Netflix's Q4 financial report was almost "flawless," but by suspending share buybacks and All In all-in, it has embarked on a long-term game of exchanging cash flow for an IP moat.

Written by: DaiDai, MaiTong MSX MaiDian

Netflix's (NFLX.M) Q4 2025 earnings report presents a highly disjointed narrative.

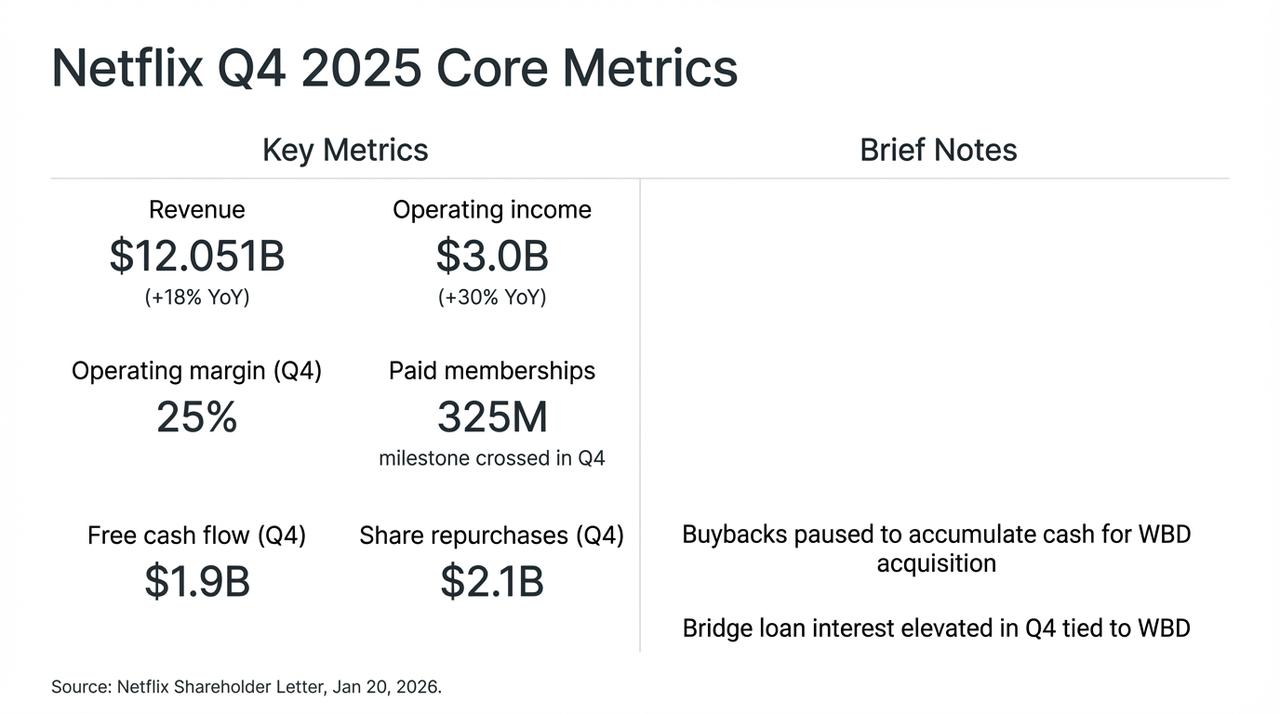

It's worth noting that, driven by the phenomenal final season of "Stranger Things," Netflix delivered an almost impeccable performance this quarter: revenue increased by 18% year-over-year to $12 billion, the number of paid subscribers worldwide surpassed 325 million, and free cash flow (FCF) reached $1.9 billion.

However, the market did not buy it. After the earnings report was released, investors’ attention quickly shifted from the impressive growth data to a controversial decision – suspending share buybacks to reserve liquidity for the acquisition of Warner Bros. Discovery (WBD).

This aggressive strategy of "trading growth for space" directly led to a sharp fluctuation in Netflix's stock price in after-hours trading. We also attempted to dissect this $72 billion acquisition plan (of which $59 billion was completed through bridge loans) and analyze this "identity transformation" that aims to become the "king of streaming" and has a certain gamble-like character.

