Bitcoin (BTC) continued to fall below the $90,000 mark in early Asian trading today, despite several positive macroeconomic signals supporting the market.

One analyst pointed out that the decreasing flow of stablecoins into exchanges is the main reason Bitcoin remains weak, and argued that liquidation is the key to a price rebound.

The key factor Bitcoin needs to return to an uptrend.

Data from BeInCrypto Markets shows that December was a period of significant volatility for the world's largest cryptocurrency. Prior to that, Bitcoin had fallen for two consecutive months, with the November drop being the deepest YTD.

At the time of writing, BTC is trading at $89,885, down 2.7% from 24 hours ago. This decline occurs despite the fact that yesterday, the US Federal Reserve (Fed) cut interest rates for the third time this year.

Bitcoin (BTC) price movement. Source: BeInCrypto Markets

Bitcoin (BTC) price movement. Source: BeInCrypto MarketsThe US central bank has cut interest rates by another 25 basis points, to a target range of 3.50%–3.75%. Typically, a rate cut is good news for the cryptocurrency market. In fact, many had expected prices to rebound .

However, the price moved contrary to expectations. So, if the reason isn't this macroeconomic policy, what does Bitcoin really need to reverse its downtrend?

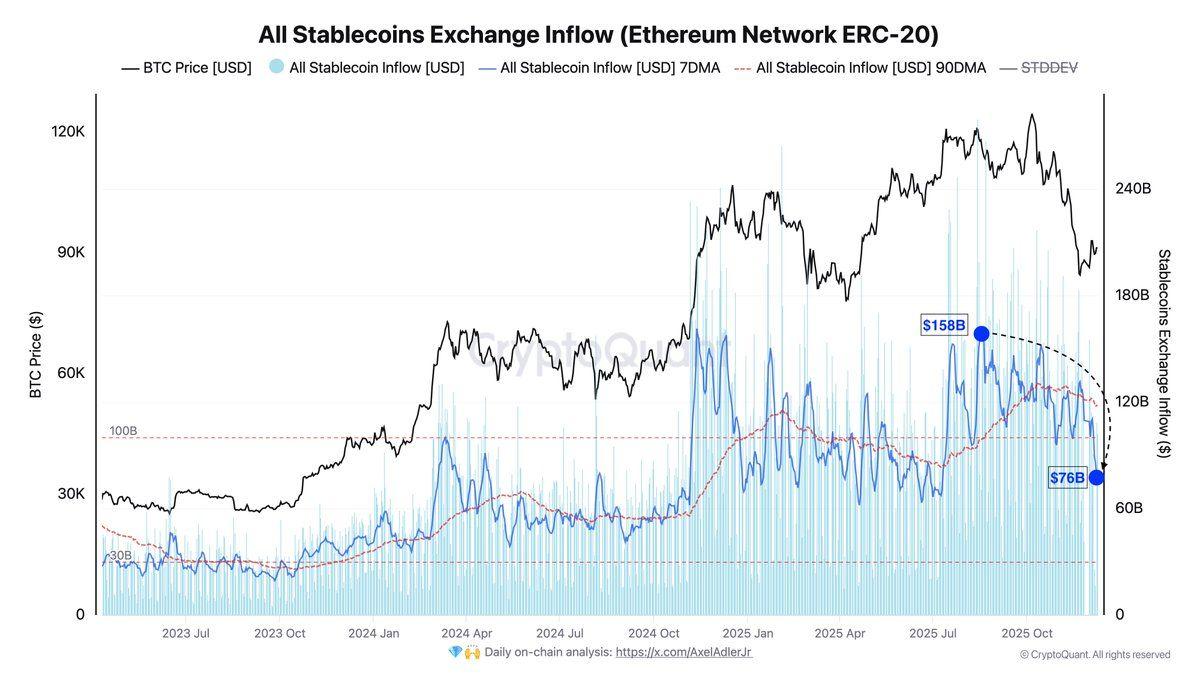

According to expert Darkfost, the problem lies in liquidation. He explained that the amount of stablecoins flowing into exchanges has dropped sharply, from $158 billion in August to around $76 billion currently.

This is equivalent to a 50% decrease in just a few months. The Medium for the last 90 days has also fallen from $130 billion to $118 billion, showing a clear downward trend.

"One of the main reasons Bitcoin is struggling to recover is the lack of new liquidation flowing into the market. When we talk about liquidation in the cryptocurrency market, we're primarily referring to stablecoins," the article states.

The amount of stablecoins deposited into exchanges continues to decline. Source: X/Darkfost

The amount of stablecoins deposited into exchanges continues to decline. Source: X/DarkfostThe expert also stated that the sharp decrease in stablecoin inflows into the market indicates weakening demand . Currently, Bitcoin is under continuous selling pressure that is not being offset by new Capital inflows. Furthermore, recent slight rallies are mostly due to reduced selling pressure, not increased buying pressure.

"For Bitcoin to truly return to an uptrend, the key factor is the influx of new liquidation into the market," Darkfost emphasized.

BeInCrypto also highlighted in a recent report that stablecoin issuers are continuously creating new Token , helping the market Capital of Circle 's Tether (USDT) and USDC reach new highs this month.

However, data shows that the majority of these stablecoins are being used for cross-border payments. Notably, a large proportion of the Capital flow is going into Derivative exchanges rather than spot trading platforms.

“Asia is leading with the largest volume , surpassing even North America. However, when considered as a percentage of GDP, Africa, the Middle East, and Latin America stand out more. The majority of Capital flows are from North America to other regions,” the International Monetary Fund (IMF) stated in a recent report.

Thus, the recent decline in Bitcoin shows that macroeconomic factors alone are not enough to support the market. Actual data indicates that the market needs a new influx of stablecoin liquidation to reverse the downward trend and enter a sustainable upward phase. Furthermore, investor sentiment remains cautious, with limited trading activity, preventing Capital from truly returning to Bitcoin.