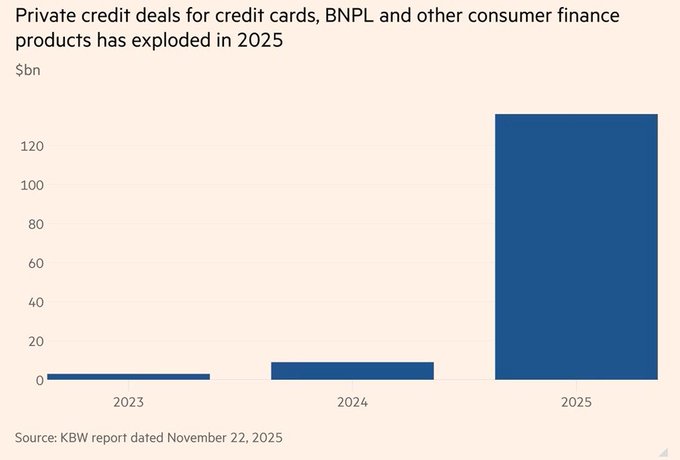

The current private credit boom is unprecedented:

Private credit firms purchased or committed to buy a record $136 billion of consumer loans in 2025.

This includes credit cards, buy now pay later (BNPL), and other consumer finance products.

This is nearly +1,300% more than in 2024, when purchases totaled $10 billion.

In other words, private investment funds are increasingly owning consumer debt.

One example is KKR, which agreed to buy a multibillion-Dollar portfolio of credit card loans from New Day, a private equity-backed lender in Europe.

Most of this debt is not backed by assets, so if borrowers stop making payments, these funds have limited options to recover the capital.

Private credit firms are taking on more risk than ever.

Unsecured asset-based finance is now the primary engine of private credit growth.

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content