BTC price action is painful, especially when gold, silver, Nasdaq pumps.

Ironically, this makes BTC attractive long term for institutions.

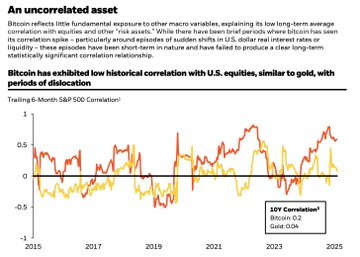

If BTC trades like tech, it’s useless for diversification.

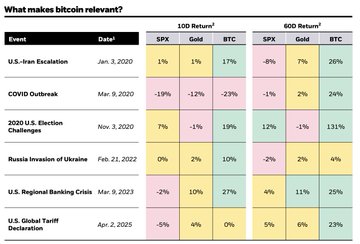

If it trades on some mysterious catalysts, it makes it allocatable.

Blackrock called it 'A Unique Diversifier' as it is obviously risky, but can't be evaluated on P/E, sales, or other criteria typical for 'risk-on' assets.

Funny, many crypto analyzoooors continue to bet on BTC as Nasdaq beta.

If this beta is gone, it's long-term bullish BTC.

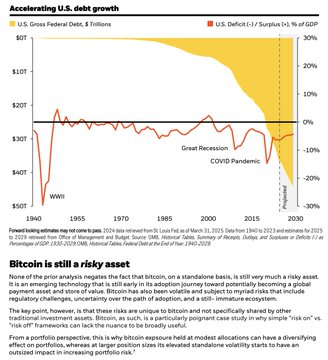

"Over the long term, bitcoin’s adoption trajectory is likely to be driven by the intensity of concerns over global monetary stability, geopolitical stability, U.S. fiscal sustainability, and U.S. political stability." - Blackrock.

None of these are broken catalysts for BTC.

Just old whales mass selling and retail panic dumping as a result.

More on BTC as a unique diversifier:

"Potential return drivers bitcoin faces are fundamentally different from traditional “risky” assets, making it unfitting for most traditional finance frameworks – including the “risk on” vs. “risk off” framework employed by some macro commentators."

BTC is still a risky asset. We now suffer from it. But still bullish longer term.

2026 gonna be the pe-bull year for BTC

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content