This article is machine translated

Show original

Stani has been consistently buying tokens ($AAVE), and his current holdings exceed $12 million. It's unclear whether this is for buying voting rights, but making Aave Labs a major holder is beneficial for aligning interests.

Essentially, this is only a temporary solution. To fundamentally resolve governance issues, the DAO must have the ability to take over the project to create a balance of power with the team; otherwise, it will still be controlled by the team. The core issue is who truly holds the "real power": The team holds a large number of tokens, which, while formally binding everyone's interests to the tokens, presents numerous opportunities for profit if the team has ulterior motives. The only solution is for the DAO to be able to take over the project at any time, thus legitimizing interests through competition and negotiation. Currently, the DAO wants more profits but doesn't want Labs to leave, putting it in a very passive position. Anyone who puts themselves in that position can understand this.

CM

@cmdefi

12-22

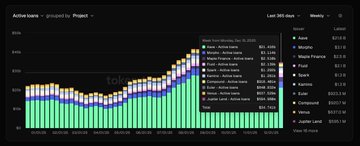

$AAVE 这一波恐慌盘有点严重,大盘涨都不跟了。治理问题我觉得并不影响项目的基本面,Aave仍然是占据借贷市场的垄断位置。Active loans占比超过60%。

The biggest players are doing this, and it feels like it's instantly eroding many people's confidence in DeFi.

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content