Netflix Q4 Core Financial Metrics and the Impact of the WBD Acquisition

I. The Financial Report Beneath the Surface: Price Increases and Advertising as "Dual Engines"

To be honest, the Q4 financial report is almost "impeccable" in terms of data alone, once again strongly demonstrating Netflix's unshakeable dominance in the global streaming market.

The unusually restrained reaction from the capital market stemmed from the fact that the suspension of share buybacks and the all-cash acquisition of WBD forced the market to re-evaluate Netflix's growth path and capital structure risks. In short, in the long-running power struggle between Silicon Valley and Hollywood, Netflix seems to have chosen the most aggressive path: sacrificing free cash flow in a final sprint to become the "King of Streaming."

This is also the real shift beneath the surface of the financial statements: Netflix's core issue has long since shifted from whether growth exists to "how to continue growth."

Looking back at the various statements made by Netflix management during this earnings call, this shift is already evident—after shedding the noise of acquisitions, Netflix's own growth logic is actually at a critical juncture of switching from "user scale driven" to "ARM (average revenue per user) driven".

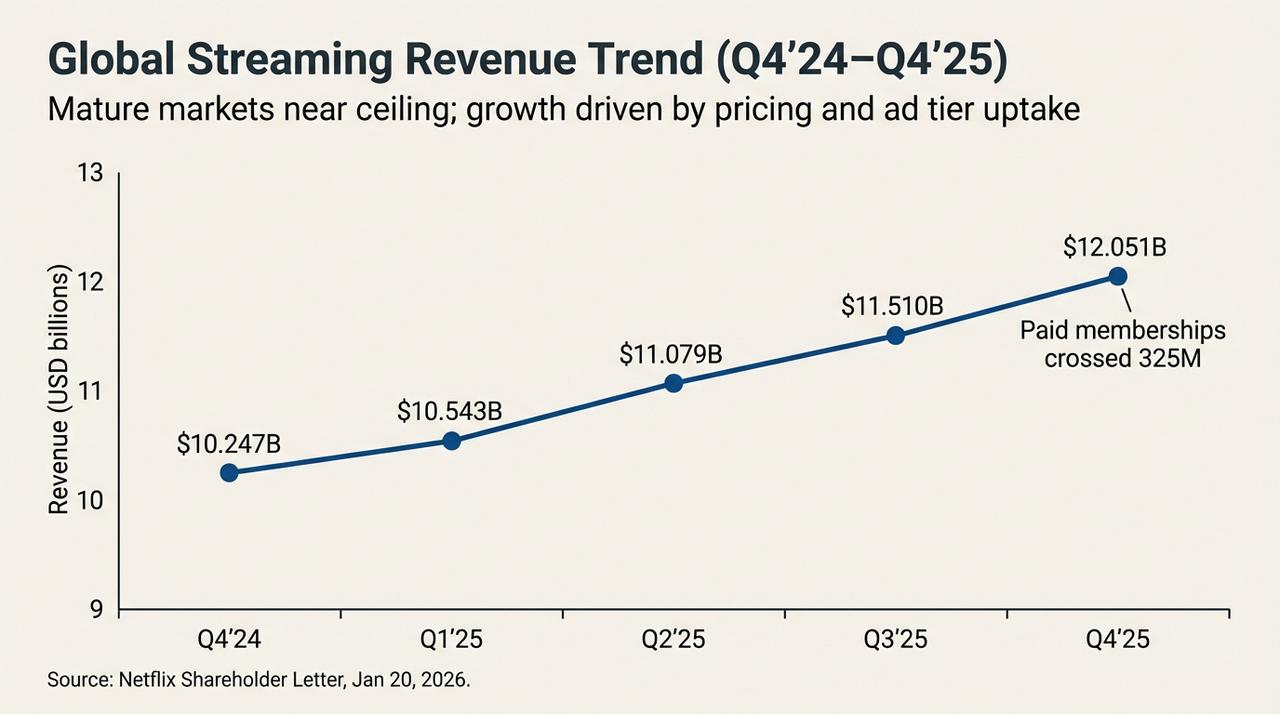

For example, although its annual advertising revenue has exceeded $1.5 billion (more than 2.5 times year-on-year growth), the user ceiling effect in mature markets has appeared, resulting in actual business performance being significantly lower than the previous aggressive expectations of some institutions ($2-3 billion). More importantly, this growth mainly comes from price increases in the North American and Western European markets, as well as the end-stage dividend brought about by the crackdown on password sharing.

