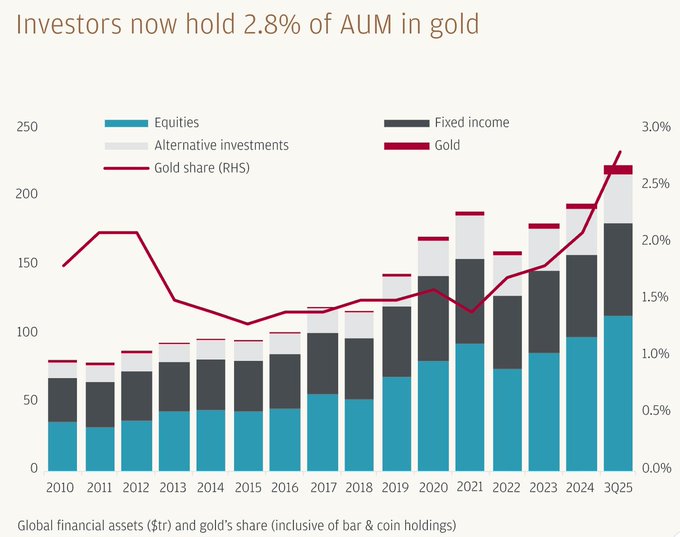

A New Era for On-Chain Assets: How Theo Network Unlocks Trillion-Dollar RWA According to the latest chart released by Theo Network (@Theo_Network), the proportion of gold in investors' portfolios has more than doubled from 1.5% to 2.8% in the past 5 years. This growth trend reveals the enormous potential for traditional financial assets (such as gold and government bonds) to migrate on-chain. As a leader in this process, Theo (@Theo_Network) has clearly stated its strategic goal of "bringing the world's most popular assets on-chain." ■ Institutional-Grade Liquidity Network Theo Network is not simply a tokenization platform; its core lies in a "financial infrastructure layer": ① Backed by an elite team: Founded by senior traders from top quantitative institutions such as Optiver and IMC Trading ② Solving the fragmentation problem: Theo achieves second-level balancing of assets across different chains through its low-latency settlement network ③ thBILL: Starting with the US Treasury basket thBILL, Theo integrates liquidity premiums with DeFi protocols, providing users with yields of 18%-20%. Theo @Theo_Network's vision for large-scale on-chain solutions has profound implications for the future financial system: ➡️Top-tier on-chain strategies ➡️Exponential improvement in capital efficiency ➡️Defining a new standard for RWA

This article is machine translated

Show original

Theo

@Theo_Network

12-24

We're bringing the world's favorite assets onchain, at scale. x.com/ampingle_/stat…

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content