All that has passed is but a prologue.

As 2025 comes to a close, looking back at the US stock market and global financial markets over the past 12 months, it is difficult to summarize this year with linear terms such as "rise" or "correction." Instead, it is more like a series of dramatic and mutually reinforcing structural changes— technological acceleration, capital expansion, political polarization, and institutional loosening occurred simultaneously and were amplified by each other within the same cycle.

I tried to approach the market from a timeline perspective, and also attempted to use market fluctuations as the main axis. However, I quickly discovered that what truly shaped the market landscape of 2025 was not a few landmark highs or crashes, but rather a series of recurring and overlapping main narratives. When strung together, the underlying theme of 2025 becomes exceptionally clear—it is a year of high contradictions, yet one with a strong sense of direction.

- On one hand, high walls are rising one after another: AI uses extremely high capital density to build new entry barriers, tariffs and trade frictions are escalating repeatedly, political polarization continues to deepen, and the 43-day government shutdown has brought "intensified partisan strife" to the forefront in such a direct way;

- On the other hand, the barriers are crumbling one after another: the regulatory attitude towards AI/Crypto is loosening systematically, financial infrastructure is being upgraded across the board, and Wall Street is reshaping "trading, clearing, and asset forms" in a more open and engineered way;

In other words, 2025 is a macro-level watershed: the old order is reinforcing its boundaries, while the new order is dismantling frictions, and the clash between these two forces constitutes the underlying noise of all market trends and narratives this year.

In retrospect, 2025 was undoubtedly a memorable year for investment. If you successfully avoided the dramatic fluctuations in cryptocurrencies, you could experience a long-awaited sense of making money amidst the general rise in US stocks, Hong Kong stocks, A-shares, and major asset classes such as gold and silver . Just like at the opening of the Snowball Carnival a few days ago, Fang Sanwen, as usual, posed the classic question: "Those who made money this year, please raise your hands?" And the audience responded with a flood of raised arms almost simultaneously.

For this reason, I ultimately abandoned using a single timeline to tell the story of 2025, and no longer tried to summarize the year with a few crashes and new highs. Instead, this article chooses to break it down into ten recurring, overlapping main narratives to review the key turning points of the US stock market and global financial markets in 2025, and to attempt to answer a longer-term question:

What truly changed this year?

I. Power Convergence: Silicon Valley Right Wing, Crypto Elites, and the New Washington

On January 20, 2025, with the new US administration taking office, the Silicon Valley right wing and the crypto upstarts completed a rare power convergence and quickly launched a "blitzkrieg" against the traditional establishment. It can be said that this meeting was directly embodied in a series of subversive personnel arrangements, policy priorities and regulatory attitudes.

The first to be thrust into the spotlight was naturally Elon Musk, wielding the scalpel of DOGE (Department for Government Efficiency). During his brief but high-pressure intervention, he tackled the long-standing overlapping functions of the regulatory system, particularly in the AI-related field, pushing for the abolition or merger of AI-related regulatory functions within the Federal Communications Commission (FCC) and the Federal Trade Commission (FTC). This move, to some extent, broke the traditional path of bureaucratic intervention in the boundaries of technology and significantly reduced institutional friction in emerging technologies such as AI.

Following closely behind was an epic vindication for the crypto industry. With Gary Gensler stepping down as chairman of the U.S. Securities and Exchange Commission (SEC), the "enforcement-style regulation" that had long loomed over the crypto market began to loosen. The new SEC chairman, Paul Atkins, quickly pushed for the release of the "Statement on Securities Offerings and Registration in the Crypto Asset Market," shifting the regulatory focus to rule-making and project compliance.

With this systemic shift, many pending cases have come to a temporary close, including the withdrawal or downgrading of long-term investigations and accusations against projects such as Coinbase (COIN.M), Ripple, and Ondo Finance. Crypto has officially returned to the policy discussion table from being a target of law enforcement.

What's even more intriguing is the deep connection between the core members of the new government and tech and crypto capital: from the Trump family's direct involvement in projects like Trump/Melania tokens and WiFi (USD1), to Treasury Secretary Scott Bessent, Commerce Secretary Howard Lutnick, Director of National Intelligence Tulsi Gabbard, and Secretary of Health and Human Services Robert F. Kennedy Jr., it can be said that from the president and his core staff to a group of cabinet officials, a group of decision-makers who deeply embrace AI, the Silicon Valley tech right wing, and even crypto are systematically entering the center of power.

