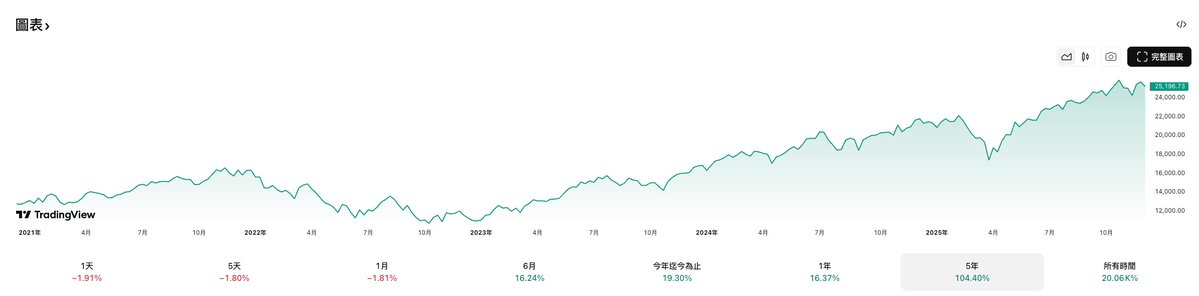

Many people have asked what the impact would be if MicroStrategy were removed from the index. Because many funds directly buy into the index, they indirectly buy the stocks of the companies included in the index. Therefore, if a company is included in the index, it naturally gains significant purchasing power in addition to brand exposure. If it's removed, there will be a significant decrease in buying pressure. So why do these funds blindly buy into the index? The Coindesk 80 and Nasdaq 100 indices represent the fundamental trends of Crypto and US stocks, respectively, as shown in the charts below. Currently, the Coindesk 80 has fallen below its all-time low, meaning that buying now would result in a loss, while the Nasdaq 100 has broken through its all-time high, similarly meaning that buying now would result in a profit. Sigh.

This article is machine translated

Show original

陈剑Jason

@jason_chen998

12-14

前段时间MSCI提议从26年开始要将数字资产持有量超过总资产50%的公司踢出其指数,直指以微策略为代表的一大堆DAT公司,搞的人心惶惶市场摇摇欲坠,而在昨天公布的最新年度纳斯达克100指数中,移除名单里没有出现微策略,利空消失了至少一半。MSCI在这个月会进行审议是否保留微策略,预计明年1月正式公布

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content