- Chainlink’s oracle network allow over $27 trillion in transactions, lead to broader institutional adoption of tokenized assets.

- CRE and Confidential Compute empower banks and asset managers to addressing compliant, cross-chain smart contracts faster and more secure.

In early November 2025, Chainlink presented Chainlink Runtime Environment (CRE), a unified development environment which authorize institutions in deploying smart contracts across multiple blockchains while integrating finance protocols, compliance rules, and real-time data at the same time.

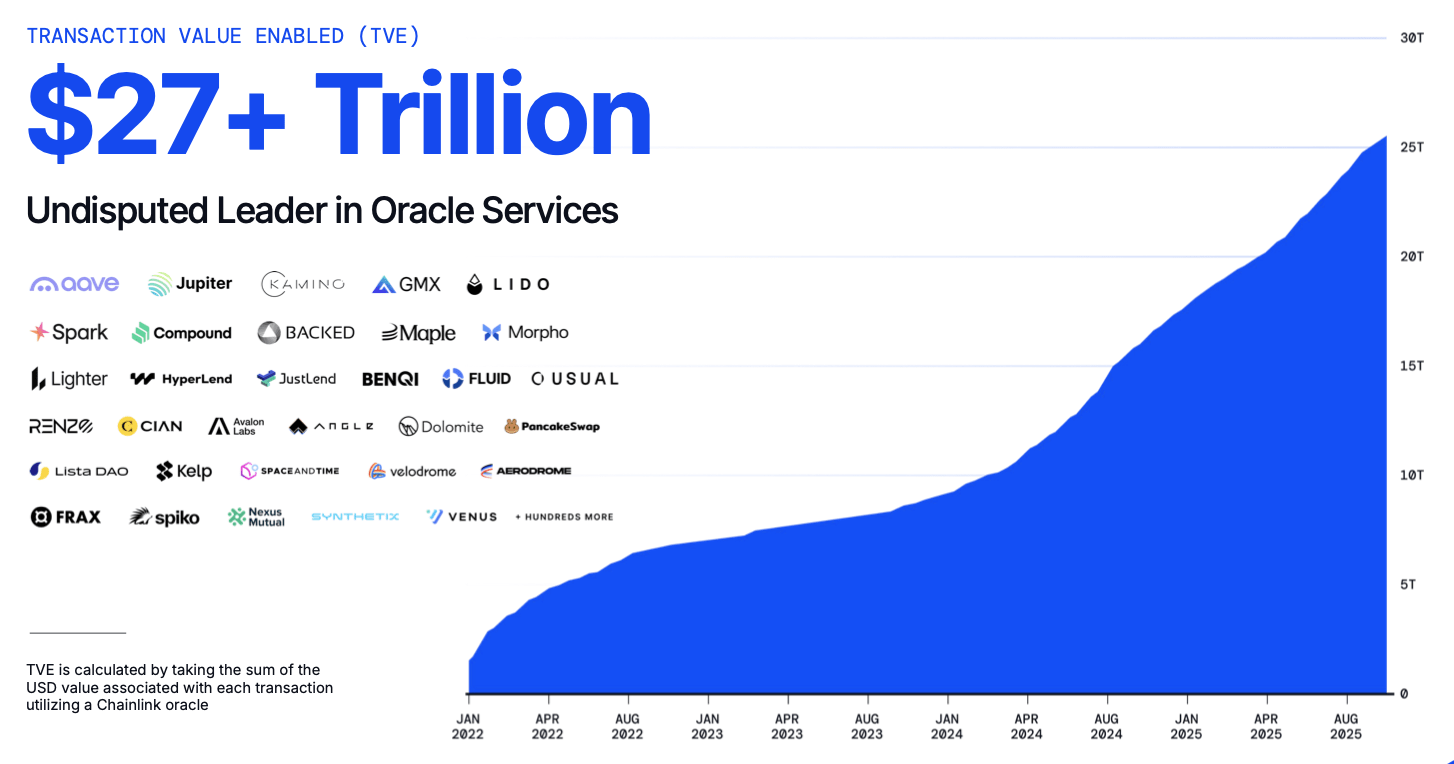

The data from December 2025, further confirmed this move since Chainlink’s oracle infrastructure has now supported more than $27 trillion in verified transaction value, showing how deeply it has become embedded in real financial systems. As tokenization accelerates across global markets, banks, asset managers, and fintech firms are highly depend on Chainlink as the connective layer between traditional systems and blockchain rails.

