Ethereum's price continues to face pressure after failing to break out of a two-month-long downtrend. ETH attempted a recovery last week but quickly lost momentum.

Weak investor support has caused Ethereum to fall further, raising concerns about the possibility of a sustainable short-term recovery.

Ethereum is losing support from retail investors.

on-chain data shows that the returns of both long-term and short-term investors have decreased. Currently, both groups are at roughly the same level of return, indicating indecision across the market. The convergence of returns from both groups means that no one is clearly profitable at the current price.

The MVRV Longing/ Short Difference has slipped below zero, underscored this trend. This indicator shows that neither long-term nor short-term investors have significant uncapitalized profits. If the indicator continues to fall, profits for small retail investors holding short-term ETH could outweigh gains, increasing the risk of a price drop and reflecting investor anxiety.

Want more insights on Token like this? Sign up for editor Harsh Notariya's daily Crypto Newsletter here .

Ethereum MVRV Longing/ Short Difference. Source: Santiment

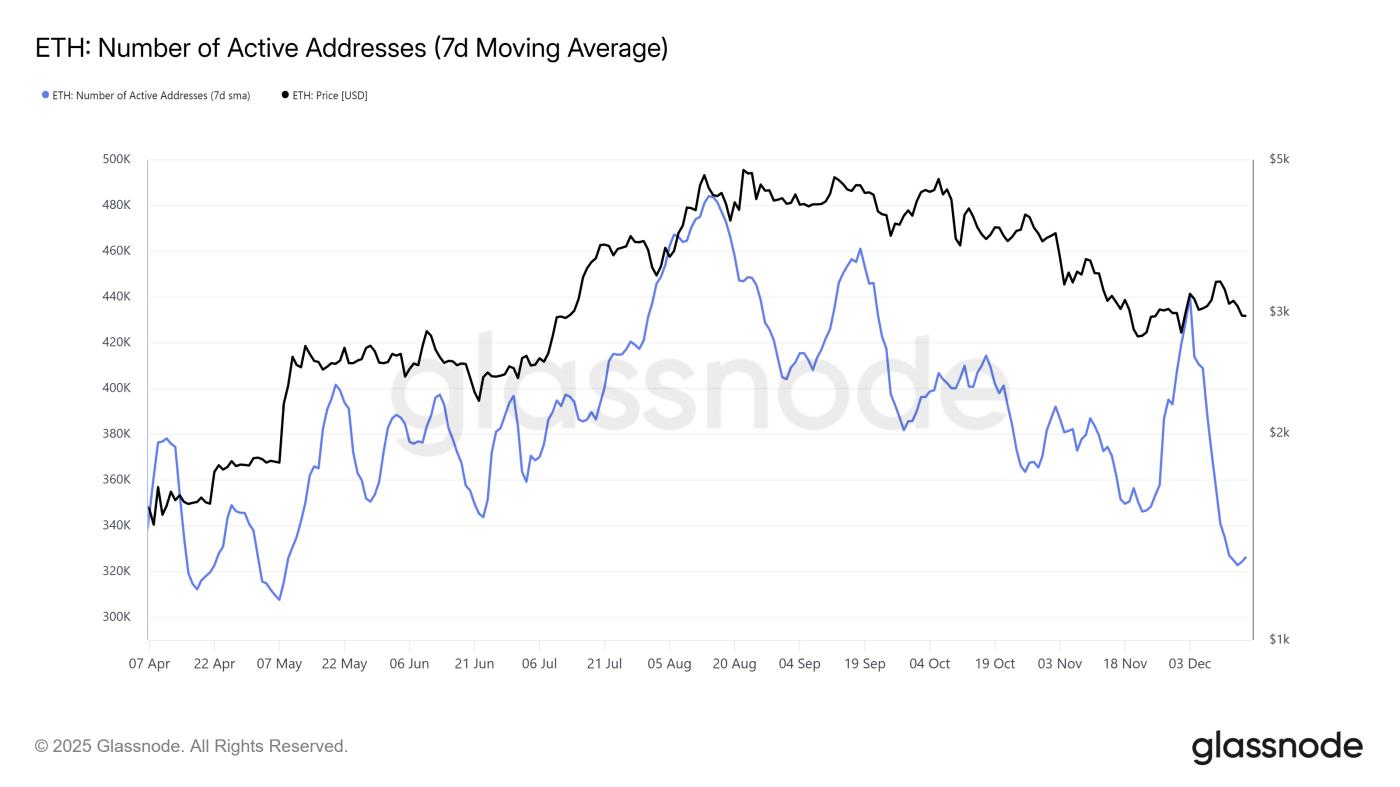

Ethereum MVRV Longing/ Short Difference. Source: SantimentEthereum's macro activity has also declined significantly. The number of active addresses on the network has dropped to its lowest level in seven months. This indicates a decrease in retail investor participation in ETH holdings , meaning the network is less used as the price continues to be disappointing.

Low network activity indicates a lack of investor motivation to trade while the price remains stagnant. Decreased network usage often reflects declining confidence. Without new demand or a major event to boost it, Ethereum may struggle to regain upward momentum in the short term.

Ethereum active address. Source: Glassnode

Ethereum active address. Source: GlassnodeETH price falls below $3,000 again.

ETH is currently trading at $2,929, marking the third time this month that ETH price has fallen below $3,000. Last week's attempt to break the downtrend was also unsuccessful, indicating a lack of interest from buyers at higher price levels and reinforcing the market's downward momentum.

Indicators suggest the downtrend remains dominant, andEthereum could retest the $2,762 support level, a previously crucial support zone. While downward pressure persists, the risk of a further sharp decline would only materialize if the overall market deteriorates significantly.

ETH price analysis. Source: TradingView

ETH price analysis. Source: TradingViewA shift in investor sentiment could help the market move more positively. To consolidate the recovery, ETH needs to reclaim the $3,000 support level. If ETH maintains above this level, the price could potentially test the $3,131 level . If this scenario occurs, the downtrend will be invalidated, opening up the possibility of ETH breaking out of the current downward pattern.