Deng Tong, Jinse Finance

As 2025 draws to a close, Jinse Finance presents a series of articles titled "Looking Back at 2025" to mark the passing of the old year and the arrival of the new. This series reviews the progress of the crypto industry throughout the year and expresses the hope that the industry will overcome its winter and shine brightly in the new year.

2025 will be a pivotal year for the crypto industry, marked by a gradually clarifying regulatory framework, deeper penetration by traditional finance, and accelerated technological iteration. Each key juncture relies heavily on the leadership of key figures who either guide policy direction, lead institutional entry, tackle technical challenges, or stir up market trends. This article focuses on the key figures in the crypto industry in 2025.

I. US President Trump

1. Return to the White House, the first "crypto president"

On January 20, Trump was sworn in as the 47th President of the United States in the Capitol Rotunda in Washington, D.C., becoming the first “crypto president” in U.S. history.

On January 23, Trump issued his first executive order on crypto. Specific provisions include: protecting and promoting the ability of individual citizens and the private sector to access and use public blockchains; allowing U.S. citizens to develop and deploy software, participate in mining and verification, conduct transactions, and self-custody digital assets; promoting and protecting the sovereignty of the dollar and fostering the development and growth of dollar-backed stablecoins; protecting and promoting fair and open access to banking services for all law-abiding citizens and private sector entities; providing regulatory clarity and certainty; protecting Americans from the risks of CBDCs and prohibiting the creation, issuance, circulation, and use of CBDCs within U.S. jurisdiction; rescinding Executive Order 14067, "Ensuring the Responsible Development of Digital Assets," and the Treasury Department's "Framework for International Participation in Digital Assets"; establishing the Presidential Working Group on Digital Asset Markets; proposing a federal regulatory framework to manage the issuance and operation of U.S. digital assets (including stablecoins); assessing the feasibility of establishing and maintaining a national digital asset reserve and proposing standards for establishing such a reserve.

For details, please see the Jinse Finance special report , "Trump's Official Inauguration Ushers in a New Era for the Crypto Industry."

2. Wielding the tariff weapon

February 1: Trump signed an executive order imposing a 10% tariff on Chinese goods imported into the US, citing issues such as fentanyl; simultaneously, a 25% tariff was imposed on goods from Mexico and Canada, with a separate 10% tariff on Canadian energy products; April 3, "Liberation Day," Trump officially signed an executive order regarding reciprocal tariffs; April 8: Announced an increase in the "reciprocal tariff" on Chinese goods imported into the US from 34% to 84%, bringing the total tariff rate to 104% after adding previous tariffs; April 10: First, a 90-day tariff suspension period was announced, with reciprocal tariffs on relevant countries significantly reduced to 10%, but tariffs on Chinese goods were simultaneously increased to 125%, bringing the total tariff to 145% after adding the fentanyl tariff; May 12: Following the Geneva trade talks between China and the US, a joint statement was issued, with the US reducing tariffs on Chinese goods to 30%, and the US officially completed this tariff adjustment on May 14; August 12: Following the Stockholm trade talks, China and the US reached a consensus to suspend the 24% tariff from that day. The two sides agreed to impose reciprocal tariffs for 90 days, with both retaining their existing 10% tariffs on each other's goods. China also suspended some non-tariff retaliatory measures against the United States. On November 5, in conjunction with the previous agreement to suspend tariffs between China and the US, China announced that it would continue to suspend the 24% tariff on US goods for one year, starting November 10, retaining the 10% tariff rate. The US maintained its corresponding tariff policy and did not introduce any new tariff increases.

The cryptocurrency market is heavily influenced by tariff policies. In late February, when Trump suddenly announced plans to impose tariffs on Canada and the EU, BTC fell by about 15% in the following days. In early April, as Trump continued to escalate tariffs, the total market capitalization of the cryptocurrency market fell by about 25.9% from its January high, wiping out nearly $1 trillion in market value, highlighting the cryptocurrency market's high sensitivity to macroeconomic instability.

