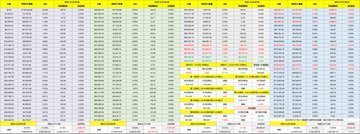

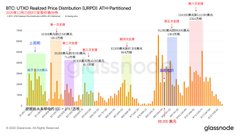

Today's US third-quarter GDP growth figures were quite good, far exceeding expectations. However, their impact on risk markets was very weak, mainly because the market is concerned that an overly strong economy could hinder the Federal Reserve's interest rate cuts in 2026. This concern even prompted Trump's speech, the essence of which was a demand for trust in the Fed Chairman to cut rates. Trump is powerless to influence Powell; all that's left is to wait for Powell's term to end. ETF data has repeatedly mentioned that we've entered the Christmas season, with some investors already on holiday. Liquidity and trading volume have begun to decline significantly. Under these circumstances, narrow-range fluctuations are highly probable. Market buying and selling intentions have decreased at this stage, and tomorrow is Christmas Eve, so trading volume will inevitably decline further. Looking back at Bitcoin's data, the price struggled to break $90,000 on $BTC. Even with declining trading volume, the turnover rate didn't decrease. I'm a bit confused now. I used to think it was quantitative trading, but now the trading volume has clearly dropped by more than 20%, yet the turnover rate is still rising. What are all those Bitcoins on the chain doing? However, the overall supply structure remains relatively stable, with no signs of investor panic. Most holders are still taking a wait-and-see approach. I personally think the next major shift might begin when Trump announces the new Federal Reserve Chairman. @bitget VIP, lower fees, better benefits

This article is machine translated

Show original

Phyrex

@Phyrex_Ni

我是真发现了 $BTC 90,000 美元的魔咒到现在还没有消除,在连续8天中有6次 Bitcoin 都在尝试或者已经冲破了 90,000 美元,然后被砸回来,但我还是觉得在本周接下来的圣诞行情中只要美股能保持上涨的趋势,BTC 就不会太差。

今天美股盘前和 BTC x.com/Phyrex_Ni/stat…

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content