XRP price has struggled to recover in recent weeks, with multiple failed attempts to bounce back, further increasing downward pressure. The Token remains stuck in a downtrend, reflecting the overall caution in the crypto market.

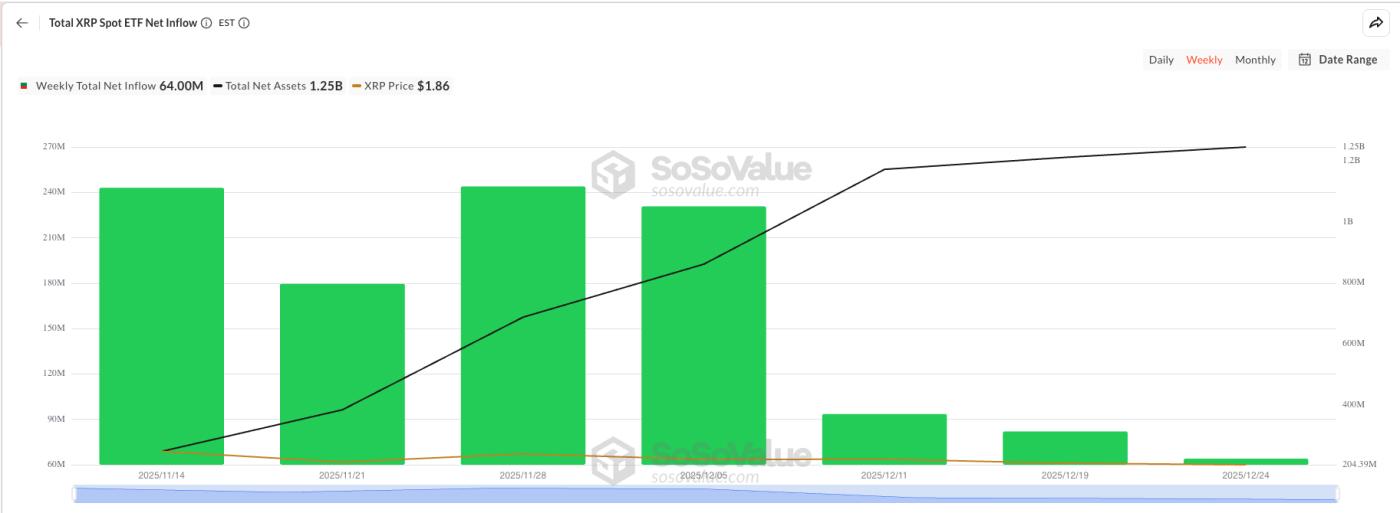

Nevertheless, XRP ETFs continue to attract Capital inflows, indicating that demand from institutional investors remains robust.

Demand for XRP ETFs remains strong.