For details, please see the Jinse Finance special report , "Where Will the Crypto Market Go After Trump Wields the Tariff Stick?"

3. Send Trump and push WLFI

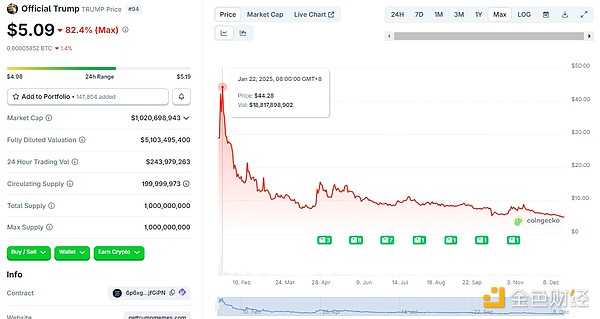

On January 18, Trump announced the launch of his personal Meme cryptocurrency, Trump. Upon its launch, Trump experienced a surge in price, reaching a high of over $44 on January 22. It subsequently plummeted, currently trading at $5.09, a drop of 82.4% from its January peak.

The launch of the Trump meme coin directly ignited the celebrity meme coin craze at the beginning of the year, and Trump's price trend is a microcosm of all celebrity meme coins. First, after the launch of meme coins, the celebrity effect was used to pump and dump, for example, Trump launched Trump three days before his inauguration to create a short-term frenzy. Second, memes have no real value support. From its inception, Trump has been controversial, with accusations of political bribery constantly emerging. Finally, most meme coins have internal manipulation issues, with price peaks being dumped, causing price crashes.

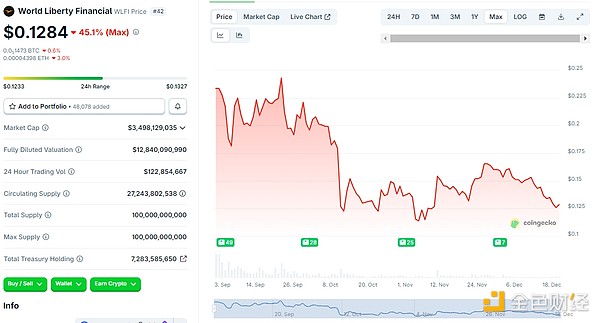

On September 16, 2024, World Liberty Financial, a decentralized finance project of the Trump family, was established. On September 1st of this year, several cryptocurrency exchanges listed WLFI for trading. However, it's clear that WLFI's popularity was merely a temporary fad; it peaked at $0.24 in its launch month, but as of this writing, it has fallen 45.1% to $0.1284.

WLFI's product architecture is based on the governance token WLFI and the stablecoin USD1, aiming to connect traditional finance with DeFi. Its core consists of the institutional-grade stablecoin USD1 and the community-driven governance token WLFI. The product architecture features multi-chain deployment, compliance management (including KYC and third-party audits), and community governance mechanisms, and provides transparent and secure digital asset services through the USD1 stablecoin backed by US dollar reserves.

However, since its initial launch last September, WLFI has not achieved any remarkable results. WLFI co-founder Zach Witkoff recently announced that it will launch its real-world asset product in January next year, but the final outcome remains to be seen.

For details, please see the Jinse Finance special report , "When Politics Meets Encryption: The Trump Family's WLFI Experiment."

II. SEC Chairman Paul Atkins

In April 2025, after Atkins became Chairman of the SEC, he proposed Project Crypto, considered the clearest crypto strategy from US regulators to date. Its main objectives include: clarifying that most digital assets are not securities, reducing legal uncertainty; avoiding complex regulations, namely clarifying the financial and legal attributes of crypto tokens as commodities, avoiding cumbersome case-by-case reviews; supporting on-chain capital raising, enabling a compliant tokenized market; establishing stablecoins and on-chain settlement mechanisms to promote the dominance of the US dollar in the crypto market; promoting inter-agency cooperation (with the CFTC, Treasury Department, and White House task force); supporting crypto innovation, and even supporting platforms that integrate trading, staking, and lending to improve financial efficiency. He believes that if the US wants to maintain its financial leadership, it must establish compliance and market advantages in the digital asset field.

