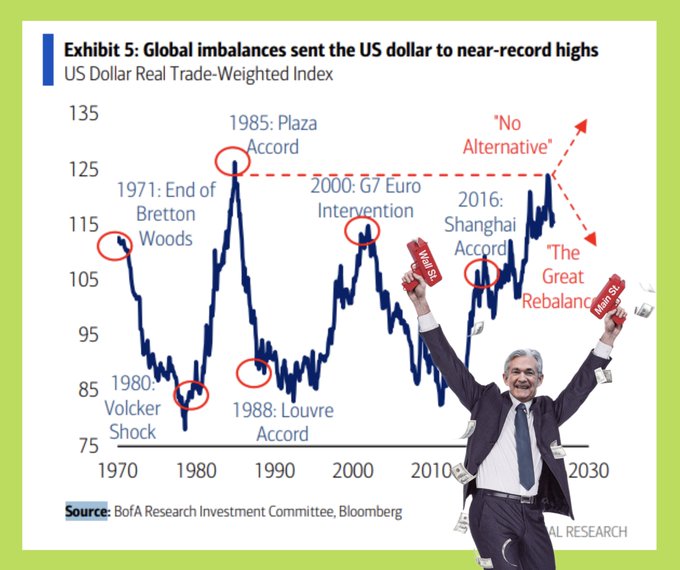

💥 The USD is at its peak, and what does that mean for investors? This chart shows that the USD is currently very strong, nearly matching its highest levels in over 50 years. Historically, each instance of such USD strength has been accompanied by significant imbalances in the global economy and often forced major countries to intervene to correct them. 📍 There have been several significant milestones in the past: - In 1971, the old global monetary system collapsed. - In 1985, the US actively weakened the USD. - In 2000 and 2016, major countries coordinated to stabilize exchange rates. The unique aspect of the current situation is: there is no clear alternative to the USD. The USD is strong not necessarily because the US economy is overwhelmingly superior, but because other regions are weaker and global capital flows still seek "safe havens". 📍According to Bank of America, if the USD weakens in the next few years, it would be a positive sign: - The world is gradually rebalancing after years of imbalance - Money is no longer flowing excessively into the US 📍For individual investors, this means: - The current USD is at a high level, difficult to maintain long-term - When the USD falls, non-US assets, commodities, and emerging markets usually benefit - The forecast of DXY around 95 by the end of 2026 indicates a period of global money reallocation, not just short-term fluctuations In short, this chart simply says: the USD is in an "overly strong" zone, and if it weakens, it could be good news for global markets in the coming years. 💯 Read more: US Dollar M2 Supply: The Impact of M2 on Crypto? coin98.net/cung-tien-m2

This article is machine translated

Show original

Upside GM

@gm_upside

12-27

💵 25 năm bơm tiền: Bức tranh vĩ mô mà nhà đầu tư không thể bỏ qua

📌 1. Cung tiền toàn cầu đã mở rộng đến mức nào?

Đến tháng 9/2025, tổng cung tiền rộng toàn cầu đạt khoảng 142 nghìn tỷ USD, so với chỉ 26 nghìn tỷ USD năm 2000. Điều này tương đương tăng x.com/gm_upside/stat…

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content