Last night, the market experienced another dip, with Bitcoin briefly falling below its recent low. However, news of Trump's announcement regarding the cancellation of tariffs on Europe scheduled for February 1st spurred a market rebound. Time to continue!

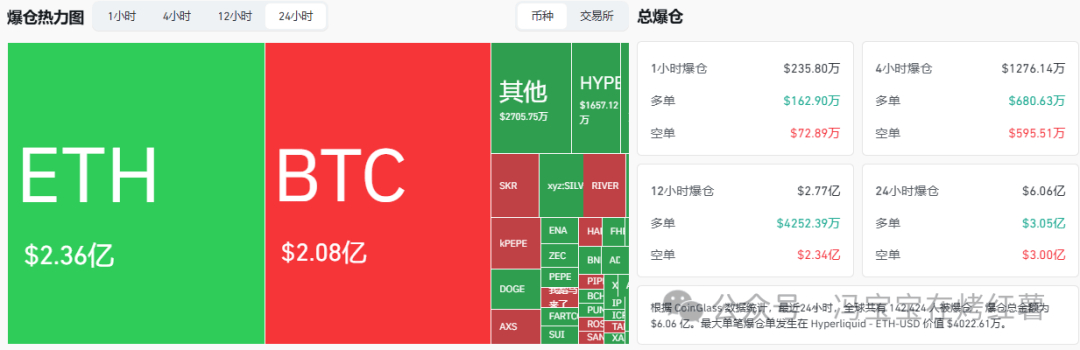

In the past 24 hours, a total of 142,424 people across the internet have had their positions liquidated, with a total liquidation amount of $606 million. Long positions were liquidated for $305 million and short positions for $300 million.

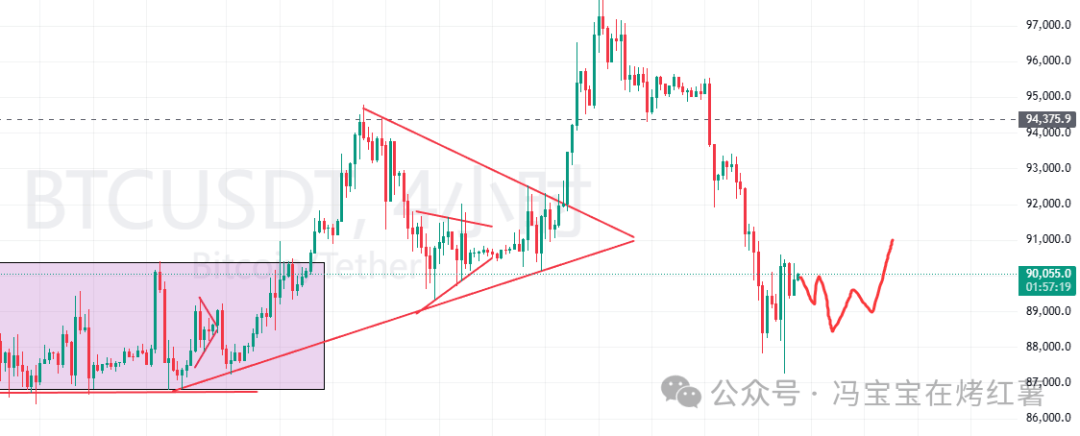

BTC

Bitcoin's short-term decline has slowed, with minor signs of a bottom appearing on smaller timeframes. The price has largely recovered after the overnight dip. It's highly likely that the price will consolidate and form a bottom in the short term. On the 4-hour chart, consider entering long positions after a divergence signal appears.

I suggest placing a buy order around 88500, which is near the Fibonacci retracement level after a double bottom. Set your stop-loss order near the recent low. If you successfully enter the trade, you could potentially earn over 3000 points, making it worth the risk!