Previously, our highlight on CRE, together with UBS enabling in-production tokenized fund automation within the Hong Kong Framework, noted that

the system delivers real-time transparency and operational efficiency while maintaining full alignment with regulatory requirements.

Chainlink Connects Blockchains to the Real World

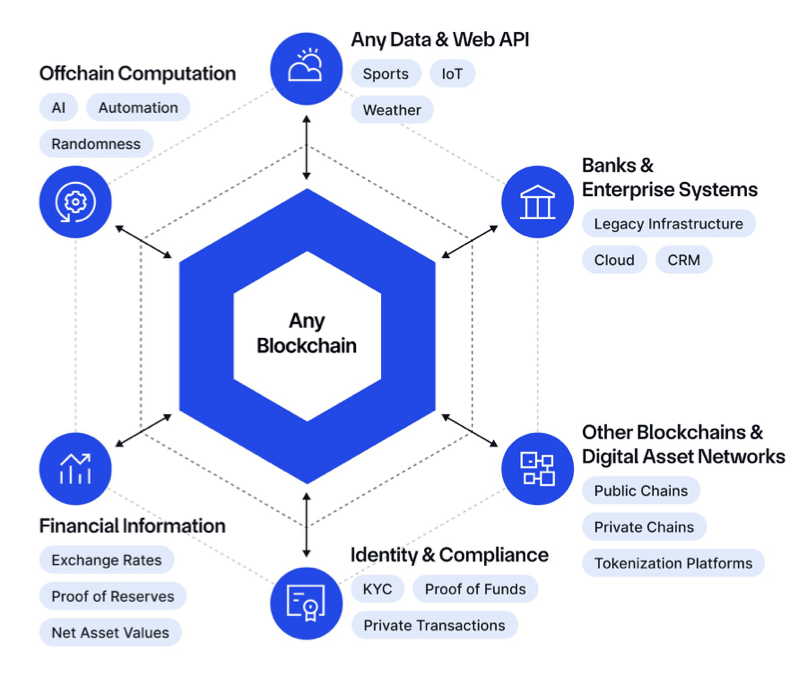

Chainlink successfully resolves isolation of blockchains by delivering authenticated data, cross-chain messaging, and automated compliance logic with unified oracle framework. Institutions can also link settlement systems, identity tools, pricing feeds, and custody platforms directly to blockchain networks without rebuilding their technology stacks.

As displayed in the image below, this architecture unlocks advanced use cases such as tokenized funds, real-time NAV updates, atomic settlement, programmable assets, and on-chain risk management—capabilities that traditional infrastructure cannot achieve on its own.

According to Chainlink’s recent launch of Confidential Compute enables private smart contracts on any blockchain, allowing institutions to tokenize sensitive assets and run compliance-heavy workflows, yet still without exposing data for public, which complementing CRE and expands Chainlink’s enterprise-grade offerings to fully support privacy and regulatory requirements.

Chainlink’s $27T+ TVE Milestone

According to the data, Chainlink’s Transaction Value Enabled (TVE) surpassing $27 trillion showing how central its services have become in the broader tokenization economy.

Each Chainlink-powered transaction, from DeFi collateral updates to institutional settlement workflows, contribute to this updates, indicating both scale and real monetary exposure. According to a recent 2025 institutional-platform overview, Chainlink supports roughly 2,400+ integrations and holds ~69.9% of the oracle-service market by value secured.

Moreover, Global demand is also increasing with financial institutions and trading events, including from Deutsche Börse Group, that pushing live market data onto blockchain networks through Chainlink’s DataLink service.

This adoption is empowered with quick settlements, operational cost savings, and enhanced transparency, benefits that tokenization offers compared with legacy systems. Lastly, Chainlink’s leadership is also reinforced by its full-service approach, providing oracles, CCIP, Proof-of-Reserve, and cross-chain interoperability, all in one infrastructure, according to CoinShare.

As of now, Chainlink (LINK) is trading at $14.40, reflecting an increase of 1.91% in the past day and 7.54% in the past week. See LINK price chart below.