At the same time, the new Washington's attitude toward AI has also undergone a fundamental change. From "Eliminating Barriers to U.S. AI Leadership" and "The U.S. AI Action Plan" to "AI Caretaker Act," the policy narrative has shifted from "preventing risks" to "ensuring absolute leadership (to China)," which has enabled a large number of AI companies in vertical fields to thrive in the secondary market.

The most representative examples are companies like Palantir (PLTR.M) and Anduril (not yet listed), which have strong right-wing leanings and a "technology for the country" label. In 2025, they became one of the hottest targets on Wall Street, with their market value and valuation rising rapidly.

Objectively speaking, over the past decade, emerging technology fields represented by AI and crypto have become the engine of wealth growth. These emerging industries emphasize efficiency, innovation, and decentralization, and the call for "less regulation" has become a common demand. Therefore, the current power convergence between the Silicon Valley right wing and the crypto upstarts is essentially a phase of celebration surrounding "technological freedom, capital efficiency, and deregulation." The market even once regarded deregulation and technological supremacy as the only path to prosperity.

However, the problem lies in the fact that the stability of this narrative itself is cause for concern, because the path of liberalization and deregulation will inevitably further strengthen the dominant position of tech giants and capital giants—technologies such as AI and crypto will concentrate wealth more efficiently, accelerate the widening gap between the rich and the poor, and further marginalize the interests of Trump's base, including Rust Belt workers, social conservatives, and the anti-globalization middle class.

As the 2025-2029 political cycle progresses, especially with the 2026 midterm elections approaching, electoral pressure, macroeconomic and fiscal constraints will gradually return to the core of policy. The seemingly solid alliance of capital is very likely to break apart. I have always believed that in the next four years or even longer, how to find a balance between the pursuit of efficiency by "new money" and the maintenance of stability by "old money" will determine the final direction of this power reshuffle.

This not only concerns the political and economic structure of the United States itself, but will also have a deeper impact on the evolution of global capitalism in the new technological era.

II. AI: When Capital Builds High Walls, the CapEx Drama Reaches a Climax

If the focus of AI competition in 2023–2024 was still on “who has larger model parameters and higher test scores,” then 2025 will be a year of returning to common sense and competition entering a deeper phase: the moat of AI will be redefined, no longer a single model breakthrough, but who has the ability to withstand the heavy pressure of CapEx (capital expenditure) over a sufficiently long period of time.

Looking back at the timeline, the contrast between the beginning and the end is quite humorous. After all, at the very beginning of 2025, the Chinese AI startup DeepSeek released DeepSeek-R1, which indeed greatly impacted the pricing logic of the global AI market with its low cost, high efficiency, and open-source approach. For the first time, it shook the long-standing myth of "piling up computing power" in Silicon Valley and sparked a global re-discussion about whether "computing power really needs to be so expensive."

It was precisely because of this impact that market skepticism about the return on investment of AI reached its peak. On January 27, Nvidia's (NVDA.M) stock price plummeted by 18% in a single day, bringing the "small model + engineering optimization" approach back into the mainstream view.

However, the paradox lies precisely in this: although the efficiency revolution brought about by DeepSeek is widely regarded as the "Sputnik moment" in the AI world, in the game between the leading players, the ultimate battlefield of AI competition has actually shifted from model architecture to electricity, infrastructure, and the cash flow from continuous investment in this year.

This is specifically reflected in two subdivisions:

- On the one hand, the physical world foundation supporting these models is becoming more expensive than ever before . Giants such as OpenAI, Meta (META.M), and Google (GOOGL.M) have almost simultaneously escalated the arms race, continuously revising their CapEx expectations upwards. The market predicts that the cumulative CapEx of these giants will reach $2-3 trillion between 2025 and 2030.

- On the other hand, Chinese AI giants such as OpenAI, Google, and Alibaba (BABA.M) are also engaging in a full-scale competition in technology, ecosystem, and commercialization, leveraging their respective strengths, and attempting to build a complete closed loop covering entry point—cloud—computing power—applications. The competition in AI has entered a system engineering game .

It can only be said that the old order was indeed disrupted during the brief window of opportunity. However, through rounds of back-and-forth struggle, the market has gradually formed a new consensus: the AI race is still a marathon with no end in sight. The real moat is not whether the model itself is smarter, but rather who can withstand higher capital expenditure intensity and the ability to continue investing.

In other words, the impact of DeepSeek on the old order at the beginning of 2025 did not end the "expensive" nature of AI, but instead pushed it into a more brutal and realistic stage: a high wall built by capital, energy and time is slowly closing at the entrance to the AI world.

