Bitcoin continued to weaken, with Americans becoming the main force behind the sell-off. Coinbase continued to trade at a negative premium, and last week, ETFs saw a continuous inflow of $1.5 billion, prompting a frenzy of selling at the start of that week.

Gold and silver continue to trade at low prices, while the crypto market remains sluggish. In short, the current trend remains unchanged, and the only question is whether it can rebound to over 100,000.

The privacy sector has gone crazy, with Dash, Dusk, and other similar products experiencing massive price manipulation by major players. They've basically already gone through their cycle.

BTC

After breaking through a minor support level, BTC accelerated its decline again. This is almost the last phase of the accelerated decline, with the current low around 90,700. From a short-term perspective, it is almost at the bottom, and the entire upward movement has been wiped out.

The support around 90,000 is still a strong support level, and there is a high probability that a bottoming signal will appear after it is touched. Therefore, I plan to place orders in batches around 90,000, adding positions at 89,800 and 89,500. After this kind of accelerated decline stops, it is easy for a rebound to occur. If the low point prediction is correct, there will be at least a good profit, and it may directly rebound to around 92,500.

ETH

After a minor period of consolidation, ETH experienced another sharp drop, reaching a low of 3109.3. This pattern mirrors the exit pattern of BTC's 4-hour chart. The potential for a rebound is still around 1%. Monitor the market and set profit targets accordingly. If the price rallies and then falls back, the support levels of 3110-3062 remain valid.

There are no signs of a bottoming out yet, but the decline is not expected to be too significant. Referring to the three-wave decline, the current wave C is the strongest. The low point is expected to be around 3050, corresponding to the Fibonacci retracement level.

I plan to place a buy order at 3062, which is also a previous support area with strong support. The selling pressure from this accelerated decline has been largely digested, and a rebound is expected after another low point. If the buy order is successfully placed, the profit should be at least 100 points or more.

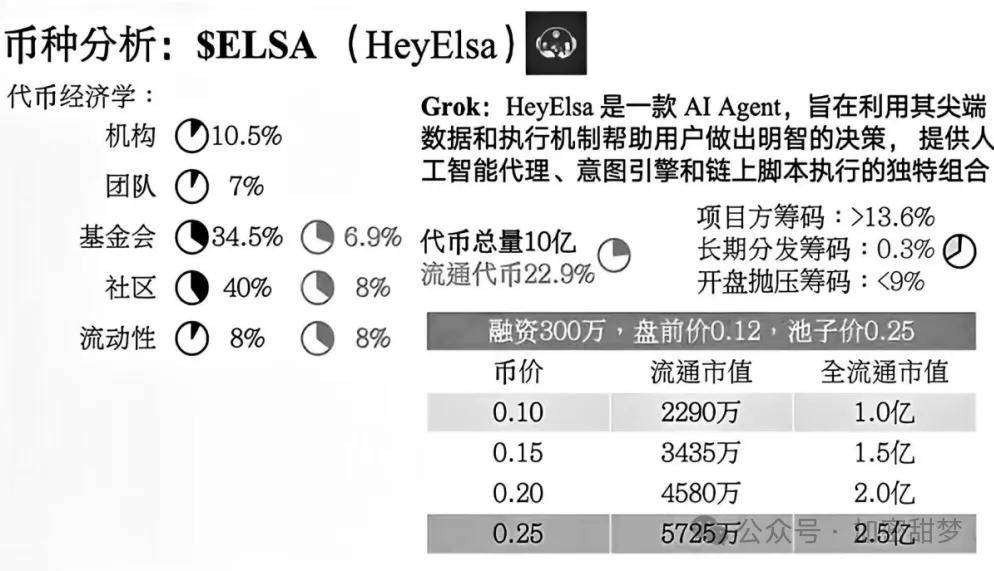

ELSA

Total supply: 1 billion, initial circulating supply: 22.9%, pre-market price: 0.12, pool price: 0.25, total funding: 3 million, tokens allocated: 10.5%, average institutional cost price: 0.0286.

