Author: Pillage Capital; Source: X, @PillageCapital; Translated by: Shaw Jinse Finance

Bitcoin was never the future of currency. It was merely a battering ram in the regulatory war. Now that war is nearing its end, the funds that fueled Bitcoin's growth are quietly withdrawing.

For 17 years, we firmly believed that the magical internet currency was the ultimate form of finance. This is not the case. Bitcoin is a regulatory battering ram, a siege weapon specifically designed to destroy a particular barrier: state-sponsored intolerance of digitally held assets.

This work is essentially complete. Tokenized US stocks have begun to be issued. Tokenized gold is legal and growing in value. The market capitalization of tokenized US dollars has reached hundreds of billions of dollars.

In wartime, the battering ram is priceless; in peacetime, it is merely a bulky and expensive antique.

As the financial system upgrades and becomes more legitimate, the narrative of Bitcoin as “Gold 2.0” is crumbling, returning to what we really wanted in the 1990s: the tokenization of real assets.

I. The Prehistory of Bitcoin: E-gold

To understand why Bitcoin is becoming obsolete, we must understand why it was born. Its journey was not smooth; it was born amidst the shadow of repeated failures in the cryptocurrency market.

In 1996, E-gold launched. By the mid-2000s, it had approximately 5 million accounts and billions of dollars in transaction volume. This proved an important point: the world needed digital assets backed by real-world value. However, the government stifled it.

In December 2005, the FBI raided E-gold. In July 2008, its founder pleaded guilty. The message was clear: destroying a centralized digital gold currency is easy. Just knock on a door, seize a server, prosecute one person, and it's all over.

Three months later, in October 2008, Satoshi Nakamoto published the Bitcoin white paper. Prior to this, he had pondered these issues for years. In his writings, he pointed out that the fundamental flaw of traditional currencies and early digital currencies lay in their excessive reliance on central and commercial banks. Experiments like E-gold demonstrated just how easy it was to attack these points of trust.

Satoshi Nakamoto witnessed a genuine innovation in the cryptocurrency space being stifled. If you want digital assets to survive, you cannot allow them to be so easily killed.

Bitcoin was designed to eliminate attack paths that could cause E-gold to crash. It prioritizes survivability over efficiency.

II. Regulatory Warfare: The Necessary Illusion

In the early days, introducing users to Bitcoin was almost like magic. We simply told them to download a wallet to their phones. When the first Bitcoins arrived, you could see their immediate awe. It was as if they had opened a financial account and instantly gained value, without any permission, documentation, or regulatory oversight.

This was a complete shock. The banking system suddenly seemed outdated and obsolete. You realized then that you had been suppressing your feelings all along without even knowing it.

At the Money 20/20 conference in Las Vegas, a speaker displayed a QR code on a big screen and held a live Bitcoin raffle. Audience members sent Bitcoins, accumulating a prize pool in real time. A man next to me, who works in traditional finance, leaned over and told me that the speaker had just broken about fifteen laws. He might be right. But nobody cares. That's the point.

This is not just a financial issue; it's a rebellion. One of the earliest Bitcoin posts on Reddit perfectly captured this sentiment: Buy Bitcoin because "it's a powerful blow to the swindlers and robbers who try to steal my hard-earned money."

This self-funding mechanism is near perfect. By contributing to this cause, posting, promoting, debating, and recruiting new users, you directly increase the value of the tokens in your own wallet and your friends' wallets. This revolution benefits you immensely.

Because the network could not be shut down, it continued to grow after each crackdown and negative publicity. Over time, everyone began to act as if "Magic Internet Money" was the real goal, not just a stopgap measure.

This illusion grew so strong that even mainstream institutions began to cooperate. BlackRock applied to issue a Bitcoin ETF. The US president discussed making Bitcoin a reserve asset. Pension funds and universities invested in Bitcoin. Michael Thaler persuaded convertible bond buyers and shareholders to fund the company's purchase of billions of dollars worth of Bitcoin. Mining scaled up to the point that its electricity consumption was comparable to that of a medium-sized country.

Ultimately, with over half of the campaign funds coming from cryptocurrency, calls for the legalization of cryptocurrency were finally heard. Ironically, the government's crackdown on banks and payment processing institutions spawned a three-trillion-dollar behemoth, forcing the government to back down.

III. The Road to Success: Profits Destroy Trading

Infrastructure upgrades and the breaking of monopolies

Bitcoin's advantage has never been just its resistance to censorship, but rather its monopolistic position.

For years, if you wanted tokenized holding value, Bitcoin was the only option. Accounts were being closed, and fintech companies were terrified of regulators. If you wanted the benefits of instant, programmable money, you had to accept all of Bitcoin's terms.

So we accepted it. We liked it and supported it because we had no other choice at the time.

