According to the Seoul Economic Daily , South Korea's financial authorities are drafting new guidelines that would allow listed companies and professional investors to invest a portion of their funds in crypto assets, with a 5% cap and trading regulations. This represents a shift from the ban on corporate investment in South Korea since 2017 and is seen as a significant step forward in the authorities' attempt to rebalance risk and innovation.

South Korean authorities to allow businesses to invest in cryptocurrencies after a nine-year ban.

The report indicates that South Korea's Financial Services Commission (FSC) has completed a draft guideline for corporate cryptocurrency trading, with the final version expected to be released as early as January or February this year. According to the plan, listed companies and professional investors could officially allocate crypto assets as early as this year, ending the comprehensive ban imposed in 2017 due to concerns about money laundering and speculation.

This policy continues the FSC's phased opening strategy of recent years. In May 2025, South Korea allowed non-profit organizations and cryptocurrency exchanges to sell their crypto assets; this further liberalization of corporate investment is seen as an important step in institutionalizing the recognition of corporate participation in the crypto market.

From a risk control perspective: 5% investment cap and restrictions on investment targets

According to the draft guidelines, companies and professional investors can allocate a maximum of 5% of their own capital to crypto assets each year, and the investment targets are limited to the top 20 cryptocurrencies by market capitalization.

Furthermore, regulators are still discussing whether to include USDT and other USD stablecoins in the scope of investable assets. To reduce market volatility and systemic risk, the guidelines will also incorporate mechanisms such as staggered trading and price limits to prevent large-scale, one-time inflows of corporate funds from impacting the market.

Last November, the FSC was also reported to be considering allowing non-bank entities such as technology companies and financial startups to issue Korean won stablecoins. Meanwhile, the five major local banks had quietly started testing cross-border remittances and laying out infrastructure and custody services, highlighting their high level of interest.

The scale of enterprises opens up possibilities: Will hundreds of millions of yuan enter the market?

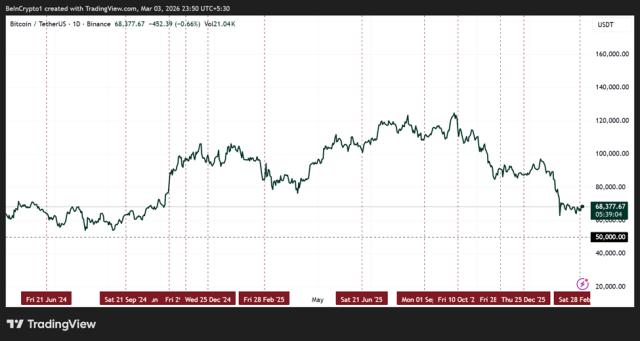

Looking at the scale of South Korean companies, the potential investment size of some large enterprises is still considerable. For example, South Korean internet giant Naver has approximately 27 trillion won (about US$18.4 billion) in equity capital, and 5% of that could buy thousands of Bitcoins.

However, despite South Korea's cryptocurrency trading frenzy, Min Jung, associate researcher at Presto Research, points out that most local companies don't seem inclined to allocate a large proportion of their funds to highly volatile assets.

Meanwhile, we believe that capital allocation will remain highly concentrated in Bitcoin (BTC) and Ethereum (ETH), which will have limited spillover effects on other small and medium-sized tokens.

Stablecoins and ETFs: Regulation is the key variable.

Compared to the proportion of corporate investment itself, the market is more focused on the upcoming Digital Asset Basic Act . As South Korea's second comprehensive regulatory framework for cryptocurrencies, the bill is expected to be finalized in the first quarter of this year, and will cover specific regulations for Korean won stablecoins, cryptocurrency spot ETFs, and existing pilot policies.

Jung believes that the impact of the advancement of stablecoins and ETFs on the South Korean crypto ecosystem will far exceed the symbolic significance of opening up corporate investment.

It now appears that South Korea is attempting to gradually integrate crypto assets from a high-risk speculative label into a financial system that can be institutionally accepted, and the subsequent implementation of its regulations remains a focus of market attention.

This article, " Is a Billion-Dollar Fund About to Enter the Market? South Korea Plans to Lift Ban on Corporate Investment in Crypto Assets, Setting a 5% Cap as a Test," first appeared on ABMedia, a news outlet specializing in ABMedia .