Positive factors: 1. Coinbase roadmap; 2. No checkers were released in the community airdrop, so the selling pressure might not be that high; the only certainty is the 0.6% Mindshare airdrop; 3. Coinbase ecosystem fund invested, a positive development reflected in the roadmap; 4. Extensive marketing and promotion, indicating sufficient funds; 5. Annual income of 5 million.

Negative factors: 1. Indian project; 2. Community buyers are hesitant to purchase unless there's a sell-off.

The pre-market price is lower than the pool price, and the circulating market capitalization is too high. It's likely that the community airdropped tokens are heavily rigged for insider trading. I have no plans to participate at this market capitalization for now.

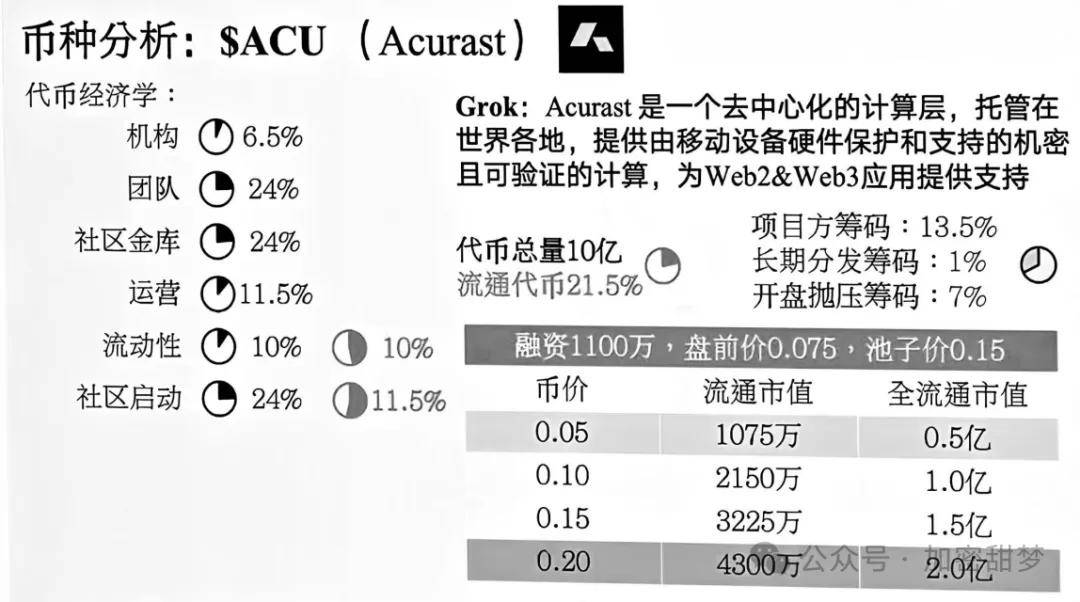

ACU

Total supply: 1 billion, initial circulating supply: 21.5%, pre-market price: 0.075, pool price: 0.15, total funding: 11 million, token allocation: 6.5%, average institutional cost price: 0.169.

Positive news: 1. Airdrop will be released in one week. 2. ETH co-founders have invested. 3. The community is furious about the airdrop; few are actually qualified, and those who are are just trying to profit from it. 4. The KAITO airdrop has not yet been announced.

Negative factors: 1. Too many shares offered in the public offering will suppress the price. 2. The pre-market price is severely inverted, already below the public offering price. 3. The fundraising amount seems questionable, and the background is not very good.

The DePIN track boasts top-tier backing and an extremely low VC stake (6.5%), resulting in favorable post-IPO selling pressure. Note the 24-month linear release rule for the airdrop portion, which may reduce initial selling pressure from airdrop participants. Alpha is projected to reach 250+ points, valued at 30+ USDT.

The market is constantly changing, so entry and exit points should be determined based on real-time conditions. Follow the trend after a breakout! No matter how confident you are, please strictly adhere to your stop-loss and take-profit strategies! That's all for today! Follow me so you don't get lost!

Every sharp drop is followed by a period of great potential. Those who are unsure about future market strategies can follow Sweet Dream (or add WeChat: RFGH8689).