Management also admitted that the programmatic advertising system is still in the testing and ramp-up phase. In the short term, the advertising layer plays more of a role as a low-cost customer acquisition tool than a true profit engine.

Against this backdrop, Netflix's revenue growth guidance for 2026 is 12%–14%, significantly lower than the pace of previous years. This has led many analysts to view Netflix as having entered a "low-growth era" that relies more on refined operations rather than extensive expansion.

Global streaming revenue trends (Q4'24-Q4'25)

From another perspective, as it becomes increasingly difficult to maintain the double-digit "growth myth" by relying on sophisticated ARM management, the marginal returns of achieving valuation breakthroughs through internal forces are diminishing. Since the internal engine can no longer support greater ambitions, finding an "external driving force" that can rewrite the competitive landscape is no longer an option, but an inevitability.

This may be the underlying catalyst for Netflix's decision to gamble heavily on WBD at this time.

II. The Acquisition of WBD: A Turning Point in the Growth Story

Despite the strong fundamentals, what truly turned market sentiment cautious was Netflix's acquisition of WBD, which had a "heavy industry" feel to it.

"Could this be a poisoned candy?" This is probably the core question swirling in the minds of all investors right now regarding Netflix's acquisition of WBD.

Objectively speaking, the WBD acquisition instantly dragged Netflix from a light-asset technology company back into the quagmire of heavy assets in traditional media. To complete this all-cash deal at $27.75 per share, Netflix took on a staggering $59 billion in senior unsecured bridge loan commitments. The direct consequence of this decision was a breathtaking "stress test" on its balance sheet.