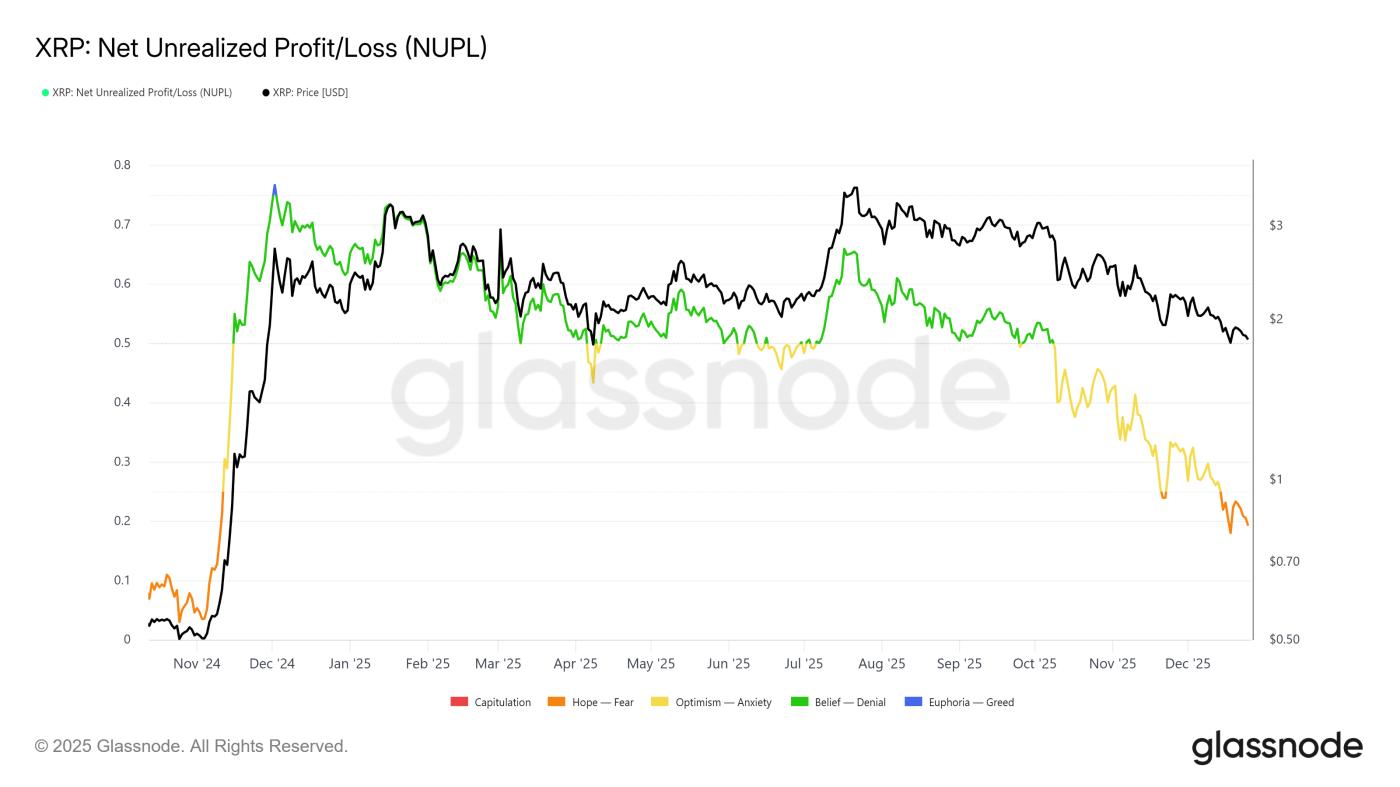

The number of XRP investors facing losses is increasing, putting pressure on the price in the short term. Net Unrealized Profit and Loss data shows that unrealized profits have fallen to their lowest level this year. Those who bought XRP above $1.86 are now losing money, while only those who bought at lower prices are still profitable.

This development is raising concerns about the sentiment of long-term investors. Those holding XRP for over a year may consider selling to lock in remaining profits. If profit-taking from this group increases, selling pressure will intensify and could further destabilize the XRP price.

XRP NUPL. Source: Glassnode

XRP NUPL. Source: GlassnodeXRP ETFs are currently the most solid support for this Token at the macro level. Since their launch six weeks ago, these funds have not recorded any net Capital . This is an impressive figure amidst the overall market uncertainty and liquidation of cooling liquidity in the spot market.

The positive trend continued into its seventh week. In the trading session before Christmas, XRP ETFs recorded inflows of $11.93 million. This data shows that institutional investors still have confidence in XRP's long-term prospects , even though retail investor sentiment has weakened somewhat and the price remains stuck in a sideways trading range.

Weekly inflows of funds into the XRP ETF. Source: SoSoValue

Weekly inflows of funds into the XRP ETF. Source: SoSoValueThe downward trend of XRP continues.

At the time of writing, XRP is trading near $1.86, still holding above the $1.85 support zone. The price remains constrained by a descending trendline that has lasted for over six weeks. The repeated failure to break through this structure has fueled increasingly bearish sentiment in the short term.

In the current circumstances, the likelihood of XRP breaking out is quite low. The overall market direction remains unclear, and increasing losses raise the risk of a sell-off. However, inflows into ETFs could help XRP stabilize above $1.79. If this level is breached, the downtrend could extend to $1.70.

XRP price analysis. Source: TradingView

XRP price analysis. Source: TradingViewHowever, if overall market conditions improve, the outlook could be different. As risk sentiment improves, XRP could recover from the $1.85 region. If it breaks above the descending trend line, the new target would be $1.94. If it continues to surpass this level, the price could head towards $2.00, and the bearish scenario would be invalidated.