Despite the sharp drop in stock prices, Strategy's Bitcoin holdings remain profitable and continue to outperform leading tech stocks over time.

Despite the sharp drop in stock prices, Strategy's Bitcoin holdings remain profitable and continue to outperform leading tech stocks over time.

Investment firm Bitcoin Strategy is going through one of its toughest times this year, sparking speculation that its all-in Bitcoin strategy is starting to fall apart. However, looking beyond the one-year chart, the story is quite different.

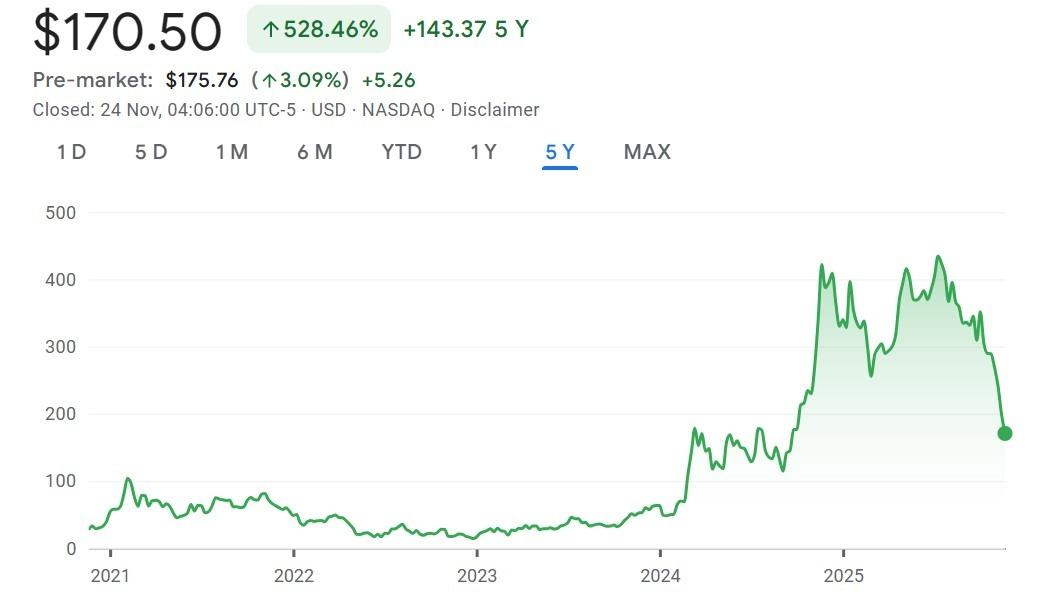

Strategy (MSTR) shares have fallen nearly 60% over the past year and more than 40% YTD (YTD), according to data from Google Finance. The stock had traded around $300 in October before falling to around $170 at the time of writing.

While some have argued that Strategy’s Bitcoin investment model is “exposed,” the firm is still reaping double-digit returns on its Bitcoin holdings, and its long-term stock performance still outpaces the tech giants.

According to data from BitcoinTreasuries.NET, Strategy bought Bitcoin at an Medium price of $74,430. With Bitcoin trading around $86,000, Strategy is still making a profit of nearly 16% on its BTC investment.

Strategy has risen more than 500% over the past five years, according to Google Finance data. Apple has risen about 130%, while Microsoft has risen nearly 120% over the same period.

Even over a shorter two-year timeframe, Strategy shares are up 226%, outpacing Apple's 43% gain and Microsoft's 25%.

Investors are Short Strategies as a way to hedge Longing crypto positions

Strategy's stock decline may not be due to Bitcoin's fundamentals, but rather to how large investors are hedging their crypto positions.

In a recent interview with CNBC, BitMine President Tom Lee explained that Strategy has become the easiest way to hedge Bitcoin.

“One can use MicroStrategy’s Derivative products – which are very liquidation – to hedge their entire crypto portfolio,” he said.

“The most convenient way to hedge a Longing position is to Short MicroStrategy or buy puts.”

This mechanism has turned Strategy into an unwanted “pressure Dump ” for the crypto market, absorbing hedge orders, Short orders, high volatility, and market anxiety — even though those are not entirely related to the company’s core Bitcoin strategy or the effectiveness of its long-term vision.

Despite the weak stock price, Strategy Chairman Michael Saylor has shown his determination on the X platform, declaring that he “will not back down.”

On November 17, Strategy announced that it had purchased an additional 8,178 BTC worth $835.6 million. This was a far larger purchase than previous purchases (which ranged from 400–500 BTC per week). The purchase brought the company’s total Bitcoin holdings to 649,870 BTC, or nearly $56 billion.

Digital asset funds face widespread cash flow decline

On November 6, crypto market maker Wintermute pointed out that stablecoins, ETFs, and Digital Asset Treasuries (DATs) are the main sources of liquidation in the crypto market, and it is this decline in liquidation that has caused the recent decline.

The company said cash flow into all three areas has begun to slow.

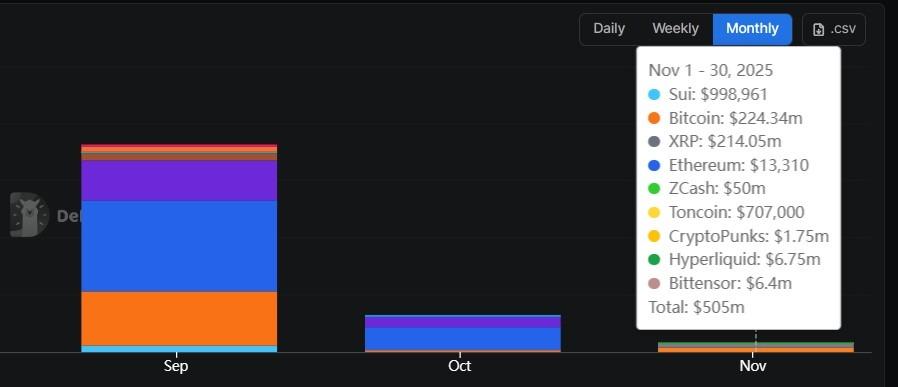

Data from defillama shows that DAT inflows began to slow in October, following a $20 billion liquidation in the crypto market. DAT inflows fell from nearly $11 billion in September to around $2 billion in October — an 80% drop.

This cash flow continued to decline sharply in November. As of Monday this week, cash flow into DAT reached just over 500 million USD, down 75% compared to October.