Source: Haseeb Qureshi, Managing Partner of Dragonfly

Compiled by: Azuma ( @azuma_eth ), Odaily

Editor's Note: Remember the news not long ago about Russian cryptocurrency billionaire Roman Novak and his wife Anna being found dismembered and buried on a Dubai beach? In 2025, another undercurrent in the cryptocurrency industry is the increasing frequency of physical violence against cryptocurrency holders, especially the wealthy.

Haseeb Qureshi, a highly recognizable industry figure and managing partner of Dragonfly, today analyzed data on violent incidents in the cryptocurrency field in recent years, explaining that he wrote the article because he was "growing increasingly afraid." Data shows that in 2025, there were 65 violent incidents in the industry, including four fatal ones—not only is the number of attacks rising rapidly, but the attacks themselves are also becoming more violent. Haseeb thoughtfully included some personal safety advice at the end of the article.

The following is the full text of Haseeb's Odaily, translated by Odaily.

Are personal attacks against cryptocurrency holders on the rise?

Jameson Lopp has been quietly maintaining a database of so-called "wrench attacks" —attacks that forcibly force cryptocurrency holders to hand over their crypto assets. This is currently our closest source of "real-world benchmark data" to determine whether holding crypto assets becomes more dangerous over time.

I've become increasingly wary of these kinds of attacks lately, so I took the Lopp dataset and used a Vibe Coding-like approach to create some visualizations to see what's really going on. Here are my findings.

