- Theoriq is not optimizing yield products. It is redesigning how on chain financial decisions are made by shifting execution from human timing to autonomous agent coordination.

- By treating AI agents as accountable on chain entities with identity, reputation, and constraints, Theoriq turns judgment itself into a measurable and competitive resource.

- Policy Cages are the project’s most critical design choice, enabling AI driven capital management while enforcing deterministic risk boundaries required for institutional trust.

FROM PASSIVE YIELD TO AUTONOMOUS DECISION MAKING

For most of DeFi’s history, the core promise was simple. Remove intermediaries and let smart contracts execute financial logic. That promise was largely fulfilled. But as markets matured, a deeper limitation became clear. Smart contracts do not decide. They wait.

Yield strategies across DeFi still rely on human timing and static rules. A person designs a strategy. A contract or bot executes it. When market structure shifts, the system reacts late. Capital stays passive. Risk appears before adjustment.

This gap has nothing to do with yield levels. DeFi has never lacked opportunity. What it lacks is continuous judgment. Humans cannot monitor markets without pause. Simple automation cannot understand context. As volatility rises and narratives rotate faster, this weakness becomes structural.

Theoriq enters at this exact fault line. It does not attempt to improve a single yield product. It questions the role of the decision maker itself. If capital lives on chain and markets never sleep, why should decision making remain manual.

The project frames this not as optimization but as a transition. From automation to autonomy. From reacting to deciding.

