This article is machine translated

Show original

In the past week

1/ Let's start by talking about the overall market sentiment. From the market's perspective, the general consensus is bearish. In groups that rely solely on chart analysis, losses have already fallen below 50,000. Investment research analysts are also very pessimistic, generally believing that it's difficult for any truly innovative products to emerge, and that attention and capital are being severely drained by the AI sector.

I bought both BTC starting with 8 and ETH starting with 2. Although the market thought it could reach 7, I still acted first.

Starting in December, most altcoins migrated to Ethereum and Ethereum, leaving only a few projects with cash flow, such as AAVE LINK.

Compared to the previous cycle, I feel I've become much more conservative. During the bear market after LUNA, I bought a lot of altcoins at the buy the dips. Although I ultimately made a profit and some projects even had a second rise, I also experienced too many stories of things going back to zero.

The situation is a bit different this cycle. I think there are very few counterfeit products that have been wrongly killed. The market's calculation and evaluation capabilities have improved, and it's not so easy to "pick up bargains".

In particular, this cycle has a large number of projects without actual business operations, as well as projects that were created to complete previous financing tasks; these projects are very risky.

Of course, I would still buy if a good opportunity came along, but it's practically impossible to find one now.

4/ Equity Tokenization and the RWA Track

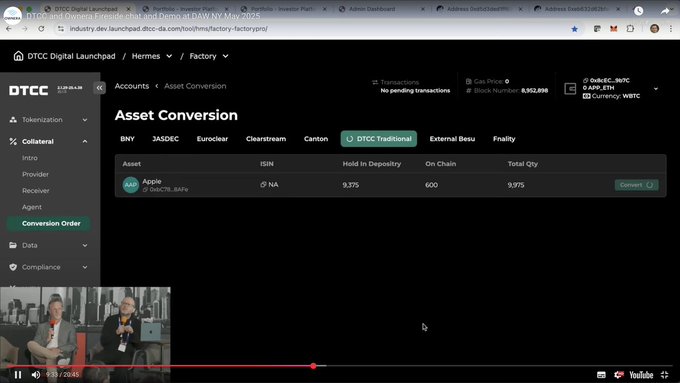

DTCC's asset tokenization plan has been approved by the SEC, reigniting market attention on this track. From a policy perspective, the SEC is taking a very open and supportive approach, with supporting documentation, detailed rules, and standards in place.

The market's interpretation of the impact on existing equity tokenization projects seems somewhat misguided.

Some believe that DTCC's entry reduces opportunities for other projects. This is not the case. First, this initiative serves institutional clients (primarily DTC participants and their clients, typically financial institutions such as banks, brokers, and asset management companies), and has no direct relation to retail investors. Therefore, it does not conflict with existing equity tokenization products like Ondo. For institutional clients, the benefits include faster settlement and increased efficiency, enabling 24/7 trading, and allowing for automated management through smart contracts (reducing human intervention).

From a retail investor's perspective, faster and lower-cost institutional settlement may lead brokers (such as Robinhood or Fidelity) to lower fees or commissions, passing the cost on to retail investors. Retail investors trading through institutional products (such as ETFs or mutual funds) may experience faster order execution and better price discovery. Similarly, using products like Ondo could theoretically benefit them, as it also relies on the execution efficiency of off-chain institutions.

Therefore, the relationship is delicate. The SEC has begun to support stock tokenization in its attitude and has started to advance the technology, but it hasn't clearly defined how to regulate on-chain "gray area" businesses like Ondo, while simultaneously allowing them to benefit under existing policies. It's estimated that in the short term, it will remain largely unregulated. Things may change as the scale grows; we'll see then. In the current context, my interpretation is positive.

(This month, the U.S. Securities and Exchange Commission (SEC) officially concluded its two-year investigation into Ondo Finance and confirmed that it would not bring any charges against it.)

For more content, see the full version:

Welcome to subscribe 👏

cmdefi.substack.com/p/cmdefi-f...…

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content