Gold prices have just experienced a short-term correction after a strong rally that pushed the precious metal to record highs. Meanwhile, Bitcoin underperformed in what was XEM its best quarter of the year, prompting comparisons between the two assets.

Despite Bitcoin's weakness, experts say there are macroeconomic, statistical, and technical signals from the gold market suggesting that BTC may be bottoming Dip and preparing for another period of significant volatility.

The 2020 strategy is making a comeback as gold and silver prices surpass Bitcoin.

From a macroeconomic perspective, experts believe that gold and silver typically peak first, followed by Bitcoin's price increase. One analyst clearly explained this pattern in a post on X (formerly Twitter).

Following the crisis in March 2020 , the US Federal Reserve (Fed) injected significant liquidation into the market. This money initially flowed primarily into safe-haven assets.

Gold rose from around $1,450 to $2,075 as of August 2020. Silver also surged from $12 to $29. During the same period, Bitcoin fluctuated between $9,000 and $12,000 for five months, according to analysis from BullTheory.

"At that time, the market had also just experienced a major sell-off in March 2020 due to COVID," the post stated.

When precious metal prices peaked in August 2020, money began shifting towards riskier assets. This shift caused Bitcoin to surge from $12,000 to $64,800 in May 2021, an increase of approximately 5.5 times. In addition, the total cryptocurrency market Capital also increased eightfold.

Currently, gold prices have reached a record high of nearly $4,550, and silver has also risen to around $80. Bitcoin, however, remains mostly sideways, forming a pattern similar to that seen in mid-2020. The BullTheory account also added that,

“We also just experienced another major sell-off on October 10th, quite similar to the event in March 2020. And after that, Bitcoin continued to trade sideways for many months.”

Analysts believe that the liquidation injected by the Fed was the main driving force in 2020. Notably, several new factors will emerge to provide impetus by 2026.

These factors could include injecting more liquidation into the market , forecasts of interest rate cuts, the possibility of SLR exemptions for banks, clearer regulations on crypto, the risk of paying back bailout funds under Trump , the addition of spot crypto ETFs, greater access to crypto for large asset managers, and Fed leaders appearing more friendly towards the sector.

“In previous cycles, Bitcoin's rise was primarily driven by liquidation. This time, it's not just liquidation , but also a solid structural framework providing support. The current context is quite familiar, but the momentum is even stronger. The fact that gold and silver are leading isn't necessarily a bad sign for crypto, but often an early warning sign. If this pattern continues, Bitcoin and the crypto market won't be the first to break through, but will only surge after precious metals cool down. Therefore, the current sideways movement of BTC isn't the start of a bear market, but rather a lull before major volatility occurs,” BullTheory commented.

Statistical separation signals predict a crypto price surge.

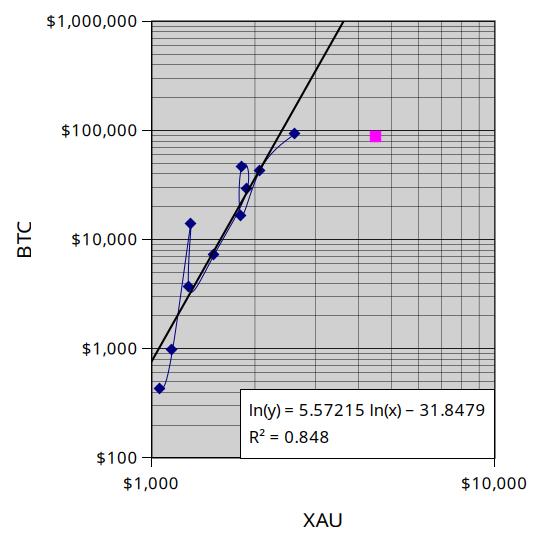

Another important signal comes from the relationship between Bitcoin and gold and stocks. Expert PlanB says that Bitcoin is currently moving away from its traditional correlation with both gold and stocks. The last time this happened was when Bitcoin was below $1,000, before increasing in value more than tenfold.

"This has happened before when BTC was below $1,000 and then the price increased tenfold," PlanB Chia .

The correlation between BTC and gold. Source: X/100trillionUSD

The correlation between BTC and gold. Source: X/100trillionUSDHowever, this expert also noted that the market is constantly changing, so the relationships between assets may also change. Therefore, it is not certain that this cycle will repeat itself according to the old scenario.

Gold/ BTC ratio: A market Dip indicator

From a technical perspective, the BTC/GOLD ratio is also sending important signals. Macro strategist Gert van Lagen notes that the RSI of this ratio is approaching a descending trend line for the fifth time in history.

In previous cycles, each time this signal appeared, it coincided with the Dip of a bear market, such as in 2011, 2015, 2018, and 2022. Afterward, Bitcoin regained strength against Dip and created higher lows. If this scenario repeats, the current situation could signal a similar turning point.

Therefore, if historical, statistical, and technical models are all correct, the current divergence between asset classes may only be a transitional phase rather than a permanent one, thus opening up new growth opportunities for Bitcoin as gold and silver stagnate and risk appetite returns to the market.