That era is over.

You can observe Tether (USDT) to understand what happens when multiple trading channels are available. USDT was initially issued on the Bitcoin trading channel, but most of its circulation later shifted to Ethereum due to its lower fees and ease of use. When Ethereum's fees skyrocketed, retail investors and emerging markets turned to Tron for issuance. Same USD, same issuer, different trading channels.

Stablecoins are not loyal to any blockchain. They treat the blockchain as a one-off conduit. The asset and the issuer are key; the conduit is merely a combination of fees, reliability, and connectivity with the rest of the system. In this sense, the "blockchain, not Bitcoin" camp has actually won.

In the early days, horse-drawn carriages were widely used to ridicule banks' reports on blockchain technology.

Once you understand this, Bitcoin's situation changes dramatically. When there's only one channel, all assets are forced to rely on it, and you might confuse the value of the asset with the value of the channel. But when there are many channels, value flows to those with the lowest cost and easiest access.

This is our current situation. Outside the US, most of the world's population can now hold tokenized equity in US stocks. Perpetual futures, once a killer app for cryptocurrencies, are being replicated domestically by physical exchanges like the Chicago Mercantile Exchange (CME). Banks are also starting to offer USDT deposit and withdrawal services. Coinbase is evolving into a combination of banking and brokerage accounts, allowing users to send money, write checks, and buy stocks while holding cryptocurrency. The network effects that once protected Bitcoin's monopoly are gradually disintegrating, replaced by general-purpose network infrastructure.

Once the monopoly is broken, Bitcoin will no longer be the only way to generate revenue. It will become one of many products, competing with regulated, high-quality goods and services that are closer to people's original, real needs.

Technical Reality Test

During the war, we overlooked a simple fact: Bitcoin is a terrible payment system.

We're still transferring funds by scanning QR codes and pasting long, meaningless strings of characters. There are no standardized usernames. Transferring funds across levels and chains is as difficult as passing through a game. Once you can't figure out which address corresponds to which account, your money is gone forever.

"The Currency of the Future"

By 2017, Bitcoin transaction fees had skyrocketed to nearly $100. A Bitcoin café in Prague had to accept Litecoin to stay afloat. While having dinner in Las Vegas, it took me half an hour to pay with Bitcoin because people were frantically fiddling with their mobile wallets, and the transaction kept getting stuck.

Even today, wallets frequently experience basic glitches. Balances fail to display, transactions get stuck, and people send money to the wrong addresses, resulting in lost funds. Early on, almost everyone who received a free Bitcoin lost it. I personally lost over a thousand Bitcoins. This is commonplace in the cryptocurrency world.

The widespread adoption of purely on-chain finance is terrifying. People click a "sign" button in their browsers, without being able to read or understand the code. Even complex operations like Bybit could be hacked, resulting in billions of dollars in losses with no effective recourse.

We used to tell ourselves that these user experience issues were just temporary growing pains. A decade later, the real improvement in user experience didn't come from some sophisticated protocol, but from centralized custodians. They provided people with password, account recovery, and fiat currency access.

From a technical standpoint, this is the crux of the problem. Bitcoin has consistently failed to learn how to truly function without recreating the very intermediaries it claims to replace.

The deal is no longer worth the risk.

Once infrastructure improves elsewhere, all that's left is trading.

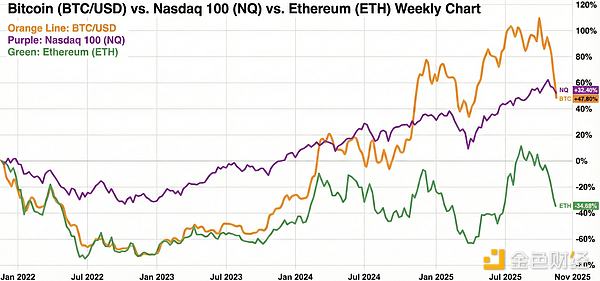

Look at the returns over the past four years (a complete cryptocurrency cycle). The Nasdaq has outperformed Bitcoin. You've taken on existential regulatory risks, endured devastating drops, and survived constant hacks and exchange failures, yet your returns are less than a typical tech index. The risk premium has vanished.

Ethereum's situation is even worse. What should have been the part that brings you the greatest returns through risk-taking has now become a direct drag on performance, while the lackluster index is only rising slowly.

Part of the reason lies in structural issues. There's a large group of early holders whose entire net worth is in cryptocurrency. Now they're older, have families, real expenses, and a legitimate desire to reduce risk. They sell some coins every month to maintain a comfortable lifestyle. Thousands of holders selling every month adds up to billions of dollars in "living expenses" being sold off.