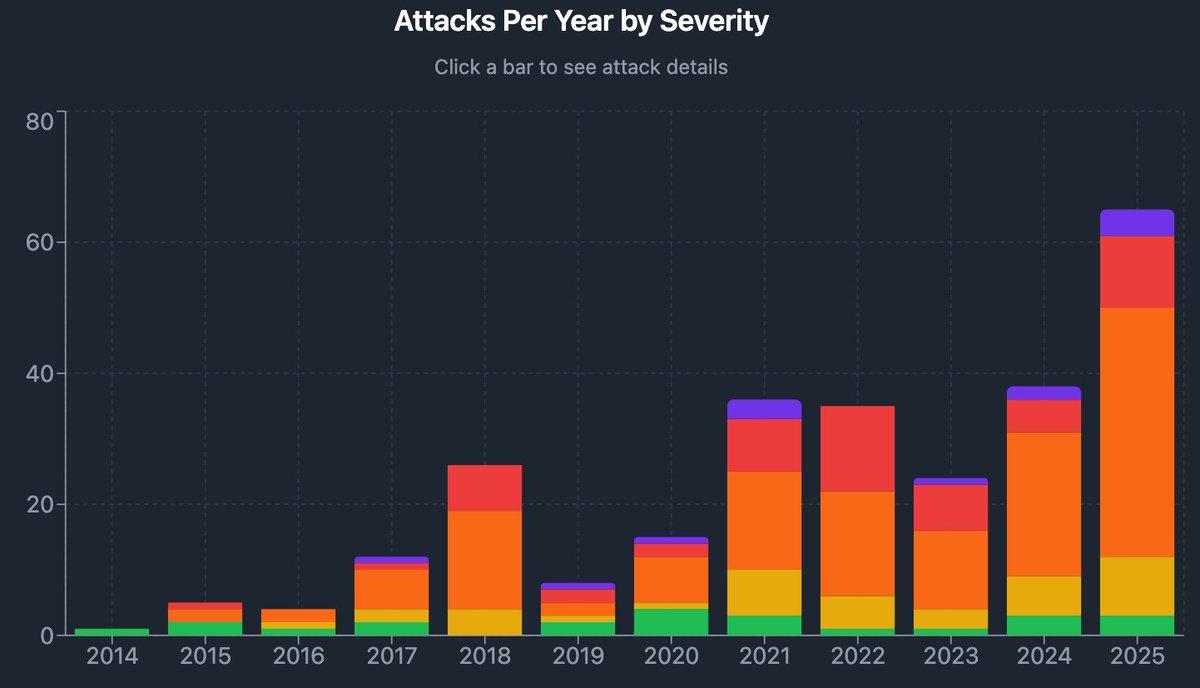

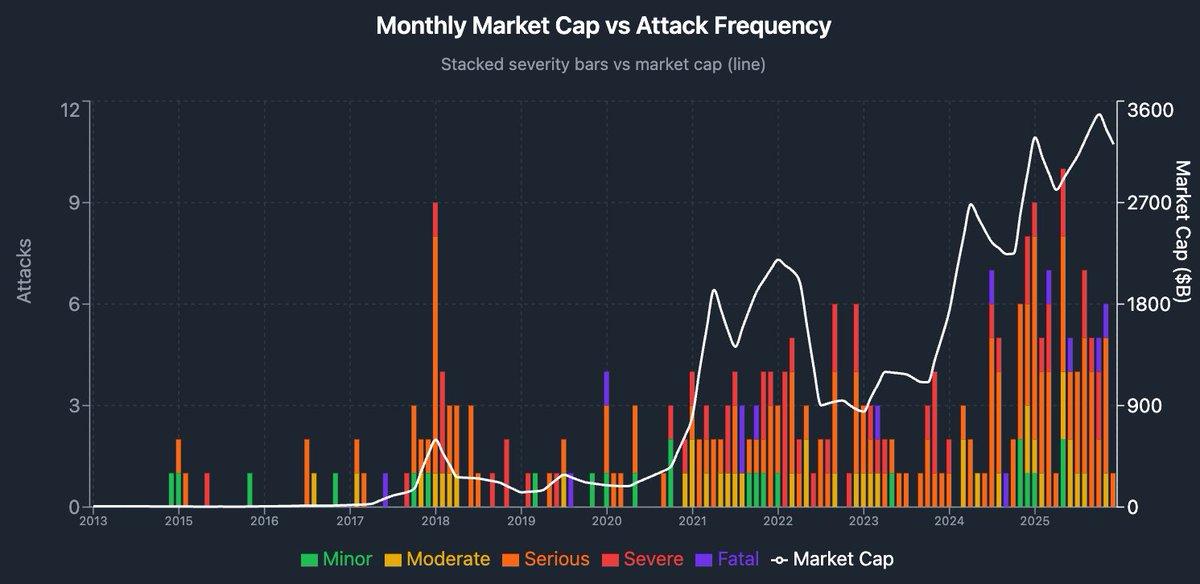

You're not mistaken— the number of attacks is indeed increasing over time (65 in total in 2025). Moreover, the attacks themselves are becoming more violent.