For more details, please see "Paul Atkins: Believer in Free Economics, Head of Project Crypto".

Under his leadership, the SEC shifted towards a pro-crypto policy. In 2025, the SEC ended its illegal enforcement case against Coinbase and its investigations into crypto projects such as Ondo, Aave, and Yuga Labs.

III. Ethereum co-founder Vitalik Buterin

1. Ethereum upgrade

On May 7th, the Ethereum Pectra upgrade was triggered and completed on the mainnet around 10:05 UTC. This is the most significant upgrade since the merger in 2022. This update aims to simplify the staking process, enhance wallet functionality, and improve overall efficiency. One of the key elements of this upgrade is increasing the amount of ETH that users can stake from 32 to 2048. This change aims to help staking institutions and infrastructure providers by meeting the needs of validators who stake ETH to keep the blockchain running.

For more details, please see the Jinse Finance special report , "Understanding the Ethereum Pectra Upgrade".

On December 3, the Ethereum Fusaka upgrade was officially activated at block slot 13,164,544 on the mainnet.

Fusaka marks a significant step in Ethereum's scaling roadmap, enhancing Layer 1 performance, expanding Blob capacity, improving the cost-effectiveness of Rollups, and delivering an upgraded user experience. It also introduces a "Blob-only" fork mechanism to safely increase Blob capacity as Rollup demand grows.

For details, please see the Jinse Finance special report , "A Comprehensive Analysis of the Ethereum Fusaka Upgrade".

2. Focus on the privacy sector

At the Ethereum Developers Conference held from November 17th to 22nd, Vitalik released Kohaku, an Ethereum privacy-preserving cryptographic tool.

For developers, the Ethereum Foundation provides an open-source framework that includes a modular Software Development Kit (SDK) and a reference wallet. The SDK offers reusable components for private sending, more secure key management and recovery, and risk-based transaction control, so teams don't need to build the entire privacy protocol stack from scratch. For users, the first version is a browser extension wallet for advanced users, built on Ambire. It supports private and public transactions, independent accounts for each decentralized application, peer-to-peer broadcasting (rather than a centralized relay), and tools for hiding Internet Protocol (IP) addresses and other metadata as much as possible.

For details, please see "Ethereum Privacy Explosion? What Messages Did the Ethereum Developer Conference Convey?"

On November 27th, Vitalik again focused on the privacy sector, strongly supporting two decentralized messaging applications, Session and SimpleX Chat, by donating 128 ETH to each. Vitalik pointed out that digital privacy protection in encrypted messaging is crucial. Two important future directions in this field are: (i) permissionless account creation; and (ii) metadata privacy protection.

For details, please see "What are the two apps that Vitalik strongly supports? Is private communication the next big thing?"