However, entering the fourth quarter of 2025, the market's pricing logic for AI has begun to show a subtle but crucial shift. For example, there is a "divergence" in stock performance based on financial reports—for instance, Oracle (ORCL.M) and Broadcom (AVGO.M) saw significant stock price pullbacks after their latest quarterly earnings reports. This is not due to a slowdown in AI-related revenue, but rather because the market has begun to reassess a question: with CapEx already fully leveraged, is the next phase of growth still linearly predictable?

In contrast, Micron Technology (MU.M)'s financial report within the same time window became a new anchor for capital. HBM's order visibility, price improvement, and profit release pace transformed it from a beneficiary of the AI narrative into a direct recipient of profit certainty, and quickly obtained repricing of funds.

The contrast between the hot and cold AI investments signifies that the market is no longer indiscriminately rewarding AI relevance, but rather distinguishing between those burning through CapEx and those reaping the benefits. From a broader perspective, this also marks a new phase in AI investment paradigms, moving from an infrastructure arms race to an audit of cash flow and rate of return.

Capital has not wavered in its long-term belief in AI, but it is no longer willing to pay a premium for every high wall —and this reordering of monetization capabilities and profit paths may be the most core and most repeatedly priced object in 2026.

III. Tariff Storm and its Dramatic Clash with the Old and New Geopolitical Order

By 2025, tariffs will no longer be just a macroeconomic variable, but will have officially become the "number one killer" of risk appetite in the US stock market.

Against the backdrop of historically high valuations and liquidity being extremely sensitive to policy, April 2, 2025, was dubbed "Liberation Day" by the White House. Trump signed an executive order announcing a 10% benchmark tariff on all imported goods in the United States and imposing precise "counter-tariffs" on countries with huge trade deficits.

This policy instantly triggered the most severe structural shock to global financial markets since the 2020 pandemic.

The sharp declines from April 3rd to 4th have become one of the most representative "stress tests" in recent years. Major US stock indices all experienced their biggest drops since 2020, with a market capitalization loss of approximately $6.5 trillion. The Nasdaq Composite Index and the Russell 2000 Index even entered a technical bear market (i.e., a drop of more than 20% from their highs).

Subsequently, the market entered a long period of policy negotiation. Although there was an AI-driven rebound in May due to the positive impact of the "90-day negotiation buffer period", the market experienced a deep correction similar to that in April in October as the government shutdown crisis and tariff uncertainty reignited.

From a higher perspective, the essence of this round of tariff storms is not a short-term reversal of trade policies, but the last counterattack of the old trade order under the new industrial structure. After all, in the past few decades, the benefits of globalization have been built on three premises: low tariffs, efficient cross-border supply chains, and a relatively stable geopolitical framework.

However, in this new phase where AI, semiconductors, energy, and security are highly intertwined, trade is no longer just a matter of efficiency, but has become an extended battleground for national security, industrial control, and technological sovereignty . For this reason, tariffs will be repriced in 2025. They are no longer merely a cyclical policy tool, but are seen by the market as a structural friction cost in the process of geopolitical restructuring, becoming a source of uncertainty that cannot be easily hedged but must be incorporated into the long-term pricing system.

This change also marks a new stage in the global capital market, where any company and any profit must include a high "geosecurity cost" in addition to its operations/profits.

IV. Pullback, Clearing, and Recovery: US Stocks Remain Steadfast as the "Anchor of Global Risk Assets"

However, if the tariff storm in April was an extreme stress test, then the subsequent market performance actually tested the true "quality" of the US stock market: the pullback was fierce, but the recovery was equally rapid. Funds did not withdraw for a long time, but quickly flowed back into the core market after a brief period of deleveraging.

This textbook demonstration of resilience is not only reflected in the speed of price recovery, but also in its status as the ultimate safe haven for global liquidity—in an environment of rising global uncertainty, US stocks remain the place where capital is most willing to "return."

Looking at the entire year's timeline, this resilience is not accidental. On February 19, 2025, the S&P 500 reached a record high. Although it subsequently experienced repeated fluctuations due to concerns about an AI bubble and the impact of tariffs, the index did not suffer a trend reversal. Instead, it continuously completed structural reassessment amidst the volatility. This structural "stabilizing force" was further strengthened at the end of the year.

As of the time of writing, the Nasdaq 100 (QQQ.M) is up 21.2% for the year, with the technology narrative remaining the underlying driver of growth; the S&P 500 (SPY.M) is up 16.9%, steadily breaking out of its range amid high-frequency trading; and the Dow Jones and Russell 2000 (IWM.M) are up 14.5% and 11.8% respectively, completing the structural puzzle from "value reversion" to "small and mid-cap recovery".

