This article is machine translated

Show original

This is the lesson learned from the "biggest mistake" in the career of legendary Warren Buffett ⚠️

Billionaire Warren Buffett once called buying Berkshire Hathaway the "biggest mistake" of his career, even though it later became a conglomerate worth over $1 trillion.

In the early 1960s, Buffett bought Berkshire not because he believed in the business, but because he saw the stock as cheap and thought he could profit from share buybacks by a struggling textile company.

In 1964, after being offered a takeover price $0.125 per share lower than the agreed price, Buffett became angry and bought more shares to gain control, rather than withdrawing.

Looking back, he believes this was a fundamental mistake: pouring large Capital into a failing business, resulting in a "textile debt burden" that lasted for many years and took him nearly 20 years to completely abandon.

Buffett admitted that if Berkshire had Capital in insurance from the beginning, it could have been worth twice as much, equivalent to an opportunity cost of hundreds of billions of dollars.

Upside GM

@gm_upside

05-04

💎 10 triết lý đầu tư vàng của Warren Buffett & Ví dụ thực tế! ✍️

Warren Buffett qua những con số:

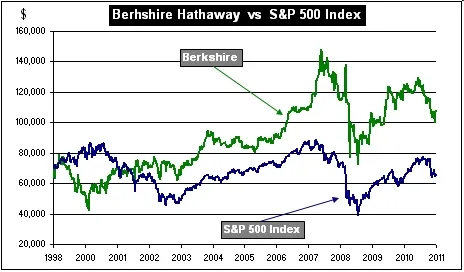

📍Lèo lái Berkshire Hathaway tăng trưởng 3,787,464%

📍Giúp quỹ đầu tư của ông đạt 900 tỷ USD vốn hoá

📍Tỷ suất đầu tư vượt S&P 500 trong 47/57 năm

📍Tài sản 168

The core lesson Buffett learned is: don't buy a business just because it's cheap. He famously said, "It's far better to buy a great business at a reasonable price than to buy a bad business at a bargain price."

Buffett also emphasized that if you've already invested in a poor-quality business, the right thing to do is to withdraw, rather than stubbornly trying to prove yourself right.

The paradox here is: even though Berkshire became a great empire under Buffett's leadership, the initial decision to buy it was a mistake in investment thinking. Later success came from building successful business segments on the foundation of a bad decision, not because that initial decision was right.

(According to CNBC)

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content