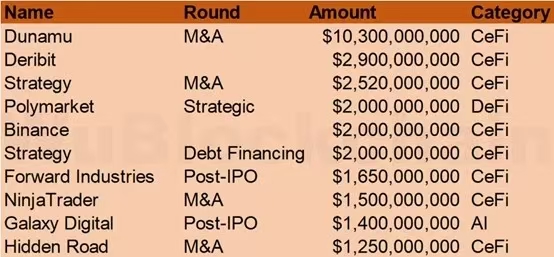

The prevailing sentiment is that it's still a bear market, and many VCs have stopped investing. However, in 2025, total Crypto funding surged to $49.75 billion, more than quadrupling. A closer look at the data reveals that the majority of this $50 billion came from acquisitions, primarily driven by blockbuster projects exceeding $1 billion. Therefore, the funding market is forming a barbell structure. Startups don't need much initial capital. If the product-market fit (PMF) is good and the company is profitable from the start, the founders will pool their money. If you really need funding, ICOs and ICT (like PF's Creator Fee) can provide initial startup capital, and of course, there's Binance's @EASYResidency. Speaking of which, my second year at Huobi was during the 2022 bear market. I was mainly involved in Incubator, a project whose concept was very similar to the current EASYResidency: providing comprehensive, long-term support for earlier-stage projects. However, subsequent internal and external factors distorted this concept significantly... Many of the projects we incubated were selected for MVB and EASY Residency after 2023, some even becoming Top 1/Top 2 in their respective sectors. It's impossible not to feel regret, but without MVB and EASY Residency, these projects might not have been so successful...

This article is machine translated

Show original

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share