AGENTIC ECONOMY AND THE SHIFT OF DECISION POWER

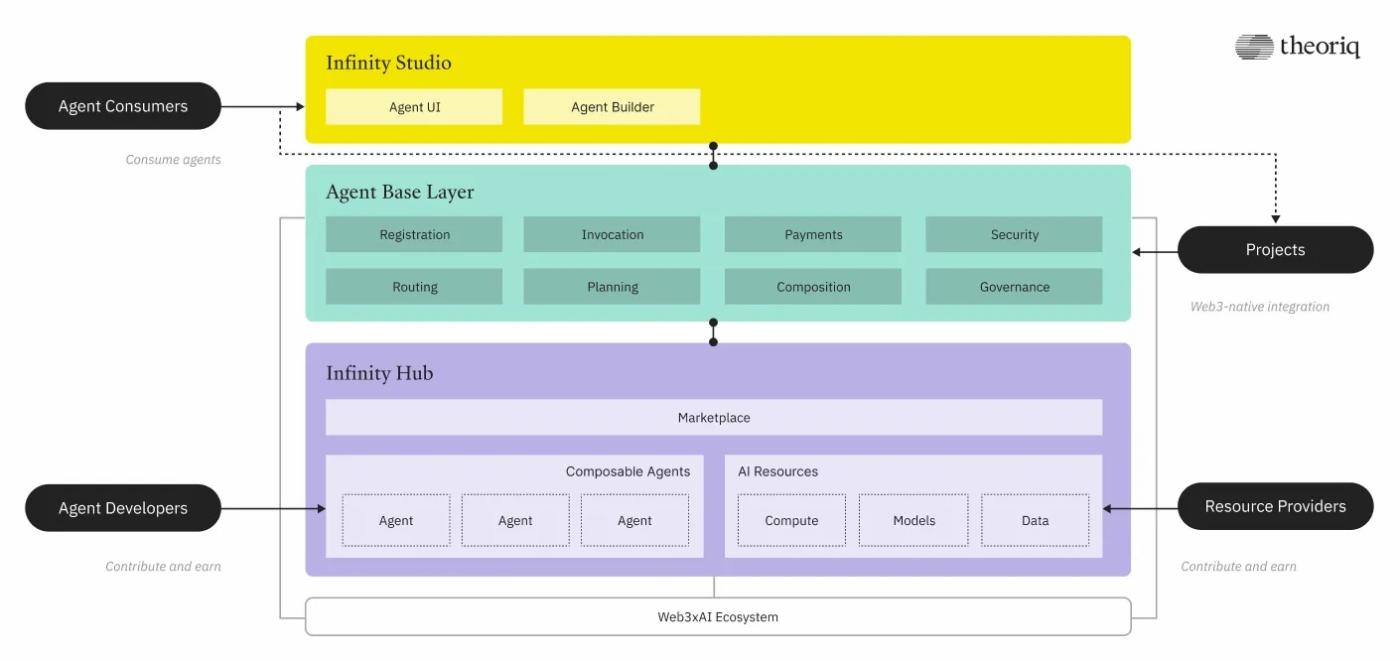

Theoriq is built around a concept called the Agentic Economy. In this model, the primary actors are not human wallets but autonomous agents powered by AI systems. These agents are designed to observe markets, reason about conditions, plan actions, and execute within defined limits.

This is not about replacing users. It is about changing how interaction works. Instead of users triggering every action, users express intent. The system handles execution.

To make this possible, Theoriq treats agents as first class on chain entities. Each agent has an identity. Each action is signed. Performance is recorded over time. Agents earn or lose credibility based on results.

This structure turns judgment into something measurable. An agent that consistently adds value gains access to more responsibility. An agent that performs poorly is excluded. Decision making becomes competitive and auditable.

What emerges is not a single AI brain but a network of specialized agents. Data interpreters. Forecasters. Allocators. Executors. These agents form temporary collectives to handle specific tasks. Value comes from collaboration, not from any single model.

In this system, decision power shifts away from human timing and toward continuous machine judgment that can be evaluated on chain.

ALPHA STACK AND THE LOGIC OF AGENT COORDINATION

AlphaVault is the most visible product in the Theoriq ecosystem. But it is not the core innovation. It is a proof point.

The foundation lies in the Alpha protocol stack. AlphaProtocol defines who can act as an agent. Identity registration. Capability disclosure. Accountability. Without this layer, agents would be indistinguishable scripts.

Above it sits AlphaSwarm. This is where coordination happens. Users provide high level intent rather than instructions. AlphaSwarm decomposes that intent into tasks and assembles a group of agents based on historical performance. Selection is dynamic. Reputation matters.

Execution results are fed back into the system. Agents are evaluated on outcomes. Over time, better combinations emerge. Poor ones disappear.

This feedback loop introduces causality into DeFi decision making. When performance changes, the system can identify why. Data quality. Forecast error. Execution slippage. This is rare in on chain finance, where strategies usually fail without explanation.

AlphaVault exists to test this architecture under real conditions. Capital is not simulated. It is deployed. The question it answers is simple. Will users trust non human systems with real funds. Early traction suggests that some already do.

POLICY CAGES AND WHY CONSTRAINTS MATTER MORE THAN INTELLIGENCE

AI systems are powerful but imperfect. They hallucinate. They misjudge. In finance, that is unacceptable. Theoriq does not try to solve this with better models alone. It introduces constraints.

Policy Cages are immutable smart contract rules that define absolute boundaries. Which assets can be touched. Which protocols can be used. How much risk is allowed. Agents operate freely inside these boundaries but cannot escape them.

This creates a hybrid security model. AI handles complexity. Smart contracts enforce limits. The system assumes error will happen and designs for containment rather than perfection.

This approach is critical for institutional relevance. Large capital does not fear innovation. It fears undefined downside. Policy Cages turn AI from an uncontrolled actor into a bounded decision layer.

Seen from this angle, Theoriq is not arguing that AI should replace humans outright. It argues that decision making can be delegated gradually, under strict constraints, with accountability baked into the protocol.

That is the real bet. Not on intelligence, but on structure. Not on prediction, but on governance of decision power.

If DeFi’s first phase removed intermediaries, Theoriq points toward the next one. Removing manual finance itself.

〈Theoriq’s Bet: Letting On Chain Capital Make Its Own Decisions〉這篇文章最早發佈於《CoinRank》。