Although precious metals such as gold (GLD.M) and silver (SIVR.M) showed a more dazzling performance in absolute returns in 2025, the value of US stocks does not lie in running the fastest, but in their irreplaceable structural profit-making effect. It is both a deep-water port in complex geopolitical games and a source of certainty for global capital to repeatedly anchor in a highly volatile environment.

When tariffs escalate friction, geopolitics amplifies noise, and technological revolutions reshape industrial structures, US stocks do not shy away from risks; instead, they absorb risks, repric the risks, and ultimately bear the risks.

This is precisely why, in 2025, a year of intense clashes between the old and new orders, US stocks were able to firmly sit on the "anchor of global risk assets."

V. Computing Power Equals Power: From Nvidia's 5 Trillion GHz to the "Rebuilding Infrastructure" Echoes in Various Sub-sectors

If US stocks are to firmly establish themselves as the "anchor of global risk assets" by 2025, then the heaviest link in that anchor chain will undoubtedly be computing power.

On October 29, 2025, the global capital market witnessed a historic moment when NVIDIA (NVDA.M)'s market capitalization broke through $5 trillion, becoming the first company in the history of the capital market to achieve this milestone. Its size has exceeded the total market capitalization of the stock markets of many developed countries such as Germany, France, the UK, Canada, and South Korea.

More symbolically significant is the non-linear acceleration trajectory of its market capitalization leap: it took 410 days for its market capitalization to jump from 3 trillion to 4 trillion, and only 113 days to jump from 4 trillion to 5 trillion . This change itself is difficult to explain by performance growth, marking that the market has begun to price core assets using a new scale of "computing power hub".

Objectively speaking, Nvidia's significance has long transcended the growth narrative at the individual stock level. Thanks to the close integration of its GPU and CUDA ecosystems, it holds a crucial 80%–90% share of the AI chip market. Furthermore, the extreme reliance of large-scale model training and inference on massive computing power makes it an indispensable infrastructure node in the entire AI industry chain.

But it was precisely during this stage that the market gradually realized that the limits of computing power were hitting the boundaries of the physical world. As a result, the logic behind the hype surrounding AI stocks underwent a profound shift. The bottleneck was no longer solely in GPUs themselves, but rather propagated downstream along the industry chain: computing power → memory → electricity → energy → infrastructure.

This transmission chain also directly triggered a round of capital linkage across multiple sub-sectors.

The first sector to be ignited was memory and storage. As the scale of AI training and inference continued to expand, the bottleneck of computing power began to shift from GPUs to HBM (High Bandwidth Memory) and the storage system itself. In 2025, HBM continued to be in short supply, and the price of NAND flash memory entered a new upward cycle. This also led to the outstanding performance of Micron Technology (MU.M), Western Digital (WDC.M), and Seagate Technology (STX.M) with a year-on-year growth of 48%-68%.

At the same time, data centers, a typical "power-consuming behemoth," have enabled companies with nuclear power assets and independent power grids to begin to control the hard currency of the AI era. As a result, in 2025, many energy and utility companies that were originally considered defensive assets actually followed the trend of technology stocks: Vista Corp (VST.M) +105%, Constellation +78%, and GE Vernova +62%.

This spillover effect has even extended to Bitcoin mining companies, which were originally considered old-cycle assets . As AI crowds out and redistributes electricity resources, former mining companies such as IREN (IREN.M), Cipher Mining (CIFR.M), Riot Platforms (RIOT.M), Core Scientific (CORZ.M), Marathon Digital (MARA.M), Hut 8 (HUT.M), CleanSpark (CLSK.M), Bitdeer (BTDR.M), and Hive Digital (HIVE.M) have been reintegrated into the new valuation framework of "computing power-energy".

Of course, the AI chip market is not without its ups and downs as the year draws to a close. In November, Google's Gemini 3 surpassed OpenAI's GPT-5.1 in multiple benchmark tests. At the same time, the market is reporting that Google plans to sell its self-developed TPU chips on a large scale and double its TPU production to 7 million units by 2028, a 120% increase over previous expectations.

Even more impactful is the pricing strategy. Morgan Stanley predicts that Google's TPU cost is only one-third of Nvidia's. This will undoubtedly force the AI chip market to return to a business game of "cost-effectiveness" rather than a pure "scarcity" monopoly, posing a structural challenge to Nvidia's market share and ultra-high gross margin.

