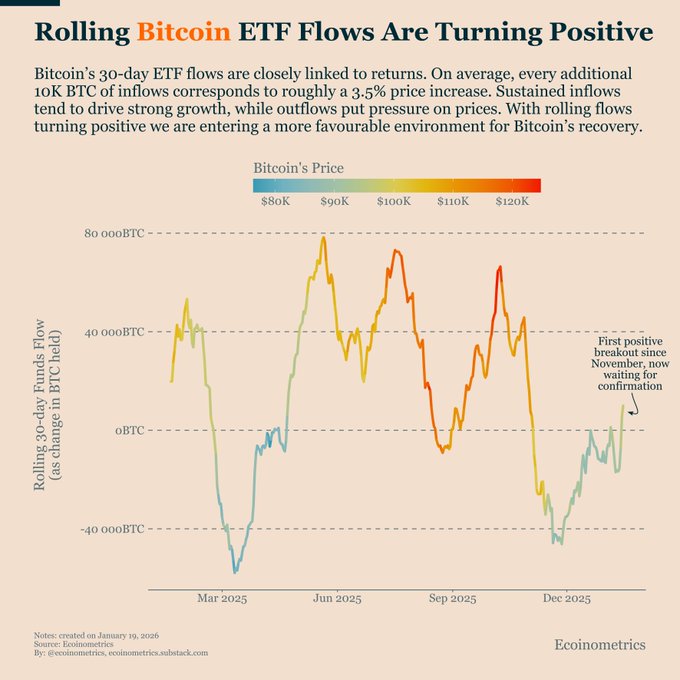

Bitcoin’s 30-day ETF flows just crossed back above zero for the first time since November.

That matters because flows are closely tied to short-term returns.

This is not confirmation of a new demand regime yet. But it does mark a shift to a more supportive demand backdrop for Bitcoin’s price recovery.

The key question from here is whether or not this demand is persistent.

Flows crossing above zero changes the directional bias to growth. But we’ll need at least a couple of weeks of that to call it a real regime change.

Early transitions like this are a good time to reasses Bitcoin exposure cautiously, watching whether inflows persist or fade again.

Follow @ecoinometrics for data-driven insights on Bitcoin and macro.

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content