After three consecutive months of selling pressure due to unstaking, the Ethereum network is showing positive signs. Currently, the Staking queue has surpassed the unstaking queue.

How do analysts assess this change? How might this affect the price of ETH?

Why can ETH double in value when unstaking pressure decreases?

Ethereum's Staking and unstake queues are used to track the amount of ETH waiting to be Stake or unstaken.

Previously, analysts had predicted that selling pressure could intensify if the amount of ETH in the Staking queue continued to rise.

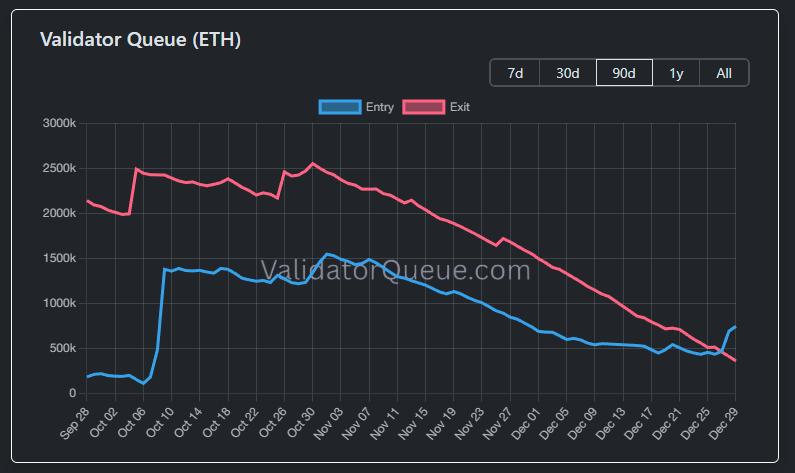

Data from ValidatorQueue shows that, as of September 10, 2024, the Staking queue has surpassed the unstake queue. This trend has officially reversed the previous imbalance.

Currently, approximately 745,600 ETH are in the Staking queue, while around 360,500 ETH remain in the unstake queue.

Validator Queue (ETH). Source: Validator Queue

Validator Queue (ETH). Source: Validator QueueChuyên gia CryptoHuntz gọi giai đoạn vừa qua là “Great Migration” của ETH. Đợt di chuyển này là một trong những nguyên nhân lớn khiến giá ETH giảm đều từ khoảng 4,800 USD hồi đầu tháng 09 xuống quanh mức 3,000 USD như hiện tại.

“The Great Migration is over… finally, the selling pressure that lasted for the past three months is gradually disappearing. Demand for ETH Staking is returning to lead the market. Nature is slowly recovering,” CryptoHuntz Chia .

In addition, Abdul – head of DeFi at Monad – offers an even more positive perspective based on past price fluctuations.

He estimates that approximately 5% of the total ETH supply, equivalent to about $15 billion, has been traded since July 2024. Abdul also predicts that the validator unstake queue could reach zero by January 3, 2025.

He also highlighted that the last time the Staking queue surpassed the unstake queue was in June 2024. After that, the price of ETH doubled in a short period.

This observation suggests that a similar scenario could very well repeat itself. The price of ETH has a chance to recover from its current price range of around $3,000.

This optimistic momentum was further reinforced when Tom Lee, chairman of BitMine – the company holding the world's largest amount of ETH , worth approximately $12 billion – decided to participate in Staking.

According to BeInCrypto , BitMine has deposited approximately 74,880 ETH, worth nearly $219 million, into its Ethereum Staking contract. This represents only a small fraction of BitMine's total holdings of 4.07 million ETH . BitMine's goal is to generate passive income, potentially reaching $371 million per year if all ETH is Staking at an APY of 3.12%.