VI. Trump-style Capitalism: From Increased Political Polarization to State Intervention in Capital

If AI and tokenization are the "technological manifestations" of 2025, then the institutional fluctuations caused by political polarization and the profound shift in US industrial policy constitute the most complex "underlying background" of 2025.

That year, the market witnessed an unprecedented 43-day shutdown of the U.S. federal government. Widespread flight delays, disruptions to food aid programs, a standstill in public services, and hundreds of thousands of federal employees being forced to take unpaid leave... It can be said that this stalemate, which lasted for more than a month, impacted people's livelihoods and the economy in almost every capillary of American society.

But what is more alarming than the economic losses is the institutional signal this shutdown sends to the market. Political uncertainty is transforming from a "predictable event" into a source of systemic risk. In the traditional financial framework, risk can be priced, hedged, and postponed; but when the system itself frequently fails, the market's options shrink dramatically, forcing it to either increase the overall risk premium or withdraw in stages.

This also explains why the US stock market experienced several sharp corrections in 2025, which were not due to the deterioration of any particular macroeconomic data, but rather more like a series of severe stress tests on the reliability of the system by the market.

In this highly polarized political environment, the economic governance logic of the new US government has also begun to show a more distinct characteristic: the national will is no longer satisfied with traditional subsidies and tax incentives, but chooses to directly intervene in the capital structure.

Unlike past industrial policies that primarily relied on subsidies, tax breaks, and government procurement, a more controversial and symbolic shift began to emerge in 2025: moving from "funding subsidies" to "direct equity investment," building an equity-based support system with "financial participation." I have also seen many discussions about the path of "Trump-style capitalism" or "a variant of state capitalism."

The Intel (INTC.M) agreement was the first shot fired, marking a milestone in the agreement with the federal government. The U.S. government will directly acquire 10% of Intel's equity, signifying that the U.S. federal government has begun to play the role of a long-term shareholder in key strategic industries.

From the perspective of supporters, this shift is not without logic. After all, for many fields that are at the forefront of technology but are still in the early stages of commercialization (such as quantum computing), direct government investment can theoretically significantly reduce financing uncertainty, extend the cash flow runway of enterprises, and provide stable expectations for long-term R&D. Moreover, compared with one-time subsidies, equity support is also considered to be more in line with the policy goal of "long-termism".

As a result, rumors circulated that the U.S. government might consider exchanging federal funds for equity stakes in IonQ (IONQ.M), Rigetti Computing (RGTI.M), and other quantum computing companies. However, the U.S. Department of Commerce quickly denied this, stating that it had not engaged in formal negotiations regarding acquiring stakes in the aforementioned quantum computing companies.

This clarification reflects both the ongoing back-and-forth negotiation regarding policy boundaries and the highly sensitive nature of this issue. In fact, the core issue is not whether the government has actually acquired a stake in a particular quantum company, but rather how the market should re-evaluate the boundaries of policy, capital, and risk when the state begins to intervene in cutting-edge technology industries as a shareholder.

This kind of resource allocation driven by national will was the original sin that Western media and capital markets have criticized and questioned for decades regarding China's photovoltaic, new energy, and other industrial policies. Now, this boomerang has circled halfway around the world and hit the United States right in the face.

VII. Decoupling of Monetary Policies among Major Countries: The Federal Reserve Moves Left, the Bank of Japan Moves Right

Beyond industrial policies, changes in monetary policy in 2025 further reveal that the space for macroeconomic control is systematically shrinking.

Amid the ongoing tug-of-war between inflation and employment, the Federal Reserve officially restarted its interest rate cut cycle in September 2025, followed by a 25 basis point cut in October and December, for a total of 75 basis points cut throughout the year.

However, in the current macroeconomic environment, the market's understanding of this round of interest rate cuts has already changed. It is clear to everyone that this is not the beginning of a return to an easing cycle, but rather more like a "pain relief" measure to exert pressure on the economic system and even politics. This also explains why multiple interest rate cuts have failed to dispel market uncertainty as expected. The US stock market has not ushered in an indiscriminate liquidity frenzy, but has instead become more structurally differentiated.

Ultimately, everyone is becoming increasingly aware of a reality: the available space for monetary policy is becoming increasingly limited , especially under the constraints of high debt, high fiscal deficits and structural inflation, the Federal Reserve can no longer support the market through large-scale easing as it has in the past.

To put it bluntly, every interest rate cut these days is more like drinking poison to quench thirst, rather than creating new growth momentum.