IV. Strategy co-founder Michael Saylor

1. Frenzied buying of BTC

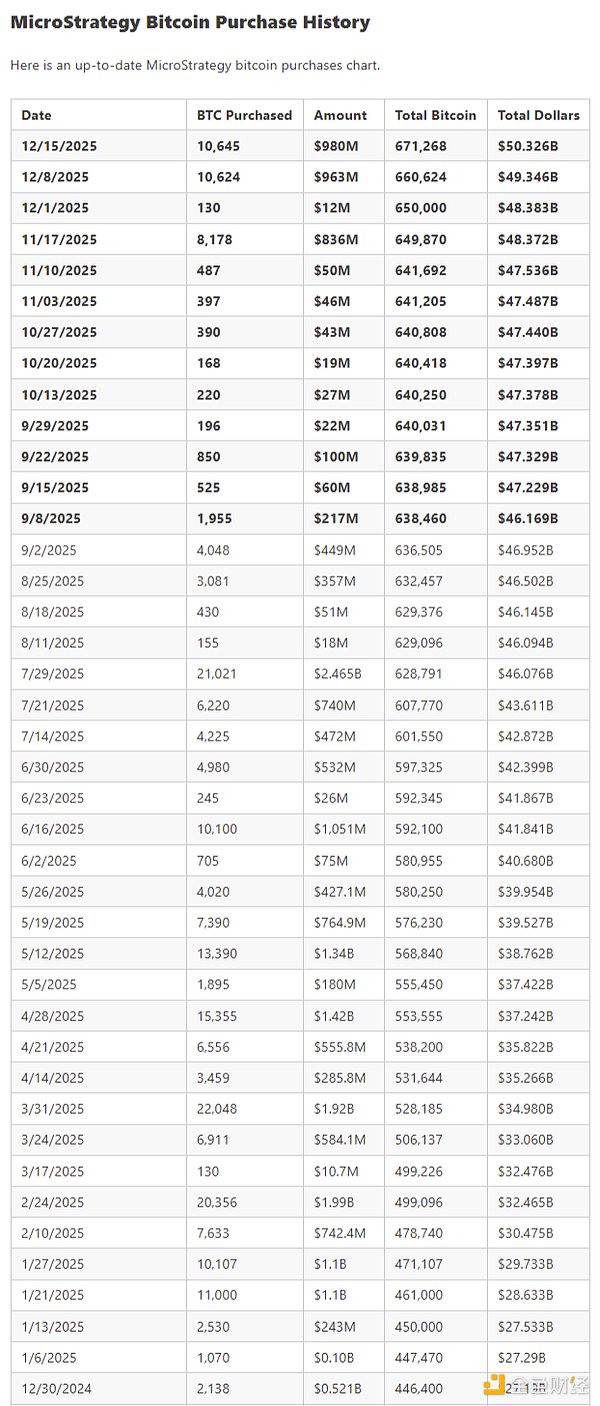

On December 30, 2024, Strategy held a total of 446,400 BTC; as of December 15, 2025, Strategy held 671,268 BTC. In nearly a year, Strategy purchased 224,868 BTC. Its holdings represent 3.197% of the total BTC supply.

2. Responding to the risk of being removed from the MSCI index

In October, MSCI announced it was soliciting feedback from the investment community to discuss whether companies with digital asset reserves where crypto assets account for more than 50% of their balance sheets should be excluded from its indices. MSCI noted that some feedback suggested these companies "exhibit characteristics similar to investment funds, which currently do not qualify for index inclusion." The consultation period will last until December 31, with a final decision to be announced on January 15, and any resulting changes taking effect in February. The initial list of companies MSCI is considering includes 38 companies, such as Michael Saylor's Strategy Inc., Sharplink Gaming, and cryptocurrency mining companies Riot Platforms and Marathon Digital Holdings.

Michael Saylor responded to questions about the risks of being excluded from the MSCI index in a social media post. He stated that Strategy, as a publicly traded and operating company, is fundamentally different from funds, trusts, and holding companies. Strategy not only has a $500 million software business but also uniquely uses Bitcoin as productive capital in its fund management. Index classification cannot define Strategy. The company has a clear long-term strategy, a firm belief in Bitcoin, and its mission has always been to become the world's first digital currency institution based on sound money and financial innovation.

3. Encourage the government to develop a digital banking system backed by Bitcoin.

In early December, Michael Saylor urged governments to develop Bitcoin-backed digital banking systems that would offer high-yield, low-volatility accounts and attract trillions of dollars in deposits. Saylor stated that countries could use overcollateralized Bitcoin reserves and tokenized credit instruments to create regulated digital bank accounts with yields higher than traditional deposits. Bank deposits in Japan, Europe, and Switzerland offer virtually no returns, while euro money market funds yield around 150 basis points, and US money market rates approach 400 basis points, explaining why investors are turning to corporate bonds.

For details, please see "Controversial Strategy: The Dilemma of BTC Faith Stocks After the Crash".