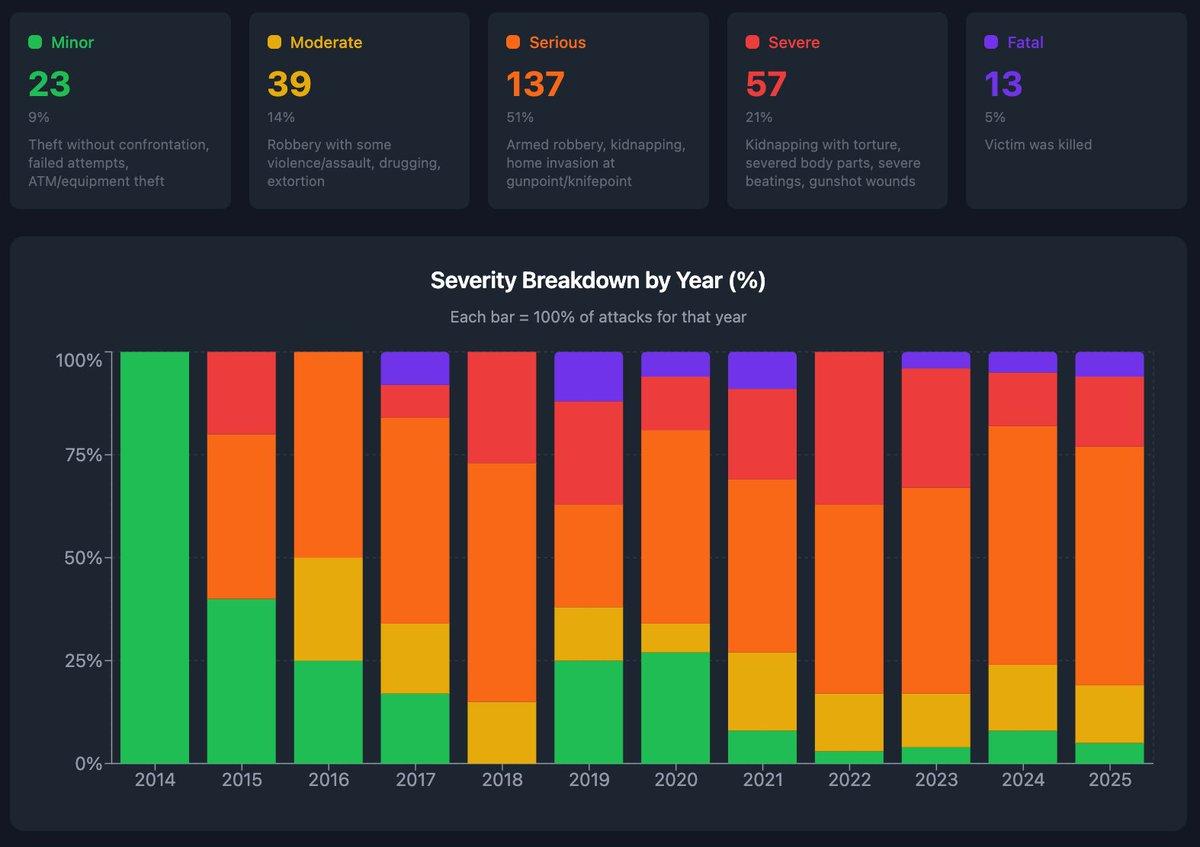

I had Claude categorize each attack into 5 levels, with the specific classification scheme as follows:

- Minor (3 incidents in 2025): Theft without direct confrontation, attempted theft, ATM/equipment theft.

- Medium (9 cases in 2025): Robbery, drugging, and extortion accompanied by some violence or assault;

- Serious (38 cases in 2025): Armed robbery/kidney robbery, kidnapping, armed or knife-wielding home invasion robbery;

- Extremely serious (11 cases in 2025): kidnapping accompanied by torture, dismemberment, severe beatings, and gunshot wounds;

- Fatal (4 incidents in 2025): Victims died.

The results show that, on average, the level of violence in a single attack is constantly increasing.