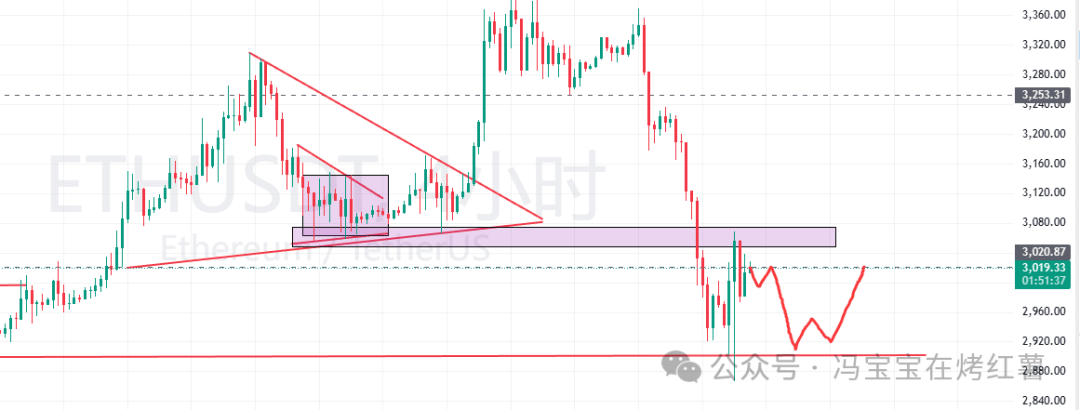

ETH

Ethereum has shown signs of bottoming out on a minor timeframe, and is likely to consolidate and correct its indicators in the short term before potentially bottoming out and rebounding. It's time to prepare to go long. Short selling volume continues to shrink, making a break below the short-term low unlikely. Furthermore, the price quickly recovered after the overnight spike, indicating ample buy the dips interest. This is a solid bottoming signal.

However, the rebound on the 1-hour chart is weak, and there's a high probability of another downward move, a minor double bottom test, with a target range of 2930-2900. The plan is to enter long positions within this range, with a stop-loss based on the low of the overnight dip. If the prediction is correct, it could yield two to three hundred points, which is worth a try!

Copycat

Currently, noteworthy Altcoin opportunities revolve around the 2026 FIFA World Cup in the USA, Canada, and Mexico (June 11 - July 19, 2026). These assets typically experience a price surge every four years, often independent of the broader market trend. A phased approach to spot investment is currently recommended.

Considering liquidity and market activity, the leading cryptocurrencies $CHZ and Binance-backed $SANTOS are more worthy of attention, while other niche coins are riskier and more like lottery tickets. Currently, overall trading volume remains low, indicating that there are not many investors yet, and the market is still in the accumulation phase.

For example, Santos recently rose 10%, with a trading volume of only a few million US dollars, while historically, trading volumes during bull markets often reach tens or even hundreds of millions of US dollars. Following the logic of "buying when no one is interested and selling when everyone is talking about it," now may be the time to gradually build positions.

$SENT

Has this become a major negative factor for the spot market?

$ELSA

I only profited from the first wave of Elsa; the subsequent surge was truly unexpected. This project clearly doesn't leave much for those who just want to profit from arbitrage; those who engage in trading can at least get a small share. Ultimately, understanding your niche in the crypto ecosystem is crucial. You're into memes and saying VC is dead, but I'm still making money with VCs; you're into VCs and complaining about how difficult memes are, but I'm still reaping the rewards.

$ICNT

This coin has formed a W-bottom pattern. Could it experience a V-shaped rebound? After all, it has fallen for three consecutive days after its previous high, and the current rebound is incredibly strong! You could buy a small position, with a take-profit target of 0.6 and a stop-loss at 0.32.

$SAN

Speaking of Sand, there's been some positive news recently, and both the monthly and weekly charts show a bottom. If this pattern were a mainstream coin, it would definitely surge. However, mainstream coins aren't performing well right now, so it's uncertain whether altcoins can experience a rally.

