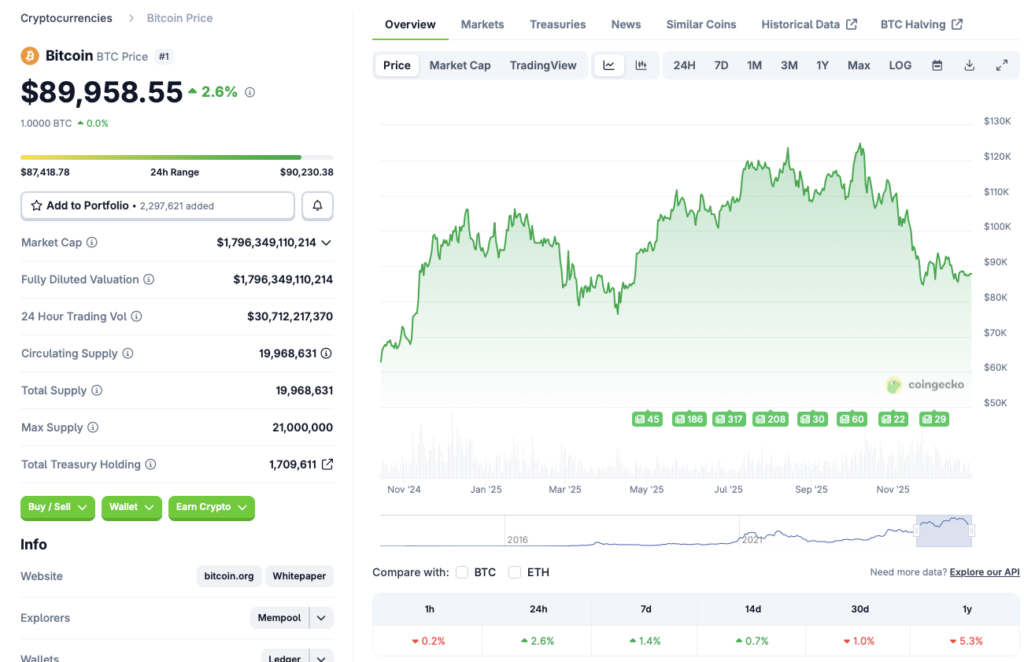

Bitcoin (BTC) is struggling to hold the $90,000 price level as we near the end of 2025. The year has been quite bullish for the crypto industry, but things took a turn for the worst towards the end of the year. BTC climbed to a new all-time high of $126,080 in October of this year, but has since fallen by more than 28%. However, the original crypto is showing some signs of a reversal. According to CoinGecko’s Bitcoin data, BTC is up by 2.6% in the last 24 hours, 1.4% in the last week, and 0.7% in the 14-day charts. However, the asset is still down by 1% over the previous month and 5.3% since December 2024. Let’s discuss if 2025 was a bad year for Bitcoin (BTC), and if 2026 will be any different.

Was 2025 a Dud Year For Bitcoin, And Will 2026 Be Different?

While 2025 may be ending in a way not many envisioned, the year sure did have some memorable milestones. Bitcoin (BTC), in particular, had quite an incredible start to the year. Apart from hitting a new all-time high in 2025, BTC also saw mass adoption in the form of ETF inflows and corporate treasury buys. The original crypto is expected to continue seeing more adoption from corporate treasuries in the coming years.

The market correction over the last few months was unprecedented. Macroeconomic uncertainties and the low chances of another interest rate cut in the coming months has led to a substantial exodus of investors from risky assets, such as cryptocurrencies.

Also Read: Cryptocurrency Market 2026: 2 Bullish Catalysts & 2 Bearish Risks

2026 may be different from 2025. In fact, we may see Bitcoin (BTC) go even higher than its 2025 peak. According to Bernstein, BTC could climb to a new peak of $150,000 next year. Grayscale also presents a bullish outlook for BTC in 2026. Both financial institutions claim that BTC is following a 5-year cycle, and not a 4-year path. This means that the asset will climb to a new high next year before facing a dip (five years after the 2021 peak).