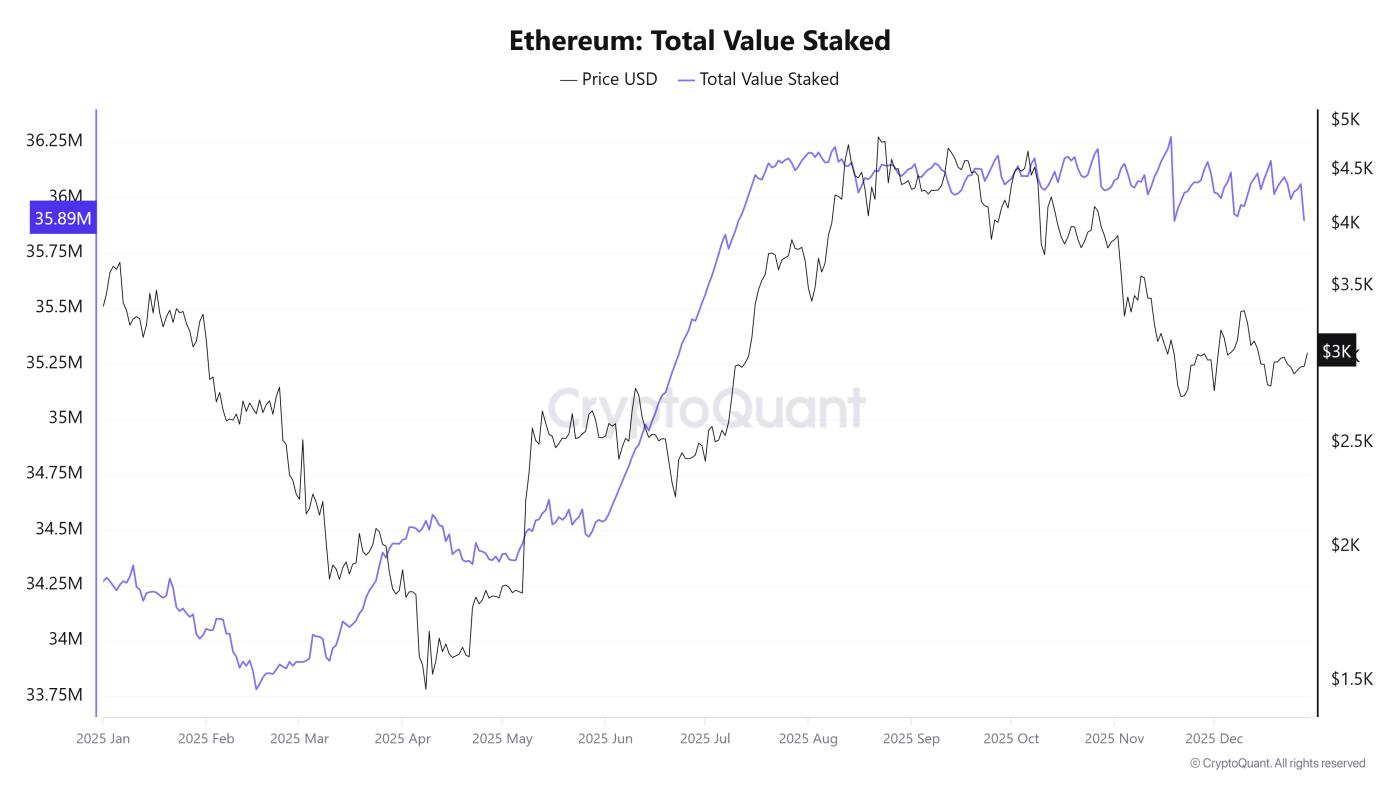

Ethereum – Total value Staking. Source: CryptoQuant .

Ethereum – Total value Staking. Source: CryptoQuant .CryptoQuant data shows that the amount of ETH deposited by retail investors into protocols and contracts has remained stable at around 36 million ETH since ETH peaked near $4,900. Despite these positive signs, it is still too early to confirm whether the price of ETH will break out of its current sideways trend.

However, this positive outlook still faces numerous challenges. Many on-chain indicators suggest that selling pressure from retail investors in the US shows no sign of abating.