New inflows, however, present a stark contrast. ETF buyers and wealth management firms are mostly allocating 1% or 2% for compliance purposes. While these funds are stable, they are not aggressive. These modest allocations must contend not only with continuous selling by early holders but also with exchange fees, new coins issued by miners, fraudulent tokens, and hacking attacks, in order to barely prevent prices from falling.

The era of reaping huge profits by taking on regulatory risks is over.

Developers sensed a stagnation.

Developers aren't stupid. They can sense signs that technology is losing its edge. Developer activity has plummeted to 2017 levels.

Weekly developer commit logs across all ecosystems

Meanwhile, the codebase has practically stagnated. Decentralized systems are designed to be difficult to change. Those ambitious engineers who once saw cryptocurrency as a cutting-edge field have now turned to robotics, aerospace, artificial intelligence, and other areas where they can do things far more exciting than simply playing with numbers.

If transactions are poor, user experience is even worse, and talent is being lost, then the future path is not hard to predict.

IV. Error correction mechanisms are superior to pure decentralization.

Decentralization advocates tell a simple story: code is law, currency is uncensored, and no one can block or reverse a transaction.

Most people don't actually want that. What they want is well-functioning infrastructure, and they want someone to fix it when problems arise.

This is evident in how people treat Tether. When funds were stolen by North Korean hackers, Tether froze those balances. If someone mistakenly sends a large amount of USDT to a contract address or a burn address, as long as they can still sign from the original wallet, complete KYC verification, and pay the fees, Tether will blacklist the frozen tokens and mint new tokens to the correct address. While this involves some paperwork and time delays, at least there is a process, and a management team that can acknowledge mistakes and fix them.

This is counterparty risk, but it's also the risk that people value. If you suffer losses due to technical glitches or a hacker attack, at least there's hope for recovery. On-chain Bitcoin is different. If you enter the wrong address or sign an incorrect transaction, the loss is permanent. There are no appeals, no customer service, and no second chances.

Our entire legal system is built on diametrically opposed intuition. Courts have appeals. Judges can overturn judgments. Governors and presidents can pardon criminals. Bankruptcy exists to prevent a single wrong decision from ruining a person's life. We prefer living in a world where obvious mistakes can be corrected. Nobody really wants a systemic vulnerability like the Parity multi-signature vulnerability, which froze Polkadot's $150 million, leaving everyone to just shrug and say, "Code is law."

We now have far greater trust in issuers than we did in the past. Back then, "regulation" meant early cryptocurrency businesses losing their bank accounts because banks feared regulators would revoke their licenses. We watched as some crypto-friendly banks collapsed in a single weekend. Governments felt more like executioners than referees. Today, the same regulatory mechanisms have become a safety net. They mandate disclosure, audit issuers, and empower politicians and courts to punish blatant theft. Cryptocurrency and political power are now inextricably intertwined, and regulators cannot arbitrarily destroy the entire sector; they must regulate it. This makes coexisting with the risks of issuers and regulators far more sensible than living in a world where losing a seed phrase or a malicious signature hint could bankrupt you beyond repair.

Nobody truly wants a completely unregulated financial system. A decade ago, a flawed regulatory framework made the chaos of unregulated systems seem appealing. But as the regulatory system has been modernized and strengthened, that trade-off has reversed. People's preferences are clear: they want robust infrastructure, but they also want a referee on the field.

V. From "Miraculous Internet Currency" to Tokenized Real-World Assets

Bitcoin has accomplished its mission. It was like a hammer blow, shattering the barriers that had held E-gold and all similar attempts. It made a permanent ban on tokenized assets politically and socially impossible. But this victory also brought a paradox: the high value of this hammer blow vanished when the system finally agreed to upgrade.

Cryptocurrencies still have their place, but we no longer need a three-trillion-dollar "rebel." Hyperliquid developed prototype features with just 11 employees and forced regulators to respond. Once a feature worked well in a test environment, traditional finance (TradFi) copied it under a veneer of regulatory compliance.

Today, the primary strategy is no longer to invest the majority of net worth in "magic internet currencies" for a decade in hopes of appreciation. This approach only makes sense if the financial system collapses and the returns are extremely attractive. "Magic internet currencies" have always been a strange compromise: a flawless financial system wrapped around assets supported solely by a story. In subsequent articles, we will explore what happens when these financial systems embody claims to truly scarce assets in the real world.

Capital is already shifting. Even the unofficial central bank of cryptocurrencies is changing. Tether's gold holdings on its balance sheet have surpassed those of Bitcoin. Tokenized gold and other real-world assets are growing rapidly.

The era of "magical internet currency" is coming to an end. The era of tokenized real-world assets is beginning. Now that the door is open, we can stop worshipping Bitcoin and start paying attention to the assets and transactions that truly matter on the other side.