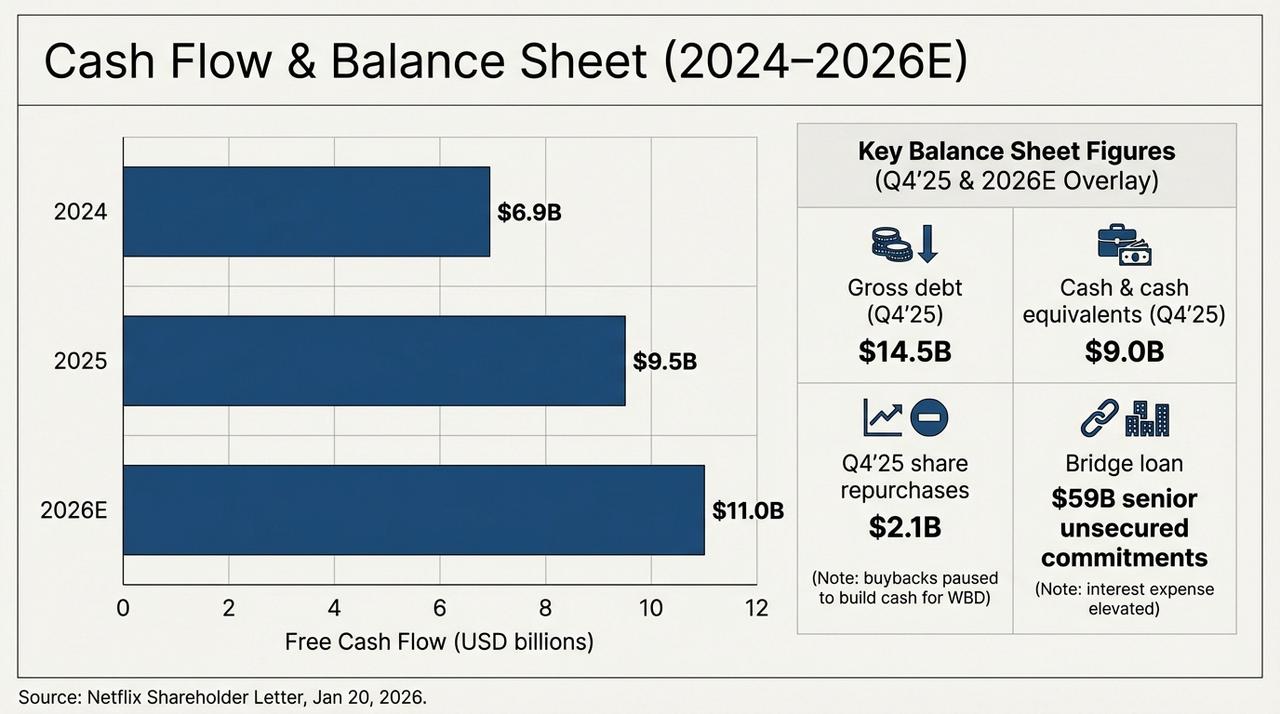

The chart below clearly shows the evolution of the company's cash flow and debt structure over the next two years. As of Q4 2025, Netflix's confirmed gross debt is $14.5 billion, while its cash and cash equivalents are only $9 billion. This means that before officially acquiring WBD, the company's net debt has already reached $5.5 billion. With the arrival of the $59 billion bridge loan, Netflix's debt will jump to more than four times its original size.

Cash Flow and Balance Sheet Outlook (2024-2026E)

Meanwhile, Netflix’s free cash flow is actually steadily climbing: about $6.9 billion in 2024, about $9.5 billion in 2025, and is expected to reach about $11 billion in 2026 (guideline). Looking at this curve alone, Netflix is still one of the few streaming platforms in the world that can generate cash continuously and on a large scale.

The problem is that even if Netflix uses all of its projected $11 billion in FCF for 2026 solely to pay off debt, it will still take more than five years to clear the bridge loans. More worrying is that while the content amortization ratio is currently maintained at around 1.1x, the future amortization pressure will increase significantly with the integration of HBO and Warner Bros.' massive film libraries.

This "cash flow sacrifice" is essentially a gamble on the marginal ARM increment generated by WBD's top assets such as HBO and DC Universe to cover interest expenses and depreciation costs.

This also means that before WBD assets are truly integrated and begin to enhance content supply and user retention, Netflix must endure a relatively long transition period of "cash flow priority service debt." If the integration efficiency falls short of expectations, this huge loan will turn from a "booster" driving growth into a "black hole" dragging down valuation.

III. The Alchemy of IP: Can the Magic of Copyright Overcome the Gravity of Debt?

Why is Netflix willing to risk criticism to All In?