In stark contrast, while the Federal Reserve shifted to cutting interest rates, the Bank of Japan is firmly pushing forward with the normalization of monetary policy. On December 19, the Bank of Japan announced a 25 basis point rate hike, raising the policy rate to 0.75%, the highest level since 1995. This is also the fourth rate hike by the Bank of Japan since ending its eight-year negative interest rate policy in March 2024.

On December 26, the day this article was written, according to Jinshi Data, although the decline in Tokyo's inflation exceeded expectations and pressure on food and energy prices eased, the market generally believes that this is not enough to stop the Bank of Japan from continuing its interest rate hike process. The divergence in global monetary policies between the two is being brought to the forefront and is also severely squeezing the space for yen carry trades that have been maintained for several years, forcing global funds to reassess the risk structure across currencies and markets.

Objectively speaking, by 2025, monetary policy has gradually lost its "magic wand" aura. With the deeper involvement of state capital and the continuous rise of geopolitical barriers, interest rates are no longer a universal lever for regulating the economy, but rather more like a painkiller to prevent the system from collapsing acutely.

Among the world's major central banks, Japan is becoming the "last bastion" of global liquidity tightening, which could very well become one of the most formidable sources of risk in 2026.

8. The Fed's "Tightrope": Interest Rate Cut Cycle and New Leader Outlook

At the same time, the intrusion of political pressure is causing the Federal Reserve's "altar" to gradually crumble.

In 2025, Trump's attacks on Powell extended from the Fed to the White House. With Powell's term ending in May 2026, the market has already begun trading in advance the policy orientation of the "next Fed chairman" or even the "current shadow Fed chairman".

If the "loyal doves" represented by Kevin Hassett ultimately emerge, then the Federal Reserve, following the White House's lead, is very likely to release more aggressive liquidity signals in the short term. That means Bitcoin and Nasdaq may usher in an emotion-driven frenzy, but the cost could be another loss of control over inflation expectations and further erosion of the dollar's credibility.

If the successor is closer to the "reformist" path of Kevin Warsh, the market may experience a period of growing pains due to tightening liquidity. However, under the framework of deregulation and a sound monetary policy, long-term capital and traditional financial institutions may actually gain a greater sense of institutional security (further reading: " The Fed's 'Successor' Reversal: From 'Loyal Dove' to 'Reformist,' Has the Market Script Changed? ").

We cannot predict who will be "the last person to speak with Trump," and this unpredictable state of mind may continue until the selection is finalized.

We cannot predict who will be "the last person to speak with Trump," and this unpredictable state of mind may continue until the selection is finalized.

But regardless of who ultimately wins, one fact remains unchanged: interest rates themselves are gradually evolving from an economic variable into part of the political game. After all, in 2020, Trump could only criticize Powell on Twitter; but in 2025, Trump, returning with an overwhelming victory, will no longer be content to be merely a bystander.

Whether the actors on stage are Hassett or Walsh may determine the direction of the plot, but the overall director of this show has firmly become Trump.

IX. The Financial Infrastructure Revolution: From 5x16 to 5x23, and then to 7x24?

If we were to identify the most easily underestimated yet potentially most likely long-term ripple effect of a change in 2025, the answer wouldn't lie in a particular star stock or sector, but rather in the trading system itself.

This is also the most far-reaching, yet most easily obscured, invisible change in 2025. At the institutional level, Wall Street has officially decided to proactively dismantle its walls and move towards tokenization and 24/7 liquidity.

