This article is machine translated

Show original

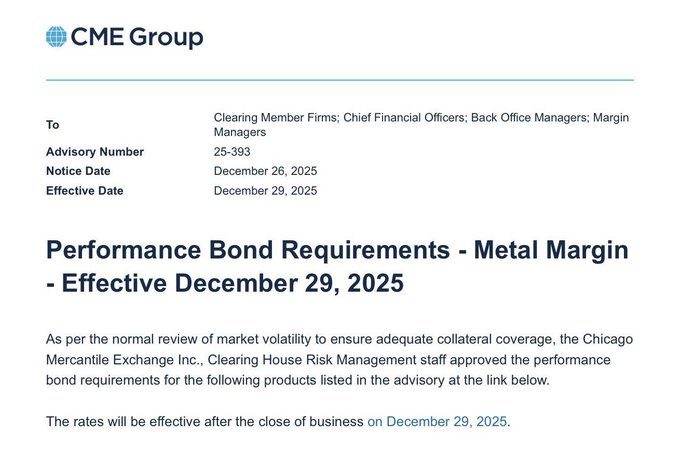

The CME has intervened in silver prices again. For the second time in two weeks, the CME has raised the margin requirements for silver, increasing the initial margin for the March 2026 contract to approximately $25,000 (the first increase was on December 12th, from $20,000 to $22,000). The new rule took effect on December 29th. This brings back memories of the CME's two previous interventions that crushed silver bulls.

Historically, silver has experienced two major price surges: the last one was in 2011, and the one before that was in 1980. In both instances, the CME intervened at the peak of silver prices.

1. In 2010, the Federal Reserve implemented zero interest rates and quantitative easing (QE), causing real yields to fall into negative territory; coupled with the European debt crisis, market concerns about national finances; and low inventory levels leading to a short squeeze. Silver surged from $8.50 to $50.00 in two years, an increase of 500%.

In the second quarter of 2011, the Chicago Mercantile Exchange (CME) raised silver margin requirements five times in nine days. This move forced massive deleveraging in the futures market, causing silver prices to plummet by nearly 30% within weeks. Although physical demand did not disappear, the withdrawal of leveraged funds severely impacted prices.

2. Late 1970s to 1980

In the late 1970s, the Hunt brothers hoarded over 200 million ounces of silver, worth over $4.5 billion, to hedge against inflation and dollar devaluation. They used the leverage effect of the futures market to control huge positions at extremely low cost, driving silver prices from $1.50 in 1973 to nearly $50 in early 1980.

This price surge also triggered regulatory intervention. In January 1980, the CME issued "Silver Rule 7," strictly limiting margin purchases for silver futures and restricting the number of contracts held. This meant that traders had to maintain nearly 100% cash to maintain their positions, effectively eliminating leverage.

Of course, then-Federal Reserve Chairman Volcker's continued interest rate hikes also dealt a heavy blow to the Hunt brothers. Under the dual pressure of margin calls and a broken cash flow, the Hunt brothers were forced to liquidate their positions, ultimately losing over $1 billion and filing for bankruptcy. Silver prices also plummeted.

This time, the CME didn't intervene as frequently as in 2011, raising margin requirements for the second time within two weeks. Raising margin requirements effectively reduces leverage: traders need more capital to control the same contract size.

Of course, silver demand is currently stronger than before, with greater applications in AI chips, electric vehicles, and photovoltaics. Strong physical demand coupled with China's export restrictions and the disconnect between the paper silver (futures) and physical silver markets are all contributing factors to the rise in silver prices.

However, the CME's actions need to be taken seriously. Excessive FOMO (fool of speculation) should be avoided. The more a silver becomes a "strategic asset," the less likely governments will stand idly by while prices soar and industrial costs rise.

qinbafrank

@qinbafrank

12-27

最近贵金属走势很猛,各种说法也都出来了,例如下面截图里的观点:认为上一次发生黄金、白银暴涨情况是20年互联网泡沫和08年金融危机期间,听上是不是很有道理。但是如果你把黄金、白银的历史走势拉出来一看,根本就不是那么回事:00-02年互联网泡沫破裂,中间还有01年的911事件这绝对是改变世界地缘政 x.com/qinbafrank/sta…

It's a repeat of 2011; I short it.

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content