5. Tether CEO Paolo Ardoino

1. Intending to acquire Juventus

On December 12, Tether announced its plan to acquire a full stake in Italian football club Juventus FC. Tether submitted an all-cash binding offer to its controlling shareholder, Exor, for 65.4% of the club's shares and planned to launch a public tender offer for the remaining shares after the transaction, aiming to increase its stake to 100%. However, the Exor Group rejected Tether's offer to acquire Juventus shares, reiterating its intention not to sell.

2. Create fiat currency-pegged tokens

On December 9th, Tether's stablecoin USDT was officially recognized as a "fiat-pegged token" at the Abu Dhabi Global Market (ADGM), authorizing institutions to provide regulated custody and trading services. This marks a significant step forward in the UAE's stablecoin regulation. USDT has been officially recognized as a fiat-backed reference token for multiple blockchains, including Aptos, Cosmos, and Near. This move helps Tether penetrate the compliant digital asset market in the Middle East, leveraging Abu Dhabi's regional financial center status to further expand the influence and circulation of its stablecoin in the global compliant market.

3. Mobile payment

On December 9th, Oobit, a Tether-backed mobile payment app, announced its partnership with Bakkt and officially launched in the United States. This "touch-to-pay" solution integrates non-custodial wallets such as Base, Binance, MetaMusk, Phantom, and Trust Wallet, allowing users to make purchases directly using cryptocurrency on iOS and Android devices. Merchants receive fiat currency settlements in real time through their existing Visa payment network. The collaboration between Tether and Oobit began last year. In 2024, Oobit completed a $25 million Series A funding round, led by Tether, with participation from investors including the co-founder of Solana. This funding has become a crucial support for Oobit's subsequent technological iterations and global market expansion.

4. Digital asset lending

On November 18, Tether announced a strategic investment in digital asset lending platform Ledn. This move aims to expand access to credit, enabling individuals and businesses to obtain loans without selling their digital assets. Ledn focuses on Bitcoin-secured loans and has disbursed over $2.8 billion in loans since its inception, with over $1 billion disbursed by 2025, marking the company's strongest annual performance. Its annual recurring revenue (ARR) has exceeded $100 million.

5. Robot

On December 8th, it was reported that Tether is supporting the development of a new type of industrial humanoid robot that will perform dangerous and physically demanding tasks in factories and logistics centers. Tether, along with AMD Ventures, the Italian state-backed artificial intelligence fund, and other investors, raised €70 million for Generative Bionics (a new spin-off company from the Italian Polytechnic Institute).

6. Large Language Model

On December 2, Tether Data announced the launch of QVAC Fabric, a large language model framework that enables users to execute, train, and personalize large language models directly on everyday hardware, including consumer-grade GPUs, laptops, and even smartphones. Tasks that previously required high-end cloud servers or dedicated NVIDIA systems can now be accomplished on users' existing devices. The model reportedly supports training on a variety of GPUs, including AMD, Intel, NVIDIA, Apple Silicon, and mobile chips.

For details, please see "The Tether Empire: More Than Just Juventus – A Fortune of $15 Billion in One Year".

VI. BlackRock CEO Larry Fink

BlackRock's Bitcoin Spot ETF (IBIT) continues to lead the market, holding the top spot in the global Bitcoin spot ETF market throughout the year. At its peak, it ranked 23rd among all ETFs worldwide. Its latest net asset value (AUM) is approximately US$70.84 billion.

In 2025, IBIT successfully established its dominant position in the field of combining crypto assets with traditional finance. Its performance is closely linked to the volatility of the Bitcoin market and the sentiment of institutional funds, exhibiting the characteristics of "long-term capital attraction" and "short-term sharp fluctuations".

For more details, please see "BlackRock: Why Can IBIT Change the Bitcoin Investment Landscape?"