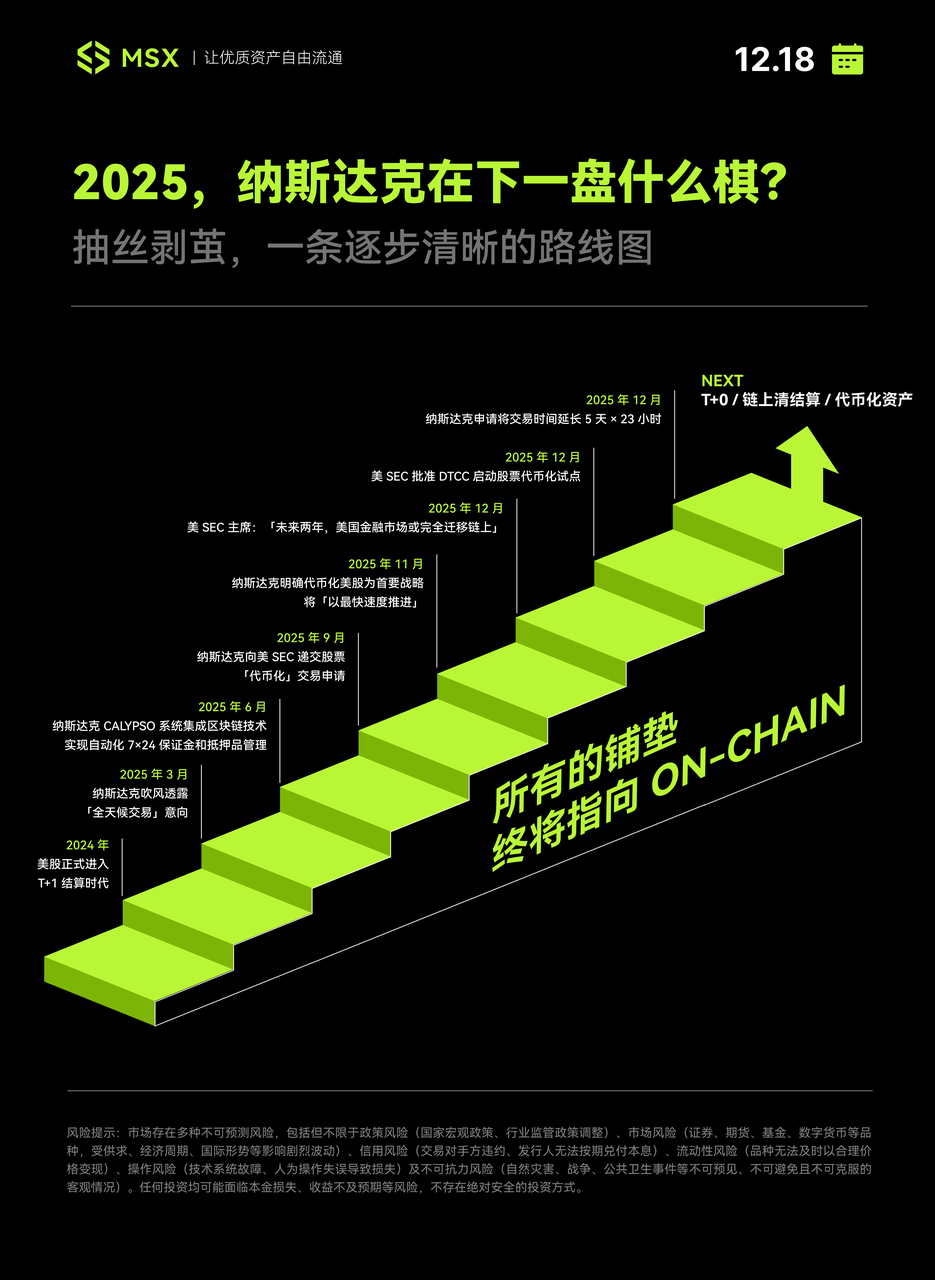

If we take a longer view and connect Nasdaq's recent flurry of moves, we become even more convinced that this is a carefully orchestrated, step-by-step strategic puzzle. The core objective is to eventually give stocks the ability to circulate, settle, and price like tokens. To this end, Nasdaq has chosen a gentle, traditional financial reform path, advancing layer by layer:

- The first step occurred in May 2024, when the US stock settlement system was officially shortened from T+2 to T+1. This was a seemingly conservative but actually crucial infrastructure upgrade.

- Then, in early 2025, Nasdaq began signaling its intention to offer "24/7 trading," hinting at plans to launch five-day-a-week uninterrupted trading services in the second half of 2026.

- Subsequently, Nasdaq integrated blockchain technology into the Calypso system to achieve 24/7 automated margin and collateral management. This step had almost no obvious impact on ordinary investors, but it was a very clear signal for institutions.

- By the second half of 2025, Nasdaq began to make positive progress at the institutional and regulatory levels. First, in September, it formally submitted an application to the US SEC for stock "tokenization" trading; then in November, it openly stated that tokenizing US stocks was a top strategic priority and that it would "promote it at the fastest speed."

- Almost simultaneously, SEC Chairman Paul Atkins stated in an interview with Fox Business that tokenization is the future direction of capital markets. By putting securities assets on the blockchain, clearer ownership confirmation can be achieved. He predicted that "within the next two years, all markets in the United States will migrate to the blockchain and achieve on-chain settlement."

It is against this backdrop that Nasdaq submitted an application to the U.S. SEC in December 2025 for a 5x23-hour trading system. In this context, The Economist also published an article discussing "How RWA Tokenization is Changing Finance," and put forward a rather symbolic analogy: if history can be used as a reference, the stage of tokenization today is roughly equivalent to the Internet in 1996 —when Amazon only sold $16 million worth of books, and three of the "Magnificent 7" that dominate the U.S. stock market today have not even been established yet.

