This article is machine translated

Show original

Pre-IPO valuations are growing rapidly, prompting companies to seek opportunities in the primary equity market. A recent letter from SpaceX's CFO to shareholders revealed that SpaceX is preparing for an IPO next year, possibly as early as June. A secondary offering has already been launched, valuing the company at $800 billion. This has caused a stir in the market, considering that SpaceX's valuation in its last funding round was only $400 billion six months ago; its valuation has more than doubled in just a few months.

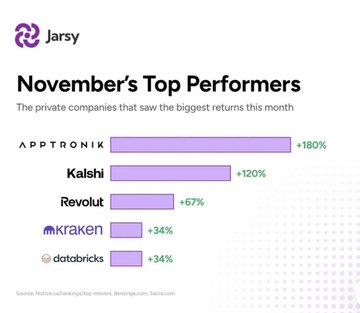

In fact, it's not just SpaceX; the valuations of many popular and high-profile projects in the equity market have grown rapidly in the past two years.

1) OpenAI's valuation rose from $300 billion in July to $500 billion, a 60% increase;

1) Authorop was valued at $180 billion in the middle of this year, and recently its valuation has exceeded $300 billion, nearly doubling;

3) Kalshi's valuation was $5 billion three months ago, and its latest valuation has exceeded $10 billion, more than doubling;

4) Polymarket's initial valuation was $1 billion, and it has now exceeded $8 billion, representing a 700% increase.

There are many other examples of rapid growth in valuations in the primary equity market.

what does that mean?

For most equity investments, value creation and exponential growth have shifted from before the IPO to before the IPO. If you only invest in the secondary market, by the time the company goes public, its market capitalization will already be very high, significantly limiting the growth potential of the secondary market. Especially now that companies are staying private longer than ever before, it means that much more value creation is completed before the IPO.

Over the past 25 years, according to Cambridge Associates, venture capital has outperformed public equity by an average of 3–5% annualized. Furthermore, unlike most asset classes, the private market has extremely low correlation with the public market (i.e., the secondary market) (r ≈ 0.3) because equity investments are locked up before listing, making them difficult to trade and decoupled from market and macroeconomic changes, highly correlated only with company business growth. This results in genuine diversification, rather than just another asset disguised as stocks.

Private equity is highly attractive, but it remains inaccessible to ordinary investors. How can the average person invest in SpaceX or OpenAI? As privately held companies, they remain out of reach for most. The opportunity for ordinary investors to participate before these companies' IPOs is virtually zero. The core issue is the mechanism or regulatory environment, which excludes ordinary investors from wealth creation in the private equity market, even though the market capitalization created by private equity over the past 25 years is three times that created by the public market.

This is the value of Jarsy @JarsyInc

Jarsy is a platform focused on tokenizing illiquid assets. By issuing digital assets directly pegged to the equity of pre-IPO companies, it transforms traditional private equity into on-chain tradable assets, thereby improving asset liquidity. Jarsy's operating mechanism is also quite robust: Jarsy first completes the actual equity acquisition of the target company through the platform, and then puts this equity on the blockchain in a 1:1 format using tokens. This is not a simple securities mapping, but a substantial transfer of economic rights.

Therefore, Jarsy stated that it is not a "short promise," and its tokens are backed by "real-world private company shares." In other words, each token is backed by shares/economic interests held by a real SPV, rather than a mere "guess."

At Jarsy, retail investors can purchase tokenized equity in unicorn companies like SpaceX, Anthropic, and OpenAI with a minimum investment of just $10, and trade it in real time, which is quite attractive.

Recently, Musk retweeted a post from Jarsy's Official Twitter about SpaceX. As a pre-IPO platform for equity investment in RWA, its compliance and security are extremely important.

Jarsy's legal counsel is Wilson Sonsini Goodrich & Rosati, a top Silicon Valley law firm.

The platform strictly enforces KYC/AML; US users are required to undergo accredited investor verification.

Each private equity token is held in an independent SPV custody structure, ensuring complete asset segregation and protecting investor rights even if the platform shuts down.

The proof of reserves is published on-chain every month; transparency is crucial.

The opportunities remain enormous.

According to Preqin data, the global private equity market's total assets under management (AUM) exceeded $13.1 trillion in 2024, representing a 150% increase since 2018. If you believe we are at the beginning of a massive technological revolution in areas such as AI, robotics, and defense technology, the private equity market will undoubtedly be the first to exhibit excess returns.

As the secondary market becomes more efficient—

Benefiting from asset tokenization and gradual deregulation—

The liquidity problem is also rapidly disappearing.

Eventually, we will gradually enter a period where investors can truly invest in and allocate private equity assets and exit when they want.

You can register to try out the Jarsy platform app.jarsy.com/?invite_code=vmj...…

Jarsy

@JarsyInc

12-09

Why is no one talking about Google pulling off one of the greatest trades of all time?

Ten years ago, they invested ~$900M into SpaceX.

It's now worth ~$50 billion after SpaceX's latest secondary sale.

That's a 56x return.

Returns aside, that early bet loops back into one of

Equity tokenization is a huge untapped market 👍

That's absolutely true; the growth rate of the primary market is no slower than that of the secondary market.

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content