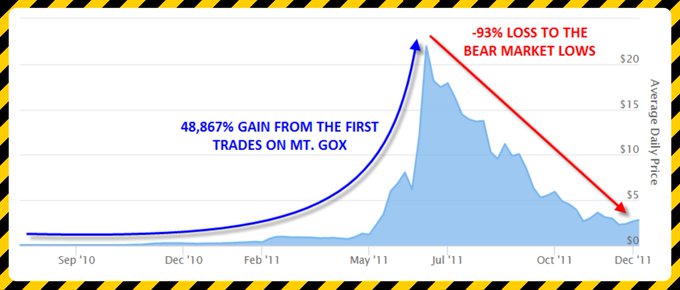

3⃣ Mt.Gox - when the entire market's trust is misplaced During this cycle, Mt.Gox was the name that almost completely dominated the market. This exchange handled the majority of global Bitcoin volume . For many, the presence of Mt.Gox meant that the market was still functioning normally. 👉 This was the biggest weakness, but at the time, very few people realized it. When Mt.Gox encountered problems and stopped withdrawals, the market reacted very strongly. The price of Bitcoin didn't immediately crash to Dip, but it rapidly dropped from around $800 to around $400–500 in just a few months. More importantly, confidence was severely damaged. 👉 The collapse at that time wasn't just a hack or mismanagement. It showed that crypto was operating on an extremely centralized infrastructure, lacking risk control, and almost entirely dependent on a single intermediary. And when trust is misplaced, the consequences begin to spread.

This article is machine translated

Show original

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content