From yellowed paper certificates to the electronic SWIFT system in 1977, and now to the atomic settlement of blockchain, the evolution of financial infrastructure is replicating, and even surpassing, the speed of the Internet.

For Nasdaq, this is a high-stakes gamble where "if you don't revolutionize yourself, you will be revolutionized"; for the Crypto industry and new RWA players, this is not only a brutal reshuffling of the fittest, but also a historic opportunity comparable to betting on the next "Amazon" or "Nvidia" in the 1990s.

10. The "Year Zero" of AI Agents: It exploded, but it doesn't seem to have fully exploded.

The term that is most frequently heard in 2025, yet always seems to be missing something, is undoubtedly "the first year of AI Agent".

If one word could describe this year's AI Agent market, it would be "explosive".

The market has long reached a clear consensus that AI is transforming from a passively responding dialog box into an agent capable of autonomously calling APIs, handling complex task flows, performing operations across systems, and even participating in decision-making in the physical world. The explosive popularity of Manus at the beginning of the year certainly fired the first shot (as of the time of writing, the latest news is that Meta has acquired Manus for billions of dollars, and Xiao Hong will become Meta's vice president). Subsequently, the emergence of multiple agent products such as Lovart and Fellou has given the market the illusion that "the application layer is about to explode".

However, to be realistic, while Agent has validated its direction, it has not yet scaled up. Early hit products quickly encountered problems such as declining user activity and usage frequency. Although they proved what Agent "can do", they have not yet answered the question of "why use it in the long term".

This is not a failure, but a necessary stage in the technology diffusion cycle.

In fact, neither OpenAI's CUA (Computer-Using Agent) nor Anthropic's MCP (Model Context Protocol) points to a specific application, but rather to a longer-term judgment: the capability curve of AI will be exceptionally steep in the next two years, but the real value release depends on system-level integration rather than single-point functional innovation.

Therefore, the AI Agent in 2025 is more like a directional tone setting. According to the diffusion law of innovative technologies, it takes at least three years from the "first year" to large-scale implementation. So, 2025 is just enough to complete the consensus switch from 0 to 1.

Of course, it is worth noting that as the year draws to a close, a new and dynamic variable is emerging – ByteDance's exploration of AI terminal forms is shifting the focus of Agents from software capabilities back to the fundamental issue of hardware entry points and scenario binding. This does not necessarily mean that AI phones will succeed immediately, but it serves as a reminder to the market that the ultimate goal of Agents may not lie in a particular App, but rather in becoming actors within the system.

This time, capital may have outpaced application, but once the direction was chosen, there was no turning back in 2026.

Conclusion | What did 2025 leave behind?

In a sense, 2025 is not a year that provides answers, but rather a "first year" of a collective shift.

Looking back on this year, the global capital markets seem to be in a labyrinth of paradoxes:

- On one hand, high walls continue to rise: global trade frictions are escalating, tariff barriers are returning, political polarization is intensifying, the shadow of government shutdowns looms, and great power rivalry is moving from the background to the forefront;

- On the other hand, the barriers are crumbling: a major shift in regulatory attitudes toward new technologies (SEC/CFTC policy reassessment), accelerated dismantling of barriers in financial infrastructure (full on-chain/tokenized assets), and the cross-temporal and cross-spatial productivity leap brought about by AI;

This absurd and contradictory landscape is essentially a result of political and geopolitical structures constantly erecting new boundaries, while Washington and Wall Street are attempting to dismantle the old fences of finance and technology.

In fact, the alarm bells had already been rung.

When precious metals such as gold and silver lead the gains among major asset classes this year, even outperforming the vast majority of tech stocks, we should perhaps realize that the prediction of a "major upheaval" is not a prophecy. After all, the AI game, with its capital expenditures of hundreds of billions of dollars, is destined to be unsustainable. The geopolitical games hanging over the global capital markets are pushing us toward the "Minsky moment" that was warned about many years ago—the collapse inflection point after overexpansion.

As Shakespeare wrote in Romeo and Juliet, "These violent delights have violent ends." As 2025 fades into the distance and the bells of 2026 are about to ring, what we need to deal with is likely not the outcome of a single event, but rather the natural extension of this structural state.

The real change may not lie in "what will happen," but in the fact that the market no longer allows participants to continue pretending that nothing will happen.

Goodbye 2025; Hello 2026.