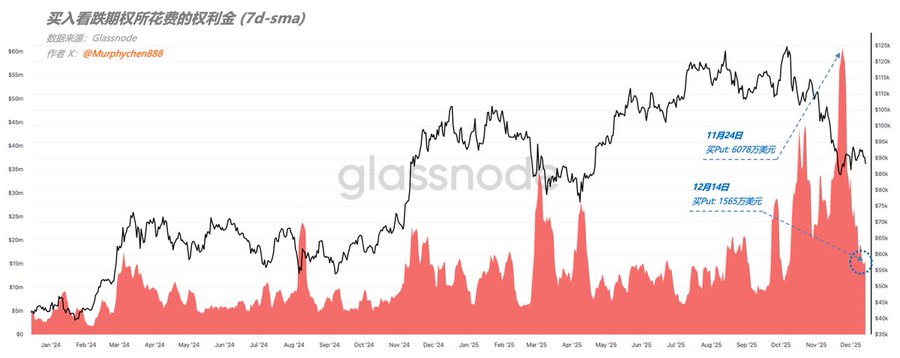

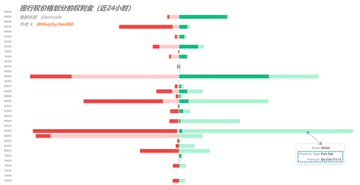

Changes in Market Pricing of BTC Downside Risk In the options market, buying Puts is how investors pay for insurance against potential downside risk. So, when Put premiums drop sharply without any significant price action, it usually signals that the market’s panic over a “short-term rapid dump” is easing. Looking at the two points marked in Chart 1: On Nov 24, Put buying ≈ $60.78M (7d-SMA); by Dec 14, it’s down to ≈ $15.65M. That’s a massive decrease—at the very least, it shows traders are way less willing to pay for short-term downside protection compared to late November. (Chart 1) But this doesn’t mean the bears have left the chat—it’s more likely that hedging strategies are shifting. As BTC bounced after dipping near $80K and volatility cooled off, the cost-effectiveness of buying expensive Puts dropped fast. So, the market’s moving towards buying fewer Puts, or not buying at all. But the real signal for “has the market started to reprice BTC downside risk?” isn’t just about how many Puts are being bought—it’s whether people are stepping up to sell Puts. (Chart 2) That’s why Chart 2 is key. In the past 24 hours, we’ve seen a ton of Put selling at the $85,000 strike, which means the market is actively betting against BTC breaking below $85K. In trader speak: As long as BTC stays above $85K at expiry, you pocket that $4.33M in premium for free. In other words, some big players are starting to bet that $85K is a level that’ll hold, even if it gets tested. (Chart 3) Looking at the net premium flow across strike ranges and expiry dates: For Dec 19 expiry, the market’s worried about BTC dipping below $80K, so everyone’s buying Puts at $80K (Dec 19 also happens to be BoJ rate hike day); by the bigger expiry on Dec 26, we see heavy Put selling at $85K, which tells us the market expects BTC to be above $85K at that point. To sum up: 1. End of November: Investors were pricing in tail risk by loading up on Puts in full panic mode. 2. As BTC found support and volatility dropped, demand for downside protection (buying Puts) fell off a cliff. 3. Heavy Put selling at $85K shows traders are actively repricing BTC downside risk. ---------------------------------------------- Sponsored by @Bitget| Bitget VIP: Lower fees, bigger perks.

This article is machine translated

Show original

Murphy

@Murphychen888

12-14

12月26日有名义价值约238亿美元的期权将集中到期,覆盖季度期权、年度期权和大量结构性产品。意味着BTC衍生品市场在年末将迎来一次“风险敞口的集中清算与再定价”,价格可能在到期前被结构性约束,但到期之后不确定性反而上升。

(图1)

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content