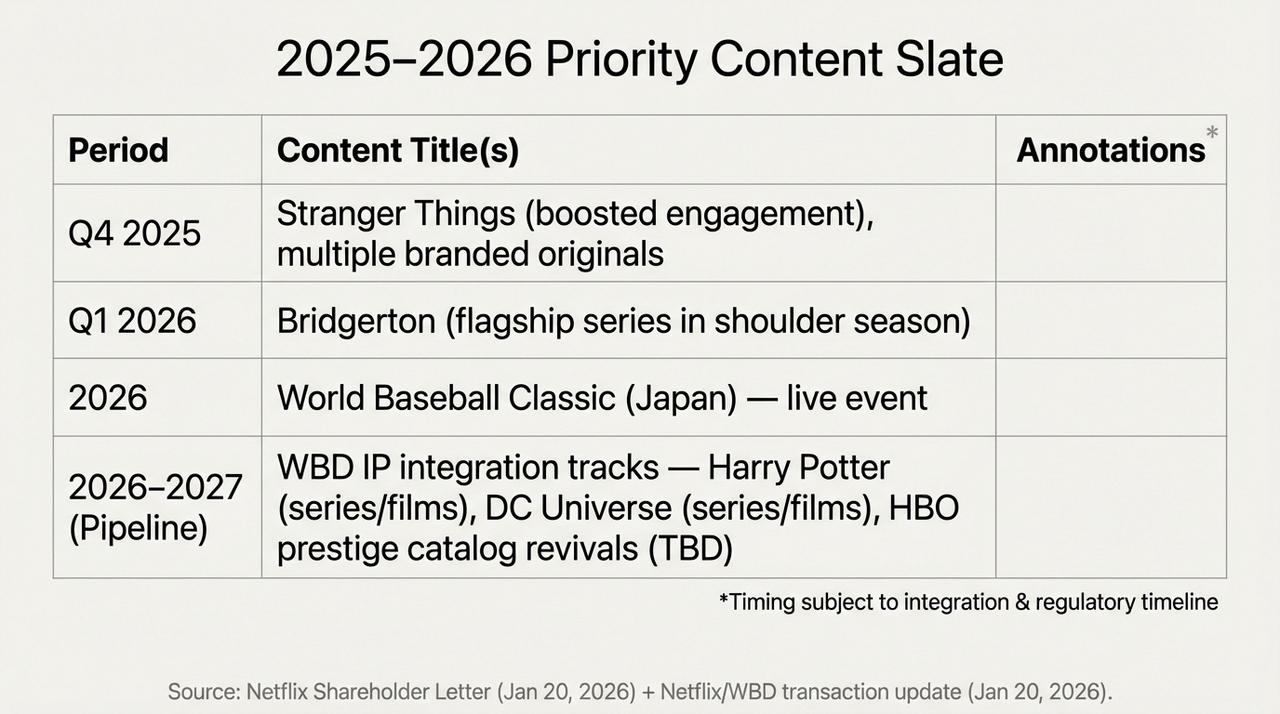

The answer lies in WBD's "dusty" assets. As is well known, from the Burbank set to the London studio, WBD possesses an arsenal that streaming services dream of, such as the Wizarding World of Harry Potter, the DC Universe's hero cloaks, and HBO's irreplaceable library of premium content.

These are all "content moats" that Netflix has long been relatively weak in, yet desperately needs. Therefore, for Netflix, this is the final piece of the puzzle in building its "all-encompassing streaming empire," and its trump card in the second half of its gamble. Ultimately, the true significance of this acquisition lies not in short-term financial performance, but in the long-term change in the competitive structure.

- On the one hand, WBD's IP can significantly enhance Netflix's ability to provide stable content and reduce its reliance on a single blockbuster.

- On the other hand, global distribution networks and mature recommendation systems also provide these IPs with unprecedented commercialization opportunities;

The problem is that the realization of this path will obviously take longer than the pace currently preferred by the capital market. After all, with a price-to-earnings ratio of around 26, Netflix is in a delicate position.

For optimists, the stock price volatility offers a "discounted ticket"—once WBD's IP is successfully integrated into Netflix's content ecosystem, a new growth flywheel may be restarted. For cautious investors, however, the billions of dollars in M&A financing, the suspension of buybacks, and the downward revision of growth guidance all indicate that the company is entering a new phase where both risks and rewards are amplified.

This is precisely the root of the market divergence.

2025-2026 Key Content Schedule and WBD IP Integration Plan

In other words, this has become a repricing of Netflix's future positioning. The largest "IP alchemy" in human history that Netflix is currently undertaking comes at a considerable cost—before the free cash flow (FCF) ramps up in 2026, every penny of revenue will be prioritized for repaying the "abyss" of interest payments.

The final answer will obviously take time to emerge.

In conclusion

Ultimately, the stock price drop after the Q4 earnings report was released was more like a fierce exchange of hands between bulls and bears regarding the "king of streaming media" belief.

In any case, Netflix is no longer just an app to help you pass the time on a boring weekend; it is becoming a financial behemoth burdened with heavy responsibilities.

Perhaps in 2026, when Harry Potter emerges from the fog of debt onto the Netflix homepage, we will know whether this alchemy was a success or a betrayal of its creator.

Disclaimer: The content of this article is only a macro analysis and market commentary based on publicly available information and does not constitute any specific investment advice.