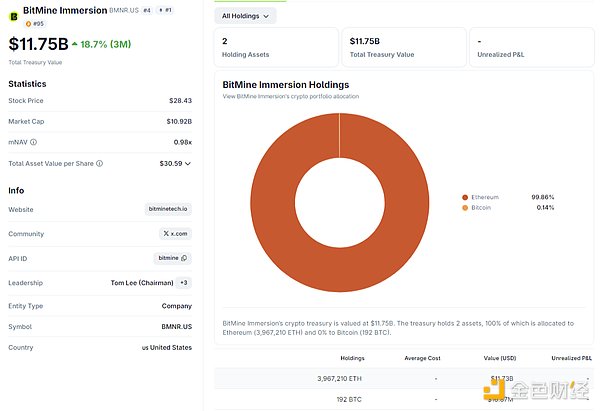

VII. Tom Lee, Chairman of the Board of BitMine

In June 2025, BitMine officially appointed Tom Lee as Chairman of the Board and simultaneously launched its ETH reserve strategy, making him a key decision-maker in the company's transformation. He proposed the positioning of "becoming the MicroStrategy of Ethereum" and promoted the vision of "5% alchemy," aiming to hold 5% of the global ETH circulation and reshape the company's valuation logic with "each ETH" as the core performance indicator.

Currently, BitMine holds 3,967,210 ETH, worth $11.73 billion.

Even with the recent overall downturn in the crypto market, Tom Lee has expressed his determination not to sell ETH: Bitmine already holds nearly 4% of the total Ethereum supply, and if we stake these ETH now, we will generate more than $1 million in net income every day.

For more details, please see "Tom Lee Interview: ETH is like BTC in 2017, with a potential for leapfrog growth in the future".

For more details, please see "Tom Lee Interview: ETH is like BTC in 2017, with a potential for leapfrog growth in the future".

8. CZ, former CEO of Binance

On October 22, Trump signed a pardon for CZ, which was disclosed to the public the following day.

White House Press Secretary Carolyn Levitt issued a statement saying, "The President exercised his constitutional powers to pardon Mr. CZ, who was indicted in the Biden administration's war on cryptocurrencies. The Biden administration's war on cryptocurrencies is over." Following his release, CZ quickly expressed his gratitude to Trump, stating that he "will do everything in his power to help the United States become the cryptocurrency capital and advance the development of Web3 globally."

For details, please see "From Imprisonment to Presidential Pardon: CZ Embarks on a 'Political Career'"

9. Circle Co-founder and CEO Jeremy Allaire

On June 5th, Circle officially listed on the New York Stock Exchange. During trading, Circle triggered circuit breakers multiple times, closing with a 168.48% increase at $83.23, giving it a market capitalization exceeding $18.5 billion. It continued to rise by nearly 30% the following day. Circle's listing brought stablecoins, previously only accepted by a select few, into the mainstream, gaining favor with some "old money" investors and making it one of the most successful IPOs in recent years.

Following Circle's IPO, Jeremy Allaire wrote that stablecoins may be the most practical form of currency ever, but the industry has yet to reach a pivotal "iPhone moment." He pointed out that once the stablecoin industry enters this phase, developers will be able to unlock programmable digital dollars as easily as unlocking a programmable phone. At that time, digital dollars will unleash enormous potential and bring widespread opportunities on the internet. He believes this era may not be far off.

For details, please see the Jinse Finance special report , "The Profound Impact of Circle's Listing as the First Stablecoin Stock on the Industry."

10. Xiao Feng, Director and Chairman of the Board of Directors of HashKey

On December 1, the Hong Kong Stock Exchange (HKEX) disclosed that HashKey Holdings Limited had passed its listing hearing and was about to conduct its IPO, with JPMorgan Chase, Guotai Junan Securities, and Haitong Securities acting as joint sponsors. HashKey Holdings Limited officially listed on the HKEX on December 17.

HashKey's successful IPO under Xiao Feng's leadership marks a significant milestone in the compliant development of Hong Kong's cryptocurrency industry and is a microcosm of global crypto companies embracing mainstream capital markets.

For details, please see "Xiao Feng: The Old Regime and the Revolutionary New Coordinates of HashKey in the Crypto World".