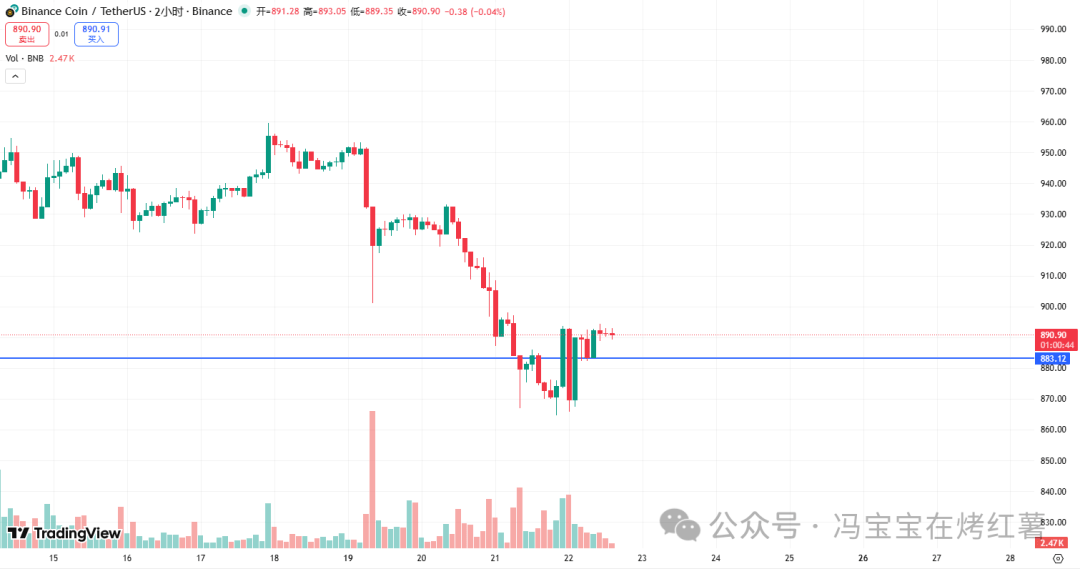

$BNB

Today, keep a close eye on the key level of 883. As long as the price doesn't fall below this level, the 1-2 hour chart could see a continued rebound, with resistance levels at 894, 908, and 920. However, if the price breaks below 883 on the 1-2 hour chart, this small rebound will be over, with support levels at 875, 864, and 856 .

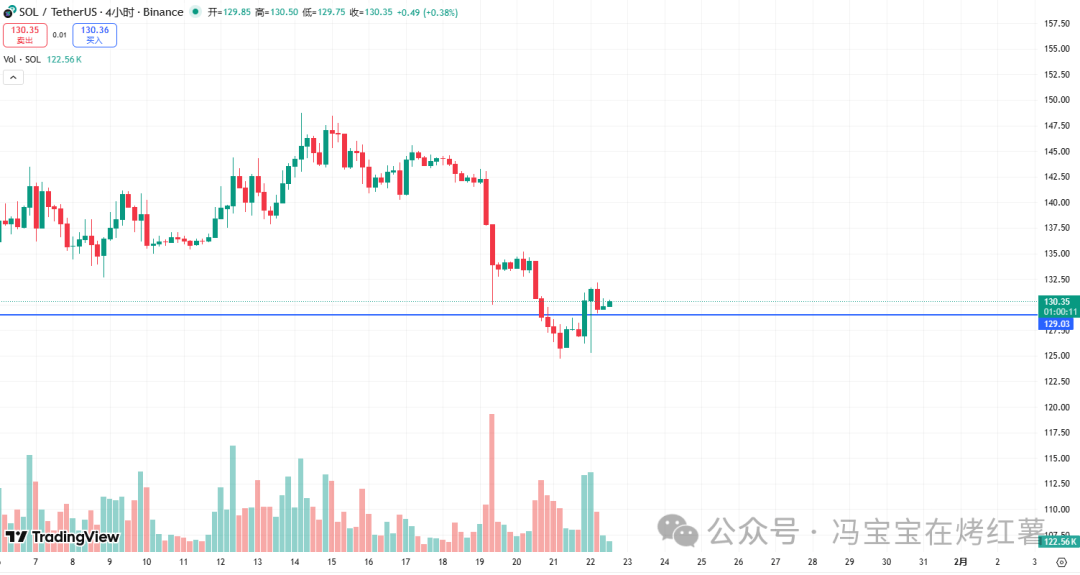

$SOL

Last night, the price accurately hit the first resistance level; today, the key level to watch is 129. As long as the pullback doesn't break this level, the 4-hour rebound will continue, with resistance levels at 132, 135, and 137. If the 4-hour level breaks down, this rebound will be over, with support levels at 126, 124, and 122 .