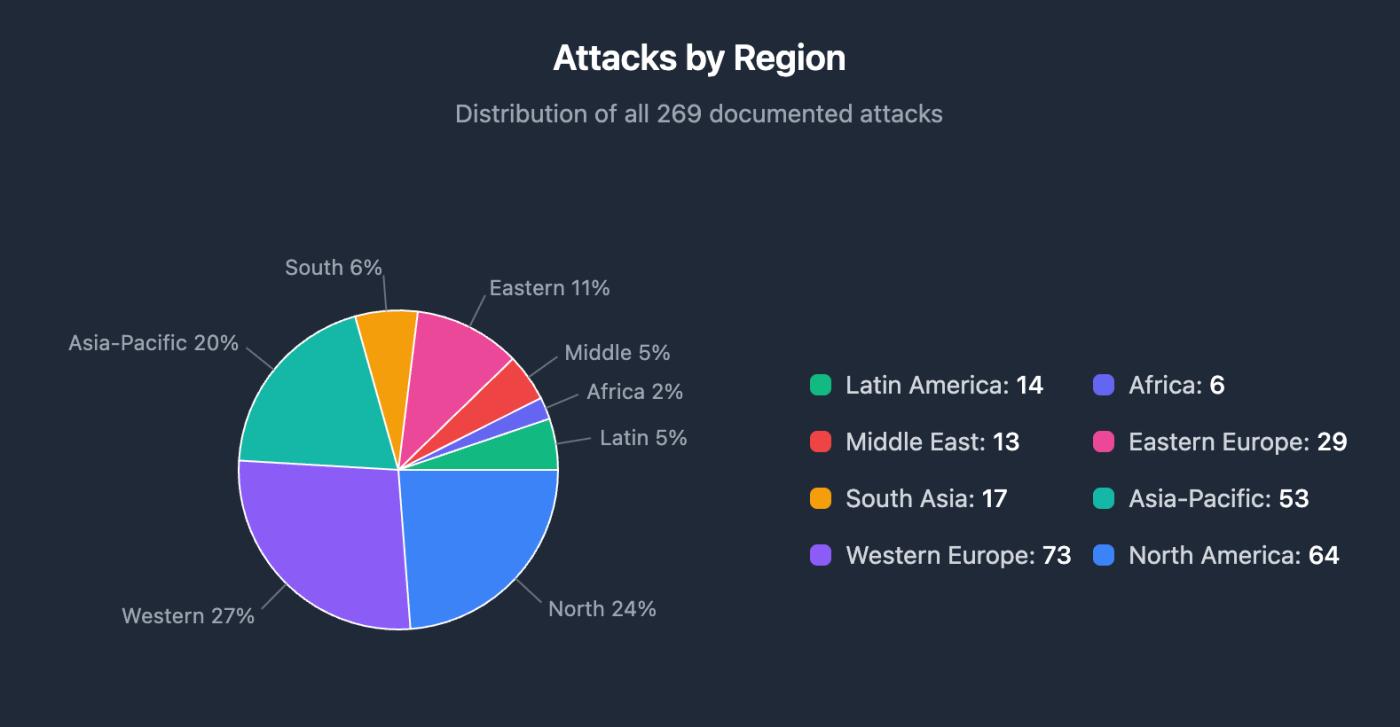

Geographically, Western Europe and the Asia-Pacific region saw the largest increases in violent incidents. North America remains the relatively safest region, but even there, the absolute number of incidents has risen.

So, what has led to the rise in violent incidents?

One of the most intuitive explanations is to link the frequent occurrence of violent incidents with the growth of the total market capitalization of the crypto market. Simply put—the higher the price, the more crime.

Let's take a look at the results shown in the chart: the white line represents the total market capitalization of cryptocurrencies; the colored portion represents the number of violent incidents.

A simple regression analysis yielded an R² result of 0.45, meaning that 45% of the violent event fluctuations can be explained solely by price itself. That is, as we mentioned earlier, rising prices lead to more violent events— I also ran regression analyses for other variables, but none were more convincing than total market capitalization.

So, is it really that simple? Is this enough to prove that the personal dangers of holding cryptocurrency are becoming increasingly serious?

We can conduct another "stress test" to see if there are any other hypotheses that can explain the rise in the number of violent incidents.

