputes over contract settlement. Second, unclear compliance boundaries continue to constrain market expansion, as the regulatory approaches for event-based derivatives in the US and EU are not yet fully aligned. Third, some platforms still lack KYC/AML processes, potentially posing compliance risks related to funding sources. Finally, excessive concentration of liquidity on leading platforms (Polymarket's market share exceeds 90%) could lead to price deviations and amplified market volatility under extreme market conditions.

Overall, the performance of prediction markets in the third quarter shows that they are no longer a marginal "crypto game," but are becoming an important carrier of macro narratives. They are both an immediate reflection of market sentiment and an intermediary tool for information aggregation and risk pricing. Looking ahead to the fourth quarter, prediction markets are expected to continue evolving along a dual-loop structure of "on-chain × compliance": the on-chain Polymarket will expand its reach by leveraging DeFi liquidity and macro narrative trading; while the compliant Kalshi will accelerate its attraction of institutional capital through regulatory approval and its USD-denominated pricing mechanism. With the popularization of data-driven financial narratives, prediction markets are moving from an attention economy to a decision-making infrastructure, becoming a rare new asset layer in the financial system that can both reflect collective sentiment and possess forward-looking pricing capabilities.