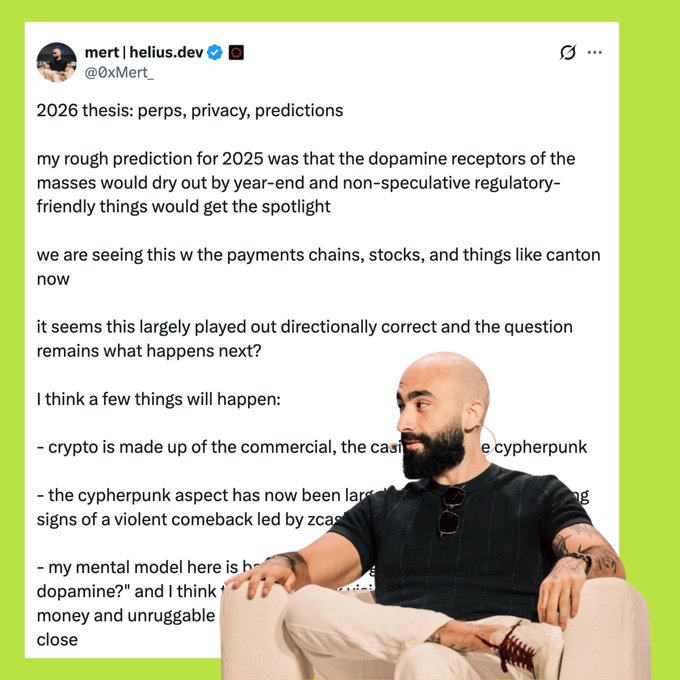

🧐 Mert Mumtaz and the crypto 2026 picture In late 2024, Mert predicted that by the end of 2025, the dopamine of the masses would run out. Crypto would become less speculative, and "safe and legal" options would prevail. That's exactly right. Payment chains, on-chain stocks, Canton Square… all became the focus of attention. But when that wave passes, where will crypto go next? According to @mert, crypto has always consisted of three parts: commerce, casinos, and cypherpunk. For many years, cypherpunk (private money, an uncontrollable system) was almost forgotten due to legal fears. But privacy is starting to become appealing again. For Mert, this is the biggest dopamine generator left in crypto. Therefore, 2026 will be the year of privacy. (Remember this, guys: if 2026 isn't the year of privacy, then you can come back and laugh in Mert's face!) At the same time, Robinhood, Revolut, and Stripe started going on-chain, capturing the "easy and safe" segment. This forced crypto builders to be more innovative in order to survive. Products that run right on the legal borderline, but cleverly capitalize on the crypto-native niche, will thrive. Perps for stocks and commodities. The prediction market is directly linked to newspapers and social media. Completely new ways of trading. Mert also believes that X and at least one other major app will try to go head-to-head with Robinhood and Coinbase. 👉 And starting with Solana, more teams like Pump or Axiom will emerge, truly competing with traditional fintech. The reason is: Fintech requires years to build its infrastructure. - Crypto builders just need to plug it into the blockchain and then focus entirely on the user experience. ✍️ Qing

This article is machine translated

Show original

Upside GM

@gm_upside

12-25

🌋 Chu kỳ 4 năm của crypto có lẽ đã kết thúc. Một kỷ nguyên khác đang mở ra.

Suốt hơn một thập kỷ, nhà đầu tư crypto tin vào một quy luật quen thuộc:

3 năm tăng mạnh, 1 năm sụp đổ. Cứ thế lặp lại.

Nhưng vài năm gần đây, thị trường không còn vận hành x.com/gm_upside/stat…

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content