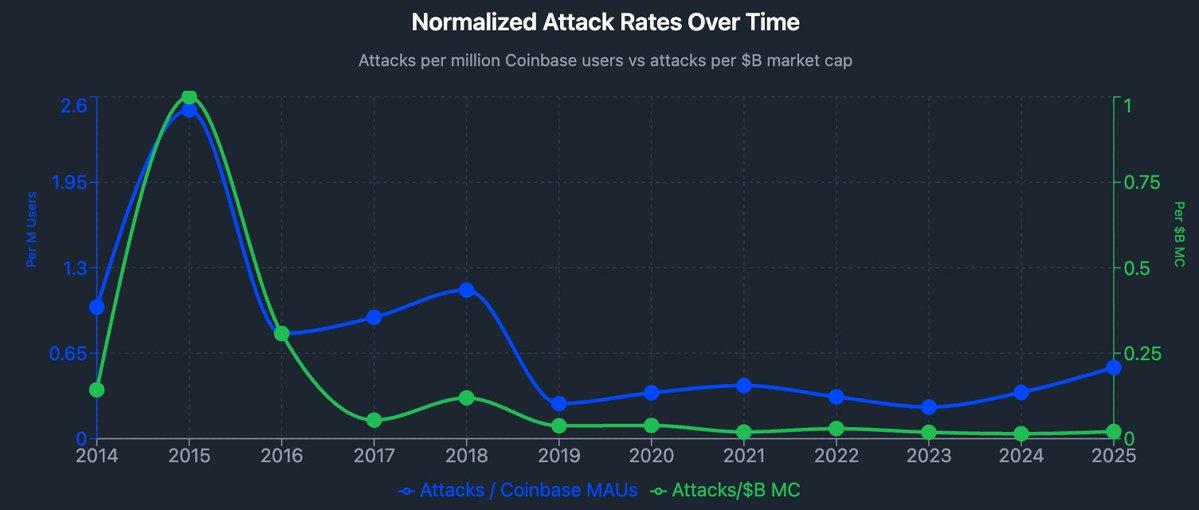

One possible explanation is that the rise in cryptocurrency prices simply means that more people are holding crypto assets. In other words, the increase in crime may simply be due to a larger population base, and the risk of violence faced by each individual may not actually have increased.

Let's conduct a feasibility test on this. Accurately measuring the total number of cryptocurrency users is difficult, so I chose two alternative metrics:

- The first is Coinbase's monthly active users, note that this is not the cumulative registered users, because we want to exclude people who have churned and no longer hold tokens;

- The second method is cruder: it analyzes the number of violent incidents per unit of market value to derive an approximate measure of the "probability of each dollar being stolen".

After standardizing the above data, you will see completely different conclusions: the blue line represents the number of violent incidents per Coinbase user; the green line represents the number of violent incidents per dollar of wealth.

This data suggests that 2015 and 2018 were actually the most dangerous periods for holding cryptocurrencies. That's right, while the number of attacks was far fewer then than it is now, the number of cryptocurrency holders was also far, far fewer.

From 2015 to 2025, Coinbase's monthly active users will grow from 2 million to 120 million, a 60-fold increase, but violent incidents will not increase proportionally.

Of course, the number of violent incidents per user has indeed increased in recent years, but the increase has been relatively moderate, roughly equivalent to the level of violence in 2021, and significantly lower than the level before 2019. Meanwhile, the incidence of violent incidents per dollar of wealth has remained almost unchanged.

We must also consider the alternative hypothesis of "news reporting bias"—that is, whether events are simply more easily reported—but this is beyond the scope of this analysis.

Overall, while the number of violent incidents is indeed increasing and the methods of attack are becoming more violent, this can be partly attributed to the "demographic effect," meaning that there are now more people holding cryptocurrency, so the risk to an individual user is not as exaggerated as it appears.

But ultimately, this is not just an academic discussion. It's a truly serious and real-world issue.

If you belong to a high-risk group, there are many ways to improve your personal safety. Here are some standard offline safety tips:

- Try to live in a safe city, preferably a residence with 24/7 security;

- Do not wear crypto-related clothing or make it obvious that you hold crypto assets in public .

- Use services like DeleteMe to remove your personal information from data brokers;

- Apply for a PO Box (Post Office Box) to send all business mail there and avoid your address being widely disseminated;

- Prepare a hot wallet containing a sum of money that can be handed over, completely isolated from actual cold storage assets ;

- Diversify your funds: Use multiple services, platforms, and devices to store your assets so that you don't lose them all at once in the worst-case scenario;

- Unless absolutely necessary, do not publicly broadcast your exact location in real time, especially during crypto conferences ;

- If you truly belong to an extremely high-risk group, or are about to travel to a high-risk area, consider hiring private security—in some areas, this can be far more useful than you might imagine.

2026 has arrived, and the year-end holiday is just around the corner. Please be sure to pay attention to safety.