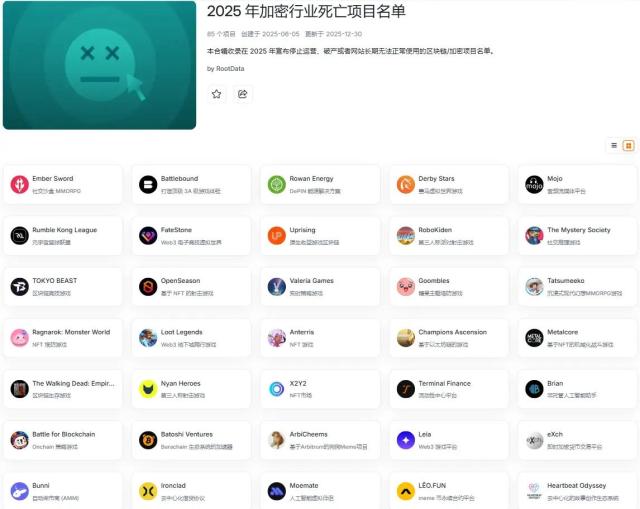

✨ KEY PREDICTIONS FOR 2026 (According to @glxyresearch) 1⃣ Bitcoin could reach $250,000, but not in 2026. Galaxy believes Bitcoin still has a strong upward trend in the long term and could reach the $250,000 mark by the end of 2027. However, 2026 alone is XEM to have too many variables: the macroeconomic situation is unpredictable, and the options market shows very wide price ranges. Therefore, it is not an "easy" year to trade, even though the long-term trend remains positive. 2⃣ Internet Capital Markets on Solana reach a Capital of $2 billion. @ Solana 's on-chain economy is shifting away from short-term meme cycles and towards business models capable of generating revenue. This change is expected to boost the size of Internet Capital Markets on Solana from approximately $750 million to $2 billion. 3. Blockchain must solve the question of "what are Token used for?" Galaxy argues that the biggest challenge facing blockchains today is the ability to create value for their native Token . Since the majority of economic value lies in its application, Layer 1 blockchains will have to change how they operate so that Token are more closely tied to cash flow and network activity. 4. Solana will not be able to reduce inflation in 2026. Galaxy predicts that none of Solana 's proposed inflation reduction measures will be approved in 2026. The reason is that the community has yet to reach a consensus, and the focus of development is prioritized on improving market structures rather than controlling inflation. 5⃣ Large businesses are starting to use blockchain for real payments. Galaxy predicts that at least one Fortune 500 corporation will deploy its own blockchain to process real-world financial transactions, with a total value exceeding $1 billion. These blockchains will remain connected to the public blockchain to leverage liquidation and the DeFi ecosystem. 6. Stablecoins surpass traditional money transfer systems. Galaxy predicts that the volume will surpass the US ACH system. The main drivers are stablecoins, which are fast, low-cost, and operate continuously. However, the stablecoin market will gradually become concentrated in a few major coins backed by banks and distribution platforms. 7⃣ DEXs account for over 25% of Spot Trading . Galaxy predicts that by the end of 2026, decentralized exchanges will account for more than 25% of the total spot crypto volume . Currently, this figure is around 15-17%. The main reason is that on-chain transactions don't require complex KYC procedures and have a more competitive fee structure. 8 Crypto ETFs are booming in the US. Galaxy predicts: - Over 100 crypto ETFs have been launched in the US. - Net inflows into crypto spot ETFs exceeded $50 billion. - Bitcoin is included in the standard investment portfolios of institutions with a weighting of approximately 1-2%. This shows that crypto, especially Bitcoin, is gaining increasing acceptance within the traditional financial system. 9⃣ The crypto market is entering a strong consolidation phase. Many weak crypto models will not survive. Companies that simply hold digital assets but lack a clear strategy, or projects where the Token has no specific economic Vai , may be forced to sell, be merged, or shut down. ✍️ Qing

This article is machine translated

Show original

Upside GM

@gm_upside

🎯 Researcher quỹ Pantera dự đoán gì về 2026?

Lại đến mùa tổng kết và dự đoán. Dưới đây là 12 góc nhìn của Jay Yu @0xfishylosopher:

1⃣ Tín dụng tiêu dùng tối ưu vốn

Cho vay crypto sẽ bước sang giai đoạn mới: dùng dữ liệu on-chain lẫn off-chain để chấm x.com/gm_upside/stat…

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content