Polygon: A Trillion-Dollar Architecture for Non-USD Stablecoins and Global Payment Flows As of early 2026, Polygon (@0xPolygon) had established itself as the preferred global non-USD stablecoin and real-world payment platform. The Polygon network demonstrated phenomenal growth throughout 2025: ① Core Data Explosion: Cumulative non-USD stablecoin transaction volume exceeded $11.1 billion ② Real-world Adoption: Revolut processed over $690 million in traffic; Stripe's stablecoin settlement volume on Polygon exceeded $50 million ③ Bank-Grade: In early 2026, Telcoin successfully launched eUSD, the first stablecoin backed by a US bank, on Polygon (@0xPolygon) ■ Performance Suppression from the "Gigagas" Roadmap to the "Rio" Architecture Polygon's ability to handle massive payment flows stems from its continuous iteration of "payment-grade" infrastructure: ➡️ Realization of the Gigagas Roadmap ➡️ Rio Upgrade and VEBloP Model ➡️ Cross-chain functionality of the AggLayer Polygon @0xPolygon is evolving from an Ethereum scaling solution into an internet-level global financial operating system. By supporting the Euro, Japanese Yen, and various local currency stablecoins, Polygon is breaking the US dollar's single monopoly in the digital asset field, providing efficient on-chain payment paths for non-dollar economies.

This article is machine translated

Show original

syk233 MemeMax

@syk233

01-04

Flipster USDe 生息:以 20% 年化收益引领稳定币

在 2025 年底至 2026 年初的市场环境下,交易者往往面临两难选择:是将稳定币存入借贷获取收益(如 Aave 的 6.6%),还是将其锁仓在 DeFi 协议中丧失流动性以换取高收益

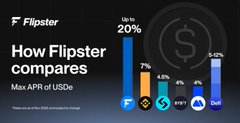

Flipster @flipster_io 通过推出最高 20% APR 的 USDe x.com/flipster_io/st…

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content